Both bounded and axiological models of rationality will create

advertisement

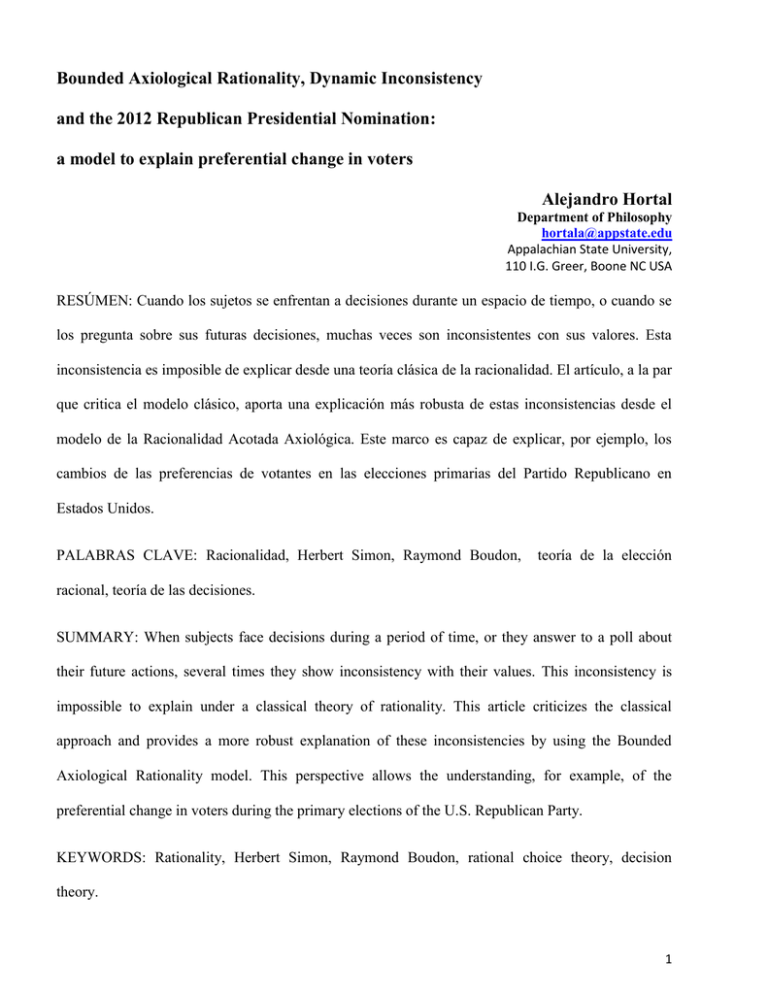

Bounded Axiological Rationality, Dynamic Inconsistency and the 2012 Republican Presidential Nomination: a model to explain preferential change in voters Alejandro Hortal Department of Philosophy hortala@appstate.edu Appalachian State University, 110 I.G. Greer, Boone NC USA RESÚMEN: Cuando los sujetos se enfrentan a decisiones durante un espacio de tiempo, o cuando se los pregunta sobre sus futuras decisiones, muchas veces son inconsistentes con sus valores. Esta inconsistencia es imposible de explicar desde una teoría clásica de la racionalidad. El artículo, a la par que critica el modelo clásico, aporta una explicación más robusta de estas inconsistencias desde el modelo de la Racionalidad Acotada Axiológica. Este marco es capaz de explicar, por ejemplo, los cambios de las preferencias de votantes en las elecciones primarias del Partido Republicano en Estados Unidos. PALABRAS CLAVE: Racionalidad, Herbert Simon, Raymond Boudon, teoría de la elección racional, teoría de las decisiones. SUMMARY: When subjects face decisions during a period of time, or they answer to a poll about their future actions, several times they show inconsistency with their values. This inconsistency is impossible to explain under a classical theory of rationality. This article criticizes the classical approach and provides a more robust explanation of these inconsistencies by using the Bounded Axiological Rationality model. This perspective allows the understanding, for example, of the preferential change in voters during the primary elections of the U.S. Republican Party. KEYWORDS: Rationality, Herbert Simon, Raymond Boudon, rational choice theory, decision theory. 1 1. Introduction From the fields of economics, political science and psychology, many authors (Caplan 2008; Bendor 2010; 2011) have argued that voters don’t follow the behavioral prescriptions of classical economics as expressed by rational choice theory. Following this idea, the model of bounded rationality of Herbert Simon (1957) will be used, together with the axiological rationality model from Raymond Boudon (1998; 2001; 2003), to create a complementary approach denominated Bounded Axiological Rationality (Echeverría & Álvarez 2008). The goal is to apply the different swings in voters’ preferences that are shown in polls during the primary elections of the conservative party in the U.S. from August to December of 2011 to understand the shift in choices among subjects. I will prove that some of the reasons for such change can be found in how information is processed from the way it is presented within a frame (A. Tversky & Kahneman 1981) and how the choices of voters, at a given moment, are affected by the difficulty to consider all alternatives of a decision at the same time. Voters, therefore, fall short from the ideal rationality postulated by classical economists, challenging that homo economicus vision prescribed by some authors (L. Lee et al. 2009; Rankin 2011; Cramer 2002). The idea that voters don’t act rationally can be approached from different perspectives: one that argues about the irrationality of voting per se1, other that refers to the different paradoxes, like Condorcet (Binmore 2008, p.154) which shows “situations where transitive preferences of individuals combine to make an intransitive collective preference” (Kurrild-Klitgaard 2001, p.135), and another which tries to understand the rational status of the actual choice of such voters. This article will be devoted to explain the reasons why voters may change their preferences (in some examples, more than once) before deciding. The preferences during the months prior to a specific election will be used as an example. The data will be taken from 1 Based on the idea that the act of individual voting is not likely to change the outcome of an election (Boudon 2003). 