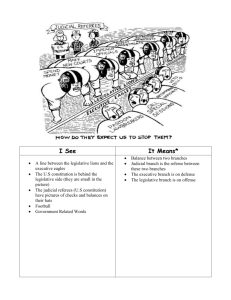

Legislative budget oversight in presidential systems

advertisement

Governance of the budget in Peru Legislative budget oversight and public finance accountability in presidential systems Carlos Santiso with Arturo Garcia Belgrano ECLAC XVI Regional Seminar on Fiscal Policy Santiago de Chile, 27 January 2004 Overview • Context and introduction – Budgetary process and fiscal reform – Delicate balance: legislative budgeting, political accountability, and fiscal prudence • Economic governance and legislative budgeting – Budgetary institutions and government accountability • Legislative budget authority: Legal framework – Constitutional provisions and regulatory framework – Time, timing and sequencing • Legislative budget oversight: Actual practice – Internal constrains – legislative organization – External constrains – governance context Objectives • Role of parliament in the budget process – Understanding the budget process and incentives and behaviour of multiple agents (parliament) – Governance of the budget beyond the executive • Risks to budget governance of unrestrained executive discretion – Hierarchical budgetary institutions – Horizontal and vertical accountability • Constraints to and conditions for effective budget oversight (internal and external) • Politics of public budgeting – Executive-legislative relations – Formal and informal dynamics Introduction and context (1) • Newfound interest in role of parliament in public budgeting, especially in presidential systems • Two waves of budgetary reform – Transparency and efficiency – focus on executive – Accountability and integrity – beyond the executive • Four phases of the budget process – Differentiated roles for executive and legislature along the budget cycle (formulation, adoption, execution, and control) – Institutional analysis and political economy approach Introduction and context (2) • Disjuncture between formal powers and actual role • Four sets of explanatory variables – – – – Legal framework Technical capacities Political incentives Governance environment • Key challenge: ability of institutional arrangements to adequately balance political accountability and fiscal prudence Budgetary institutions and government accountability • Budget reform, hierarchical budgetary institutions and fiscal discipline • Accountability deficit in public budgeting – Ex ante accountability (policy priorities and budget allocations) – Coincident accountability (execution oversight and integrity) – Ex post accountability (accounting for results) • New patterns of governance – Divided government and the rediscovery of legislative budgeting Economic governance and legislative budgeting in Peru • Economic reform and institutions of economic governance – Modernization of governmental financial administration (1993: tax reform, organic budget law) – Building hierarchical budget institutions (finance ministry, central bank, tax agency) – Insulation and vulnerability to capture • Patterns of executive-legislative budget relations – – – – Confrontation (1990-1992) and rupture (1992) Executive dominance (1993) Neutralization (1993-2000) and capture (1997-2000) Restoration of democratic institutions (2001 -) Legislative budget authority (1) • Legislature and public finance – Different powers in taxation and budgeting (art. 74) – Taxation and budgeting as separate policy processes • Legislative budget powers – Constitution of 2003, organic budget law of 1999 revised 2003, and Congress internal rules – Key features: • • • • Uncommon executive prerogatives Neutralization of key legislative powers Delegation of legislative authority Extensive use of executive decrees TABLE 1: CONSTITUTIONAL RESTRICTIONS ON LEGISLATIVE BUDGET AUTHORITY IN LATIN AMERICA Country Year of constitution (amendment) PERU 1979 PERU 1993 ARG 1994 BOL 1967 (1994 ) BRA 1988 (1999) CHI 1980 (1989) COL 1991 (1997) CR 1949 (1997) ECU 1998 URU 1997 VEN 1999 Only the President can propose the budget Yes (Article1 97) Yes (Article 78) Article 100.6 Art 147 Article 61(1)II (b) Article 64 Article 346 Article 178 Article 258 Article 215 Article 313 Yes (Art 199) Yes (Art 79) No No Yes with loopho le (Art 166) Yes with loopho le (Art 64) Yes (Art 351) No No Yes (Art 215) No No No Yes Implicit No No No No Yes Implicit No Yes Implici t Yes Article 313 Yes (Art 198) Yes (Art 80) No Yes (Art 147) No Yes (Art 64) Yes (Art 348) No Yes (Art 258 No No Congress cannot increase the budget for any items or create new budgetary categories If no new budget is passed, current budget remains in effect OR President’s proposal takes effect Legislative budget authority (2) • Legislative powers along the budget cycle – Budget formulation and drafting • Executive has the exclusive right of initiative (art. 78) – Amendment powers and adoption • Legislature can neither increase the budget nor create new budget categories (art. 79) • If legislature fails to act within the imparted time, the executive proposal takes effect by legislative decree (art. 80) – Oversight of budget execution – Certification of public accounts • Time, timing and sequencing TABLE 2: TIME FOR BUDGET REVIEW IN LATIN AMERICA Country Parliame ntary structure Budget approval authority Argentina Bolivia Brazil Colombia Chile Paraguay Dominican Republic Uruguay Venezuela Mexico Costa Rica Ecuador El Salvador Guatemala Bicameral Bicameral Bicameral Bicameral Bicameral Bicameral Bicameral Both chambers Both chambers Both chambers Both chambers Both chambers Both chambers Both chambers Bicameral Bicameral Bicameral Unicameral Unicameral Unicameral Unicameral Honduras Nicaragua Panama