Corporate Finance Exam Questions: Shares, Debentures, Buyback

advertisement

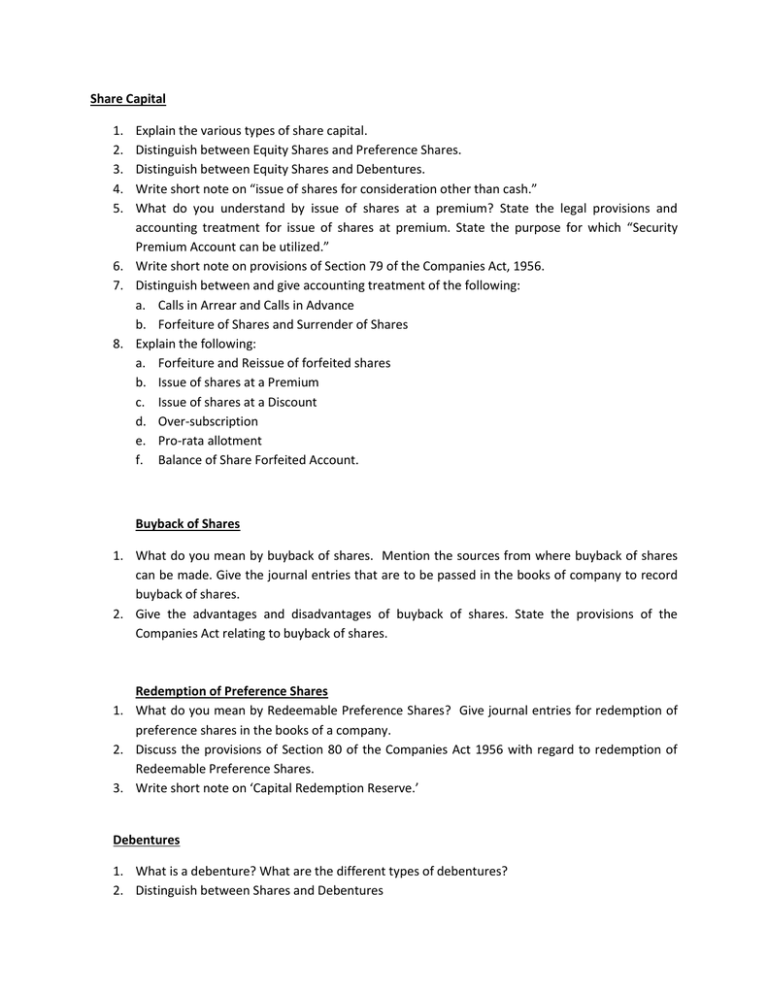

Share Capital 1. 2. 3. 4. 5. Explain the various types of share capital. Distinguish between Equity Shares and Preference Shares. Distinguish between Equity Shares and Debentures. Write short note on “issue of shares for consideration other than cash.” What do you understand by issue of shares at a premium? State the legal provisions and accounting treatment for issue of shares at premium. State the purpose for which “Security Premium Account can be utilized.” 6. Write short note on provisions of Section 79 of the Companies Act, 1956. 7. Distinguish between and give accounting treatment of the following: a. Calls in Arrear and Calls in Advance b. Forfeiture of Shares and Surrender of Shares 8. Explain the following: a. Forfeiture and Reissue of forfeited shares b. Issue of shares at a Premium c. Issue of shares at a Discount d. Over-subscription e. Pro-rata allotment f. Balance of Share Forfeited Account. Buyback of Shares 1. What do you mean by buyback of shares. Mention the sources from where buyback of shares can be made. Give the journal entries that are to be passed in the books of company to record buyback of shares. 2. Give the advantages and disadvantages of buyback of shares. State the provisions of the Companies Act relating to buyback of shares. Redemption of Preference Shares 1. What do you mean by Redeemable Preference Shares? Give journal entries for redemption of preference shares in the books of a company. 2. Discuss the provisions of Section 80 of the Companies Act 1956 with regard to redemption of Redeemable Preference Shares. 3. Write short note on ‘Capital Redemption Reserve.’ Debentures 1. What is a debenture? What are the different types of debentures? 2. Distinguish between Shares and Debentures 3. What do you mean by “issue of Debentures for Consideration other than Cash.” 4. Write short note on “issue of Debentures as Collateral Security.” 5. What is meant by “Discount on issue of Debentures.” How would you treat the discount on issue of Debentures? What do you mean by ‘Redemption of Debentures.’? Describe the various methods of redeeming debentures. 6. What is Sinking Fund? Give the accounting entries for the redemption of debentures under Sinking Fund Method. Also show how the relevant items appear in Balance Sheet under this method. 7. Write short note on “Cum- Interest and Ex- Interest Quotations.” 8. What do you mean by ‘ex-interest’ and ‘cum interest’ price for purchase of own debentures. Give accounting entries for the cancellation of debentures by purchase in the market. 1. 2. 3. 4. 5. Underwriting Shares and Debentures What is an “Underwriting Contract”? Discuss the various types of underwriting contracts. What is meant by underwriting of shares and debentures? State the advantages of underwriting of shares. What do you mean by the terms ‘Pure underwriting’ and ‘Firm underwriting’? What are the provisions of Section 76 of the Companies Act 1956 regarding the payment of underwriting commission? What is the maximum underwriting commission that can be paid in respect of underwriting of (i) shares and (ii) debentures. How would you calculate the liability of various underwriters under the contract of underwriting. Right Shares & Bonus Shares 1. Discuss right shres including relevant SEBI guidelines in brief. Can these shares be offered by a company to outsiders without offering the same first to the existing shareholders? If so, state the circumstances under which it can be done. 2. How would you value rights? Explain with one example. 3. What do you mean by ‘Bonus Shares’? Give important SEBI guidelines for the issue of bonus shares. What are the sources out of which bonus shares may be issued? 4. Explain the accounting procedure for issuing Bonus Shares. 5. Distinguish between Bonus Shares and Right Shares. 6. Discuss the provisions regarding capitalization of profits. Profits Prior to Incorporation 1. What do you mean by ‘Profit Prior to Incorporation?’ What is the nature of such profits? How are they calculated and treated in the books of accounts? 2. For what purpose can profit prior to incorporation be utilized? Final Accounts 1. Explain how the net profits of a company are calculated for the purpose of computing managerial remuneration. 2. Write short note on ‘Corporate Dividend Tax.’ 3. Distinguish between Interim Dividend and Final Dividend. 4. What accounting entries are passed for dividend? 5. What do you mean by contingent Liabilities? How are they shown in the Balance sheet of a company. 6. What do you mean by “Divisible Profits?” What are the provisions relating to them under Companies Act, 1956? Explain them in detail. 7. Who is responsible for the maintenance of books of accounts? Explain the provisions of Company Law regarding maintenance of Proper books of accounts. 8. Give revised Format of the Balance Sheet of a Company as per Companies Act 1956.