Manufacturing Account

advertisement

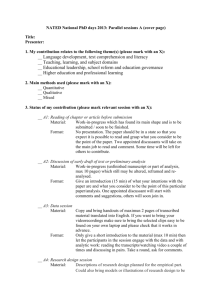

Supplies of raw materials A Manufacturing firm (make the product) Customers Manufacturing a/c calculate the production cost Manufacturing a/c Stock of raw materials as at 1.1.2002 Add : Purchase Less: Stock of raw materials as at 31.12.2003 Cost of raw materials consumed $ 2000 12000 14000 6000 8000 Manufacturing a/c for the year ended 31 Dec 2002 $ Cost of raw materials consumed 8000 Direct wages 2000 Prime Cost 10000 Factory overhead expenses 6000 Total cost of production 16000 Add: Work-in-progress as at 1.1.02 3000 19000 Less: Work-in-progress as at 31.12.02 4000 Production Cost of good completed c/d 15000 Production Cost of good completed Prime Cost Factory overhead expenses (Direct Cost) (Indirect cost) Eg. Wage, Royalties Eg. Indirect Wages, Lighting, Rent, Depreciation That can be traced back to the items being manufacturing Work-in-progress 31.12.2002 1.1.2002 Production line Store Room Work-in-progress Have not include in prime cost and factory overhead expense Store Room Work-in-progress Have included these goods at year start but not those at year end Trading a/c Opening Stock of finished good Add:Production Cost of goods completed b/d Less : Closing Stock of finished goods Cost of good sold Gross profit b/d $ 3890 Sales $ 100000 79345 83235 4000 79235 20765 100000 100000 Profit &Loss a/c Administration Expenses $ Salaries 4400 Rent 200 Insurance 70 General expenses 1340 Selling & Distribution expenses Salesmen’s salaries 3000 Commission on sales 1150 Carriage outwards 590 Net Profit $ Gross profit b/d $ 20765 6010 4740 10015 20765 20765 Balance Sheet (extract) Current Assets Stock : Raw material Finished good Work-in-progress $ 6000 10000 4000 Manufacturing a/c for the year ended xx/xx/xx $ Production cost of goods completed Manufacturing profit X X _____ X ==== $ Market value of goods completed c/d Profit disposal of plant and machinery X X ____ X ==== Trading a/c for the year ended xx/xx/xx $ X Opening stock of finished goods Add: Market value of goods completed b/d X Purchases of finished goods X X Less: Closing stock of finished goods X Costs of goods sold X Gross Profit c/d X X === Stock loss raw materials X Sale $ X ____ X ==== Gross Profit b/d X Manufacturing Profit X Solution: CCC Ltd. Manufacturing a/c for the year ended 31 December 2003 $ Stock of raw material 1.1.2003 Add: Purchase Carriage inwards Less: Stock of raw materials31.12.03 Cost of raw materials used (i) 4500 8800 390 9190 13690 5800 7890 Stock of case 1.1.2003 Add : Purchase Less : Stock of cases 31.12.2003 Cost of wooden cases uses (ii) Wages (2250*4/5) Prime cost (iii) 2250 2250 4500 1920 2580 18000 28470 Factory overhead expenses : (iv) Indirect Wages (2250*1/5) Manger ‘s salary Power Rates Lighting (600*1/2) Depreciation Add: Work-in-progress Less : Work in progress 31.12.2003 Production cost of goods completed c/d (v) 4500 1650 1820 910 300 20000 29180 57650 1250 58900 1900 57000 Trading &Profit and loss a/c for the year ended 31.12.2003 Sales (80*1000) Less : Production cost of good sold b/d Gross Profit Less : Expenses: Administration expenses 2400 Salesmen’s salaries 5950 Lighting (600*1/2) 300 Carriage outwards 210 Net Profit 80000 57000 23000 8860 14140 Tang Sau Lin (10) Wong Wing Yin (14)