Module Leader - Personal Home Pages (at UEL)

advertisement

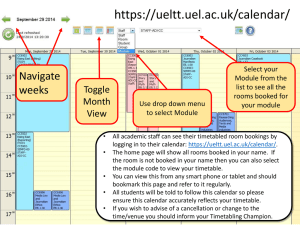

Royal Docks Business School University Of East London MODULE GUIDE Module Code: FE 1016 Module Title: Financial Accounting 1 Semester / Year Semester A 2012/13 Contents Page Module leader…………………………………………………………………………………….2 Introduction……………………………………………………………………………………….2 Synopsis of the Module……………………………………........…………………..………..2 Aims of the Module……………………………………………………………………………..3 Learning outcomes………………………………………………………………………………3 Teaching and learning approach...........................................................................3 UEL Plus…………………………………………………………………………………………….3 Teaching time table……………………………………………………………………………..4 Attendance requirement………………………………………………………………………..4 Indicative timetable….…………………………………………………………………………..5 Recommended reading………………………………………………………………………….6 Knowledge and skills developed and forms of assessment…………………………….6 Assessments………………………………………………………………………………………7 Teaching staff…………………………………………………………………………………….7 Module specification…………………………………………………………………………….8 FE 1016 Financial Accounting 1 Module Leader Mostafa Hussien Office No e.mail: Extension Office Hours BS 3.35 m.hussien@uel.ac.uk 0208 223 2181 Wed 1pm-3pm Thu 1pm-2pm Preferred style of contact In the first instance, if you have any queries regarding the teaching or assessment for this module, please refer to your seminar tutor. If you do not receive a satisfactory response and my office availability is not convenient, please e-mail me with your query for an appointment. Introduction Welcome to FE 1016, Financial Accounting 1. The module leader is Mostafa Hussien, who will take the 2 hours lecture and 1 hour workshop each week. There will also be a 1 hour seminar each week. If you have anything which you wish to discuss outside lectures, seminars and workshops, feel free to contact us. In common with all the Accounting and Finance lecturers, we have set aside certain hours (“office hours”) to see students without an appointment (these times can be found on UEL Plus and are also on each lecturer’s door). Also any notices about the module will normally be posted on UEL Plus. (To access UEL Plus see the section on “UEL Plus”). Synopsis of the module The module starts by looking at the double entry book-keeping process and then builds up to final accounts for sole traders and limited companies (for both internal and external use) taking account of various adjustments eg depreciation and stock, and also the concepts which are used when producing final accounts. We then look at cash flow statements. After examining the advantages and disadvantages of historical cost accounting there will be a brief introduction to alternatives to historical cost accounting. Finally we look at control accounts, accounting for nonprofit organisations and incomplete records. 2 Module Guide FE 1016 Financial Accounting 1 Aims of the module The Module aims to develop, on a sound basis of theory and principles, the accounting techniques and skills necessary as a foundation for further study and practical experience in accounting. Learning outcomes At the end of this module, students will be able to: 1 Demonstrate an understanding of the context within which accounting operates and through which it relates to the business environment 2. Select and employ suitable concepts, methods and analytical tools in the assessment of business and financial problems 3. Demonstrate an understanding of the limitations and problems of accounting theory and practice 4. Prepare financial reports for user groups 5. Demonstrate an understanding of the Analysis and Interpretation of Company Financial Statements 6. Demonstrate the treatment of Long-Term Finance Teaching and learning approach Each week you will have: two hours lecture one hour workshop one hour seminar UEL Plus A lot of information about the module will be placed on UEL Plus. You can access UEL Plus from the UEL website (www.uel.ac.uk) by clicking on “UEL DIRECT” in the top left hand corner of the home page. Log on to UEL DIRECT - your User Name is “uxxxxxxx” (where xxxxxxx is your student number) and the Password is your date of birth. For instance if your date of birth was 28 January 1991 it would be expressed as “28-jan-91”. Then access UEL Plus. Any changes to the timetable or to classes eg sickness will be communicated through UEL Plus. I will also post the