Research Components - Electricity Human Resources Canada

advertisement

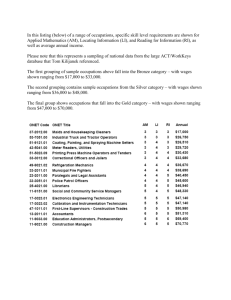

2013 National Conference Building Powerful HR Strategies for Canada’s Renewable Energy Workforce Bill Empey, Managing Director, Prism Economics and Analysis 1 Research Components 1. 2. 3. 4. 5. 6. Technology Review Employer Survey Labour Market Model Province Specific Summaries Sector Summaries The National Human Resources Strategy 2 HR Planning for the Deployment of Renewable Electricity Canadian renewable electricity suppliers are expected to add between 20,000 and 52,000 MWs of capacity by 2022. This will raise labour requirements by 2 to 3 times the current levels. Renewing Futures research describes the labour market conditions and HR practices that are the basis for a National HR Strategy. You are invited to consider proposed actions that will build the needed, skilled workforce. 3 Outline A. Background and Research Findings 1. Growth 2. Technology 3. Stakeholders 4. Labour markets B. Proposed Strategic Actions 1. Goals 2. 12 Actions 3. Implementation 4 Research Findings 1. Growth • Growth as a strong, positive, global theme for RE Deployment, and • Growth is associated with risk and uncertainty • Pace of growth and disruptive change • RE capacity replaces legacy systems (coal) • Accelerated expansion adds risks to: • Safety • Work and system quality • Productivity 5 Research Findings 1. Growth • First order growth is expanding capacity and operations • Second order growth is new investment, design and construction: • Employment gains are in engineering, manufacturing and construction: • Changing investments add temporary employment all along the supply chain for design, construction and supply 6 Research Findings Renewable Electricity in Canada, Total Installed Capacity, 2012 to 2022, All Scenarios 7 Research Findings Renewable Electricity in Canada, Total Installed Capacity, 2012 to 2022, All Scenarios, Excluding Large Hydro 8 Research Findings Change in RE Installed Capacity, Canada, Three Scenarios, Excluding Large Hydro 6,000 Scenario C (Vision) 5,000 MW 4,000 Employment in Construction Falls 3,000 2,000 Scenario B (NEB) 1,000 Scenario A (Utility) 0 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 9 Research Findings Sectors 1. 2. 3. 4. 5. 6. 7. Wind Solar Geothermal Bioenergy Large and Small Hydro Marine…..and Interconnection and storage systems 10 Addition to Capacity by Sector – Scenario C 11 Research Findings 12 Research Findings 2. Technology Technology to be deployed will be similar to current technology except for interconnection technologies: • Variable wind and solar supply alter system needs • Changing distribution technology for RE and traditional generation include Smart Grid modernization • Emphasis on IT technicians and IT skills for • Power electricians • Power station and system operators 13 The Supply Chain Research and Development • Governmental and R&D funding Manufacturing and Distribution • Generating systems • Cells • Turbines • Balance of system • Towers, racks • Structures • Electrical components Construction and Installation Project Planning • Design • Permitting • Finance • Purchase agreements • Procurement Engineering management • Civil • Structural • Site preparation • Installation • Utility upgrades Operation and Maintenance (on-site/offsite) • Monitor • Maintenance • Security • Reporting • Storage Grid Operation, Maintenance and Distribution • System maintenance • Upgrades/ Smart Grid • Storage • Substation • Grid modernization Employers Manufacturing equipment, ICT, Software Manufacturing equipment, ICT, Software Consulting, finance, legal, business management Engineering consultants, contractors (general / electrical), developers, operators Utilities 14 Research Findings 3. Stakeholders / Employers Employers are often small, dispersed and diversified and: • Business is diversified across many sectors and outside RE • HR risks are avoided with short term contact jobs • Shared focus on growing hiring requirements • Need for employee skills to be portable across sectors 15 Research Findings 3. Stakeholders / Employers Employers are often small, dispersed and diversified and: • Report economic and market issues take higher priority than HR, • Fewer than half of the sample report recent hiring difficulties, • Have confidence in existing HR capabilities, • Often plan to hire from other industry employers, • More than two thirds plan to increase staff significantly in the next two to three years 16 Research Findings 3. Stakeholders / Workforce • Growth in labour requirements by sector and occupations is: • Very strong in scenario C • Limited in operations and construction, employment falls in scenario B • Limited in both operations and construction in scenario A 17 Key Occupations in the RE workforce Occupational Categories Leaders and Mangers Renewable Energy Core Occupations 1 Engineering managers 2 Utilities managers 3 Information systems analysts and consultants 4 Financial auditors and accountants 5 Sales, marketing and advertising managers 6 Other Leaders and Managers 7 Electrical and electronics engineers 8 Mechanical engineers Electrical and electronics engineering technologists and technicians Mechanical engineering technologists and 10 technicians 9 Engineers and Technologists 11 Power systems and power station operators 12 Other Engineers and Technologists 13 Electricians (except industrial and power system) 14 Power system electricians Trades and Related 15 Electrical power line and cable workers 16 Mechanical trades 17 Construction trades helpers and labourers* 18 Other Trades and Related Source: EHRC, Prism Economics and Analysis 18 Employment in Key RE Occupations – Distribution