Steps to Financial Security for OFWs

advertisement

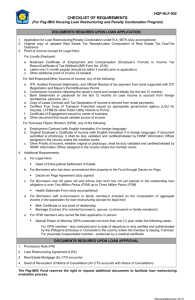

OFW UsapangPiso Forum Pocket Seminars HOW TO INVEST ofwup INVESTMENT-BUSINESS-FINANCIAL PLANNING FORUM FOR PINOYS ABROAD Speaker: Tristan Cristobal LOGO http://www.ofw-usapangpiso.com Who We Are ? Angat Pilipinas Coalition for Financial Literacy is a global non-profit organization of active and former Overseas Filipino workers (OFWs) and personal finance advocates who have bonded together as a support group to address issues, discuss concerns, and share knowledge with OFWs on entrepreneurship, investment, and financial literacy in order to contribute to poverty alleviation and improve the quality of life in the Philippines. Steps to Financial Security for OFW’s 2 Vision & Mission Statement Vision OFW UsapangPiso envisions a nation by the year 2020 where 100,000 or more former OFWs and dependents are financially-independent, entrepreneurial, and investing in the Philippine capital market. By 2050, being an OFW comes as a choice rather than a need. Mission To provide affordable and accessible information on how to save and invest their money wisely through education and workshops, interactive online forum, webinars, social media, life-coaching, and by bridging resources from other organizations to active and former OFWs and their families. It also aims to serve the best interest of its members and other stakeholders, and participate to the achievement of the nation's economic objectives. Steps to Financial Security for OFW’s 3 About The Speaker Tristan Cristobal He is a CPA, Daddy of a lovely daughter, and husband. He is a financial educator advocate He is the Western Regional Director – KSA of OFW Usapang Piso He is currently working in Toyota as Compliance Officer He is an entrepreneur He is an investor of various investment vehicles like insurance investments, stocks, uitf etc… He was exposed in their family business at a young age He experienced the success and failure of their family business He is a Financial Advisor of Pru Life UK He practices basic yoga daily He likes to watch anything that interests him, plays badminton, billiards, basketball, swimming etc.. He belongs to the generation of getting good grades to graduate and get a high paying job He will soon escape his day job after the established safety net needed Mobile # - 0542136373 Email: ticristobal@gmail.com Steps to Financial Security for OFW’s 4 SAD FACTS Only 1% of Phil’s Population invests in Stock Only 15% is successful while the remaining failed Only 1.1% has life coverage Steps to Financial Security for OFW’s 5 Investment – Is an asset that you buy to generate an economical value in the future – Is use for financial personal planning – is not a get-rich quick scheme – controlling your finances – is a magic touch of TIME – fights back inflation – better than bank savings Steps to Financial Security for OFW’s 6 INVESTMENT VEHICLES BUSINESS INVESTMENTS STOCKS PROTECTION (VUL -Variable Unit Linked) MUTUAL FUNDS, UITF PRECIOUS METALS etc Steps to Financial Security for OFW’s 7 What’s your Purpose? Protection Cover emergencies Education Savings Retirement Fund Steps to Financial Security for OFW’s 8 WEALTH FORMULA SMALL amount of MONEY + BIG amount of TIME = WEALTHY INVESTOR Steps to Financial Security for OFW’s 9 COMPOUNDING OF INTEREST Year Invested 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 TOTAL Investment A 60,000 60,000 60,000 60,000 60,000 60,000 60,000 60,000 60,000 60,000 60,000 60,000 60,000 60,000 60,000 60,000 60,000 60,000 60,000 60,000 1,200,000 Investment A Value in Year 20 @ 10%* growth 66,006.60 72,639.23 79,893.48 87,847.73 96,618.36 106,382.98 116,959.06 128,479.66 141,509.43 155,440.41 171,428.57 188,087.77 206,896.55 228,136.88 251,046.03 275,229.36 303,030.30 333,333.33 365,853.66 402,684.56 3,777,503.96 *PSE Min Ave Growth from 1987-2010 Steps to Financial Security for OFW’s 10 Investment Strategies Small amount of Money (monthly) Long term investment Invest in strong companies (blue chip companies) Market Timing Steps to Financial Security for OFW’s 11 UNDERSTANDING STOCK MARKET Steps to Financial Security for OFW’s 12 Steps to Financial Security for OFW’s 13 Steps to Financial Security for OFW’s 14 Steps to Financial Security for OFW’s 15 Basic Consideration Invest in Basic Needs – Food, Water, Shelter – Infrastructures Invest in BIG Companies – Ayala, Sy, Gokongwei, Tan, etc Steps to Financial Security for OFW’s 16 Steps to Financial Security for OFW’s 17 Philippine Online Stockbrokers Steps to Financial Security for OFW’s 18 Mutual Funds Steps to Financial Security for OFW’s 19 