2 opinion polls done during the months of August to December of 2011 for the primary elections of the Republican Party in the USA. The information will show the changes of preferences to determine the front runner at a given moment and the position of the other candidates according to percentage points. During that interval, several candidates had changed their relative positions as desired front runners for the Republican Party nomination. The following thesis will be defended in this article: the best model of rationality to explain these changes in preferences is found in a complementary approach in which bounded2 and axiological (expressive) rationality theories are combined. These restrictions or boundaries (time inconsistency is one of the consequences of them) within an already complex task environment, make these subjects consider not all information relevant in a given moment to arrive at the best decision (that one which would satisfy their utility function), but only a few of the possibilities and always in a sequential manner. It will be posited that the specific moment when the information is received affects our preferences. It is as if voters tend to forget the information about the negative actions of candidates in favor of new information. If I know that a candidate was accused of sexual misconduct in a specific moment, I would not consider voting for him/her. If in a few weeks later, I was informed that another candidate had accepted money from a lobby whose values I disagreed with, although I may consider the sexual misconduct a worse act than the second one, I may shift my preference to vote for the first candidate. The reason may be found, as Bryan Jones argued (2001, p.25), in our normally considering new information more relevant than the old information. This produces inconsistency in our preferences, choices, and their relationship with each other, and makes the optimization postulated by classical economists impossible due to 2 The boundaries I will be referring to in this article are only such, if they are considered under a classical frame. If we abandon it, as I will do, those boundaries are just a realistic description of decision processes 3 dynamic or time inconsistency. As expressed by Rosanas (2004, p.13), individuals may not be able, or be willing, to make decisions in accordance with their values (contradiction). Our bounded rationality makes the time of arrival of new information, and not the importance of such, be one of the factors that produce these inconsistencies. Time inconsistency will be considered in its general approach (how time or the order of information interferes with a decision) as a case of prospect theory (Kahneman & Amos Tversky 1979) following the approach of Loewenstein (1988) who linked it to intertemporal choices. 1. Classical and bounded rationality 1.1. Classical model of rationality From a classical economical frame, the concept of rationality is linked to the maximization of a determined objective (Dahl & Lindblom 1953, p.38). According to this, the instrumental interpretation of rationality denotes a specific understanding of human nature based on the assumption that subjects, from the moment they are rational, behave in order to maximize their utility function: they are homo economicus. Herbert Simon, economist and Nobel laureate, stated that traditional economical theory postulates an economical man that in his path to be economical, it happens to be rational (H. A. Simon 1987, p.241). Simon will use different adjectives to describe this classical concept of rationality: “Substantive Rationality” (H. A. Simon 1976b), “Global rationality” (H. A. Simon 1955; H. A. Simon 1972; H. A. Simon 1983; H. A. Simon 1987; H. A. Simon 1991), “Olympic Rationality” (H. A. Simon 1997b, p.357; H. A. Simon 1983, p.chapter 1; H. A. Simon et al. 2008) or “Perfect Rationality” (H. A. Simon 1997a). Others (Dosi 2004) also called it Hyper-rationality, or Complete Rationality (Selten 2001; Gigerenzer 2008) or even Comprehensive rationality (Jones 1999). 4 The rationality of the homo economicus requires a deep knowledge of the environment, an organized system of preferences and a superior calculative cognition in order to choose the best decision to achieve a goal: the one that will maximize that utility function by postulating also a complete scale of pay-offs. Besides such cognitive capabilities, according to the classical model, our homo economicus enjoys an omniscient knowledge of the environment and her preferences. These preferences are always consistent, allowing the decision among all the available alternatives possible to maximize. “There are no limits on the complexity of the computations he can perform