across markets 1. Employment across all industries in the Province 2. Employment in Electricity Generation and Distribution Industry (NAICS 2211) 3. ERE Employment in Electricity Industry ERE Related Employment in industries outside NAICS 2211 19 Research Findings Employment Growth, Key Occupation Groups, National totals – Electricity Utilities and RE jobs 20 Research Findings 21 Research Findings 22 Renewable Energy (Excluding Large Hydro) Employment 2011 – 2022, Scenario C 2011 54,302 Quebec British Columbia 14,215 Alberta 9,230 Manitoba 10,255 5,284 Atlantic Canada 8,202 4,063 21,026 Saskatchewan 3,172 6,718 2022 650 977 2,032 378 Ontario Canada 99,214 41,291 23 Research Findings 3. Stakeholders / Training Training is concentrated in colleges: • In short programs or courses added programs • College programs can be linked to other postsecondary programs • Programs mention RE training for design, sales, public relations, sustainable development as well as technology 24 Research Findings 3. Stakeholders / Training • Limited references to RE in apprenticeship programs • Limited opportunities for university training in RE • Certification systems are available: • • • • • NABCEP BZEE Red Seal ECO Canada Canadian GeoExchange Commission • Limited interest in certification for RE work Canada 25 Research Findings Post-Secondary Programs Offering RE related Specializations Occupations Leaders & Managers Technical Sales Specialists Natural and applied science policy researchers, consultants and program officers Engineering and Technology Engineers Engineering Technicians & Technologists Trades & Related Trade Apprenticeship Programs Other Trades Solar PV Installers Wind Turbine Technicians Geothermal/GeoExchange Installers Programs -ERE Specific 11 4 13 39 n/a 1 14 11 2 26 Research Findings 3. Stakeholders / Provincial Governments • Scenarios track both energy and labour policy • Provincial legacy drives different energy policy and priorities • Governments share some common policies to encourage RE but approaches differ • Provinces manage / regulate most RE occupations in a similar manner 27 Research Findings 4. Labour Markets Labour market conditions are tight in competing industries: • Market conditions are related to expansion and replacement demand: • Tightest markets in the west, • In construction, oil and gas, mining, • Major engineering projects – infrastructure including: • Transit, water systems, pipelines and • Electrical generation – hydro and nuclear (refurbishment) • Transmission and distribution systems 28 Research Findings 4. Labour Markets Labour market conditions are tight in competing industries impacting: • Scientists, engineers, managers and estimators • Related technicians and technologists • Skilled construction trades including electricians • Specialized trades and occupations • Solar installers • Wind technicians • Power Line Technicians, etc. 29 Research Findings Labour market dynamics, RE key occupations 16% Unemployment rate (%) 14% 12% 10% 8% 6% 4% 2% 0% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Leadership and Management Engineering and Technical Trades and Related LM Normal UE Rate ET Normal UE Rate TR Normal UE Rate 30 Research Findings 4. Labour Markets Labour market conditions are tight in competing industries where tight markets: • are related to retirement: • these demands exceed new jobs for economic growth • depend on age profiles and retirement patterns • create different market conditions for entrants and experienced or specialized workers, and • impact recruiting choices from post secondary programs and immigration 31 Research Findings 4. Labour Markets Tight markets related to retirement demand impact: • scientists and engineers • managers • supervisors • key trades • A key factor for large hydro employers 32 Research Findings 33 Research Findings Conclusions • Rapid growth in RE capacity will drive rising labour requirements • Employers may not recognize the industry scope of the HR problem • Power generation technologies will change little but distributions systems will incorporate new technologies • Eighteen key technical occupations require specialized training and certification • RE related training is limited to college programs 34 Research Findings Conclusions • RE jobs are created across a long supply chain and with diverse employers • Labour markets for the key RE occupations in other industries are tight – often driven by retirement demands • RE employers rarely share HR practices and perspectives, but • RE employers all share the same small group of priority occupations 35 National Human Resources Strategy Background RF findings support the need for a strategy: • Strong labour requirements in the Vision Scenario • Competition for skilled labour from other industries in all scenarios • Collective action to: • • • consolidate industry strength and overcome narrow interests bridge distinctive Provincial resource legacies, energy policies and labour conditions and policy Common focus on occupations provides a natural starting point 36 National Human Resources Strategy Goals The strategy must: • Build a consensus for collective action • Encourage youth and job seekers • Provide more graduates from post secondary training programs that meet employer needs • Provide more bridges that connect programs and certifications and promote mobility • Protect RE employers from shortages and the RE workforce from unemployment 37 National Human Resources Strategy Common Elements • • • A unified vision of the RE Sector and a public relations campaign to promote careers Background documents supporting the strategy with material from the research New training and certification material that meets employer needs And Measures