Peru Unicameral Unicameral Unicameral Unicameral Both chambers Both chambers Chamber of Deputies Legislative Assembly National Congress Legislative Assembly Congress of the Republic National Congress National Assembly Legislative Assembly Congress of the Republic Source: Gutiérrez 2001:Chapter III. Days allowed for reviewing budget proposal n.a. 60 100 90 60 90 Max 90 90 n.a. 30 90 90 90 120 105-120 n.a. 90 90 TABLE 3: TIMING AND SEQUENCING OF BUDGETARY PROCESS IN PERU Phase of the budget CY1 Budget formulation Budget proposal Budget review Budget adoption CY2 Budget execution CY3 Accounting Auditing Preparation of public accounts CY4 Opinion on public accounts Certification of public accounts Responsible state institution Timing Executive (MEF/DNPP) Executive (PCM/MEF) Legislature (budget committee) Legislature (plenary) 30 August 15 November 30 November Spending agencies 1 January – 31 December Executive (MEF/CPN) External audit office (CGR) Executive 30 June 30 June 15 November Legislature (budget committee) Legislature (plenary) 15 February 15 March FIGURE 1: TIMING AND SEQUENCING OF BUDGETARY PROCESS IN PERU Executive branch Formulation Submission CY1 30 Aug Execution 15 Nov 30 Nov CY2 Review Adoption Accounting CY3 Legislative branch 30 Jun Auditing 15 Nov CY4 15 Feb 15 Mar Public accounts Opinion Certification Constraints to effective legislative budget oversight (1) • Credibility of the budget – Budget transparency (legal framework, perceptions, enforcement mechanisms) – Budget rigidity (size, inertia and capital expenditures) • Executive discretion in budget execution – Budget integrity: gap approved-executed (underspending), off-budget expenditures – Extensive and early uses of executive decrees (reallocations) TABLE 4: BUDGET TRANSPARENCY IN LATIN AMERICA (AGGREGATE INDEX) Country Assessment of Legal Framework Perceptions Index Average Index (un-weighted) 1 to 10 6.1 5.8 6.6 5.1 4.9 Out of 1000 points 1 to 10 1 to 10 Argentina 700 7.0 5.1 Brazil 636 6.4 5.1 Chile 733 7.3 5.9 Mexico 507 5.1 5.0 Peru 598 6.0 3.7 Source: IBP 2003:5. Notes: The legal framework score is on a scale of 0 to 1000. The index of perceptions is an average on a scale of 1 to 10, of not transparent to transparent. TABLE 5: BUDGET TRANSPARENCY IN LATIN AMERICA (DISAGGREGATE INDEX) Phases of the budget Average score of 1 to 5 Most transparent Least transparent Formulation Average Chile 3.36 Mexico 2.67 Argentina 2.57 Peru 2.47 Brazil 2.47 Approval Average Chile 2.80 Argentina 2.79 Brazil 2.63 Mexico 2.44 Peru 2.39 Execution Chile Average 3.16 Oversight and auditing Chile Average 3.07 Economic Information Chile Average 3.53 Source: Based on IBP 2003:3. Argentina 2.71 Brazil 2.40 Peru 2.38 Mexico 2.36 Brazil 2.31 Mexico 2.27 Argentina 2.19 Peru 1.89 Argentina 3.15 Brazil 3.15 Mexico 2.75 Peru 2.66 Constraints (2) TABLE 6: APPROVED AND EXECUTED BUDGET (1999-2003) Year Approved Executed Difference Executed – (bn Nuevos Soles) (bn Nuevos Soles) Approved (bn Nuevos Soles) 1999 2000 2001 2002 31,947,306,720.00 34,045,803,045.00 35,985,274,003.00 35,771,987,911.00 2003 44,516,006,305.00 Source: MEF SIAF-SP (various years). Deviation from approved budget (in percentage) 27,253,744,605.12 28,636,662,805.83 34,542,383,234.54 35,329,849,152.55 -4,693,562,114.88 -5,409,140,239.17 -1,442,890,768.46 -442,138,758.45 14.7% 15.9% 4.0% 1.2% 41,565,072,361.19 -2,950,933,943.81 6.6% TABLE 7: CHANGES IN THE BUDGET (1998-2001) Fiscal year Changes in Date of first Number of secret budget * emergency decrees ** change 1998 29 19 February 2 1999 34 25 January 2 2000 38 16 February 1 2001 (first semester) 19 13 January 0 Source: Mostajo (2002:19.) *: Essentially supplementary credits and transfers. **: Between 1995 and 2000, there have been 20 such secret emergency decrees. Constraints (3) • Weak institutionalisation of legislative budgetary institutions – – – – – Parliamentary structures and procedures Parliamentary budget and finance committees Legislative technical budget capacity Legislative budget research capacity Legislative oversight and external auditing • Relations public accounts committee and general audit office • General audit office (internal and external auditing) – Consequences: • Limited access to independent budget analysis and advise • Limited availability of timely information on budget performance Constraints (4) • Unrestrained executive discretion – Presidential nature of political regime and executivelegislative relations – Executive decree authority and legislative delegation (how much is too much?) – Insulation of economic policymaking and institutions of economic governance (‘veto knots’ or ‘accountability points’) (ex.: general audit office) – External oversight and social control Constraints (5) • Political system and legislative budgeting – Vertical determinants of horizontal accountability – Political parties and electoral rules – Political party system fragmented and volatile – Party cohesion, coherence and discipline – Party structures, parliamentary groups and legislative committees Concluding remarks • Key challenges: – Adequate balance between executive power and legislative oversight: How to retain the advantages of strong executive authority required to ensure fiscal discipline while providing the institutional checks and balances that guarantee effective accountability • The politics of legislative budgeting – Different roles for different phases of budget cycle (oversight and accountability roles of parliament) – Technical capacity, institutional arrangements and political incentives – Chicken and egg dilemma : technical capacities and political incentives Thank you