Wilson Group

advertisement

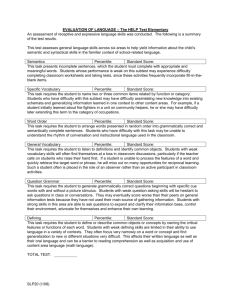

Concord, MA Page I. Overview of the Survey and the Participants 3 II. Base Salary Projections 11 III. Variable Pay Projections 15 IV. Changes Planned for Compensation Programs 19 V. Breakout of Survey Highlights by Industry 24 VI. Primary Conclusions and Ideas to Consider 27 Overview of the Wilson Group www.wilsongroup.com 29 2 www.wilsongroup.com 3 This survey was created to fill an important gap in information about compensation plans. As companies consider changes in their business strategies and develop their plans for 2014, it is often very important to examine the projections and trends regarding compensation plans. As companies emerge from the “great recession”, they will be facing a more competitive environment for talent. While this survey does not include actual pay data, it does provide information and insights on overall compensation plans – base salaries, variable pay, sales compensation plans, and equity based compensation and other forms of total rewards. This survey was conducted in collaboration with Vicky Cudmore, Compensation Program Manager and Trupti Khanderia of BOSE Corporation. Our joint sponsorship of this survey is intended to bring important information to companies in the New England region and those with significant operations in this area. New England has enjoyed a better than the national average recovery from the recent recession, and as things improve, we both felt it was important to determine what organizations are planning to do in 2014. Further, Wilson Group worked with BOSE to design the survey questions, and we administered the survey so that individual company responses can be kept confidential. We appreciate the contribution and collaboration with members of BOSE Corporation, and hope you find this report of value to your planning and setting 2014 priorities. www.wilsongroup.com 4 Based on the results of this survey, several of the most important findings include: 1. The companies surveyed reported a minor revenue growth in 2013 over 2012. The median growth projection was 5.0% for 2012 and 5.6% in 2013. It appears that most companies are not projecting strong increases in revenue growth for 2013. 2. Base salary increases are likely to be what they were in 2013. The median merit increase budget for 2012 was 3.0% and 3.0% is planned for 2013. The range of increases is very tight, between 2.5% and 3.0% for 2013. 3. There is a modest increase in the percent of employees that will NOT likely receive pay increases. In 2013 this median percent was 3.0% (8.1% average) and is planned for 2013 at 5.0% (11.4% average). This means that despite a slowly improving economy, companies are taking a harder line on giving merit increases. Instead of paying high performers more money, companies appear to be giving 0% increases to more people. 4. Similar to last year, 90% of the survey companies are making bonus payouts in 2013 for 2012 performance. These payouts are projected to be 90% of the target payouts which is a little lower than last year. The payouts as a percent of the target ranged from 50% (at the 10th percentile) to 110% (at the 90th percentile). 5. Most companies are doing normal updates to their base salary, variable pay, and equity based pay plans (6 – 8% are planning changes). Twice this level (17%) are planning on changes to their sales compensation plans. www.wilsongroup.com 5 The survey includes information from 37 companies. They are all based or have significant operations in the New England region. The companies represent a broad range of industries. Twenty-two (42%) are in the Technology and Life Sciences industry, 17% are in the Professional Services industries, 17% are in Financial and Insurance Services, 14% are in Consumer Products, Retail Services, and 11% are in Healthcare and other Non-Profit industries. www.wilsongroup.com 6 The survey reflects responses from a broad range of companies in terms of their revenue size and employee population. The median revenue of the participating companies is $771M and they have approximately 1,672 employees. There are a number of very large companies, and many mid-market size companies in the survey. This means that the survey provides important information from a large breadth of companies. As you will see in the report, despite this wide range of companies, the actual variation in the responses is not that large. So, even though there is a significant range, there appears to be very similar pay practices for 2013 and 2014. The demographics of this group includes the following: Demographics: 25th Percentile Median 75th