Building supply chain resilience

advertisement

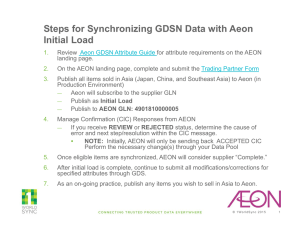

Case study – December 2011 © IGD 2011 Disaster recovery after Japan’s ‘3/11’ • On March 11th, 2011, an earthquake measuring magnitude 9, Japan’s largest ever recorded earthquake struck, off the coast of Sanriku in Miyagi prefecture • This earthquake produced tremors across an extensive area from the Tohoku region all the way to Kanto region and triggered a massive tsunami in its wake creating extensive damage • AEON, Japan’s largest multi-format retailer, was forced to close 65% of the 449 stores in Tohoku region • Although physical infrastructure was important for a quick recovery, close collaboration with suppliers was critical This presentation is an example of how beverage manufacturers and retailers in Japan, through close collaboration, successfully responded to market needs within the bottled products category in times of adversity. IGD would like to acknowledge the contribution of AEON Global SCM Co. Ltd and Kirin Beverage company in developing this case study Source: www.japan-guide.com, Aeon, 2011 AEON’s Sendai food processing centre © IGD 2011 About the businesses • • • • The Kirin Group is a leading food and beverage company in the Asia-Oceania region in a diverse range of businesses • The US$ 28 billion (revenue) group has 15 manufacturing locations in Japan • The group’s product portfolio in beverages range from beer, chu-hi drinks, shochu, whisky, and includes branded liquors produced by Diageo and wines by Mercian Corporation AEON is Japan’s leading retail group which consists of around 168 companies in Japan and overseas, structured round the core holding company AEON Co Ltd. About 70% of its US$ 57 billion revenue is from retail store operations AEON Global SCM Co. oversees group-wide distribution and inventory management using its own distribution network across Japan for AEON Source: IGD Research, 2011 © IGD 2011 Disaster impact on AEON’s supply chain • The scale of disaster meant that multiple functions were disrupted. For example, – – – – – Distribution centre in Tohoku, northern Japan was damaged Regional DCs in eastern Japan were also damaged Kanto RDC located near Tokyo, pallet stacking frames and the automated storage and retrieval systems were among the many assets that were damaged In the Tokyo bay area, liquefaction of land caused many problems This meant that products could not be received or shipped from these DCs as they were ‘blacked out’ • Right after the earthquake, about 30% of supply chain capacity was lost. Further, many roads in Tohoku region were cut-off and there was a shortage of fuel and trucks • A decision to shift the logistics network the day-after the disaster struck meant that DCs in western Japan were operating at over 200% of their capacity. In addition, temporary DCs in Sendai city and Ibaraki prefecture (200km from Tohoku) were set up Source: IGD Research, AEON, 2011 © IGD 2011 Disaster impact on Kirin’s supply chain • Two of Kirin’s plants and other facilities were damaged in the earthquake / tsunami • Major damage included damage to facilities, buildings, and product stocks at the Sendai plant and Toride plant Chitose Sendai Kobe • In addition to the collapse of beer storage tanks, the packaging equipment and warehouses were inundated and the stock flowed out in the Sendai plant Okoyama Siga Gotemba Toride Fukuoka Nagoya Yokohoma • Automated warehouses in the Tokyo metropolitan area and Toride were run down • Material supplies such as cans and PET bottle caps were affected as manufacturers of these materials were badly damaged as a result of the disaster • Loss related to the earthquake is forecast to be less than 20 billion yen (US$ 257 million) Source: IGD Research, www.kirinholdings.co.jp © IGD 2011 Scale of the problem • Retail sales in Japan plunged in March 2011 as consumers stayed away from shops in the wake of the earthquake and tsunami, registering a year-onyear 8.5% drop, according to the Japanese trade industry (Source: www.bbc.co.uk) • In addition to affecting store opening hours, demand and supply of everyday products such as water, milk, canned tuna and paper products were affected • There was a nationwide panic over a shortage of bottled water. AEON’s weekly sales of bottled water was up 250% in the first week and 375% in the second week after the disaster, as shoppers resorted to ‘panic buying’ • Regulation on bottled water imports were relaxed during the disaster (bottled water could be sold in Japan without labels written in Japanese only during this time) and AEON’s import of bottled water from South Korea, Canada and France had to be ramped up © IGD 2011 Bottled water – creating new priorities and industry solutions • The industry had to ‘pull together’ when a manufacturer of PET bottle caps in the area was seriously damaged and a shortage of bottle caps caused severe shortage of plastic bottle products • Retailers including AEON and beverage manufacturers such as Kirin, Suntory, Itoen, Asahi and Coca-Cola Japan shared the target to increase the amount of beverage supply to consumers and co-operated with each other • For example, having shifted its logistics network to the nearby DCs, Kirin Beverage company delivered their products to AEON’s temporary depot, and these products were delivered to AEON stores by AEON’s temporary supply chain network • AEON’s