Finance Basics

advertisement

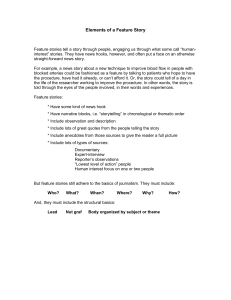

Business Basics FINANCE BASICS Finance Basics Who cares anyway? You should Investors will Why? Because financial statements tell you the truth about your business They allow you to plan for the future (i.e. Do you need external funding? How much?) Some key terms Gross profit – sales less the cost of sales Net profit - final profit for business Bottom line Fixed asset – not sold directly to end consumer Finance Basics You need to make profit: To maintain and repair To develop and expand (and/or to line the shareholders pockets) Finance basics: The Bottom Line Price Revenues x Volume Profit Sell it for more Sell more of it Fixed Costs Reduce costs Buildings, Salaries + Variable Materials, Cost of Sales Finance basics I made a £2 million turnover last year! Turnover is vanity Profit is sanity But... CASH IS KING! Financial Statements Balance sheet Profit and loss account Capital expenditure Cash-flow statement Balance sheet A snap-shot of finances at any moment in time Shows: Assets and Liabilities showing in summary everything owed and owned Tells you about past performance and potential for the future The difference between assets and liabilities is known as equity The sheet should balance! i.e like a bank statement Profit/Loss account Also known as income statement Shows incomes and outgoings for a particular period of time Basically a record of sales, other revenues and costings Bottom line is the bottom line for the business: net profit or loss Transactions are recorded in the period to which they relate E.g a transaction made in April but not paid in until May would be recorded as a transaction in April Does not include fixed assets but does include interest etc. Capital expenditure o expenditures creating future benefits o To buy a fixed asset o Add value to existing asset o Restoring a property o Starting a new business! o Costs usually over a number of years, not just for a particular month Cash-flow statement Show financial flows when they actually happen E.g so a transaction occurring in April but not paid until May would be recorded as a transaction in May Most important Finance basics: Cash Flow You must NOT run out of cash! When do you collect payments? When do you pay your debts? How do you finance your company? Resources Spreadsheet online www.businessbasecamp.co.uk Types of cash for a start up Organic Debt - Bank, Customer, Supplier Equity – FFF, Angel, Venture Capitalist, Private equity Grants Prizes Useful materials The definitive guide to Business Finance by Richard Stutely www.business basecamp.co.uk