module timetable on UEL Plus. 3 Module Guide FE 1016 Financial Accounting 1 Teaching Time table Your personal teaching timetable is as follow: Lecture Thurs Workshop Thurs Seminar 11– 1 2–3 WB.G.02 Mostafa Hussien WB.G.02 Mostafa Hussien 1 Thurs 9 – 10 BS.3.04 Albert Owusu 2 Thurs 9 – 10 BS.3.05 Mostafa Hussien 3 Thurs 10 – 11 BS.3.04 Albert Owusu 4 Thurs 10 –11 BS.3.05 Mostafa Hussien 5 Thurs 3–4 BS.3.02 Mostafa Hussien Attendance requirement. You are expected to attend regularly, and punctuality is important. I do not welcome students into the classroom who are late than 10 minutes late. You are also expected to complete preparatory work for the class, and are liable to be asked to leave and lose your attendance if you come to class unprepared. Your attendance will be monitored on this module. You should let the School office know if you are unable to attend any class, preferably prior to the day of the class, and if you can not do so, within 7 days of the absence. If you fail to attend for three consecutive weeks, or miss more than 75% of your classes during the semester, you will be withdrawn from the module. However, if such absence is caused by an event of a serious nature which can be verified, you should provide the evidence and fill in the relevant form at the student help desk. In the lecture the topic will be explained to you and for most lectures you will be required to print out the handout from UEL Plus which will contain reading references to textbook chapters. Once you have attended the lecture and carried out any required reading, you should have a good understanding of the topic. You need to spend as much time reading about the topic as is necessary in between the lecture; workshop and the seminar to make sure you have understood the topic. If you cannot understand any aspect, you are encouraged to go and see your seminar tutor to clarify any difficult areas. The workshops and seminars give you the opportunity of developing the topic covered in the lecture, carrying out exercises to apply financial accounting techniques where appropriate. Often you will be left with a question, or questions, 4 Module Guide FE 1016 Financial Accounting 1 to finish off in your own time. It is very important that you find time after the seminars to finish off these questions as they are a very important part of your learning experience. Also many of these questions are past examination questions. If you find you are having trouble with these questions please do not hesitate to contact either myself or the tutor who takes the Seminar. Indicative timetable Week commencing Syllabus 24 September Introduction to Accounting 1 October Users and Uses of Accounting Information 8 October Assets, Liabilities and Ownership Interest The Balance Sheet 15 October Principles and Measurement of Financial Performance The Income Statement 22 October Analysis and Interpretation of Company Financial Statements 29 October The Double-Entry System and Final Accounts 5 November Treatment of Non-Current Assets 12 November Accounting for Inventories and Receivables 19 November Treatment of Long-Term Finance 26 November Accounting requirements of the Companies Act Nature and context of auditing 3 December Revision 10 December Revision 5 Module Guide FE 1016 Financial Accounting 1 Recommended reading The recommended book is: Weetman, P., (2011), Financial Accounting – An Introduction, 5th edition, Prentice Hall. Also you are strongly recommended to refer to other books. Typical books which you are recommended to refer to are: Bebbington, Gray and Laughlin, (2001) Financial accounting - practice and principles (3rd edition), London: Thomson Learning Black, G. (2009) Introduction to accounting and finance (2nd edition), Harlow: Financial Times Prentice Hall Thomas and Ward (2009) An introduction to financial accounting (6th Edition), Maidenhead: McGraw Hill Wood, F. and Sangster, A. (2008) Frank Wood’s Business accounting UK GAAP 1, Harlow: Financial Times Prentice Hall. Gilert, G. (2008) Sage 50 Accounting 2009 in easy step, Southam: In Easy Steps Limited. Knowledge and skills developed and forms of assessment During the course of this module, you will have had the opportunity to gain knowledge and understanding of the topics listed above, both by means of attendance at lectures, seminars and workshops and reading the recommended books. 6 Module Guide FE 1016 Financial Accounting 1 Assessments There will be 2 assessments: 1. An Assignment 2. 