Mid Term Review - Teaching Web Server

advertisement

IS Auditing Midterm Review

ISMT 350

Time & Venue: 5 Oct 2006, 10:30 am to 11:50 am @ Room 2463

Note: You will be allowed one A4 sized sheet of paper as a “ Cheat Sheet” for

your reference during the IST350 Midterm Exam. You can fill out both sides, and

there are no limits on handwriting, font, or techniques for the information you

place on the page. No other materials will be allowed during the exam

Course Topics So Far

Topic

Readings

Practicum

Competency

Case Study

What is Information Systems (IS)

Auditing?

Industry Profile: The Job of the IS

Auditor

Identifying Computer Systems

Chapter 1

Evaluating IT Benefits and

Risks

Jacksonville Jaguars

IS Audit Programs

Chapter 2

The Job of the Staff Auditor

A Day in the Life of Brent

Dorsey

IS Security

Chapter 3

Recognizing Fraud

The Anonymous Caller

Logical Structure of the Course

With Readings from the Text

Material Covered

(colored area)

IS Components

Ch. 1&2

Controls over IS

Assets

Ch. 7 & 8

Encryption

Ch. 11

IS Auditing

Current and

Future Issues in

IS Auditing

Audit Components

Ch 3&4

Procedural

Controls

Ch. 9

Audit Standards

and Procedures

Ch. 10

Forensics and

Fraud Audits

Ch. 12

Classes of Things

You have Learned

Concepts: Things you need to know These include:

Theories and frameworks

Facts

Activities and Tasks: Things an auditor needs to

do

Tools: Used to make audit decisioms

Identifying Computer

Systems

Chapter 1

1.

2.

3.

4.

Identifying what you are going to audit

The Computer Asset Inventory

Identification of Transactions, and Risk Levels

Audit programs for high risk transactions

Audit Program

Audit programs are checklists of the various tests (audit

procedures) that auditors must perform within the scope of their

audits to determine whether key controls intended to mitigate

significant risks are functioning as designed.

Objective

To determine the adequacy of the controls over the particular

accounting processes covered by the audit program

This is fundamentally what the assurance and attestation

aspects of the audit are expected to achieve

during the ‘tests of transactions’ or

mid-year or

internal control tests

The objective

The reason for an audit is to write an opinion:

Saying stock price is fairly stated (external)

Control processes are effective (internal & external)

Assets are not at risk of theft or damage (internal)

We only need to identify computer systems where one

of more of these objectives is affected

Benefits

The use of audit programs is fairly standard for audit firms,

and is considered good business practice. List three (3)

benefits to the audit firm of using an audit program

The improve resource planning (where to spend money and

employ people on an audit)

They promote consistency from year to year when personnel and

situations of an audit change

Prior years’ programs are the basis for the current year’s audit

procedures

Anything else that seems reasonable

Control assessment

Information systems audit programs should assess

the adequacy of controls in four (4) areas.

1.

2.

3.

4.

Environmental controls

Physical security controls

Logical security controls

IS operating controls

Computer Assets

Central Processing Unit

Peripheral Processor

(Video, Bus, Etc.)

Memory

RAM / ROM

Network Devices

Optical &

Magnetic Media

Operating Systems

Specialized

O/S

Network O/S

Utilities

Database O/S

Applications

Programming Languages,

Utilities and Services

Tools & Environments

The main categories of Computer

Applications, and their relative importance

Information

Technology

Market

Operations & Accounting

Search & Storage

Tools

Embedded

Communications

Total

Annual

Expenditures

($US billion)

Employees

(thousand)

Major Suppliers

500

2000

US, India

1000

5000

US

300

300

US, Germany

1500

700

US, Japan, Korea, Greater China

700

2000

4,000

10,000

US, Germany, Japan, Greater China

GWP ~$45 trillion (Pop: 6 billion)

US GDP ~$10 trillion (Pop: 300 million)

The Risk Assessment Database

Asset (Ex 2.1)

Risk Assessment (Ex. 2.2 with improvements)

Asset Value

($000,000 to

Owner)*

Transaction Flow

Description

Total Annual Transaction

Value Flow managed by

Asset($000,000)*

Cost of

single

occurrence

($)

Probability of

Occurrence (# per

Year)

