CH18 INTRODUCTION 2 COST

advertisement

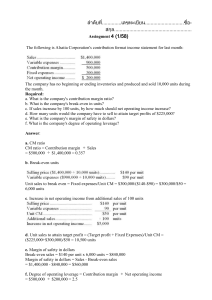

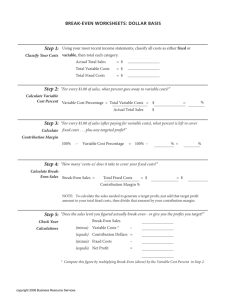

Chapter 18 Cost volume profit analysis Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-1 Cost volume profit (CVP) analysis • • • • A technique used to determine the effects of changes in an organisation’s sales volume on its costs, revenue and profit Can be used in profit-seeking organisations and not-for-profit organisations Not confined to profit-seeking enterprises Commonly used in many not-for-profit situations Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-2 The break-even point • • • The volume of sales where the total revenues and expenses are equal, and the operation breaks even At this level of sales, there is no profit or loss Can be calculated for an entire organisation or individual projects Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-3 Formulas Fixed costs Break - even point (in units) = Unit contributi on margin Break - even point (in sales Rands) = Fixed costs Unit contributi on margin ratio Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-4 Terminology • Contribution margin (or variable costing) statement – A profit report where costs are reported by cost behaviour and a contribution margin is calculated – Fixed and variable costs are separated • Total contribution margin – The difference between the total sales revenue and the total variable costs – The amount available to cover fixed costs and then contribute to profits continued Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-5 Terminology • Unit contribution margin – The difference between the sales price per unit and the variable cost per unit • Contribution margin ratio – The unit contribution margin divided by the unit sales price – The proportion of each sales Rand available to cover fixed costs and earn a profit • Contribution margin percentage – The contribution margin ratio multiplied by 100 – The percentage of each sales Rand available to cover fixed costs and earn a profit Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-6 Projected revenues & costs at a theatre company (CTC) Revenue Price per ticket Variable costs per ticket Royalties Theatre rental Fixed costs of the play Creative: Director Stage designer Lighting designer Extra artistic staff Actors Pre-production: Sets and props Wardrobe Freight Stage management Set up and demolish stage R 100.00 R 18.75 16.25 R 35.00 R 30,000 25,000 12,500 5,000 350,000 R 60,000 25,000 7,500 89,000 20,000 R 624,000 Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-7 Break-even number of tickets Break-even point (in units) = fixed costs unit contribution margin = R 624,000 R 65 = 9,600 Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-8 Break-even point (in Rands) • • Unit Contribution margin = R100 – R35 = R65 Unit contribution margin as % of selling price = R65/R100 = 0.65. Also called the unit contribution margin ratio. Break-even point (in Rands) Break-even point (in sales Rands) = fixed costs unit contribution margin/unit sales price = R 624,000 0.65 = R 960,000 = fixed costs unit contribution margin ratio Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-9 Cost-volume-profit graph for CTC Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-10 Profit volume (PV) graph • • • Shows the total amount of profit or loss at different sales volumes The graph intercepts the vertical axis at the amount equal to the fixed costs The break-even point is the point at which the line crosses the horizontal axis Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-11 Profit volume graph, CTC production of Calypso Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-12 Target net profit • • A desired profit level determined by management Can be used within the break-even formula Fixed expenses + target profit Target sales volume = Unit contribution margin Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-13 Target net profit • Assume that the target profit for the theatre company is R70 000 (we will use R70 005 to avoid rounding differences) Target sales volume (in units) = = = fixed costs + target profit unit contribution margin R 624,000 + R 65 R 70,005 10,677 units Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-14 Using CVP analysis for management decision making • Common applications include – – – – Safety margin Changes in fixed expenses Changes in the unit contribution margin Multiple changes in key variables Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-15 Safety margin • • Difference between the budgeted sales revenue and the break-even sales revenue Gives a feel for how close projected operations are to the break-even point Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-16 Changes in fixed costs • When estimates of fixed costs are revised, the break-even point will change – Percentage change in fixed expenses will lead to a similar increase in the break-even point (in units or Rands) • Different fixed costs may apply to different levels of sales/production volume – More than one break-even point Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-17 Changes in the unit contribution margin • Change in unit variable expenses – Changes the unit contribution margin – A new break-even point – An increase in unit variable expenses will increase the break-even point • Change in sales price – Changes the unit contribution margin – A new break-even point – An increase in unit price will lower the break-even point continued Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-18 Change in variable cost per ticket Variable costs per ticket Unit contribution margin per ticket Break-even calculation Break-even point (units ie. No. of tickets) Price Break-even point (Rands) = x Original estimate New estimate R 35.00 R 65.00 R 41.25 R 58.75 R 624,000 R 65.00 R 624,000 R 58.75 9,600 R 100.00 R 960,000 10,622 R 100.00 R 1,062,200 [rounded-up] * * If we use a contribution margin of 0.5875, then B/E (Rands) = R664000/0.5875 = R1062128 (slight difference due to rounding) Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-19 Change in selling price & fixed costs Ticket price R 100.00 R 90.00 Sales revenue: Currently New Less Variable costs: Currently New Total contribution margin Less Fixed costs of the play Profit 10,032 x R 100.00 12,500 x R 90.00 R 1,003,200 10,032 x R 35.00 12,500 x R 35.00 R 351,120 R 1,125,000 R 652,080 R 624,000 R 28,080 Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith R 437,500 R 687,500 R 650,000 R 37,500 18-20 Cost volume profit graph with step-fixed costs, CTC production of Calypso Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-21 Multiple changes in key variables • May involve – – – – • Increasing unit prices Increasing selling prices Undertaking a new advertising campaign Leasing a new office An incremental approach to analysis – Focuses on the differences in the total contribution margin, fixed expenses and profits under the two alternatives Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-22 CVP analysis with multiple products • Sales mix – The relative proportions of each type of product sold by the organisation • Weighted average unit contribution margin – The average of the products’ unit contribution margins, weighted by the sales mix Fixed expenses Break - even point = Weighted average unit contribution margin Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-23 CVP Analysis with multiple products • Seat type Unit ticket price Unit variable cost A B R 125 R 85 R 35 R 35 Number of seats in theatre 495 165 Weighted average unit contribution margin • Unit contribution margin R 90 R 50 = (R90 x 75%) + (R50 x 25%) = R80 Break-even Break-even point = fixed costs weighted average unit contribution margin = R 624,000 R 80.00 = 7,800 tickets Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-24 Profit volume graph with multiple products, CTC production of Calypso Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-25 Including income taxes in CVP analysis Sales volume required to earn target after - tax profit Fixed costs + = target net profit after tax (1 - t ) unit contribution margin Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-26 Assumptions underlying CVP analysis • • The behaviour of total revenue is linear The behaviour of total costs is linear over a relevant range – Costs can be categorised as fixed, variable or semivariable – Labour productivity, production technology and market conditions do not change – There are no capacity changes during the period under consideration continued Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-27 Assumptions underlying CVP analysis • • • For both variable and fixed costs, sales volume is the only cost driver The sales mix remains constant over the relevant range In manufacturing firms, the levels of inventory at the beginning and end of the period are the same – Thus, the number of units produced and sold during a period are equal Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-28 CVP analysis and long-term decisions • • • CVP analysis is usually regarded as a short-term or tactical decision tool Classification of costs as variable or fixed is usually based on cost behaviour over the short term The financial impact of long-term decisions is best analysed using capital budgeting techniques – Takes into account the time value of money Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-29 Treating CVP analysis with caution • • • CVP analysis is merely a simplified model The usefulness of CVP analysis may be greater in less complex smaller firms, or stand-alone projects For larger firms, CVP analysis can be valuable as a decision tool for the planning