The IS Schedule

advertisement

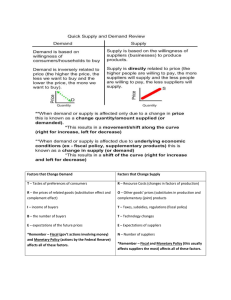

Learning Objectives • Understand the relationship between the aggregate expenditure function to graphically derive the IS curve. • Learn how to shift the IS curve • Understand how government spending, and taxes shift the IS curve. The IS Schedule • The IS schedule plots every income interest rate (Y, r) combination that results in equilibrium in the real goods market. – The IS schedule is an equilibrium schedule. • At every point on an IS schedule, aggregate expenditures are just equal to aggregate supply. The IS Schedule: Derivation AE AE(r1) E2 AE(r2) E1 0 r r2 Y1 Y E1 E2 r1 0 Y2 Y Y IS Y At E1, where the interest rate is r2, aggregate expenditures equal aggregate supply, and the the equilibrium level of income is Y1. At E2, where the interest rate is r1, aggregate expenditures equal aggregate supply, and the equilibrium level of income is Y2. The points E1 and E2 are two points on an IS schedule. Each point represents an income/interest rate combination that yields equilibrium in the real goods market. The IS Schedule: Derivation • At the equilibrium point E1, where the interest rate is assumed to be r2, aggregate expenditures just equal aggregate supply. • Let the interest rate fall to r1, causing interest sensitive spending to rise. • Equilibrium now occurs at E2, where aggregate expenditures, AE(r1), are just equal to aggregate supply. The IS Schedule: Derivation • The points E1 and E2 can be transferred from the top graph to the bottom graph. – To transfer E1, we find the point Y1, r2 in the bottom graph. – To transfer E2, we find the point Y2, r1 in the bottom graph. • The points E1 and E2 are two points on an IS schedule. – Each point represents an income/interest rate combination that yields equilibrium in the real goods market. The IS Schedule:Shifts AE AE(r1) E2 AE(r1) A shift in the IS schedule occurs when there has been a change in spending that is not caused by a change in the rate of interest. E1 0 r r1 0 Y1 Y2 E1 Y Increases in spending shift the IS curve to the right; decreases in spending shift the IS curve to the left. E2 IS1 IS2 Y The IS Schedule: Shifts • At point E1, the equilibrium level of income is Y1 and the interest rate is r1. – Let spending increase with no change in the rate of interest. • The aggregate expenditure curve shifts up to AE(r1), and income increases to Y2. – The interest rate is still r1. • The new equilibrium occurs at the point E2. • When we transfer the points E1 and E2 to the IS graph, E1 represents a point on IS1 and E2 a point on IS2. IS: The Algebra • IS Y = C + I + G + NX where C = a + b(Y – tY), I = e – dr and NX = X – nr – (M + mY) Y = a + b(Y – tY) + I – dr + G + X – nr – M Y – bY + btY + mY = a + I – dr + G + X – nr – M 1 Y= 1– b(1 – t) + m a + I – dr + G + X – nr – M IS: The Algebra • IS Y= 1 1– b(1 – t) + m a + I – dr + G + X – nr – M • Note: – The inverse relationship between Y and r – The coefficient of t is negative. • Increases in t rotate the IS to the left; decreases rotate it right – The coefficients of G, I and X are positive • Increases (decreases) in G, I and X shift the IS right (left). – The coefficients M and m are negative • Increases (decreases) in M and m shift (rotate) IS right (left). Net Exports and the IS • Net exports are assumed to be determined by domestic interest rates and domestic GDP. – Exports: X = X – nr • As interest rates rise, the dollar rises, and exports fall by n times the change in r. – Imports: M = M + mY • As GDP rises, imports rise by m times the change in Y. – Net Exports: X – M = X – nr – ( M + mY) = NX = X – nr – M – mY Explaining Exchange Rates with Interest Rate Parity • Interest rate parity says that the higher domestic real rates of interest are relative to foreign real interest rates, the higher will be the value of the domestic currency, other things remaining the same. Learning Objectives • Understand how people choose how much money to demand. • Learn how money demand changes when interest rates and income change. • Understand how money supply and money demand interact to determine the equilibrium rate of interest. • Understand