in order to determine which alternatives are best” (H. A. Simon 1997a, p.87). The environment of decision is presented to the subject in a complete manner. Such complete knowledge would let him apply his cognitive calculative capabilities to arrive at a decision capable of maximizing his interests and always in a consistent manner. The complete account of the environment is essential to understand the issue of voting. Once we have a complete description of the alternatives, we are able to choose the one that, according to our determined values, optimizes our desires. “Neoclassical economic theory assumes that the problem agenda, the way in which problems are represented, the values to be achieved (utility function), and the alternatives available for choice have all been given in advance” (H. A. Simon et al. 2008, p.5) Ariel Rubinstein (1998, p.7) explained that a decision is rational in the classical way if it is the outcome of a process of deliberation in which takes into consideration what is feasible, desirable and what is the best alternative according to the notion of desirability, given the feasibility constraints. This model is well described by Vernon Smith under the concept of Constructivist Rationality: “[It] involves the deliberate use of reason to analyze and prescribe actions judged to be better than alternative feasible actions that might be chosen” (2008, p.2). The rational man from this model should have a “clear picture of the choice problem he faces”, clear preferences, 5 the ability to optimize and must show indifference to logically equivalent descriptions of alternatives and choice sets (Rubinstein 1998, p.8). Summarizing, the homo economicus, in decisions, should have the following characteristics (Hargreaves Heap & Varoufakis 1995, p.8): reflexivity, completeness, transitivity, and continuity. The question here is not if rationality is instrumental, but rather if all rationality is. Postulating an instrumental model of rationality, as classical economics does, imposes preferences on the individual, without having to explain them. From this perspective, agents must be able to distinguish costs and benefits of each of the alternatives in order to choose the one that will maximize the utility function, optimizing, therefore, the decision (Boudon 2003, pp.3–4). This maximization, as Keita (1992, p.44) affirms, must be interpreted from an individualistic point of view. We may declare, agreeing with Simon, that the rationality of the classical maximizing procedures is essentially the rationality of Robinson Crusoe (H. A. Simon 1982, p.215) in the sense that we have to neglect everything, but the individual himself, in order to explain his rationality under that economical model. The idea that economics could focus in a model centered in a rational actor that conducts himself as if he maximizes was introduced by Alchian (1950) and developed by Friedman (1953). It was intended to face the criticism against the classical model, but also trying to solve the epistemological dispute between a normative and a descriptive view of economics as a science. When empirical data started to contradict that model of perfect rationality, instead of eliminating it, they argued that economics must only interpret that agents behave as if they had complete rationality (Crowther-Heyck 2005, p.6). Under this model, agents act as if they could perform exhaustive searches for all possible decisions in order to find the best one (Conlisk 1996, p.675), eliminating the need to demonstrate 6 the realism of the model defended. According to Alchian, economics had to assume that actors behave as if they optimize (Alchian 1950, notes.12, p. 216), behaving selfishly and able to calculate pleasures and pains (Friedman 1953, pp.30–31). The only way to achieve the optimal decision is by giving agents the possibility to have complete global rationality, achieved when all relevant information about a specific decision is obtained, retained, and processed in order to extract all possible logical outcomes (Etzioni et al. 2010). 