Primary OS

Owner

Applicati

on

Win XP

Receiving

Dock

A/P

0.002

RM Received from

Vendor

23

Theft

Win XP

Receiving

Dock

A/P

0.002

RM Received from

Vendor

23

Obsolescence

and spoilage

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

Etc

*Whether you list depends on

Audit Materiality

Risk Description

Expected

Loss

100

100

10000

35

350

12250

Ideas, not Things, have Value

16

600

14

500

Asset Intensity

(Fixed Assets / Sales)

12

400

10

300

8

200

6

100

4

2

0

0

-100

Rank order by increasing return

5-yr Shareholder Return %

… and these ideas are tracked in the computer

How Accounting has had to Change

Because of Business Automation

Material

Labor

Capital

30%

50%

Knowledge

Integrator

Knowledge

Integrator

20%

Knowledge

Integrator

Manufacturing

Value Added

110%

Material

Consumer

Knowledge Base (uncertain

claims, contributions and

property rights)

Labor

Capital

5%

5%

80%

10%

Knowledge

Integrator

Manufacturing

Value Added

%

ed

ish ct 20

n

i

F du

g

Pro

rin

u

t

fac tions

u

n

a

Ma ecific

Sp

Consumer

110%

IS Audit Programs

Chapter 2

What is IS Auditing?

Why is it Important?

What is the Industry Structure?

Attestation and Assurance

Transactions

External Real

World Entities

and Events that

Create and

Destroy Value

Internal

Operations

of the Firm

The Physical World

Transactions

Corporate Law

ts

Analytical Tes

Audit Report /

Opinion

Accounting

Systems

The Parallel (Logical)

World of Accounting

Ledgers:

Databases

Auditing

Journal Entries

Reports:

Statistics

Tests of Transactions

Audit

Program

tation

Attes

Auditing

Substantive T

ests

'Owned' Assets

and Liabilities

Audit Objectives

Reporting Risks

(External Audit)

Control Process Risks

(Internal & External

Audits)

Asset Loss Risks

(Internal Audits)

Transaction Flows

Business Application

Systems

Operating Systems

(including DBMS, network

and other special systems)

Hardware Platform

Physical and Logical

Security Environment

How Auditors

Should Visualize

Computer Systems

The IS Auditor’s Challenge

Corporate Accounting is in a constant state of flux

Because of advances in Information Technology applied to

Accounting

Information that is needed for an Audit is often hidden from

easy access by auditors

Making computer knowledge an important prerequisite for

auditing

IS (and also just Information) assets are increasingly

the main proportion of wealth held by corporations

The Challenge to Auditing Presented

by Computers

Transaction flows are less visible

Fraud is easier

Computers do exactly what you tell them

Audit samples require computer knowledge and access

Transaction flows are much larger (good for the company, bad for the

auditor)

Audits grow bigger and bigger from year to year

To err is human

But, to really screw up you need a computer

And there is more pressure to eat hours

Environmental, physical and logical security problems grow

exponentially

Externally originated viruses and hacking

are the major source of risk

(10 years ago it was employees)

The Challenge to Auditing Presented

by The Internet

Transaction flows are External

External copies of transactions on many Internet nodes

External Service Providers for accounting systems

require giving control to outsiders with different incentives

Audit samples may be impossible to obtain

Because they require access to 3rd party databases

Transaction flows are intermingled between companies

Environmental, physical and logical security problems grow exponentially

Externally originated viruses and hacking

are the major source of risk

(10 years ago it was employees)

Audit Program

Audit programs are checklists of the various tests (audit

procedures) that auditors must perform within the scope of their

audits to determine whether key controls intended to mitigate

significant risks are functioning as designed.

Objective

To determine the adequacy of the controls over the particular

accounting processes covered by the audit program

This is fundamentally what the assurance and attestation

aspects of the audit are expected to achieve

during the ‘tests of transactions’ or

mid-year or

internal control tests

The objective

The reason for an audit is to write an opinion:

Saying stock price is fairly stated (external)

Control processes are effective (internal & external)

Assets are not at risk of theft or damage (internal)

We only need to identify computer systems where one

of more of these objectives is affected

Benefits

The use of audit programs is fairly standard for audit firms,

and is considered good business practice. List three (3)

benefits to the audit firm of using an audit program

The improve resource planning (where to spend money and

employ people on an audit)

They promote consistency from year to year when personnel and

situations of an audit change

Prior years’ programs are the basis for the current year’s audit

procedures

Anything else that seems reasonable

Control assessment

Information systems audit programs should assess

the adequacy of controls in four (4) areas.