of Success • More participation • More enrolments and graduates from RE programs • Guidelines – 50% increase by 2015, 2x increase by 2022 38 Findings – The National Strategy Leadership and Management Solar Specialization Five Platforms Wind Specialization Engineering and Technology Trades and Related 39 National HR Strategy Leadership and Management Strategic Action #1 Building Critical Leadership Skills • The “leadership imperative” • Broad skills, experience and talent • A National Leadership Forum • RE specific programs for promising young leaders and experienced managers from related employers 40 National HR Strategy Science and Technology Strategic Action #2 Enhance Professional Engineering and Science Post-Secondary Programs • • Focus on both employers and faculty Prepare more grads for work in RE with specialized courses • Brief faculty on job opportunities 41 National HR Strategy Science and Technology Strategic Action #3 Focus Professional Science and Engineering Human Resources Management • • • Offering practical experience to grads through coop, internships Focus on internationally trained scientists and engineers in RE work overseas Leverages government programs like TFW and support programs at OSPE and Engineers Canada 42 National HR Strategy Science and Technology Strategic Action #4 Expand College Technician and Technologists Programs • the core of the strategy • Review and assess current college RE training programs • Assist and establish employer / faculty advisory programs • Suggest targets for registrations / graduations • Prepare plans for the next generation of college programs for RE 43 National HR Strategy Trades and Related Occupations Strategic Action #5 Boost the Role of Red Seal Trades with Renewable Electricity Skills • Add RE material to apprenticeship curriculum • • Add RE related specializations or sub trades Create bridges for: • Journeypersons to advanced certified skills • Apprentices to college programs • New installers / techs to apprenticeship 44 National HR Strategy Trades and Related Occupations Strategic Action #6 Build Interconnection Skills – a Joint RE / Utility Venture Focus on college and apprenticeship programs for: • Electrical engineering technicians and technologists • Power station and system operators • Power electricians • Power line technicians Assess the potential for shared / common programs across provinces and utilities 45 National HR Strategy Sector Specialties Strategic Action #7 Address Priorities for Large Hydro Employers Retirement as an issue for employers focusing on: • Retention, recruiting experienced engineers and managers • • Succession planning for middle management Opportunities for retired managers to mentor young RE managers 46 National HR Strategy Sector Specialties Strategic Action #8 Build the Solar PV Installer Workforce • Assess existing college and private programs and certifications • Propose needed additions to skills • Assess links to apprenticeship programs and college courses • Set targets for increasing registrations and graduations -- +50% by 2015 and 2x by 2020 47 National HR Strategy Sector Specialties Strategic Action #9 Build the Wind Technician Workforce • Assess existing college and private programs and certifications • BZEE certification in Canada • Propose needed additions to skills • Assess links to apprenticeship programs and college courses • Assess needed IT skills related to interconnection • Set targets for increasing registrations and graduations -- +50% by 2015 and 2x by 2022 48 National Human Resources Strategy for RE Strategic Action #10 Increase Industry Awareness; What is in it for ME? • Public Relations to build participation • Research drives background material for targeted audiences • Target industry leaders first, • Adopt provincial and sector specific approaches • Coordinate with industry associations to avoid duplication or competition • Adopt multi year and multi media approach 49 National HR Strategy Careers, Bridges and Certification Strategic Action #11 Create Career Paths for Renewable Electricity • Research findings map potential career paths from new entrants to CEOs • Promote future RE jobs linked to growth • Using college programs as the core – describe training and certification programs that facilitate advancement and mobility across provinces and sectors • Build features that encourage under-represented groups 50 Findings – The National Strategy Leadership and Management Solar Specialization Five Platforms Wind Specialization Engineering and Technology Trades and Related 51 National HR Strategy Careers, Bridges and Certification Strategic Action #12 Aim for National Certification – A Long Term Goal • Mobility across provinces and sectors assisted by national standards for training • Attitudes and institutions inhibit short term plans for national standards but, • Current national (ECO Canada) and int’l systems (BZEE) provide leadership • Council of the Federation Energy Strategy provides encouragement 52 National Human Resources Strategy Implementation • • • • • Twelve actions are linked to draw together a critical mass of stakeholders 400+ participants form a foundation Implementation structured around platforms and provinces Potential for major role for RE and 100,000 jobs in 2022 create momentum A nationwide investment in HR that parallels expanded capacity 53 National Human Resources Strategy Conclusion Canada needs a national human resources strategy to prepare for a dramatic increase in labour requirements for RE deployment. Stakeholders have a shared interest and focus on a short list of trades and occupations. Success brings together a skilled workforce, a carbon free energy system and global business advantages. 54