Capital Account Liberalization

Capital Account Liberalization:

Lessons from the Asian Financial Crisis and Implications for China

Masahiro Kawai

Asian Development Bank Institute

“Financial Reforms in China and Latin America”

Organized by ILAS/CASS and IDB

Beijing, 7 June 2007

Outline

I.

Miracle, Crisis and Reconstruction

II. Lessons of the Crisis for Capital

Account Liberalization

III. Preconditions and Sequencing of

Capital Account Liberalization

IV. Implications for China

V. Way Forward

I. Miracle, Crisis and Reconstruction

1. Miracle

•

Low inflation and competitive exchange rates to support outward-oriented growth

•

Human capital, critical to rapid growth with equity

• Effective and secure financial system for financial intermediation

•

Limited price distortions for the development of labor-intensive sectors initially and capital-intensive sectors later

•

Use of foreign technology via licensing and/or FDI

• Limited bias against agriculture, key to reducing rural-urban income disparities

I. Miracle, Crisis and Reconstruction

2. Crisis

•

The crisis was a result of interactions between the forces of financial globalization and domestic structural weaknesses

•

Forces of financial globalization—financial market opening, capital account liberalization (double mismatches) and volatile capital flows

•

Domestic structural weaknesses—financial (mainly banking) sector, corporate sector, and supervisory and regulatory frameworks

• Lessons—manage the forces of financial globalization; strengthen financial & corporate sectors; nurture regional financial cooperation

I. Miracle, Crisis and Reconstruction

3. Recovery and Reconstruction

•

Financial and corporate sector restructuring, reforms and reconstruction, together with the introduction of better regulatory and supervisory frameworks

•

Economic recovery facilitated by intra-regional trade linkages

•

Substantial reduction of financial vulnerabilities through reduction of short-term external debt and accumulation of foreign exchange reserves

•

Nonetheless, some economy, like Indonesia, was semi-permanently damaged by the crisis

I. Miracle, Crisis and Reconstruction

4. Regional Cooperation in East Asia

•

Reforms of the international financial system have been inadequate (CCL, PSI), and national efforts to strengthen domestic economic systems take time to be effective

• An effective regional financial architecture can close the gap between the global and national efforts for crisis prevention (ASEAN+3 ERPD, ABMI), crisis management (CMI), and crisis resolution

•

On the trade front, the region has recently shifted to a three-track approach of multilateral (WTO) cum trans-regional (APEC), regional (ASEAN+1’s), and bilateral (FTA) liberalization of trade & FDI

II. Lessons of the Crisis for Capital

Account Liberalization

1. Benefits and Costs of Capital Account

Liberalization

•

Benefits: The country can smooth its consumption and face greater opportunities than a closed economy.

Savings and investment decisions can be made independently of each other.

•

But empirical evidence on the relationship between capital account openness and economic performance is mixed.

•

Costs: The country can face greater risks of a currency crisis. A surge in capital inflows and a sudden reversal of capital flows can induce crises, often due to contagion & external shocks, not necessarily domestic factors

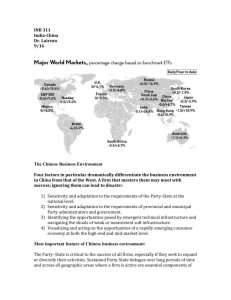

Table 1. Capital Controls in China and Other Major Emerging Market Economies

Status under IMF Articles of Agreement

Controls on payments for invisible transactions and current transfers

Controls on capital transactions

Capital market securities

Money market instruments

Collective investment securities

Derivatives and other instruments

Commercial credits

Financial credits

Guarantees, sureties, and financial backup facilities

Direct investment

Liquidations of direct investment

Real estate transactions

Personal capital transactions

Provisions specific to:

Commercial banks and other credit institutions

Institutional investors

Source : IMF, Annual Report on Exchange Arrangements

China

Article VIII yes yes no yes yes yes yes yes yes yes yes yes yes yes

Brazil

Article VIII no yes no not regulated yes not regulated no no yes no no no yes yes

India

Article VIII yes

Russia

Article VIII no yes yes yes yes yes yes yes yes yes yes yes yes yes yes no yes no yes yes yes yes no yes no no yes

II. Lessons of the Crisis for Capital

Account Liberalization

2. Capital Account Openness and Crises

•

First generation model: Worsening economic fundamentals (e.g. expanding money supply due to large budget deficits) can cause a currency crisis.

•

Second generation model: Expected policy change

(e.g. macroeconomic stimulus due to recession or high unemployment) can induce a crisis.

•

Third generation model: Presence of double mismatches, liquidity constraints on firms with external debt, and speculative runs on banks can cause a currency crisis.