1.

2.

3.

4.

Environmental controls

Physical security controls

Logical security controls

IS operating controls

Materiality

Materiality represents the maximum, combined, financial statement

misstatement or omission that could occur before influencing the decisions of

reasonable individuals relying on the financial statements.

The magnitude and nature of financial statement misstatements or omissions

will not have the same influence on all financial statement users.

The specific amounts established for each financial statement element must be

determined by considering the primary users as well as qualitative factors.

For example, a 5 percent misstatement with current assets may be more relevant for a creditor

than a stockholder, whereas a 5 percent misstatement with net income before income taxes

may be more relevant for a stockholder than a creditor. Therefore, the primary consideration

when determining materiality is the expected users of the financial statements.

For example, if the client is close to violating the minimum current ratio requirement for a loan

agreement, a smaller planning materiality amount should be used for current assets and

liabilities.

Conversely, if the client is substantially above the minimum current ratio requirement for a loan

agreement, it would be reasonable to use a higher planning materiality amount for current

assets and current liabilities.

Planning materiality should be based on the smallest amount established from

relevant materiality bases to provide reasonable assurance that the financial

statements, taken as a whole, are not materially misstated for any user.

Tolerable misstatement

This is essentially materiality for individual financial statement

accounts. The amount established for individual accounts is

referred to as "tolerable misstatement."

Tolerable misstatement represents the amount an individual

financial statement account can differ from its true amount

without affecting the fair presentation of the financial

statements taken as a whole.

Establishment of tolerable misstatement for individual

accounts enables the auditor to design and execute an audit

strategy for each audit cycle.

Tolerable misstatement should be established for all balance

sheet accounts (except "retained earnings" because it is the

residual account).

Phases and Products

of the Audit

Audit

Program

Beginning of Year

Planning & Risk

Assessment

Budget

Mid-year (9 months)

Internal Control Tests

(Mid-year; Tests of

Transactions)

SAS 30

Control Letter

Sarbanes-Oxley

management letter

Year-end (1-3 months after year-end)

Planning & Risk

Assessment

Audit Report

Planning and Risk Assessment

Output is

Audit Program

Budget (based on contract with client)

Internal Control Tests (Mid-year)

Assess internal control

Output is the annual "management letter" issued in

connection with an audit

In accordance with SAS No. 30 “Reporting on

Internal Accounting Controls”

Substantive Tests (Year-ent)

Product is

Audit Statement (signed by auditor)

Sarbanes-Oxley (signed by management)

Compliance “Management Letter

Schedule of Unadjusted Differences

List of Control ‘Weaknesses’

Practicum:

A Day in the Life of Brent Dorsey

A Staff Auditors’ Professional Pressure

Understand some of the pressures faced by young

professionals in the workplace

Generate and evaluate alternative courses of action

to resolve a difficult workplace issue

Understand more fully the implications of "eating

time" and "premature sign-off"

More fully appreciate the need to balance

professional and personal demands

IS Security

Chapter 3

Flowcharting Accounting

Systems

Each

bubble is associated with a person or entity

that is responsible for that process

The same individuals with:

Managerial Control

Accountability

Responsibility for the process

Should all be responsible for the same bubble

Flowcharting Accounting Systems

A data flow diagram

Data Flow Diagram

Notations

Flowcharting Accounting Systems

A process transforms

incoming data flow into

outgoing data flow.

Flowcharting Accounting Systems

Datastores are repositories

of data in the system.

They are sometimes also

referred to as databases or

files.

Flowcharting Accounting Systems

Dataflows are pipelines

through which transactions

(packets of information)

flow.

Label the arrows with the

name of the data that

moves through it.

Flowcharting Accounting Systems

External entities are entities

outside the firm, with which the

accounting system

communicates

E.g., vendors, customers,

advertisers, etc.

External entities are sources

and destinations of the

transaction input and output

Flowcharting Accounting Systems

The Context diagram lists

all of the external

relationships

Flowcharting Accounting

Systems …Levels

Context

DFD levels

known as Level 0) data flow diagram. It only

contains one process node (process 0) that

generalizes the function of the entire system in

relationship to external entities.

The first level DFD shows the main processes

within the system.