the relationship between money demand and money supply can be used to derive the LM curve • Learn how to shift the LM curve. The Money Market • Interest rates are determined in the money market through the interaction of money supply and money demand. Money Supply • The supply of real money balances is defined as the ratio of nominal money balances and the price level, M/P. – where M is the nominal money supply and P is the price level. • The money supply is assumed to be an exogenous variable determined by the central bank. • The price level is also assumed to be exogenous as well as fixed in the short run. • As a result, the real money supply is assumed to be fixed in supply and invariant with respect to the interest rate. Money Demand and Interest Rates • Money demand is assumed to be determined by both the level of income and interest rates. • Md = L(r, Y). • The interest rate is the cost of holding money. • As r rises, the opportunity cost of holding money rises and people hold less. • As r falls, the opportunity cost of holding money falls and people hold more. Money Demand and Income • Money demand is assumed to be determined by both the level of income and interest rates. • Md = L(r, Y). • People hold money to make transactions. • Higher levels on Y are associated with more transactions. Money demand increases. • Lower levels of Y are associated with fewer transactions. Money demand decreases. The Money Market The equilibrium rate of interest is determined by the intersection of money demand and money supply. r Money supply is vertical because M/P does not vary with the interest rate. re Md=L(r, Y) 0 M/P Money Money demand slopes down because the opportunity cost of holding money rises and falls with r. The Money Market: Money Demand Shifts Increases in Y shift money demand to the right. r Higher levels of income increase the transactions demand for money Decreases in Y shift money demand to the left. 0 Md=L(r, Y3) Md=L(r, Y2) Md=L(r, Y1) M/P Money Lower levels of income decrease the transactions demand for money. The Money Market: Monetary Policy r M/P1 M/P2 M/P3 Contractionary monetary policy shifts M/P to the left, increasing the equilibrium interest rate. r2 Expansionary monetary policy shifts M/P to the right, decreasing the equilibrium interest rate. re r1 Md=L(r, Y) 0 M/P1 M/P2 M/P3 Money The LM Schedule: Derivation r r2 r1 LM r E2 E2 E1 E1 Md=L(r, Y2) Md=L(r, Y1) 0 M/P Money 0 Y1 Y2 Y The LM Schedule: Derivation • At point E1, money demand equals money supply – The equilibrium interest rate and level of income are r1 and Y1. This combination is one point on the LM schedule. • Let Y rise to Y2. • At the point E2, money demand equals money supply – The equilibrium interest rate and level of income now are r2 and Y2. This combination is another point on the LM schedule. The LM Schedule: A Decrease in the Money Supply r r2 r1 LM2 LM r E2 1 E2 E1 E1 Md=L(r, Y1) 0 M2/P M1/P Money 0 Y1 Y A Decrease in the Money Supply • At the point E1, money demand equals money supply. – The equilibrium interest rate and level of income are r1 and Y1 respectively. • Let the money supply decrease, causing the interest rate to rise to r2. Income is still Y1. • Equilibrium now occurs at the point e2. • The point E2 lies on LM2 because it represents equilibrium in the money market when Y = Y1 and r = r2. The LM Schedule: An Increase in the Money Demand LM2 r r r2 E2 r1 E1 0 M1/P LM1 E2 Md2=L(r, Y1) Md1=L(r, Y1) Money E1 0 Y1 Y An Increase in Money Demand • At the point E1, there is equilibrium in the money market. – The equilibrium interest rate and level of income are r1 and Y1 respectively. • Let money demand increase. Y is still Y1. • Equilibrium now occurs at E2, where r is r2 and Y is Y1. • The point E2 lies on LM2 because it represents equilibrium in the money market when Y is Y1 and r is r2. LM: The Algebra • LM – M/P = L(r,Y) • L(r,Y) = eY – fr where e and f >0 – M/P = eY – fr – r = (e/f)Y – (1/f) M/P • Note: – The positive relationship between r and Y – The coefficient of M/P is negative • Decreases (increases) in M/P shift the LM left (right). IS/LM: Equilibrium r LM The intersection of the IS curve