Chapter #6 Notes - Mentor High School

advertisement

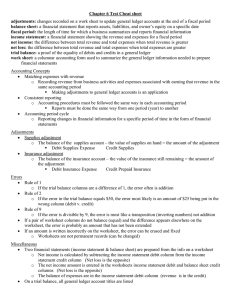

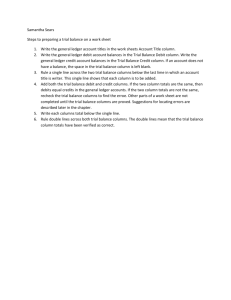

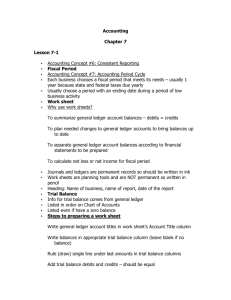

A WORKSHEET FOR A SERVICE BUSINESS Accounting – Chapter 6 WHAT IS THE PURPOSE OF AN ACCOUNTING WORKSHEET? An accounting worksheet is a tool that businesses use to balance and close out their books at the end of a period. An accounting worksheet lists all the balances of each account a business has, with adjusting and closing entries made to these balances. When a worksheet is complete, the company prepares financial statements from them. CONCEPT: CONSISTENT REPORTING The application of the same accounting procedures for each accounting period. Why is this important? Comparison Accuracy FISCAL PERIOD The length of time for which a business summarizes and reports its financial information CONCEPT: Accounting Period Cycle Changes in financial information are reported for a specific period of time in the form of financial statements DETERMINING THE FISCAL PERIOD There is no set rule about the length of a company’s fiscal period How often do you want to report financial information? Problems if the cycle is too long Problems if the cycle is too short Analysis can be conducted at anytime Aided by computer based accounting programs SETTING THE START DATE Considerations for starting a fiscal period Often follows the calendar year Must be done at least once a year Preparation of financial statements takes time Examine business activity Is it better to start/end your fiscal period at a busy or a slow time in a company’s business cycle? Sole proprietorship income is personal income Tax considerations WORK SHEET A columnar accounting form used to summarize general ledger information needed to prepare financial statements Summarize general ledger balances to prove that debits equal credits Plan needed changes to general ledger accounts to bring account balances up to date Separate general ledger balances according to the financial statements to be prepared Calculate the amount of net income/loss for the period WORK SHEET BASICS The Work Sheet is a planning tool Must be prepared in pencil Heading Three lines Name of Company 2. Name of Report 3. Date of Report 1. For the ____ended _____ 1. THE TRIAL BALANCE A proof of the equality of debits and credits in a general ledger If quality records are kept, the general ledger is all that is needed to prepare the trial balance The general journal and source documents might be required if errors are discovered Errors are found when the trial balance doesn’t result in debits equaling credits PREPARING THE TRIAL BALANCE (PG. 154) Write the heading on the worksheet Write the general ledger account (in order of account number) debit balances in the Trial Balance Debit column Write the general ledger account credit balances in the Trial Balance Credit column Accounts with no balances are included, but no amounts are entered in the Trial Balance Columns (Income Summary, Supplies Expense and Insurance Expense) PREPARING THE TRIAL BALANCE (CONT’D) (PG. 154) Rule a single line across the two Trial Balance columns below the last line on which an account title is written Shows that each column is to be added Add the Trial Balance Debit and the Trial Balance Credit columns. If they are the same, then they are in balance If not, recheck your math to locate the error The remainder of the worksheet cannot be completed until the Trial Balance columns are proved PREPARING THE TRIAL BALANCE (CONT’D) (PG. 154) Write each column’s total below the single ruled line Rule double lines across both Trial Balance columns. The double lines mean that the Trial Balance column totals have been verified as correct Stop – Section 6-1 ACCOUNTING CONCEPT Matching Expenses with Revenue Revenue from business activities and expenses associated with earning that revenue are recorded in the same accounting period Provides accuracy in reporting Provides information about level of expenses required to generate level of revenue ADJUSTMENTS Changes recorded on a work sheet to update ledger accounts at the end of a fiscal period Enables a company to apply the Matching Revenue with Expenses concept Brings the general ledger accounts up to date What is the value of supplies used during a specific period? Transform from assets to expenses How much prepaid insurance was consumed during a specific period? Any others? ADJUSTMENT BASICS Adjustments are recorded on the worksheet Changes are not made in general ledger accounts until adjustments are journalized and posted (chapter 8) Must check for accuracy first! ADJUSTMENT TO SUPPLIES (PG 158) Determine the actual supplies balance at the end of the fiscal period (HOW?) The amount of the adjustment is the Account balance minus the actual balance Supplies must be credited (reduced) by the amount of the adjustment Supplies Expense is debited by the amount of the adjustment (the amount used) ADJUSTMENT TO SUPPLIES (PG 158) Write the adjustment amount in the Adjustments debit column for Supplies Expense Write the adjustment amount in the Adjustments credit column for Supplies Label the two parts of this adjustment with (a) to identify the two amounts are part of the same adjustment ADJUSTMENT TO PREPAID INSURANCE (PG 159) Determine the actual prepaid insurance balance at the end of the fiscal period (HOW?) The amount of the adjustment is the Account balance minus the actual balance Prepaid Insurance must be credited (reduced) by the amount of the adjustment Insurance Expense is debited by the amount of the adjustment (the amount used) ADJUSTMENT TO PREPAID INSURANCE (PG 159) Write the adjustment amount in the Adjustments debit column for Insurance Expense Write the adjustment amount in the Adjustments credit column for Prepaid Insurance Label the two parts of this adjustment with (b) to identify the two