1.2. Bounded Rationality, Democracy and choice: The 2012 Republican Presidential Nomination (RPN)3 The model of rationality of classical economics segregated the behavioral factors from its explanations in decision theory, falling short of the empirical realism desired by scientific theories. By the mid 1950’s empirical studies proposed the idea that the omniscient rationality defended by standard classical economics had to be replaced by one able to incorporate our bounded rational capabilities without the assumption of perfect rationality, like the bounded rationality model of Herbert Simon (1979, p.503). The homo economicus represented a perfect methodological figure to epistemologically close economics as an exact science. From the moment that all psychological factors that bound the rationality of individuals were eliminated from the picture and we only attended to the outcome of the decision itself, economics appeared to be that precise science classical economists were hoping for. 3 The data here used comes from a webpage that collects survey polls from different sources (tv stations, newspapers, etc) about the primary elections of the Republican party from the presidential nomination http://www.realclearpolitics.com/epolls/2012/president/us/republican_presidential_nomination-1452.html 7 The optimism of assuming that if we have all the information, and we think hard enough, we can arrive at the best decision possible, as expressed by Simon at the beginning of his work Reason in Human Affairs (1983), had to eventually be criticized due to its lack of empirical realism. The idea of a subject whose only goal is to maximize benefits and cut costs was only good for a branch of economics that was able to segregate all other factors (non instrumental) that may also intervene in our decisions, ignoring our bounded cognitive capabilities, the complexity of the task environment and the role of our values. In their attempt to achieve the epistemological status of other sciences like Physics, classical economists postulated an (egotistical) individual in the center of economical decisions (Boudon 2003, p.2). This selfish maximizer would only act by optimizing his or her own behavior in an instrumental mode. At this level, economics had only to concentrate its efforts to understand the results of decisions. But if we turn the focus instead to the outcome of a decision, to the procedure used to arrive at that specific choice, what we find is that the homo economicus postulated does not really exist, nor do the Olympian rational capabilities attributed to him/her. As Keita explains: “the problem with neoclassical economics is that its founding theorists adapted from mechanics a methodology of research that was wholly inappropriate” (1992, p.82). Although used for the first time by Herbert Simon in his work titled “Models of Man” (H. A. Simon 1957), we can trace the origins of the idea of bounded rationality to Simon’s previous writings, including his doctoral dissertation, published as a book titled “Administrative Behavior” (H. A. Simon 1947). The specific moment when Simon started to criticize the classical model is a matter of controversy. According to Barros (2010), Simon’s first writings, including “Administrative Behavior,” defend a classical model of rationality. I argue against Barros that Simon separated himself from this model already in his first book. Bryan Jones also accepts the development of the idea of bounded rationality during Simon’s earliest academic years (Jones 8 1999, pp.299–300). Even Simon himself would recognize that the idea of subjects behaving with bounded rationality started to appear then (H. A. Simon 1991, p.88). According to Simon (1983, p.30), when we decide, we don’t consider the whole group of available possibilities trying to determine which one would give the greatest benefit. Our attention focuses on information as it’s presented to us, having to accommodate our bounded rationality to the complexities of different decisions within a specific environment by simplifying it (subjectively) so it can be manipulated in our cognitive scale: “As a result the human actor must ‘construct a simplified model of the real situation in order to deal with it” (Crowther-Heyck 2005, p.9). Simon called this model of rationality, understood from the way it works instead of from the outcomes themselves, “procedural rationality” (H. A. Simon 1976b), as opposed to “substantive rationality.” This model opened the door to the criticism of the complete (ideal) rationality imposed by classical economists on the subjects they