Document

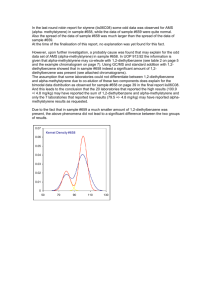

advertisement

Chapter 15 Governmental Accounting: General Fund and Account Groups C15 1 Comparison of Government and Notfor-Profits (GNPs) with Business • Different mission - no profit motive • Budget - legal document – most significant financial document – entered into accounting system – budgets drive accounting • Level of services - expenditures drive revenues • Need to assure interperiod equity C15 2 Types of GNPs • Governmental – cities, towns,counties, school districts, special tax districts, states, townships, etc. • Not-for-Profits – schools, universities, hospitals, social service organizations, civic organizations, cultural organizations, religious organizations, foundations, etc. C15 3 Purposes of Financial Reporting • Assess financial condition • Compare actual results with the budget • Determine compliance with laws and regulations • Evaluate efficiency and effectiveness C15 4 Users of Financial Reports • Main users identified by GASB: – citizens and taxpayers – investors and creditors – governing boards (legislators) • Other users – donors and grantors – regulatory and oversight agencies – employees and other constituents C15 5 Objectives of Financial Reporting • GASB objectives for state & local governments – accountability (interperiod equity, budgetary and fiscal compliance, service efforts and accomplishments) – current standards - compliance reporting – new reporting model – GASB 34 C15 6 GASB 34: New Reporting Model • Requires both fund statements and government-wide statements • Effective in – 2002 for large governments – 2003 for mid-size governments – 2004 for small governments C15 7 New Reporting Model, continued • New requirements include infrastructure reporting and depreciation • Full accrual and modified accrual information will be reported • New model requirements explained throughout Chapters 15, 16, and 17 C15 8 What is a Fund? • Fiscal and accounting entity with its own self-balancing set of accounts from which separate financial statements can be generated • Governments use funds to separate resources that have restrictions – many funds in each government – assets - liabilities = fund balance C15 9 Governmental Funds • • • • • C15 General Fund Special Revenue Fund Permanent Fund Capital Projects Fund Debt Service Fund 10 Governmental Funds, continued • Use modified accrual basis of accounting • Measurement focus is flow of financial resources • Therefore, just record inflows and outflows of financial resources • Use account groups to keep track of the long-term debt and fixed assets C15 11 Proprietary Funds • Enterprise Funds • Internal Service Funds C15 12 Proprietary Funds, continued • Use full accrual basis of accounting • Measurement focus is flow of economic resources • Therefore, record all transactions • All assets = all liabilities + fund equity • Used for all business-type activities C15 13 Fiduciary Funds • Used to account for resources that are held by the government for others (individuals, organizations, corporations, other governments) – – – – C15 Private Purpose Trust Funds Pension Trust Funds Investment Trust Funds Agency Funds 14 Account Groups • No longer reported on the financial statements • May still be used to keep track of general capital assets and long-term debt • Two types: – General Fixed Asset Account Group (GFAAG) – General Long-Term Debt Account Group (GLTDAG) C15 15 Overview of Governmental Fund Accounting • Recording – the budget • Accounting for – encumbrances – revenues – expenditures – other financing sources/uses C15 16 Recording the Budgetary Entries Estimated Revenues + Estimated Other Financing Sources - Appropriations - Estimated Other Financing Uses = Fund Balance Journal Entry: Estimated Revenues Estimated Other Financeing Sources Appropriations Estimated Other Financing Uses Fund Balance (derived) C15 xx xx xx xx xx 17 Comparison with Actual Results Estimated Revenues (debit) - Actual Revenues (credit) Variance Appropriations (credit) - Actual Expenditures (debit) Variance C15 18 Revenue Recognition • • Modified accrual basis Recognize when susceptible to accrual, i.e. – measurable and – available defined as: • • C15 collected during the period or soon enough thereafter to be used to pay current period liabilities (60 day cutoff is common) AND legally available to finance current period expenditures (usable) 19 Establish Legal Claims • • • • C15 For property taxes --- levy of taxes For charges for services --- performing services For sales taxes --- taxable sale by business For income taxes --- taxpayer earning taxable income 20 Deferred Revenues • • A liability Recorded if – – C15 unearned or not legally available 21 Common Revenue Sources • • • • • • Taxes Licenses and