Each of these processes can be broken into

further processes until you reach the level at

which individual actions on transaction flows

take place

If you use SmartDraw Drawing Nested DFDs in SmartDrawYou can easily

nest data flow diagrams in SmartDraw. Draw the high-level diagrams first,

then select the process you want to expand, go to the Tools menu, and

select Insert Hyperlink. Link the selected process notation to another

SmartDraw diagram or a web page.

The Datastore

The Datastore is used to

represent Ledgers, Journals

Or more often in the current

world

Their computer

implemented counterpart

Since almost no one keeps

physical records

Flowcharting Accounting

Systems …Lower Level with Multiple

Processes

Data Flow Diagram Layers

Draw data flow diagrams in

several nested layers.

A single process node on a

high level diagram can be

expanded to show a more

detailed data flow diagram

Practicum:

Jacksonville Jaguars

Assurance Services for the Electronic Payments

System of a privately held company

Identify benefits, costs and risks to businesses from

implementing information technologies

Determine how CPAs can provide assurance about

processes designed to reduce risks created when new IT

systems are introduced

Understand ways CPAs can identify new assurance

services opportunities (i.e., new areas for revenue

generation)

IS Security

Chapter 3

What is Security?

Security involves:

Proper security

the protection of a person, property or organization from attack.

Knowing the types of possible attacks,

being aware of the motivations for attacks and your relationship to those

motives.

makes it difficult to attack,

threatens counter-measures, or

make a pre-emptive attack on a source of threat.

IS Security is a collection of investments and procedures that:

Protect information stored on computers

Protect Hardware and Software assets

From theft or vandalism by 3rd parties

What is a Lock & Key?

Lock is a security system

The key is its password

Keys used to be worn visibly around the neck

Newer Technology

As a sign of authority (similar to employee

badges today)

Badges and electronic keys

Biometrics (M-28 fingerprint lock at right)

Remote controls (Lexus keys)

‘Keys’ are just another Security Policy

Effective security policy

Security policy defines the organization’s attitude to Assets, and

announces internally and externally which assets are mission critical

Effective information security policies

Which is to be protected from unauthorized access, vandalism and destruction

by 3rd parties

Will turn staff into participants in the company’s security

The process of developing these policies will help to define a company’s

assets

An effective security policy also protects people.

Anyone who makes decisions or takes action in a situation where

information is a risk incurs personal risk as well.

A security policy allows people to take necessary actions without

fear of reprisal.

Security policy compels the safeguarding of information,

while it eliminates, or at least reduces, personal liability for

employees.

IP

There are four types of Intellectual Property (IP) that are

protected by law

Copyright

Patent

Trade secret

Trademark

Two aspects of the use of IP are covered by intellectual

property laws

Right of publicity

Privacy

Almost All Security Controls use the Lock & Key paradigm.

Authorization system = Who gets a Key (And Why?)

Password, etc. = Key

Encryption algorithms, SSL, etc. = Lock

Entry into Computer Crime

This flowchart describes the

points at which Control

Processes may be created

to stop criminals

Controls may:

Personal

Background

Motives

Learning

S kills to

Commit

Crime

Un-premeditated

Prevent access to the asset

Detect asset access

Correct the problems or

losses after an illicit access

Remember that criminals

specialize in one type of

crime

Premeditated

Choose

"Best"

Option

Decision / Action Matrix

Commit Crime

Reaction to

Chance

Event

Select Asset

Don't Select

• Face Penalties

• Enjoy Rewards

N/A

Don't Commit

• Too Hard

• M onitored

• Unfamilar

• Not enough value

Bringing a computer

crime to court

Step

Potential Terminal Outcome

Crime committed

Reported

Investigation

Arrest

Booking

Preliminary appearance in court

Bail or detention

Adjudication

Arraignment

Trial

Sentencing

Sentencing

Sentencing

Not detected

Not investigated

Unsolved

Released without prosecution

Released without prosecution

Charges dropped or dismissed

Arbitration, Settled "Out of Court"

Charge dismissed

Acquitted

Appeal

Probation

Prison

Practicum:

