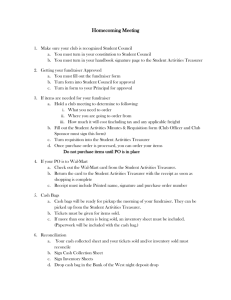

Accounting Procedures for Kentucky School Activity Funds

advertisement