permits Intergovernmental revenues Charges for services Fines and forfeits Miscellaneous – – C15 interest, rents, sales of fixed assets other financing sources (OFS) 22 Revenue: Property Taxes • • Local governments derive most of revenue from property taxes - based on value (ad valorem taxes) Recognize as revenue when levied – – – C15 to be collected in the current period or soon enough thereafter… allowance for uncollectible deferred revenue if not “available” 23 Revenue: Sales Taxes • Recognize when merchant files sales tax return – – C15 measurable available 24 Revenue: Licenses and Permits • • C15 Difficult to predict accurate amounts Normally recognize revenue when cash is received 25 Grants & Other Intergovernmental Revenues • Restricted grants - expenditure driven – • • C15 food stamps, pass-through grants (if administered), on-behalf payments Unrestricted grants - recognize upon award Entitlements - recognize upon award 26 Revenue: Charges for Services • C15 Recognize revenue when billing for services rendered 27 Revenue: Fines • Options: – – – • C15 when tickets are issued date fine is due actual payment date Common practice - when cash is received 28 Revenue: Investment Income • Record all investments at fair value – – • C15 “mark-to-market” unrealized gains/losses are recognized as revenue in period Interest and dividends accrued as earned 29 Revenue: Donations • Treatment based on type of asset – – – C15 Current assets: in funds at FMV Fixed assets that will be used: in account groups at FMV Fixed assets that will be sold: in funds as shortterm investments at FMV 30 Revenue: Tax Anticipation Notes • Recorded as a liability in the fund • Always short-term • Will not be converted into long-term so never in the account group C15 31 Other Financing Sources • • • • C15 Not a revenue Proceeds from issue of long-term debt Sale of a fixed asset up to original cost Transfer of resources from another fund 32 Accounting for Expenditures • Recognize the expenditure when the fund liability is both measurable and incurred • Current liabilities in the fund – – – • C15 funded by current taxpayers using available financial resources what is a current liability Long-term liability in the account group 33 Types of Expenditures • Wages and Salaries • Compensated Absences – vacations – sick leave • Pensions • Claims and Judgments • Supplies C15 • • • • Prepayments Fixed Assets Leases Debt Service – principal – interest 34 Wages and Salaries • Accrued at year-end • Natural (object) classification allocated to function/program Entry: Expenditures - payroll Accrued wages and salaries C15 xx xx 35 Compensated Absences: Vacations Recognize if vested and probable that the benefit will be paid out Expenditure in fund if paid this period Entry in fund: Expenditures - vacation pay Accrued wages and salaries xx xx If long-term liability, record in account group Entry in account group: Amount to be provided... Long-term liability for vacation pay C15 xx xx 36 Compensated Absences: Sick Leave Recognize if pay-out is probable at termination Expenditure in fund if paid this period If long-term liability, record in account group Entry in account group: Amount to be provided... Long-term liability for sick leave benefits C15 xx xx 37 Pensions ARC - Actuarial Required Contribution Entry in fund (portion of ARC that will be paid from current resources) Expenditures - pension benefits Accrued wages and salaries xx xx Entry in account group (portion of ARC that will be paid in future) Amount to be provided... Long-term liability for pension benefits C15 xx xx 38 Claims and Judgements Follow FASB 5: Accrue if probable and reasonably estimable Entry in fund (amount that will be paid from current resources) Expenditures - Claims/Judgments Accrued Claims and Judgments xx xx Entry in account group (amount that will be paid in future) Amount to be Provided... Long-term liability for claims and judgments C15 xx xx 39 Supplies Expenditure Purchase Method Record expenditure upon acquisition: Expenditure - supplies Vouchers payable Inventory - supplies Fund Balance - reserve for supplies C15 xx xx xx xx 40 Supplies Expenditure Consumption Method Acquisition: Inventory - supplies Vouchers payable xx xx Record expenditure upon consumption: C15 Expenditures - supplies Inventory - supplies xx Fund Balance - unreserved Fund Balance - reserve for supplies xx xx xx 41 Prepayments Purchases Method: Expenditure - insurance Vouchers payable xx xx Consumption Method: C15 Prepaid insurance Vouchers payable xx Expenditure - insurance Prepaid insurance xx xx xx 42 Fixed Asset Acquisition Acquisition: Expenditure - Fixed Assets xx Vouchers Payable (Cash) xx (the fixed asset is recorded in account group) If borrow to acquire the asset: Cash xx Other