CONSEIL SUPERIEUR DE L'AUDIOVISUEL CSA decisions The

advertisement

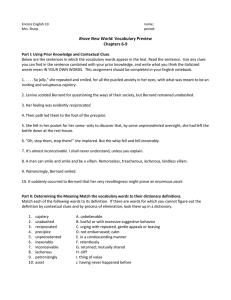

Conseil supérieur de l’audiovisuel CONSEIL SUPERIEUR DE L’AUDIOVISUEL 17-05-2007 MERGER CONTROL IN AUDIOVISUAL SECTOR IN FRANCE Prague Thursday, May 17, 2007 Bernard CELLI Deputy Head, Studies Department CSA Agenda Conseil supérieur de l’audiovisuel CONSEIL SUPERIEUR DE L’AUDIOVISUEL BERNARD DEP – Pierre PETILLAULT, Didier GUILLOUX, Bernard CELLI -–17-05-2007 20/10/2006 The current presentation intends to describe the French merger control process thanks to the description of two case studies: On the pay TV market The TPS-Canal+ Merger in 2006-2007 ; On the free to air TV market The acquisition by TF1 of a 33.5% stake in AB Group in 2007 -2- Agenda Conseil supérieur de l’audiovisuel CONSEIL SUPERIEUR DE L’AUDIOVISUEL BERNARD DEP – Pierre PETILLAULT, Didier GUILLOUX, Bernard CELLI -–17-05-2007 20/10/2006 The current presentation intends to describe the French merger control process thanks to the description of two case studies: On the Pay TV market The TPS-Canal+ Merger in 2006-2007 ; On the Free to air TV market The acquisition by TF1 of a 33.5% stake in AB Group in 2007 -3- The TPS-Canal+ Merger 1/2 Conseil supérieur de l’audiovisuel THE PLAYERS CONSEIL SUPERIEUR DE L’AUDIOVISUEL BERNARD DEP – Pierre PETILLAULT, Didier GUILLOUX, Bernard CELLI -–17-05-2007 20/10/2006 CANAL + Canal+ is the French pay TV leader. Mainly active in : Satellite pay TV distribution (CanalSat) ; French pay TV premium rights dealing (Cinema and Sports) ; Premium and thematic channels edition (Cinema and Sports). TPS TPS was created by TF1, M6 in 1996 to compete against CanalSat. Before the merger, TPS was mainly active in : Satellite pay TV distribution (second satellite distributor) ; French premium pay TV rights dealing (Cinema) ; Premium and thematic channels edition (Cinema). -4- The TPS-Canal+ Merger 2/2 Conseil supérieur de l’audiovisuel THE SCOPE OF THE MERGER CONSEIL SUPERIEUR DE L’AUDIOVISUEL BERNARD DEP – Pierre PETILLAULT, Didier GUILLOUX, Bernard CELLI -–17-05-2007 20/10/2006 The merger Canal+ France Shareholders Vivendi Universal • Announced End 05 • Effective as of Jan. 07 100% Groupe Canal + Lagardère 65% Canal+ Group 20% TPS TF1 9,9% M6 5,1% Canal + France (TF1, M6) Source : CSA (Vivendi) Canal+ France includes : TPS, CanalSat (=100% of French satellite pay TV) 48,48% share of Canal+ SA (premium channel) Thematic channels edition Canal+ France Pay per view activity 7 M pay TV subscribers Canal+ Distribution Source : CSA Media Overseas -5- Authorities involved in the merger process DGCCRF (Ministry), Competition council, CSA Conseil supérieur de l’audiovisuel Independannt administrative authorities Conseil Supérieur de l’Audiovisuel (CSA) French Electronic Communications regulator (ARCEP) RECOMMENDATION RECOMMENDATION Competition Authorities (Conseil de la concurrence) RECOMMENDATION Economy, Finance and Industry Minister (DGCCRF) Government CONSEIL SUPERIEUR DE L’AUDIOVISUEL BERNARD DEP – Pierre PETILLAULT, Didier GUILLOUX, Bernard CELLI -–17-05-2007 20/10/2006 DECISION Appeal before the French Highest administrative Court (Conseil d’État) -6- Impact of the merger on the value chain Conseil supérieur de l’audiovisuel CONSEIL SUPERIEUR DE L’AUDIOVISUEL BERNARD DEP – Pierre PETILLAULT, Didier GUILLOUX, Bernard CELLI -–17-05-2007 20/10/2006 Upstream market Content production and dealing Intermediate market Programming Downstream market Pay TV services distribution Transmission Broadcasting Viewers Rights Holders TV channels Pay TV services providers Transmission services providers Main issues from a competition point of view Upstream market: Intermediate market: Canal+ France holds major Cinema and Sports rights (French Premier League, Studio Canal…) Canal+ France controls the 2 French premium channels Canal+ and TPS Star and most of the most attractive thematic channels (Planète…) Downstream market: a unique satellite pay TV distributor left in France -7- The Ministry Decision Conseil supérieur de l’audiovisuel CONSEIL SUPERIEUR DE L’AUDIOVISUEL BERNARD DEP – Pierre PETILLAULT, Didier GUILLOUX, Bernard CELLI -–17-05-2007 20/10/2006 The Aug. 06 Ministry Decision: a clearance under conditions Based on the CSA and the competitions authorities recommendations. Canal+ France agreed to comply with 59 obligations to protect competition. Fostering competition on the innovative downstream market (ADSL, VoD…) was seen as key by the competition