The Anonymous Caller

Recognizing It's a Fraud and Evaluating What to Do

How would you politely and ethically handle a ‘dodgy’ request

for help

Appreciate real-world pressures for meeting financial

expectations

Distinguish financial statement fraud from aggressive

accounting

Identify alternative actions when confronted with suspected

financial statement fraud

Develop arguments to resist or prevent inappropriate

accounting techniques

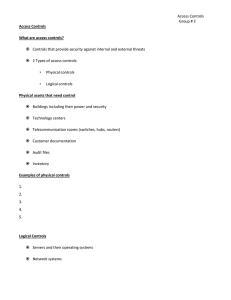

Physical Security

Logical Security

Chapter 7

Chapter 8

Security Policy

Information

Manager

Environmental

Competitive

Internal Financial

Internal

Non-financial

Action

Inputs

Plan

Organize

Actuate

Control

Manpow er

Money

Machines

Methods

Materials

Information System

Information Systems

Information System

Information System

Outputs

Objectives

Quantity

Quality

Cost

Time

Profitability

Efficiency

Grow th

Survival

Strategy Policy

Strategy defines the way that Top Management

achieves corporate objectives

Policy is a written set of procedures, guidelines and

rules

Designed to accomplish a subset of strategic tasks

By a particular subgroup of employees

Effective security policy

An effective security policy also protects people.

Anyone who makes decisions or takes action in a situation where

information is a risk incurs personal risk as well.

A security policy allows people to take necessary actions without

fear of reprisal.

Security policy compels the safeguarding of information,

while it eliminates, or at least reduces, personal liability for

employees.

Effective information security

policy

Information security policy defines the organization’s attitude to

information, and

announces internally and externally that information is an asset

Which is to be protected from unauthorized access, modification,

disclosure, and destruction

Effective information security policies

Will turn staff into participants in the company’s security

The process of developing these policies will help to define a

company’s information assets

Why Do You Need Security Policy?

A security policy should Protect people and information

Set the rules for expected behavior by users, system

administrators, management, and security personnel

Authorize security personnel to monitor, probe, and investigate

Define and authorize the consequences of violation

The Three Elements of Policy

Implementation

Standards – Standards specify the use of specific technologies in a

uniform way. The example the book gives is the standardization of

operating procedures

Guidelines – Similar to standards but are recommended actions

Procedures – These are the detailed steps that must be performed

for any tasks.

Steps to Creation of IS Security Policy

Policy Development Lifecycle

5.

Senior management buy-in

Determine a compliance grace period

Determine resource involvement .

Review existing policy

Determine research materials (Internet, SANS, white papers, books…)

6.

Interview parties {Responsible, Accountable, Controlling} assets

1.

2.

3.

4.

1.

2.

3.

4.

7.

8.

9.

10.

11.

12.

Define your objectives

Control the interview

Sum up and confirm

Post-interview review

Review with additional stakeholders

Ensure policy is reflected in “awareness” strategies

Review and update

Gap Analysis

Develop communication strategy

Publish

What’s in a Policy Document

Governing Policy

Should cover

Address information security policy at a general level

define significant concepts

describe why they are important, and

detail what your company’s stand is on them

Governing policy will be read by managers and by technical

custodians

Level of detail: governing policy should address the “what” in

terms of security policy.

Governing Policy Outline

might typically include

1. Authentication

2. Access Control

3. Authorization

4. Auditing

5. Cryptography

6. System and Network Controls

7. Business Continuity/Disaster Recovery

8. Compliance Measurement

Technical Policies

Used by technical custodians as they carry out their

security responsibilities for the system they work

with.

Are more detailed than the governing policy and will

be system or issue specific, e.g., AS-400 or physical

security.

Technical Policy Outline

might typically include

1. Authentication

2. Authorization

3. Auditing

4. Network Services

5. Physical Security

6. Operating System

7. Business Continuity/Disaster Recovery

8. Compliance Measurement

User Policies

Cover IS security policy that end-users should ever have to know about,

comply with, and implement.

Most of these will address the management of

transaction flows and

databases associated with applications

Some of these policy statements may overlap with the technical policy

Grouping all end-user policy together means that users will only have to

go to one place and read one document in order to learn everything

they need to do to ensure compliance with company security

User Policy Outline

might typically include

1. User Access

2. User Identification and Accountability

3. Passwords

4. Software

5. System Configuration and Settings

6. Physical

7. Business Continuity Planning

8. Data Classification

9. Encryption

10. Remote Access

11. Wireless Devices/PDAs

12. Email

13. Instant Messaging

14. Web Conferencing

15. Voice Communications

16. Imaging/Output