Financing Sources xx (the long-term debt is recorded in account group) C15 43 Other Financing Uses • Not an expenditure • Operating transfers of resources to other funds • Not classified as expenditures in remitting fund to avoid double counting C15 44 Encumbrances - Year 1 Commit to future expenditure Encumbrance xx F.B. Reserve for Encumbrances xx When invoice is received F.B. Reserve for Encumbrances xx Encumbrance xx Expenditures xx Vouchers Payable xx C15 At Year-End F.B. Encumbrance Expenditures xx xx xx Leave Reserve for Encumbrances open as an equity account on the balance sheet 45 Encumbrances - Year 2 At beginning of the year reinstate encumbrances: Encumbrances Fund Bal xx xx When invoice is received F.B. Reserve for Enc. xx Encumbrances Expenditures xx Vouchers payable C15 xx At year-end xx Fund Bal Expenditures xx xx 46 Year End Closing Entries Close the Budget: Appropriations Budgetary Fund Balance Estimated Revenues Close the Actual Accounts: Revenues Expenditures Encumbrances Fund Balance C15 xx xx xx xx xx xx xx 47 Statement of Revenues, Expenditures, and Changes in Fund Balance Revenues - Expenditures Excess of revenues over expenditures Other financing sources (uses) Excess of revenues and other financing sources over expenditures and other financing uses + Beginning Fund Balance Residual Equity Transfers Ending Fund Balance C15 48 Accounting for Investments • Marketable Securities – stocks, bonds, notes, other financial instruments – recent controversies • Orange County, Texas, Ohio, Pennsylvania • more risky investment, more return • more sophisticated instruments C15 49 Sophisticated Instruments • • • • Repurchase agreements Reverse repurchase agreements Securities lending transactions Derivatives (only value is some underlying asset, interest rate, or index) • Hedging on a changing economy C15 50 GASB #3 (1986) • Requires extensive disclosure of risk – 3 categories • • • C15 insured or collateralized with securities held by government collateralized with securities held by pledging financial institution uncollateralized 51 GASB Technical Bulletin 94-1 (1994) • reaffirmed GASB #3 – plus, disclose any violation of legal, regulatory, or contractual provisions by investing in derivatives – explain nature of derivative transactions • C15 reasons, exposure to credit risk, market risk legal risk 52 GASB #31 (1997) • All investments are to be shown on the balance sheet at fair value • Adjustments up or down to fair value are included on operating statement as adjustments to current-period revenue C15 53 Account Groups General Fixed Assets - GFAAG General Long-Term Debt - GLTDAG Common Features of Account Groups: • Focus on general government as whole • Accounting procedures – list and offset accounting entries – primarily just add to/remove from “list” C15 54 GFAAG • Definition – tracks all fixed assets other than those accounted for in proprietary or trust funds • Accounting equation for GFAAG Fixed Asset = Investment in GFA-source of funding C15 55 GFAAG - continued Acquisition and initial valuation – – – – cost estimated cost gifts: fair market value foreclosure: lower of FMV or amount due for taxes – eminent domain: compensation to owner – escheat: FMV C15 56 Classification of Fixed Assets • Land • Building (or Building and Improvements) • Infrastructure (or Improvements other than Buildings) • Machinery and Equipment • Construction in Progress (no capitalized interest) C15 57 Classification of Investment in GFA by Financing Source • Capital Projects Funds – – – – long-term borrowing special assessments intergovernmental grants-in-aid interfund transfers • General Fund and Special Revenue Funds – – C15 general revenues special revenues 58 GFA Options • Infrastructure – immovable in nature and of value only to state or local government – optional capitalization – disclosure policy • Capitalization Policy - legal/materiality • Recording of Depreciation - optional C15 59 GLTDAG •Definition - all unmatured debt except that of proprietary funds –unmatured principal –secured (typically) by SLG full faith & credit –not a liability of any fund C15 60 GLTD Examples • general government bond issue • general government special assessment debt • general government long-term notes • general government claims and judgments • general government compensated absences • general government capital lease liabilities • general government unfunded pension contributions • general government unfunded landfill closure and postclosure care C15 61 GLTDAG Accounting Equation • 3 phases: – when incurred: Amount to be provided = Long-term obligation – while debt is outstanding: (Amount available + Amount to be provided) = Longterm obligation – when debt matures: reverse accounts from the account group C15 62