2 hours end-of-semester examination The assignment will be marked out of 100 marks and will account for 30% of your overall module mark. The end-of-semester examination, to be held sometime in the 2 weeks commencing 12 December 2012, will be a 2 hour examination, marked out of 100 marks and account for 70% of your overall module mark. This examination will normally cover the remaining Learning Outcomes (Learning Outcomes 1, 2, 3, 4,5and 6). To pass the unit the overall mark should be 40% or more, with a minimum of 30% in the assignment and a minimum of 30% being achieved in the 2 hour examination. Teaching Staff Mostafa Hussien Albert Owusu I hope you enjoy the module. Mostafa Hussien September 2012 7 Module Guide FE 1016 Financial Accounting 1 Module Specification Module Title: Module Code: FE 1016 Module Leader: FINANCIAL ACCOUNTING 1 Level: 1 Mostafa Hussien Credit: 20 Extn 2181. Room BS 3.35 ECTS credit: 10 email: m.hussien@uel.ac.uk Pre-requisite: None Pre-cursor: None Co-requisite: Excluded combinations : FE 1010 None Is this module part of the Skills Curriculum? No University-wide option: Yes Location of delivery: UEL – Docklands Main aims of the module: The Module aims to develop, on a sound basis of theory and principles, the accounting techniques and skills necessary as a foundation for further study and practical experience in accounting. Main topics of study: The role of accounting as a financial information system for internal management and external reporting purposes. The classification, recording and summarising of business transactions in appropriate books and accounting records, utilising accounting concepts, bases and standards. Preparation of income statements and balance sheets of sole traders and limited liability companies. Detailed treatment of stock valuation and depreciation. Preparation of final accounts from incomplete records. Treatment of Long-Term Finance An introduction to the standard setting process. (Consideration will be given to standards in each appropriate topic area). The nature and context of auditing. 8 Module Guide FE 1016 Financial Accounting 1 Learning Outcomes for the module At the end of this module, students will be able to: Knowledge 1. Demonstrate an understanding of the context within which accounting operates and through which it relates to the business environment Thinking skills 2. Select and employ suitable concepts, methods and analytical tools in the assessment of business and financial problems 3. Demonstrate an understanding of the limitations and problems of accounting theory and practice Subject-based practical skills 4. Prepare financial reports for user groups 5. Demonstrate an understanding of the Analysis and Interpretation of Company Financial Statements 6. Demonstrate the treatment of Long-Term Finance Teaching/ learning methods/strategies used to enable the achievement of learning outcomes: Theoretical concepts and practical aspects of a topic will be presented in a weekly two hours lecture. This will be followed by practical applications and discussions, which will take place in weekly one hour workshops and one hour seminar. Assessment methods which enable students to demonstrate the learning outcomes for the module: Weighting: Learning Outcomes demonstrated 30% 1,3, and 5 70% 1, 2, 3, 4, 5 and 6 Component 1: Assignment Component 2: A two hour examination 9 Module Guide FE 1016 Financial Accounting 1 Reading and resources for the module: Core Wood, F.and Sangster, A. (2008) Frank Wood’s Business accounting UK GAAP 1 Financial Times Prentice Hall Recommended Bebbington, K., Gray, R., Laughlin, R. (2001) Financial accounting - practice and principles (3rd edition) Thomson Learning Gilert, G. (2008) Sage 50 Accounting in easy step, Easy Steps Limited Glautier, M., Underdown, B. (2000) Accounting - theory and practice (7th edition) Financial Times Prentice Hall Thomas, A. (2005) Introduction to financial accounting (5th Edition), McGraw Hill Weetman, P. (2006) Financial accounting - an introduction (4th Edition) Financial Times Prentice Hall Indicative learning and teaching time Activity (10 hrs per credit): 1. Student/tutor interaction Activity: Lectures 24 hours 48 hours Workshops 12 hours Seminars 12 hours 2. Student learning time: Activity : Reading, preparation for assignments and revision for final examination. 152 hours Total hours: 200 hours: 10 Module Guide