stages of new projects and ventures Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-30 An activity-based approach to CVP analysis • ABC categorises activities as facility, product, batch or unit costs – Facility, product and batch activities are non-volume activity costs Total batch, product and facility level costs Break - even point = Selling price per unit - costs per unit Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-31 Limiting assumptions of CVP analysis using activity-based costs • • • Total batch level costs are dependent on the batch size and the break-even/target production level Management may change the batch size at certain production volume levels and this will change the break-even volume More complex models are needed where there are multiple products Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-32 Including customer-related costs in CVP analysis • Some ABC systems include customer-related costs – – – – Order level Customer level Market level Facility level Profit sales revenue - (unit level costs batch level costs product level costs order level costs customer level costs market level costs facility level costs) Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-33 Sensitivity analysis and CVP analysis • Sensitivity analysis – An approach that examines how an outcome may change due to variations in the predicted data or underlying assumptions • • Can be run using spreadsheet software, such as Excel Goal seek approaches – The analyst specifies the outcome, and the software specifies the necessary inputs • What-if analysis – The analyst specifies changes in assumptions and data to examine the effect of these changes on the outputs continued Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-34 Simple sensitivity analysis at KubiliTime Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-35 Customer-related costs at KubiliTime Pty Ltd Activity level Order Customer Market Facility Cost per Volume of activity (cost) activity (cost) driver drivers R 7.50 R 30.00 R 47,500 Total cost Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 15,000 8,000 1 Estimated cost 112,500 240,000 47,500 744,000 1,144,000 18-36 Profit model for KubiliTime under activity-based costing Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-37 Real life • CVP analysis in the hotel sector – High occupancy rates – Lower fixed costs, IT & internet bookings has reduced the break-even occupancy rate • Reducing the break-even cost of mining gold at Gold Fields, was one of the reasons for the failed take-over attempt by Harmony of Gold Fields Mines Breakeven price per Breakeven price per Breakeven price in $ Breakeven price in $ kg under GF kg under HAR per oz. under GF per oz. under HAR management management management management Driefontein 9# 5# R 97,382 R 85,057 R 82,775 R 72,298 $432 $378 $368 $321 R 89,056 R 86,198 R 75,698 R 73,268 $395 $383 $336 $325 Kloof Kea EBA Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-38 Real life • Break-even at ATMS – – – – • Break-even of a major radiation medicine centre – – – • Advanced radiation and diagnostic equipment at cost of $96m Revenue mix and number of patients International and local patients Break-even in the airline industry – – – – • Decision to install an ATM driven by its break-even Revenue depends on fees from the different types of transactions. Estimate the mix of transactions to determine the revenue mix Fixed costs include installation, rent & depreciation and planned maintenance Variable costs include paper, replacing deposit envelopes, variable component of communications costs and costs of physical cash management Break-even of A380 increased from 270 to 420 planes for the Airbus Co. Boeing’s Dreamliner uses less fuel than comparable planes resulting in over 700 orders Both the A380 and the Dreamliner have been subject to delays which increases the break-even number of planes Break-even load factor is about 70% but SAA moved from the Boeing 747 to the A340 as SAA estimated that this would reduce the break-even load factor from 70% to 55% at the time. Break-even for wine producers in South Africa – – – – – Production cost (in 2001) amounted to R9933 per hectare. If a farm achieves a recovery of 773 litres of wine per ton of grapes and if the farm was producing 10 tons per hectare, then the cost of production was about R1.28 per litre Add cellar costs of R0.93 per litre Yet the average selling price for bulk wine was about R1.25 per litre at the time. Break-even depends on the yield of grapes per hectare For branded bottled wines, we need to take into account the bottling costs, the marketing costs, storage and financing costs Copyright 2008 McGraw-Hill PPTs t/a Management Accounting: Information for managing and creating value 1e Slides prepared by Kim Langfield-Smith, Carlos Correia & Colin Smith 18-39