Percentile Average $140.0 M $771 M $1.4 B $1.3 B Total No. of EEs: 395 1,672 3,977 4,520 Revenues per EE: $108.6 M $304.4 M $647.1 M Annual Revenues: www.wilsongroup.com $215.0 M 7 This group of companies is projecting a modest growth for 2013 with slightly more growth planned for 2014. Approximately one-third have revenue growth projections of greater than 4% for both 2013 and 2014. Forty-four percent (44%) of companies are expecting growth in 2014 of greater than 4% compared to 36% in 2013. Only three organizations reported a decline in revenues for 2013 and only one in 2014. Over 47% of the companies indicated they were increasing the staffing levels in 2014 with 29% projecting no change; 18% anticipated reducing staffing levels. Therefore, it appears that 2014 will likely be more prosperous than 2013 for these leading employers. Revenue growth projections for 2013 www.wilsongroup.com Revenue growth projections for 2014 8 Voluntary turnover rates are approximately twice that of involuntary turnover rates. As the economy continues to increase its rate of growth, this turnover pattern is likely to increase for many companies. The challenges facing many companies is attracting and retaining desired talent. In many firms this is specialized into a number of critical jobs. This group of companies is facing hiring challenges with the professional workforce. Attracting and retaining talent includes four key functional areas: Information technology, Engineering, Sales and Marketing and Human Resources. Little concern exists for management or operational/hourly employees. Turnover Voluntary Involuntary Average 8.9% 5.8% Executive Management Professional Service Operational 21% 21% 0% 12% 44% 15% 3% Information Technology 0% 3% Engineering 3% 10th Percentile 2.3% 1.2% Sales & Marketing 3% 12% 24% 12% 6% 25th Percentile 3.9% 2.3% Customer Service 0% 3% 0% 6% 6% 50th Percentile 7.0% 3.5% Operations & Manufacturing 0% 3% 3% 6% 9% 75th Percentile 10.3% 5.0% Finance 6% 3% 6% 12% 0% 90th Percentile 14.7% 7.7% Human Resources 0% 3% 15% 9% 3% www.wilsongroup.com 9 AIPSO Airvana LLC Alent All Screens Entertainment, Inc Anonymous American Tower Analog Devices Beth Israel Deaconess Medical Center Bose Boston Mutual Life Commonwealth Equity Services Communispace Corporation Constant Contact COVERYS Dana-Farber Cancer Institute Deluxe Draper Laboratory EMD Millipore Hebrew SeniorLife www.wilsongroup.com Idenix Pharmaceuticals Invensys Iron Mountain Kronos Inc. Mapfre Insurance MathWorks MITRE MorphoTrust USA, Inc. Ocean Spray Cranberries, Inc. Rockland Trust Stratus Technologies The TJX Companies, Inc TripAdvisor UMass Memorial Health Care Vistaprint Waters Corporation Watts Water Technologies World Energy Solutions 10 www.wilsongroup.com 11 The merit pay increase projections for 2013 and 2014 show a very tight cluster around 3.0%. There is also little change planned for 2014 from increases made in 2013. The “highs and lows” were also tightly clustered. This pattern has existed from the last several years. The only note of significance is the average number of people who will NOT be receiving pay increases. This is projected to decrease from 9.4% (average) to 7.5% (average) within companies. The difference between the Median and the Average indicates there are several companies being more disciplined about pay increases in 2013 and 2014. Merit Increase Budget for 2013 % of EE’s NOT receiving pay increases in 2013 Merit Increase Budget for 2014 % of EE’s NOT receiving pay increases in 2014 2.8% 9.4% 2.9% 7.5% th 2.0% 1.0% 2.0% 0.0% th 2.5% 1.0% 2.5% 1.0% 3.0% 4.0% 3.0% 2.8% th 3.0% 10.5% 3.0% 10.0% th 3.5% 18.8% 3.5% 11.8% AVERAGE 10 Percentile 25 Percentile MEDIAN th (50 Percentile) 75 Percentile 90 Percentile www.wilsongroup.com 12 Approximately half of the participating companies provide a budget for promotions and special market adjustments. This has only changed slightly from 2013 to 2014. The table below shows the percent of companies that have a separate budget and the amount for 2013 and planned for 2014. Promotional Increases Separate budget for promotions and special market adjustments: www.wilsongroup.com 2013 2014 Yes 53% 50% No 47% 50% Average 1.0% 3.9% 10th Percentile 0.3% 0.3% 25th Percentile 0.5% 0.5% 50th Percentile 0.9% 1.0% 75th Percentile 1.1% 1.0% 90th Percentile 1.8% 3.0% 13 The table below shows the average merit increases made to individuals with different levels of performance. The salary increases tend to range from 1.0% to 6.5% (at the 75th percentile). The range of the responses for the low and high companies is also shown in the table below; the number of companies in