Chapter 11.2 - 5 Journal System -

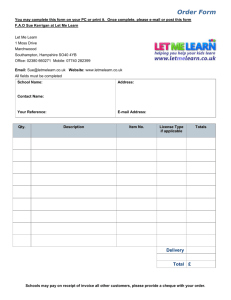

advertisement

Chapter 11 Review 11.1- Subsidiary Ledger Systems 11.2- The Synoptic Ledger 11.2- The five Journal System (NEW) 11.1 – Subsidiary Ledger System What is it? Is a separate ledger that contains a number of accounts of a similar type, such as accounts receivable The accounts in a subsidiary ledger make up the detailed data for one related CONTROL ACCOUNT (general ledger account related to a subsidiary ledger, example of Control Account: Accounts Receivable) Refer to exercise #2 pg. 518 (t), pg. 384-385 (w) 11.2 – The Synoptic Journal What is it? Takes everyday, routine transactions and enters into a “specialized” journal that sorts items during the journalizing process. Synoptic Journal has a number of columns to accumulate accounting entries Saves time when posting. Only the totals of special columns are posted, therefore, only one posting for each account Be sure to balance the Synoptic Journal (cross-balancing: grand total of all debit columns against grand total of all credit columns) Refer to Exercise #2 pg. 537-539 (t), pg. 400-402 (w) 11.2 FIVE JOURNAL ACCOUNTING SYSTEM SOURCE DOCUMENTS: REFER TO OVERHEAD Cash Sales Slips Cash Receipts Bank CR Memos Sales Invoices Credit Invoices issued Purchase Invoices Credit Invoices received Pay liabilities Pay expense Drawings Buy assets Cheque Copies Bank DR Memos -correcting entries FIVE JOURNALS Cash Receipts Journal (C.R.J) Other Source Documents (non-routine entries— adjusting/closing entries) Sales Journal (S.J) Ex. P. 497 (t) Purchase Journal (P.J) p. 498 (t) Cash Payment Journal (C.P.J) Ex. p. 498 (t) Bank DR Ex p. 497 (t) A/R Ledger A/P Ledger ALL FIVE JOURNALS ARE POSTED TO: General Ledger General Journal (G.J) 11.2 – Exercise #4 pg. 502-503 (t), pg. 405 (w) Question: In which of the five journals would each transaction below be recorded? TRANSACTIONS: a. A cheque is issued to a supplier on account b. A purchase invoice is received from a supplier of merchandise c. Cheque Copy Cash Payment Purchase Invoice Purchase Journal A cheque is received on account from a customer Cash Receipts Cash Receipts Journal Let’s Try It! Complete Exercise #3 & 4 p. 502-503 (t), p. 405 (w) Complete Exercise # 5 p. 530-532 (t), p. 443-452 (t) A) Post the subsidiary ledgers on a daily basis directly from the source documents B) Balance and rule each of the five journals C) Hand-in when done – you will have more time tomorrow to work on it. d. A cash sale is made to a customer Cash Sales Slip Cash Receipts Journal e. A sale on account is made to a customer Sales Invoice Sales Journal f. A cheque is issued to the owner for his personal use Cheque Copy Cash Payment Journal g. A cheque is issued to pay for wages for the period Cheque Copy Cash Payment Journal h. A sales invoice is used Sales invoice Sales Journal (A/R Ledger) i. A correcting entry is made to transfer a debit amount from the Supplies account to the Miscellaneous Expense account j. A cheque is issued to pay for a cash purchase of merchandise. k. Cheque Copy Cash Payment Journal A bank debit advice for a service charge is received l. Other Source Documents General Journal Bank Debit Memo Cash Payment Journal A cheque is issued to a supplier on account Cheque Copy Cash Payment Journal m. A cheque is issued to pay for monthly rent Cheque Copy Cash Payment Journal n. A bank debit advice is received with respect to a bad cheque Bank Debit Memo Cash Payments Journal o. A bank credit advice is received with respect to interest earned. Bank Credit Memo Cash Receipts Journal p. A new typewriter is purchased and a down payment is required. A cheque is issued. Cheque Copy Cash Payment Journal q. The owner collects a debt from a customer but keeps the money for his personal use r. Withdrawal General Journal, Cash Receipt Cash Receipt Journal The owner spends a sum of money out of his own pocket for a business purpose and is reimbursed by means of a cheque. Cheque Copy Cash Payments Journal