UNDERSTANDING POOLED FUNDS Steps to Financial Security for OFW’s 20 Kinds of Mutual Funds EQUITY BALANCED FIXEDINCOME 75% - 90% invested in stocks 50% in stocks, 50% in fixed-income 100% in fixed-income securities Average annual return: 15% - 20% Average annual return: 10% - 15% Average annual return: 6% - 10% Medium risk, Higher risk compared to other MF types Medium risk, Moderate risk compared to other MF types Medium Risk, Lower risk compared to other MF types For aggressive investors Ideal for long term growth (5 years or more) For balanced investors Medium to long term growth (3-5 years or more) Steps to Financial Security for OFW’s For conservative investors For long term capital preservation (5 years or more) MONEY MARKET 100% in short term fixed-income securities Average annual return: 1% - 2% Medium Risk, Even Lower risk compared to other MF types For very conservative investors For short term capital preservation (1-2 years) 21 Philippine Mutual Fund Companies Source: www.pifa.com.ph Steps to Financial Security for OFW’s 22 Philippine Major Banks with UITF’s Steps to Financial Security for OFW’s 23 UNDERSTANDING VUL Steps to Financial Security for OFW’s 24 Steps to Financial Security for OFW’s 25 Steps to Financial Security for OFW’s 26 VULs Protection Exact Period Term – 5yrs, 7yrs, 10yrs, 15yrs Focus on Protection Partial or Full Withdrawal based on available Fund Value Investment either in: Bond Fund, Managed Fund, Growth Fund, Equity Fund, Money Market, Active Fund Risk would depend on Investment Vehicle Ideal for long term growth Protection Account Plus Investor Account Millionaire Account Life time payment Single Payment Single Payment Focus on Protection Focus on Investment Focus on Investment Partial or Full Withdrawal based on available Fund Value Partial or Full Withdrawal based on available Fund Value Partial or Full Withdrawal based on available Fund Value Investment either in: Investment either in: Investment either in: Bond Fund, Managed Fund, Growth Fund, Equity Fund, Money Market, Active Fund Bond Fund, Managed Fund, Growth Fund, Equity Fund, Money Market, Active Fund Bond Fund, Managed Fund, Growth Fund, Equity Fund, Money Market, Active Fund Risk would depend on Investment Vehicle Risk would depend on Investment Vehicle Risk would depend on Investment Vehicle Ideal for long term growth Ideal for short to longterm growth Ideal for short to longterm growth Steps to Financial Security for OFW’s Source: Pru Life Uk 27 Steps to Financial Security for OFW’s Source: Pru Life Uk 28 Steps to Financial Security for OFW’s 29 Protection Account Age : 45 -50 Fund: Pro Active Term: Premium Benefits Sum assured TPD, LCB, ADD Number of Yrs 10 Yr Lifetime 4000/mo (48k/Yr) 3000 (36K/yr) Financial Products PEP10 PAA+ P250,000 - 300,000 P600,000- 800,000 P250,000 - 300,000 P600,000- 800,000 Projected Fund Value of Investment 10 Yr Amount P518,276 - 542,774 Amount P173,519 - 203,793 20 Yr P1,071,179- 1,186,627 P517,746 -658,734 Steps to Financial Security for OFW’s 30 Investor Account Age : 45-60 Investment Link: ProActive Fund Single Premium Benefits Sum assured (25%) Accelerated TPD Accidental Death & Disablement Accidental TPD Murder & Assault (included in PA-ADD) Accidental medical reiumbursemnt Number of Yrs 1 Yr 5 Yr 10 Yr 15 Yr Steps to Financial Security for OFW’s P100,000 P1,000,000 Financial Products PIA + PruMillionaire 25,000 250,000 100,000 100,000 50,000 10,000 Projected Fund Value of Investment Amount Amount P94,602- 97,505 P1,005,328 -1,008,258 P107,000 - 127,993 P1,357,271 -1,364,777 P115,713 - 173,946 P1,903,903 -1,913,021 P117,516 -234, 985 P2,624,033 -2,654,687 31 Steps to Financial Security for OFW’s 32 Top 5 Insurance Companies Sun Life of Canada (Philippines) Inc Philippine American Life & General Philippine AXA Life Insurance Pru Life Insurance Corp of UK Manufacturers Life Ins Co (Phil) Steps to Financial Security for OFW’s Source: insurance.gov.ph 33 Our Websites and Social Media Accounts Our Main/Parent Site: – www.pinoymundobiz.org (Angat Pilipinas Coalition for Financial Literacy) OFW UsapangPiso Forum Site: – http://www.ofw-usapangpiso.com Facebook Group – https://www.facebook.com/groups/ OFWusapangpiso/ (Discussion Group and Forum Extension) Twitter : – https://twitter.com/ofw_usapangpiso Steps to Financial Security for OFW’s 34 Things to remember Where are you now financially? What are your financial goals? How are you going to achieve that goals? Steps to Financial Security for OFW’s 35 OFW UsapangPiso Forum Pocket Seminars INVESTMENT-BUSINESS-FINANCIAL PLANNING FORUM FOR PINOYS ABROAD Speaker: Tristan Cristobal LOGO http://www.ofw-usapangpiso.com