File

advertisement

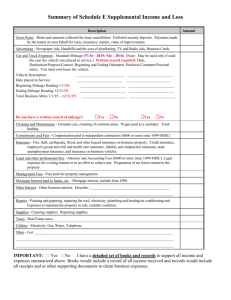

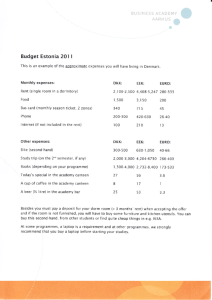

• A business needs to keep track of all their income - REVENUE and EXPENSES. • Any money coming in to a business is recorded as revenue. • Any money going out of a business is known as an expense. • For a business to be profitable their revenue must be greater than their expenses. • Businesses will generate a profit and loss statement to calculate their annual profitability. Revenue (income) • Sales – money from the sales of good s they trade in – i.e. music shop CD’s • Fees – money received from work done for a client – also known as services rendered. • Commissions earned – money received from a client based on the value of the service. • Interest received – from financial institutions. • Dividends • Rent Expenses (costs) • Wages –paid to employees • Rent – paid for the use of a business premise • Insurance – premiums paid to insurance companies • Rates and taxes – government and local government charges • Advertising and promotion • Depreciation – the loss in value of assets that occurs over time (computers) • A capital item is not included in a profit or loss statement. • These are things such as a vehicle or a building. They don’t directly bring revenue into a company like selling an item or providing a service. Prepare a profit and loss statement for Jenny’s Jam Shop for June 30. The following revenue and expenses were recorded – Sales $546,000, Interest Paid $3560, Wages $297,800, Advertising $5890, Rent $3400, Telephone $3789, Insurance $5500, Water Rates $3900, Interest received $560. Cost Of Goods Sold • The profit and loss statements that we just looked at are rather simplified. • They do not take into account the cost of the items on the shelves of the shops. • A business has to buy the goods – an expense and then this needs to be taken away from any income. • There is a procedure that you need to follow. • To calculate the cost of goods sold, a business counts its stock at the beginning and the end of the year (stock take sale). • These figures – plus the value of the goods purchased during the year are used to calculate the C.O.G.S. A shop has stock valued at $220,000 at the start of the year. During the year they purchase $278,000 worth of goods. When the shop did a stock take at the end of the year the stock was valued at $189,000. Calculate the cost of goods sold during that year. Gross Profit and Net Profit • To just calculate the COGS is not realistic for a business – it needs to be incorporated within a profit and loss statement. • Gross Profit is the difference between sales and the COGS – the profit a company makes on selling its goods. • Net Profit is the profit margin once all other costs have been taken out. Make up a profit and loss statement for Fred’s Shop has the following expenses and revenue for the year ended June 30: wages $98500, Sales $885,000, rent $22500, rates and taxes $2400, insurance $6675, opening stock $138000, electricity $1900, purchase of stock $99200, depreciation $3480, telephone $1235, advertising $4445, closing stock $116590, interest paid $568. Fred’s Shop Profit and Loss Statement Year ended June 30 Sales Less – cost of goods sold Opening Stock Plus – purchases Goods available for sale Less – closing stock $885,000 $138,000 $ 99,200 $237,200 ($116,590) $120,610 Gross Profit Less – expenses Wages Rent Insurance Rates and Taxes Electricity Telephone Depreciation Advertising Interest Paid Net Profit $98,500 $22,500 $6675 $2400 $1900 $1235 $3480 $4445 $568 $141,703 ($120,610) $764,390 ($141,703) $622,687