18- 1

Chapter

Eighteen

McGraw-Hill/Irwin

© 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

18- 2

Chapter Eighteen

Index Numbers

GOALS

When you have completed this chapter, you will be able to:

ONE

Describe the term index.

TWO

Understand the difference between a weighted price index and

an unweighted price index.

THREE

Construct and interpret a Laspeyres Price index.

FOUR

Construct and interpret a Paasche Price index.

Goals

18- 3

Chapter Eighteen continued

Index Numbers

GOALS

When you have completed this chapter, you will be able to:

FIVE

Construct and interpret a Value Index.

SIX

Explain how the Consumer Price index is constructed and

interpreted.

Goals

18- 4

36-Month CPI 2000-2002

4

3

CPI

An Index Number

expresses the relative

change in price,

quantity, or value

compared to a base

period.

2

1

0

1

3

5

7

9

11 13 15 17 19 21

23 25 27 29 31 33

Month beginning 1/1/2002

A Simple Index Number

measures the relative change in

just one variable.

Index Numbers

35

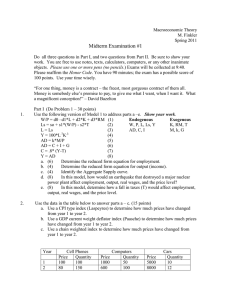

Mr. Wagner

owns stock in

three companies.

Given is the

price per share

at the end of

1997 and 2002

for the three

stocks and the

quantities he

owned in 1997

and 2002.

18- 5

Stock

1997

1997

2002

2002

Price Shares Price Shares

NWS

$1

30

$2

50

NPC

$5

15

$4

30

GAC

$6

40

$6

20

Simple indexes using 1997 as

base year (1997=100)

Price

Share

($2/$1)(100)=200

(50/30)(100)=167

(30/15)(100)=200

($4/$5)(100)=80

(20/40)(100)=50

($6/$6)(100)=100

Example 1

Easier to

Indexes

comprehend

than actual

numbers

$345,651,289,560

(percent

or 10%?

change)

Facilitate

comparison of

unlike series

Bread

Car

Dress

Surgery

18- 6

Why

compute

indexes?

Provide convenient

ways to express the

change in the total

of a heterogeneous

CPI

group of items

$0.89

$18,000

$200

$400,000

Why Convert Data to Indexes?

Indexes: Four classifications

Price

Measures the changes

in prices from a

selected base period

to another period.

18- 7

Quantity

Measures the changes in

quantity consumed from

the base period to

another period.

Special purpose

Combines and weights a

Value

heterogeneous group of series

Measures the change in the to arrive at an overall index

value of one or more items showing the change in

from the base period to the business activity from the

given period (PxQ).

base period to the present.

Types of Index Numbers

18- 8

Price Index

Producer Price Index - measures the

average change in prices received in

the primary markets of the US by

producers of commodities in all

stages of processing (1982=100).

CFMMI

CFMMI Auto

Quantity

Chicago Midwest Manufacturing Index

Base year 1997=100

180

160

140

Federal Reserve

Quantity Output

Index

120

100

80

60

40

20

0

YEAR

1996

1997

1998

1999

2000

2001

2002

Price and Quantity Indexes

18- 9

Jewellery,

watchs and

clocks and

valuable gifts

Department

stores

Furniture

and fixtures

electrical

goods and

photographic

Motor

vehicles and

parts

100

90

80

70

60

50

40

30

20

10

0

Consumer

durable

goods

Value

Index

Value Index of Feb '03 Retail Sales Base February (Monthly Average of

Oct 1999-Sept 2000)=100

Special purpose

Value and Special Purpose Indexes

18- 10

Simple Price Index, P

pt

P

(100)

p0

where

po the base period price

pt the price at the selected

or given period.

From Example 1 a simple

aggregate price index for

the three stocks

p t

P

(100)

p 0

$2 $5 $6

(100)

$1 $5 $6

100.0

Construction of Index Numbers

18- 11

Weighted index

Considers both the price and

the quantities of items

Tends to overweight goods whose prices have increased

Laspeyres Weighted Price Index, P

Two methods of

computing the

price index

Laspeyres method

Paasche method

Uses the base period quantities as

weights

pt q0

P

(100)

p0q0

where

pt is the current price

p0 is the price in the base period

q0 is the quantity consumed in the base

period

Paasche Weighted Price Index, P

Present year weights

substituted for the original

base period weights

18- 12

Tends to overweight

goods whose prices have

gone down

pt qt

P

(100)

p0qt

where

qt is the current quantity consumed

p0 is the price in the base period

pt is the current price.

Construction of Index Numbers

18- 13

Fisher’s Ideal Index

Fisher’s ideal index = (Laspeyres’ index)(Paasche’s index)

The geometric

mean of Laspeyres

and Paasche

indexes

Balances the negative

effects of the

Laspeyres’ and

Paasche’s indices.

Requires that a new set of

quantities be determined

each year.

Fisher’s Ideal Index

18- 14

Value Index

Reflects changes in both price and quantity

Both the price and quantity change

from the base period to the given period

pt qt

V

(100)

p0q0

Value Index

18- 15

In 1978 two

consumer price

indexes were

published. One

was designed for

urban wage

earners and

clerical workers.

It covers about one third of the

population. Another was

designed for all urban

households. It covers about

80% of the population.

Millions of employees

in automobile, steel,

and other industries

have their wages

adjusted upward when

the CPI increases.

Consumer Price Index

18- 16

Usefulness of CPI

It allows consumers to

determine the effect of

price increases on their

purchasing power.

It is a

yardstick for

revising

wages,

pensions,

alimony

payments, etc.

It computes

real income:

real income

= money

income/CPI

(100)

It is an economic

indicator of the

rate of inflation in

the United States.

Consumer Price Index

18- 17

Deflating Sales

Actual sales

Deflated sales

(100)

An approximate index

Determining the purchasing power of the dollar

compared with its value for the base period

$1

Purcha sin g power of dollar

(100)

CPI

Consumer Price Index

17-18

18- 18

Shifting the base

101 115

When two or more series

of index numbers are to be

compared,they may not

101 115

have the same base period.

First select a common base period for all series.

Then use the respective base numbers as the denominators

and convert each series to the new base period.

Consumer Price Index

18- 19

Stock

1997

1997

2002

2002

Price Shares Price Shares

Mr. Wagner

owns stock in

NWS $1

30

$2

50

three companies.

$5

15

$4

30

Shown below is NPC

the price per

GAC $6

40

$6

20

share at the end

of 1997 and

Laspeyres Weighted Price Index, P

2002 for the

p t q 0

P

(100 )

three stocks and

p 0 q 0

the quantities he

$2(30 ) $4(15) $6(40 )

(100 )

owned in 1997

$1(30 ) $5(15 ) $6(40 )

and 2002.

$360

(100 ) 104 .35

$345

18- 20

Paasche Weighted Price Index, P

p t q t

P

(100 )

p 0 q t

$2(50 ) $4(30 ) $6(20 )

(100 )

Value Index

$1(50 ) $5(30 ) $6(20 )

$340

p t q t

(100 ) 106 .25

P

(100 )

$320

p 0 q 0

Fisher’s Ideal Index

F = (104.35)(106.25)

$2(50 ) $4(30 ) $6(20 )

(100 )

$1(30 ) $5(15 ) $6(40 )

$340

(100 ) 98 .55

$345

=105.3

Example 1 continued

![Methodology Glossary [Tier 2 information ]](http://s3.studylib.net/store/data/007482938_1-dfe9be18f2dcf2b2e0ac156c7173c1b8-300x300.png)