the low and high are shown in parentheses. This table shows that exceptional/outstanding performers tend to receive 2x that of the average, “fully meets” employees. Unsatisfactory Falls short on most objectives Meets most objectives Exceeds most objectives Exceptional or Outstanding AVERAGE 0.0% 0.8% 2.9% 4.2% 5.7% 25th Percentile 0.0% 0.0% 2.5% 3.6% 5.0% MEDIAN 0.0% 1.0% 3.0% 4.0% 6.0% 75th Percentile 0.0% 1.0% 3.0% 5.0% 6.5% LOW 0.0% 0.0% (9) 2% (5)* 2.0% (2) 2.0% (1) HIGH 0.0% 4.0% (1) 4.5% (1) 6.0% (3) 8.0% (5)** ( ) shows the number of companies using this level of pay increase. * One firm uses 1.9% ** One firm uses 8.3% www.wilsongroup.com 14 www.wilsongroup.com 15 The table below shows the projected payouts for bonus plans based on 2013 performance. Virtually all companies in the survey indicated they would be making a bonus award payout. Companies will be making payouts that are right at their target payouts (100%). There were 6 companies that exceeded 110% payouts with the highest being 200%, and there were 5 companies that were 75% or less of target payout, with the lowest being 22% of target. Does your company intend to make bonus payouts for 2013 performance? Yes: 94% No: 6% Payouts as percent of target payouts: www.wilsongroup.com Average 92.4% 10th Percentile 25th Percentile 31.6% 76.5% Median 100.0% 75th Percentile 90th Percentile 113.0% 131.4% 16 The chart below shows the percent of positions that are eligible for variable pay programs. This chart shows that most employees participate in some form of variable pay program. On examination of the sales professionals, most of the companies that did not indicate an incentive for these positions did not have sales positions in their organizations. During the “great recession” many companies considered disbanding their variable pay programs for exempt and non-exempt employees. This data shows that most firms did not take this action albeit the percent of participation is lower than senior management. Virtually all organizations engage their senior level managers and key contributors in a variable pay program. www.wilsongroup.com 17 The chart below shows the prevalence in 2013 of special cash, recognition and award programs. New hire bonuses, spot awards and special recognition cash awards are clearly the preferred vehicles for rewarding performance. Gift cards and movie passes are also very important non-cash mechanisms for rewarding desired performance. Based on an examination of the responses for 2014, most of the programs that will be initiated new are hiring bonuses, project based bonus plans, lump sum merit pay and gift card/movie passes recognition awards. www.wilsongroup.com Currently use Planning for 2014 Retention bonuses 23% 11% New hire bonuses 74% 37% Spot awards 66% 31% Project based bonuses 46% 23% Lump sum for merit pay 40% 14% Special recognition cash awards 63% 34% Gift cards, movie passes, etc. 57% 37% Other special bonuses 9% 6% 18 www.wilsongroup.com 19 While most companies are not planning to make changes to their base pay programs in 2014, there are several areas that companies are focusing on for improvements. The most significant changes appear to be with strengthening the link between base pay systems and merit increases with the performance management and talent development priorities of the business. These initiatives strengthen the impact of base pay, and move it from being just a “hygiene factor” to one that reinforces performance and competency development. No company reported instituting a forced distribution process and only a few companies are looking to create broadbanding systems for pay. It appears that base pay plans are still an essential element of the total compensation and people management programs of the company. www.wilsongroup.com 20 The chart below shows the percent of companies that are planning changes in variable pay programs. It appears that 2014 will see some improvements in the plans, with 55% of the firms indicating that they were making some important changes to them. The most critical areas for change appears in the performance measures and funding process that supports variable pay plans. A few companies are changing the payout targets and/or modifying the weighting associated with the measures. And a number of companies are uncertain what they will be doing differently in 2014. www.wilsongroup.com 21 The chart below shows the percent of companies that are planning changes to sales compensation programs. The most important actions will be to align sales plans more with the strategy of the company. This means there will be greater emphasis on acquiring new