private brand suppliers followed the actions, which increased the amount of beverage production Before the disaster 280mlPET500ml PET Source: IGD Research, Kirin holdings, 2011 2LPET 2LPET © IGD 2011 An urgent need to respond • Japan Soft Drink Association decided to request the use of the same white plastic bottle caps for all soft drink brands on April 13th, 2011 • Plastic bottle caps manufacturers located in western Japan were not damaged by the earthquake; however, it was difficult to cover up the supply of damaged suppliers in northern Japan by using caps in different colors and different shapes • Beverage manufacturers including Kirin Beverage company took the lead as standardised plastic bottle caps improved the efficiency in production, which increased the amount of production After the disaster • In order to maximize the production capacity, beverage manufactures and the trade association in Japan released a newsletter to inform consumers about the situation • This was an integral part of the road to recovery both for AEON and its suppliers 280ml PET 500ml PET 2L PET 2L PET © IGD 2011 Progress in the changeover to white bottle caps Stage 1 “It was thanks to our close relationship with top national brand manufacturers and our private brand and global sourcing capabilities that we were able to provide bottled water even in the disaster time” March, 2011 Kirin decided to use the same caps for all brands inside the company White colour & Company Logo. Midori Yamaguchi, General Manager, AEON Global SCM Co. Ltd. Stage 2 • In the early stages, each beverage manufacturer acted independently • Subsequently, the Soft Drink Association (JSDA) announced the decision to consolidate all caps of plastic bottles which is designed with some various sizes, colours and prints by manufacturers to a white solid colour one • Through this unification the supply capacity of caps increased around 10 percent April, 2011 Beverage manufactures in Japan decided to use the same white bottle caps without company name/logo. Stage 3 September, 2011 Following the recovery of the bottle cap manufacturers, each beverage manufacture is going back to the original bottle caps for each brand; with original colours and logos. Image source: www.reuters.com © IGD 2011 Taking the consumer along in the journey • AEON’s single biggest priority during the disaster recovery phase was to maximise the supply capacity, and it was important even in this hour of need that consumers aligned with their thinking “Retail is a people business and communities rely heavily on us” Midori Yamaguchi, General Manager, AEON Global SCM Co. Ltd. • AEON tried to maximise production capacity of its private label products, and reorganised procurement and supply of more than 5,000 items sold under its Topvalu label to respond to the immediate needs • • By working with suppliers, AEON used plastic caps for the products such as seasonings in different colours from the original colour/design. Pack design was simplified and the number of SKUs reduced, which maximised the production efficiency/capacity. On explaining the need for product design simplification to customers, customers understood the situation and agreed to the use of white bottle caps for all brands • According to a survey done by Nikkei Design, most male consumers answered that they do not care about the colour of the caps, and 32.4% of female consumers said that they prefer the white bottle caps, because they look clean • About Coca-cola, consumers have strong images on red bottle caps and answered, “Coca-cola with a white bottle cap does not look tasty. The design does not look good with the Coca-cola label and the white cap.” (Source: Nikkei Design June. 2011 issue) © IGD 2011 Critical success factors • • Building collaborative practices into everyday actions Understanding the benefits of business continuity planning and role of collaboration • Leadership qualities across the organisation • Acting decisively and ‘beyond training manuals to serve customers’ Partnership Leadership “Our strong supply chain partnerships made it possible for us to keep our stores open and to keep providing our customers with products of daily necessities even during the disaster time” Responsibility People power • Communication, at the right time • Problem solution approach • High ethical standards to earn the customer’s trust at all times • Colleague empowerment to make the right judgement • Deep understanding of and demonstration of shared values, everyday “Keeping our stores open and providing products to our customer is our social responsibility. This is the role of supply chain and the supply chain is formed of many partners” Midori Yamaguchi, General Manager, AEON Global SCM Co. Ltd. Source: IGD Research, AEON, 2011 © IGD 2011 For further insight • IGD would like to acknowledge the help of AEON Global SCM Co. Ltd. and Kirin Beverage company in developing this case study • To gain further insight on best practice supply chain collaboration case studies from across the world, click here • For a detailed understanding of leading retailers’ supply chain strategies, click here • For all the latest news and updates on how retailers and manufacturers are improving their supply chain’s strategy and planning , click here • For any other information, please email Nick Downing at nick.downing@igd.com or call him on +44 (0)7730 822274 © IGD 2011