Table 2. Three Models of Currency Crises

Cause of Crisis

Number of Equilibria

Major Episodes

Main Defects

First Generation

Bad fundamentals:

Excessive expansion of money supply due to, e.g., large fiscal deficits

One

Latin America (1970s-80s)

No government optimization

Second Generation

Coordination failure:

Expectation of macroeconomic stimulus due to recession, high unemployment, etc

Third Generation

Coordination failure:

Double mismtach;

Liquidity constraint;

Bank runs

Multiple

EMS (1992)

Multiple

East Asia (1997-98)

Not obvious as to how one particular equilibruim is chosen out of many

II. Lessons of the Crisis for Capital

Account Liberalization

3. Crisis Prevention Rather than Cure

• Do not try to achieve the “impossible trinity”

•

Be cautious about the pace and scope of capital account liberalization

•

Avoid large current account deficits and double mismatches

• Secure adequate foreign exchange reserves for selfprotection

•

Strengthen monitoring of capital flows and exchange market developments and supervision over domestic financial systems

• Develop regional mechanisms to prevent crises

III. Preconditions and Sequencing of

Capital Account Liberalization

1. Preconditions

•

Establish capacity to collect reasonably good statistical data on capital flows

•

Set the domestic macroeconomic conditions right

(solid fiscal situations and macroeconomic stabilization)

•

Introduce an independent central bank for credible monetary policy

•

Develop liquid money markets for the conduct of monetary policy and financial stability

•

Establish a sound financial system and strong prudential supervisory and regulatory frameworks

III. Preconditions and Sequencing of

Capital Account Liberalization

2. Sequencing

•

Liberalization of trade and foreign direct investment

• Liberalization of money and capital markets where interest rates are market determined and business scope and entry are deregulated

• Enforcement of domestic competition policy to foster efficiency in the real and financial sectors

•

Establishment of strong regulation and supervision, legal and accounting systems to cope with systemic financial crises

•

Liberalization of long-tem capital flows, followed by short-term capital flows

III. Preconditions and Sequencing of

Capital Account Liberalization

3. Capital Account Liberalization as Part of a

Comprehensive Reform Program

•

Capital account liberalization should not be considered as an isolated policy issue.

•

There is a strong linkage among capital account liberalization, domestic financial sector reform, and the design of monetary and exchange rate policy

•

Capital account liberalization should be considered as an integrated part of a comprehensive reform program, and paced with the strengthening of domestic financial systems and implementation of appropriate macroeconomic and exchange rate policies

IV. Implications for China

1. Sound Macroeconomic Management

•

Before capital account liberalization, China must maintain stable macroeconomic conditions, i.e., by reining in over-investment and incipient asset price bubbles

• Before capital account liberalization, China must put in place market-oriented policy frameworks and instruments for effective macroeconomic management

• Make the People’s Bank of China independent of the government so that it can achieve low and stable inflation

•

Strengthen the fiscal base through tax reform and prudent debt management

Table 3. Balance of Payments of China, 2000-2006

Current Account

Trade balance

Services Balance

Income Balance

Current Transfers Balance

Capital Account

Financial Account

Direct Investment Balance

Portfolio Investment Balance

Equity Securities Balance

Debt Securities Balance

Other Investment Balance

Net Errors and Omissions

Overall Balance

2004

68.7

59.0

-9.7

-3.5

22.9

-0.1

110.7

53.1

19.7

10.9

8.8

37.9

26.8

206.2

2003

45.9

44.7

-8.6

-7.8

17.6

0.0

52.8

47.2

11.4

7.7

3.7

-5.9

18.0

116.6

2002

35.4

44.2

-6.8

-14.9

13.0

0.0

32.3

46.8

-10.3

2.2

-12.6

-4.1

7.5

75.2

2001

17.4

34.0

-5.9

-19.2

8.5

-0.1

34.8

37.4

-19.4

0.9

-20.3

16.9

-4.7

47.4

2000

20.5

34.5

-5.6

-14.7

6.3

0.0

2.0

37.5

-4.0

6.9

-10.9

-31.5

-11.7

10.7

(US$

Billion)

2006

249.9

217.7

-8.8

11.8

29.2

4.0

6.0

61.9

-58.4

--

--

70.4

-12.9

247.0

2005

160.8

134.2

-9.4

10.6

25.4

4.1

58.9

67.8

-4.9

20.3

-25.3

-4.0

-16.4

207.3

Sources : IFS Online, CEIC and IIF estimates (2006).

IV. Implications for China

2. Financial Sector Reform

•

Strengthen the banking system, i.e. both banks

(particularly SOCBs) and their clients (particularly

SOEs)

•

Make the supervisory agency independent of the political system

•

Allow interest rate liberalization, greater scope of financial business, and freer entry to the financial industry

•

Encourage more entry of foreign financial institutions so that it can make the financial system vibrant

•

Develop local-currency bond markets

IV. Implications for China

3. Exchange Rate Regime

•

Capital account liberalization will require substantially flexible exchange rates if the central bank wishes to have autonomous monetary policy

•

Exchange rate regime must be consistent with the overall macroeconomic policy framework

•

The present macroeconomic conditions in China require tighter monetary policy—that is, slower pace of reserve accumulation and RMB appreciation

•

Over time, China needs to allow greater flexibility and more rapid appreciation of RMB

V. Way Forward

• Capital account liberalization needs to be wellsequenced and well-spaced as part of an integrated, comprehensive reform package, including reforms to strengthen the macroeconomic management framework and the financial system

• It is critical to quickly but prudently establish the preconditions for a successful reform package and lay out the blueprint for reforms including capital account liberalization

•

Most important is the establishment of core institutional infrastructure—well-defined property and creditor rights; better accounting standards; strong corporate governance; clear minority shareholder rights; stringent prudential & regulatory regimes

Thank you

Dr. Masahiro Kawai

Dean

Asian Development Bank Institute

mkawai@adbi.org

+81 3 3593 5527 www.adbi.org