customers. Next, the emphasis will be on improving the efficiency of the plan through better administrative systems and documentation. Changes are being considered in the acceleration points of the commission rates in addition to other elements of the sales plan. Wilson Group has recently completed a landmark study (second annual) of sales compensation plan practices, with an emphasis on five (5) critical sales roles. If you are interested in receiving a copy of this report or discussing it with us, please contact us. Our contact information in included at the end of this report. Improving the alignment with our overall business strategy Placing more emphasis on acquiring new accounts/customers Improving the administrative systems of the plan Increasing the documentation and controls of the plan Changing the commission acceleration points Changing the commission rates Placing more emphasis on new/current products Placing more emphasis on retaining and developing current customers Simplifying the plan - reduce the number of measures and rates Changing the "on target" earnings Not making any material changes to the sales compensation plans 0% www.wilsongroup.com 5% 22 10% 15% 20% 25% There were only three companies that indicated they were making changes to their equity/ownership based compensation programs. Consequently, we cannot report any findings or trends in this area. The observation of these companies and from our practices with designing executive compensation plans indicate that companies are addressing these plan design changes for 2014: 1. Companies are shifting the use of equity vehicles from stock options to restricted stock units. Most firms are using a combination of vehicles, but the trend is clearly toward more full valued equity vehicles. 2. When companies adopt restricted stock units (RSU’s) or restricted stock, they place a performance condition to receive the award. The most common technique is to link the vesting of RSU awards to the achievement of long-term performance relative to an external benchmark group – a peer group, industry or market index. If the company achieves performance in the top quartile of this group, after 3 to 5 years, the RSU’s will vest. This vesting measure is spread out across grant cycles so that if performance is achieved, then equity units will be vested annually. 3. Companies are changing the guidelines to limit the number that are awarded below the executive or director level positions within the organization. Equity plans are viewed as rewarding the growth in the long-term value of the corporation, and therefore should be awarded to those positions that have a direct impact on the factors that create long-term value. These plans are still used with high levels of participation in private, emerging growth companies as a tool for attracting and retaining talent to offset limited cash compensation. 4. Private companies are increasingly using equity based vehicles for their executive management and senior leadership. There are a great number of vehicles and approaches used for these programs, and they are tailored to the specific philosophy and requirements of each organization. www.wilsongroup.com 23 www.wilsongroup.com 24 The following table shows the survey results for the major industries of companies in this survey. Technology & Life Sciences Retail & Consumer Products Professional Services Financial Services 4% - 8% 4% - 8% 0 - 3.9% 4% - 8% 4% - 8% 4% - 8% 4% - 8% 8% - 12% 57% 36% 7% 40% 40% 20% 40% 20% 40% 67% 17% 17% Voluntary % Involuntary % 7.3% 5.7% 5.0% 4.5% 11.0% 5.0% 5.6% 2.6% Total Cash Compensation Merit Pay Increases 2013 2014 3.0% 3.0% 2.5% 2.5% 2.5% 2.5% 2.9% 3.0% % EE's with NO Increase 2013 2014 5.0% 6.2% 4.5% 5.8% 8.5% 7.6% 1.0% 1.3% Bonus Plan Payouts % making payouts Payouts as % of Target 95% 97.5% 83% 120.0% 89% 100% 89% 105% Background Revenue Growth Projections 2013 2014 Staffing Changes Increasing Staff No Change in Staff Decreasing Staff Turnover www.wilsongroup.com 25 Technology & Life Sciences Retail & Consumer Products Professional Services Financial Services Reward and Recognition Programs Used in 2013 Retention Bonuses 29% 17% 20% 17% New Hire Bonuses 86% 50% 60% 100% Spot Awards 86% 33% 80% 67% Project based Bonuses 57% 17% 40% 33% Lump Sum Merit Pay 71% 0% 40% 33% Special Recognition Cash Awards 86% 17% 80% 83% Gift Cards, Movie Passes Awards 64% 50% 80% 50% Other Special Awards 0% 33% 17% 0% www.wilsongroup.com 26 www.wilsongroup.com 27 We hope that you have enjoyed reviewing this special survey of compensation plans for 2014 and that it has provided important information for your organization. Based on the information presented in this report, we believe there are several questions important for every organization to consider in making their total compensation plans more effective for the organization and their people. 