and the LM curve shows the interest rate and income level that satisfy equilibrium in the real goods market and equilibrium in the money market. r IS 0 Y* Y Fiscal Policy • Fiscal Policy: A tool of macroeconomic policy that seeks to influence the level of economic activity through control of government expenditure and taxation. – Expansionary Fiscal Policy • Decreases in taxes and/or increases in spending that tend to increase economic activity. – Contractionary Fiscal Policy • Increases in taxes and/or decreases in spending that tend to dampen economic activity. Fiscal Policy: Demand Side Transmission Mechanism Investment Spending Rises Government Spending Falls Deficit Decreases Aggregate Spending Decreases Taxes Increase Contractionary Fiscal Policy Interest Rates Fall Export Spending Rises IS/LM: Contractionary Fiscal Policy r A decrease in G or an increase in T shifts the IS curve to the left. LM If r does not change, Y falls by the amount Y1Y3 = E1B. But at point B, Y1<Y3 so Md < MS, causing interest rates to fall. r1 B E2 r2 0 E1 IS1 Y1 Y2 Y3 IS2 Y As r falls, interest sensitive spending rises. Equilibrium is reached at Y2 and r2. Government Spending • Transmission Mechanism – The decrease in government spending causes aggregate spending and the IS curve to shift left. – As GDP falls, the transactions demand for money falls. – If the supply of money does not change, interest rates fall. – As interest rates fall, some interest sensitive spending rises. – Equilibrium occurs at Y2 and r2. Taxes and the IS Curve • Transmission Mechanism – An increase in taxes decreases disposable income and consumption, causing the IS curve to rotate to left. – As GDP falls, the transactions demand for money falls. If the supply of money does not change, the interest rate falls. – As the interest rate falls, some interest sensitive spending rises. – Equilibrium occurs at Y2 and r2. Monetary Policy • A tool of macroeconomic policy under the control of the Federal Reserve that seeks to attain stable prices and economic growth through changes in the rate of growth of the money supply. Monetary Policy • Expansionary Monetary Policy – An increase in the money supply designed to decrease interest rates and thus increase interest sensitive spending • Contractionary Monetary Policy – A decrease in the money supply designed to increase interest rates and thus decrease interest sensitive spending. Interest Rate Channel Change in Money Supply Change in Interest Rates Change in GDP Change in Exchange Rates Monetary Policy • Transmission Mechanism – The increase in the money supply increases liquidity in the portfolios of individuals. • Money supply is now greater than money demand at the current rate of interest. – People rebalance their portfolios by using the excess liquidity to buy other assets such as bonds. – As the price of bonds rises, interest rates fall. Monetary Policy • Transmission Mechanism – The increase in the money supply decreases interest rates and the value of the dollar. – As the value of the dollar falls, exports increase and imports decrease. Interest Rate Parity: Example • Assume that U.S. real interest rates are higher than those in other countries. – The high rates of return on U.S. assets will attract foreign buyers, but in order to buy U.S. financial assets, foreigners must first buy dollars. Interest Rate Parity: Example • The demand for dollars increases in the global marketplace, causing the dollar to appreciate. • The supply of the other currency increases in the global marketplace, causing it to depreciate. IS/LM: Expansionary Monetary Policy LM1 LM2 r An increase in the money supply, other things remaining the same, means that at r1 and Y1, money demand is less than money supply. The excess supply puts downward pressure on interest rates, and as r falls, interest sensitive spending and Y rise. r1 r2 IS 0 Y1 Y2 Y IS/LM: Interaction of Fiscal and Monetary Policy r LM What happens when fiscal policy is expansionary and monetary policy is contractionary? r IS 0 Y* Y IS/LM: Interaction of Fiscal and Monetary Policy r LM What happens when both fiscal and monetary policy are expansionary? r IS 0 Y* Y