amounts are part of the same adjustment PROVING ADJUSTMENTS Once all adjustments have been entered the equality of the debits and credits must be proved Rule a single line across the two Adjustment Columns on the same line as the single line for the Trial Balance columns Add both the Adjustment columns If they are equal, rule a double line across both totals to indicate that the equality has been verified If not, locate and correct the error A QUICK REVIEW CONCEPT: Consistent Reporting Accuracy and comparison CONCEPT: Accounting Period Cycle Changes in financial information are reported for a specific period of time in the form of financial statements aka Fiscal Period Timing of the Fiscal Period A QUICK REVIEW (CONT’D) Work Sheet Planning tool prepared in pencil Trial Balance List all accounts in the first column Record debit and credit balances from the General Ledger in the Trial Balance columns Prove debits = credits by totaling the two Trial Balance Columns Rule a double line to indicate proof is verified A QUICK REVIEW (YES, THERE’S MORE) CONCEPT: Matching Revenue with Expenses Revenue from business activities and expenses associated with earning that revenue are recorded in the same accounting period Adjustments to specific asset accounts are required to apply this CONCEPT and to update General Ledger balances Transform assets to expenses Supplies and Prepaid Insurance A QUICK REVIEW Adjustments are made in the second set of columns of the worksheet Actual levels of supplies and prepaid insurance are determined The actual levels of these assets are subtracted from the General Ledger account balances to determine the amount of adjustment LAST REVIEW SLIDE (REALLY) Adjustments are entered as CREDITS to the asset accounts and DEBITS to the corresponding expense accounts Small letters in parentheses are included to help match the entries The adjustment columns are proved by totaling each column at the same point as the Trial Balance Proof of debits = credits is verified by ruling a double line under the totals ACCOUNTING CONCEPT Accounting Period Cycle Financial statements are prepared at the end of the accounting period cycle Can be weekly, monthly, quarterly or annually A company can prepare statements at any time SEC requires publically traded corporations to publish financial statements quarterly (10-Q) and annually (10K) What is the benefit of preparing financial statements? BALANCE SHEET A financial statement that reports the assets, liabilities and owner’s equity on a specific date Snap shot in time Balance sheet account balances are extended to the Balance Sheet Debit and Credit columns of the Work Sheet The balance for Supplies and Prepaid Insurance are reduced by the credits in the adjustment columns INCOME STATEMENT A financial statement showing the revenue and expenses for a fiscal period Statement of flow Up to date balances for income statement accounts are extended to the Income Statement Debit and Credit columns of the worksheet Supplies Expense and Insurance Expense are included NET INCOME/LOSS Total revenue – total expenses equals net income or loss for the fiscal period If revenue>expenses, then Net Income If revenue<expenses, then Net Loss Net Income/Loss must be calculated before the Work Sheet can be balanced and ruled CALCULATING NET INCOME/LOSS Rule a single line across the Income Stmt and Balance Sheet Columns Total the columns and record the totals below the single line Subtract total debits from total credits in the Income Statement columns (Revenue – Expenses) RECORDING NET INCOME/LOSS If the result is greater than zero, record the net income below the total in the debit column If the result is less than zero, record the net loss below the total in the credit Extend the entry to the balance sheet item Net Income is recorded as a Credit (why?) Net Loss is recorded as a Debit (why?) Rule a single line below the four columns Total the columns and rule a double line to indicate proof that debits = credits CORRECTING ERRORS ON THE WORK SHEET Errors are often detected only during the preparation of the Work Sheet How do you know there is an error? Errors on the Work Sheet must be corrected before financial statements can be prepared It is best to correct all mistakes in the Trial Balance before moving any further Then, any additional errors occur on the Work Sheet alone TYPICAL CALCULATION ERRORS The difference is 1 ($.01, $.1, etc.) Math error – Redo calculations The difference is divisible by 2 Look for the amount in the trial balance column, it is likely that an item was entered in the wrong column The difference is divisible by 9 A slide occurs when numbers are moved one decimal place to the left or right ($25 becomes ($250) TYPICAL CALCULATION ERRORS The difference is an omitted amount Look for an amount equal to the difference Often, that item has not been extended to the Work Sheet’s Trial Balance How do you prevent errors? CHECKING FOR ERRORS IN THE WORK SHEET Check for errors in the Trial Balance Column Have all General Ledger account balances been entered and in the correct columns Check for errors in the Adjustment Columns Check for errors in the Income Statement and Balance Sheet columns CORRECTING AN ERROR IN POSTING TO THE WRONG ACCOUNT Draw a line through the entire incorrect entry Recalculate the account balance and correct the work sheet Record the posting in the correct account Recalculate the account balance and correct the work sheet CORRECTING AN INCORRECT AMOUNT IN THE GENERAL LEDGER Draw a line through the incorrect amount Write the correct amount just aboive the correction in the same space Recalculate the account balance and correct the balance on the work sheet CORRECTING AN AMOUNT POSTED TO THE WRONG COLUMN Draw a line through the incorrect item in the account Record the posting in the correct amount column Recalculate the balance Correct the Work Sheet