1. If the average merit increase is 3.0%, then what should your top performers make in pay increases? The survey data showed the exceptional performers were earning approximately 6.1% or about 2x the normal pay increase. 2. What percent of your employees should receive both the top awards and zero pay increases? There was a significant mix of opinions with many companies not awarding merit pay increases to up to 20% of their workforce; the median was 4.8% of the employees. 3. Less than 20% of the companies actively use special award, recognition and spot bonus programs. What value do or can these programs provide to your organization? Can these programs be managed in a way that reinforces both the performance requirements and the desired culture of the organization? These programs may provide untapped potential to the resourceful organization to encourage and reinforce desired performance. 4. Most companies are making bonus payouts for 2013 performance. The amounts are close to the target payouts. (90%) A few companies are examining the effectiveness of these programs and examining both the eligibility and metrics associated with them. Depending on the nature of the strategies and plans for 2013, what elements of your variable pay plans are working for the organization and what elements are limiting its impact? 5. Sales compensation plans appear to be the focus for important changes by a moderate number of survey companies. Feedback comments and our experience in development of these plans with clients indicate the primary interest is to strengthen the ability of the company to increase revenues from new clients and from existing clients. If you would like to talk about your compensation plans and programs, and explore ways to improve their effectiveness and make a positive impact on the company, please contact us. We would enjoy working with you to improve the performance in your company. www.wilsongroup.com 28 Our Mission: “To help our clients assess, develop and implement performance systems and total compensation plans that translate strategy and values into action.” Our Primary Services: • • • • • Executive total compensation Board of directors governance structure and compensation Sales effectiveness and total rewards Employee total compensation and rewards Special studies in market trends and practices Key Differentiators: • • • • Our expertise -Our collaborative approach -More cost effective -Innovative insights -- Founded: Work with highly seasoned, experienced professionals We engage our clients in a collaborative, open communication fashion Highly customized, value added to address just what the client needs Simplifies complex data into easy to understand information and actions plans 1994, Concord, MA Clients and Markets: We have worked with over 150 clients. They include: • • • • • Information Technology – Stratus Technologies, iRobot, Constant Contact, Care.com Bio-technology – Cytyc, AgaMatrix, CRF Healthcare Light manufacturing – Nypro, A.W. Chesterton, Lightcontrol, Circor Professional services – Copyright Clearance Center, Morgan Samuel, Ariel Group Financial services – Safety Insurance, Boston Mutual, DentaQuest, Commonwealth Financial Network www.wilsongroup.com 29 Leadership Team: • Thomas B. Wilson, President • • • • Susan Malanowski, Principal Rhonda Farrington, Principal Plus a team of 5 other experienced professionals Our Network of additional specialized resources: John Mancuso, Head of Executive Benefits, Bostonian Group/Marsh McLennan Agency Thomas E. Shea & Associates– Executive and Board Compensation Jewon Lee – Global Equity Compensation Thought Leadership: • • • • • • • • Survey of Sales Compensation Practices – 2013 - 2014 “Goal Setting: What Has Gone Wrong and What Can Be Done” – published WorldatWork Journal, Fall, 2012 “Changes for Challenging Times – Survey Report on Economic Challenges and Company Responses” (2009) Survey Report on Changes in Variable Cash Compensation Plans (2007) Survey Report on Changes in Equity Based Compensation (2006) Innovative Reward Systems for the Changing Workplace (McGraw-Hill, revised 2003) Published over 30 articles and book chapters Presented at over 100 leading regional and national conferences Contact us at: www.wilsongroup.com 978-371-0476 801 Main Street– Suite 2 Concord, MA 01742 twilson@wilsongroup.com smalanowski@wilsongroup.com rfarrington@wilsongroup.com www.wilsongroup.com 30