authorities who therefore imposed some structural obligations (unbundling) on the intermediate market. Some key obligations: Unbundling of TPS Star premium channel and 3 former TPS thematic channels in order to allow competitive distributors (especially ISPs) to create their own pay TV offer No exclusive rigths on VoD All obligations may last up to 5 years Independent channels protection -8- CSA decisions Conseil supérieur de l’audiovisuel FROM A PLURALISM PERSPECTIVE CONSEIL SUPERIEUR DE L’AUDIOVISUEL BERNARD DEP – Pierre PETILLAULT, Didier GUILLOUX, Bernard CELLI -–17-05-2007 20/10/2006 The CSA reviewed the operation from a pluralism perspective in March 2007. CSA merger control mechanism (article 39 of the French Broadcasting Law) Licences transfer of control (article 42-3 of the French Broadcasting Law) OK OK Canal+ France is below the Some of the obligations maximum number of imposed by the Minister authorisations that a player (regarding the content of the can hold channel) are attached to the new TPS Star authorisation in order to protect the content quality level. -9- Agenda Conseil supérieur de l’audiovisuel CONSEIL SUPERIEUR DE L’AUDIOVISUEL BERNARD DEP – Pierre PETILLAULT, Didier GUILLOUX, Bernard CELLI -–17-05-2007 20/10/2006 The current presentation intends to describe the French merger control process thanks to the description of two case studies: On the Pay TV market The TPS-Canal+ Merger in 2006-2007 ; On the Free to air TV market The acquisition by TF1 of a 33.5% stake in AB Group in 2007 - 10 - TF1 Acquisition of a 33.5% stake in AB Group Conseil supérieur THE PLAYERS de l’audiovisuel CONSEIL SUPERIEUR DE L’AUDIOVISUEL BERNARD DEP – Pierre PETILLAULT, Didier GUILLOUX, Bernard CELLI -–17-05-2007 20/10/2006 TF1 The French free to air TV leader AB Group The biggest independent* French Broadcasting group. AB Group: Owns a library of more than 1,300 French speaking programmes representing 37,000 hours of programmes (Friends, Navarro…). Edits free to air channels: TMC (40% stake) et NT1 (100% stake) in France and AB 3 and AB 4 in Belgium. Edits pay TV channels distributed on satellite, cable, DTT and ADSL, with among others RTL 9 (65% stake) and AB1. Generated revenue of € 202 M and a net profit of € 46 M in 2005. *Independent: which is not controlled by another broadcasting group - 11 - TF1 Acquisition of a 33.5% stake in AB Group Conseil supérieur MARKET CONDITIONS de l’audiovisuel CONSEIL SUPERIEUR DE L’AUDIOVISUEL BERNARD DEP – Pierre PETILLAULT, Didier GUILLOUX, Bernard CELLI -–17-05-2007 20/10/2006 Viewers share Parts d'audience novembre-décembre 2006 (Nov-Dec 06) (4 ans et + vivant dans un foyer équipé d'un adaptateur TNT) Autres Lagardère 6,6% 5% M6 13,5% Groupe TF1 29,9% Advertising market shares January 2007 gratuit, janvier 2007) Parts du marché publicitaire (hertzien Autres 4% Canal+ 3,7% M6 23% Groupe AB 4,7% France Télévisions 36,6% Source : Mediamétrie Groupe TF1 53% France Télévisions 19% Groupe AB 1% Source : TNS MediaIntelligence, traitement CSA - 12 - The public authorities decisions Conseil supérieur de l’audiovisuel CONSEIL SUPERIEUR DE L’AUDIOVISUEL BERNARD DEP – Pierre PETILLAULT, Didier GUILLOUX, Bernard CELLI -–17-05-2007 20/10/2006 Economy, Finance and Industry Ministry (DGCCRF) viewpoint This is not a merger therefore the competition authorities do not have to be involved CSA Decision: no need to apply article 42-3 on the transfer of control of terrestrial licenses The operation does not place AB Group under the economic dependence of TF1 Group The CSA took under consideration that: There is no change in the format of TMC, NT1 (DTT free to air channel) and AB1 (DTT pay channel) The common advertising saleshouse between TMC and NT1 will not be extended to other AB Group channels. The CSA will be very vigilant on the evolution of financial relations between TF1 and AB Group. - 13 - CONCLUSION Conseil supérieur de l’audiovisuel CONSEIL SUPERIEUR DE L’AUDIOVISUEL BERNARD DEP – Pierre PETILLAULT, Didier GUILLOUX, Bernard CELLI -–17-05-2007 20/10/2006 Two structuring operations affecting the French audiovisual market. The market impact is likely to be significant on the long run. A way for the CSA to intervene in the future: the dispute resolution process : Any TV channel or a distributor can go before the CSA to solve a dispute regarding TV distribution ; It is the only way for the CSA to have an influence on the financial conditions of the contracts between TV channels and distributors. - 14 -