2014 Tax Developments & Updates for Canadians

advertisement

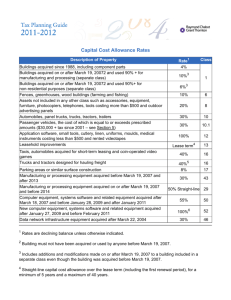

New 2014 Non-Eligible Dividend Tax Rate • What are non-eligible dividends? Payments made from a Canadian controlled private corporation from its profits (under $500,000) to a shareholder Combined 2014 Federal & Provincial Tax Rate for Non-Eligible Dividends (including surtax) 2014 Taxable Income 2014 Tax Rate for Non-eligible Dividends first $ 40,120 5.35% over $40,120 up to $43,953 10.19%% over $43,953 up to $70,651 18.45% over $70,651 up to $80,242 20.61% over $80,242 up to $83,237 23.45% over $83,237 up to $87,907 28.19% over $87,907 up to $136,270 32.91% Over $136,270 up to $150,000 36.45% Over $150,000 up to $220,000 38.29% Over $220,000 40.13% 2014 – Combined Federal and Provincial Tax Brackets and Rates (Ontario) 2014 Taxable Income Ordinary Source of Income (excluding non-eligible dividends) first $40,120 20.05% over $40,120 up to $43,953 24.15% over $43,953 up to $70,651 31.15% over $70,651 up to $80,242 32.98% over $80,242 up to $83,237 35.39% over $83,237 up to $87,907 39.41% over $87,907 up to $136,270 43.41% over $136,270 up to $150,000 46.41% over $150,000 up to $220,000 47.97% over $220,000 49.53% Fintrac – New Canadian Anti-Money Laundering Regulations (AML) • New regulations as part of Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act Aimed to combat the laundering of proceeds of crime and combat the financing of terrorist activities Who are most affected? • Most applicable industries and sectors: Money service businesses Financial services organizations Life insurance companies and life insurance brokers or agents Securities dealers Legal counsel and legal firms Accountants and accounting firms Real estate brokers or sales representatives Dealers in precious metals and stones Real estate developers Casinos Departments and agents of her majesty in right of Canada or of a province What does it mean for you? • New regulations reinforced concept of ‘business relationship’ • You automatically establish a business relationship with a client when they open an account with your entity where you conduct financial transactions or provide services related to those transactions. Continued… • Responsibilities Required to document the nature and engagement of the business relationship from the onset Perform prior due diligence on the client (ethical issues, criminal history, compliance issues) Obtain knowledge on the client’s business (owners, branches, executives) Perform ongoing yearly monitoring for any major changes Monitoring & Reporting • If you detect suspicious activity, you are required to report this to FINTRAC You can do this electronically at http://www.fintraccanafe.gc.ca/reporting-declaration/1-eng.asp New 2014 Personal Tax Credits • Changes to lifetime capital gains exemption For 2014, the limit has been increased from $750,000 to $800,000. Future increases will be indexed to inflation. Adoption Expense Tax Credit Adoption Expense Tax Credit • Nonrefundable tax credit equal to 15% of the adoption expenses incurred for adopting a child below 18. • Adoption period has been changed to include earlier adoption related expenses Hiring Credit for Small Business • Business owners are eligible for this credit if they meet all of the following conditions. deducted EI premiums from the compensation they paid to their employees, or they paid the worker's share of EI premiums for barbers, hairdressers, fishers, or drivers of taxis and other passenger-carrying vehicles and they paid these premiums (along with your share of EI premiums) to their payroll program (RP) account; They reported the income and deductions on a T4 slip and filed this information on their RP account for 2012 and 2013 The total of employer EI premiums they paid for 2012 was $15,000 or less Their total employer EI premiums increased in 2013. First-time Donor’s Super Credit New credit for first-time donors. It is on top of the existing donations credit, and increases the donations tax credit by 25% for the first $1000. Once the 25% increase is factored, donors will receive a whopping 40% tax credit for the first $200 of donations and 54% on donations made from $200 to $1,000. Ontario Retirement Pension Plan • Meant to supplement the CPP and provide additional retirement income How will it work? • Workers would kick in 1.9 percent of their annual income up to $90,000 a year; a contribution employers would match. The threshold will increase each year, consistent with the CPP maximum earnings threshold. Is it Mandatory? • The program would be mandatory except for the self-employed, those already enrolled in workplace pension plans, and those in federally regulated industries, such as banking. Am I exempt? What does it mean if I’m not? • Government has stated employers with a "comparable workplace pension plan" will be exempt from participating in the ORPP. However, they have not defined what "comparable" means. Employers who aren't exempt will certainly have increased payroll costs. • Mandatory participation is set to start in 2017 Capital Cost Allowance (CCA) • 50% straight line depreciation rate will be extended for two years to include investment in eligible manufacturing or processing machinery and equipment in 2014 and 2015. • Faster write-off of eligible investments means businesses in the manufacturing and processing sector will be able to retool with new machinery and equipment to remain competitive in the current global environment. 2014 CCA Rates Type Rate Buildings acquired since 1988, including component parts Residential 4% Buildings acquired on or after March 19, 20072 and used 90%+ for Manufacturing and processing (separate class) 10%3 Buildings acquired on or after March 19, 20072 and used 90%+ for non-residential purposes (separate class) Commercial 6%3 Fences, greenhouses, wood buildings (farming and fishing) 10% Assets not included in any other class such as accessories, equipment, furniture, photocopiers, telephones, tools costing more than $500 and outdoor advertising panels 20% Automobiles, panel trucks, trucks, tractors, trailers 30% Type Passenger vehicles, the cost of which is equal to or exceeds prescribed amounts ($30,000 + tax since 2001 – see Section 5) Rate 30% Application software, small tools, cutlery, linen, uniforms, moulds, medical instruments costing less than $500 and rented videotapes 100% Leasehold improvements Lease term4 Taxis, automobiles acquired for short-term leasing and coin-operated video games 40% Trucks and tractors designed for hauling freight 40%5 Parking areas or similar surface construction 8% Manufacturing or processing equipment acquired before March 19, 2007 and after 2015 30% Manufacturing or processing equipment acquired on or after March 19, 2007 and before 2016 50% Straight-line Computer equipment, systems software and related equipment acquired after March 18, 2007 and before January 28, 2009 and after January 2011 55% Data network infrastructure equipment acquired after March 22, 2004 30% CCA for Green Energy • • • What is it? Income tax system encourages businesses to invest in clean energy generation and energy efficiency equipment by providing an increased rate. How do I qualify? For equipment to qualify, it must be situated in Canada. Green energy equipment includes a variety of stationary equipment that generates energy by using renewable energy sources. Examples of systems that qualify under Class 43.1 are Systems that generate electricity and reusable heat under 6,000 BTU per kilowatt-hour Electrical generating equipment including • • • • • • Control, conditioning and battery storage equipment, transmission equipment, and fixed location photovoltaic equipment Heat production and recovery equipment Fossil fuel equipment Energy systems that produce power from sunlight Wind energy systems (i.e., wind-driven turbines, electrical generating equipment Heat exchangers, compressors and boilers Class 43.1 provides a 30% accelerated capital cost allowance rate