Travel Insurance for Retirees

October 27, 2015

University of New Brunswick

Agenda

1. SSQ Insurance Company Inc. – Overview

2. Accidental Death & Dismemberment

Re-issue September 2014

Eligibility

Enhancements

3. Critical Choice Care

Eligibility

4. Emergency Medical Travel Insurance

Relationship between SSQ and AXA Assistance

Schedule of Benefits

Description of Eligible Persons

Exclusions and Limitations

5. Questions

2

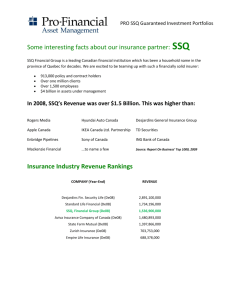

SSQ Insurance Company Inc. - Overview

History • Founded on May 9, 1944 by Dr. Jacques Tremblay

• Service de Santé du Québec (acronym SSQ originates)

1946 - 2005

• SSQ began selling Health Insurance only

• Over the 59 years, the company transformed itself from offering Health, Dental, Disability, Life, and even becoming a realty subsidiary!

2011 - 2012

• SSQ acquires AXA Life Insurance Inc. and forms SSQ

Insurance Company Inc.

• SSQ becomes 5th largest insurance company in Canada

3

3 core group products, 3 market leaders

Voluntary

Accidental Death&

Dismemberment

4

About Your Voluntary AD&D

(Policy 1L900)

Eligibility

• All employees of the Policyholder under the age of 66

• Eligible spouse under the age of 66

Amount of Principal Sum

• Employee Only Plan: minimum of $10,000 to a maximum of $350,000

• Employee and Family Plan: minimum of $10,000 to a maximum of $350,000

NEW Benefits (effective September 2014)

1. Surgical Reattachment Benefit

2. Repatriation Benefit

3. Psychological Therapy Benefit

4. Assault Benefit

5. Carjacking Benefit

6. Public Transportation Benefit

7. Comatose Benefit

8. Brain Damage Benefit

9. Bereavement Benefit

5

3 core group products, 3 market leaders

Critical Choice

Care

6

About Your Optional

Critical Choice Care

(Policy 1L910)

Eligibility

• Regular full-time, part-time, seasonal or term appointment employee under the age of 65.

• 12 month pre-existing medical clause

Amount of Principal Sum

• Minimum of $10,000 to a maximum of $150,000

• Guarantee Issue Amount: $50,000

21 Covered Illnesses

• Heart Attack

• Coronary Artery Bypass Surgery

• Stroke

• Life Threatening Cancer

• Parkinson’s Disease

• Alzheimer’s Disease

• Multiple Sclerosis

• Kidney Failure

• Paralysis

• Blindness

• Deafness

• Loss of Speech

• Benign Brain Tumour

• Coma

• Major Burns

• Major Organ Transplant

• Major Organ Failure Requiring Transplant

• Motor Neuron Disease

• Aorta Surgery

• Heart Valve Replacement

• Loss of Limbs

7

3 core group products, 3 market

Emergency

leaders

Medical Travel

Insurance

8

Relationship - SSQ and AXA Assistance

•

SSQ Insurance Company purchased AXA Life Insurance Inc., but AXA

Assistance remained as its own entity.

•

AXA Assistance is our emergency medical provider for all our Emergency

Medical Travel policies

•

Worldwide operations

9

About Your Emergency Medical Travel

(Policy 1L915)

Eligibility

• Class I: All members who enrol in the Member Only Plan to June 30 th following their 65 th birthday.

• Class II: All members who enrol in the Member and Family Plan to June 30 th following their 65 th birthday.

• Class III: All Retired members who enrol in the Member Only Plan.

• Class IV: All Retired member who enrol in the Member and Family Plan.

No termination age for Classes III and IV

Coverage is limited to a maximum duration of 180 days with respect to any one Trip.

10

About Your Emergency Medical Travel

(Policy 1L915)

Schedule of Benefits

• Medical Reimbursement Expense

• Emergency Dental Treatment

• Evacuation Benefit

• Repatriation

• Family Transportation & Accommodation

• Return of Vehicle

• Rental Expense

• Hotel Convalescence

• Referral Services outside of Province or Canada

• Deductible

• Coinsurance

$1,000,000

$2,000

Included

$15,000

$5,000

$500

$200

$1,000

$500,000

Nil

100 %

11

About Your Emergency Medical Travel

(Policy 1L915)

Referral Services Outside of Province (unique to UNB)

Travel Expenses – Charges for travel expenses along a normal and reasonable route, without delay or stopover, of an Insured Person, parent or guardian while accompanying the Dependent Insured Person for treatment outside their province of residence but while still remaining in Canada are considered as follows:

• $100 per day per Insured Person as an outpatient while receiving recommended medical treatment outside of their province of residence.

• $100 per day per parent, guardian or family member who accompanies the Insured Person.

• Economy class airfare or if transportation occurs in a vehicle or device other than one operated under a license for hire, then reimbursement of transportation expenses will be limited to a maximum of

$0.29 per km for travelled to and from the recommended place of medical services.

12

About Your Emergency Medical Travel

(Policy 1L915)

Referral Services Outside of Province (unique to UNB)

Limitations and Exclusions

1) The referral outside of the Insured Person’s province of residence or Canada must be medically necessary and must not be for services available in Canada or the Insured Person’ province of residence as determined by the Insurer.

2) The claim must have prior approval for payment from the appropriate provincial government health program and from the Insurer.

3) Payment will be made for the reasonable and customary charges of the provider of the services or supplies in the area in which the services are rendered.

4) Payment will only be made for services and supplies rendered while the patient was under the active treatment of a licensed physician.

5) Payment will not be made for treatment of any illness commencing within twelve (12) months after the Insured Person's effective date of group coverage, or for which the Insured Person has received medical treatment or has been prescribed drugs twelve (12) months prior to the effective date of this coverage.

6) The services must not be for experimental medical procedures or treatment methods not approved by the Canadian Medical Association.

13

About Your Emergency Medical Travel

(Policy 1L915)

Limitations and Exclusions (for complete listing, kindly refer to your booklet)

The following exclusion applies only to Classes III and IV: any condition for which the Insured Person received medical advice, consultation or treatment within six (6) months prior to the commencement of a Trip, with the exception of a Chronic Condition which is under treatment and Stabilized by the regular use of prescribed medication;

• "Chronic Condition" means a disease or disorder which has existed for a minimum of six (6) months.

• "Stabilized" means there has not been a change in the medical condition requiring medical or psychiatric intervention for a minimum of six (6) months. Adjustments in doses of Warfarin or

Coumadin are not considered to be medical intervention for the purpose of this definition, as long as the attending physician can confirm that the Insured Person’s condition is stabilized before the date of departure.

14