study, and the notion that its instrumental frame was the only one to consider. Due to the lack of realism of the classical model, Simon was epistemologically forced to include, within his rational model, a behavioral approach which took into account the psychological boundaries of our cognitive capabilities. From the moment that Simon turned his focus from the outcome of decisions (as classical economists were doing) to the process itself of arriving at a specific choice, he discovered that postulating a global rationality was just an idealization proper to Plato’s heaven of ideas (H. A. Simon 1983, p.13). Simon denominated this ideal type of rational model, substantive rationality, and the other one, procedural rationality. Only when we remove other factors that may contribute to our decisions that classical economics fail to explain, can we have an individual perfect for the purpose of explaining 9 economical events: “Without complications such as personality, value, belief, and emotions, economic man’s behavior can be explained by his own self-interested orientation […]Homo Economicus is a cornerstone on which economic theories are Built” (Ng & Tseng 2008, pp.266– 267). Paul Krugman (2009, p.262) defends the idea that although agents may show imperfections when using their rationality in economical problems, it’s difficult to find economists who may advocate replacing the model of utility maximization. According to Krugman, the model of the rational consumer is the main methodology used by economists to analyze consumer behavior. In other words: “In mainstream economics, explanations are regarded as ‘economic’ to the extent that they explain the relevant phenomena in terms of the rational choice of individual economic agents” (Sugden 1991, p.751). Some theories, according to Conlisk (1996, p.685), argue that without the possibility of a model of optimization, economics would degrade into a series of ad hoc hypothesis, able to describe the events, but unable to become a closed refutable science in the sense of Popper (2002, p.10). Arjo Klamer (1984) explains that Lucas and Sargent (1978) defend a position in which economical theories, in order to be scientific, must be based on the classical postulate of individual optimization (Klamer 1984, p.283). This gives theoretical elegance and produces a well developed calculus (Gigerenzer & Selten 2001, p.11) since optimization, compare to other models of rationality, seems to provide a more robust mathematical frame, but sacrificing the reality of how human rationality actually operates4. According to Simon: “Since the organism, like those of the real world, has neither the senses nor the wits to discover an ‘optimal’ path -even assuming the concept of optimal to be clearly defined- we are concerned only with finding a choice mechanism that will lead it to pursue a 4 Gigerenzer and Selten argue that the classical model has to be changed by what they call the model of ecological rationality, a more realistic approach to human behavior. 10 ‘satisficing’ path that will permit satisfaction at some specified level of all of its needs” (1957, pp.270–71). Following the explanations of Gigerenzer and Selten to clarify some confusing aspects about the definition of this model I will argue that bounded rationality is not irrationality (it’s neither an inferior form of rationality nor a discrepancy between human reason and the laws of probability nor some form of optimization but a way to understand actual behavior). Bounded rationality is not an optimization under constraints, because that would be a different form of optimization that would make everything more complicated since we would have to include in our equations the optimizations and the constraints themselves, maintaining the desire for optimization, which we deny in this article. Bounded rationality is a type of theory, not the outcomes themselves (Gigerenzer & Selten 2001, pp.4–7). Subjects, due to their bounded rationality, cannot optimize: they satisfice. The model of bounded rationality which is able to explain decisions understanding the boundaries ‘suffered’ by subjects themselves, argues that our rationality is “restricted”, observing this in many experiments (Conlisk 1996, p.670). These boundaries were summarized by Simon (1972, p.163): the risk, uncertainty, incomplete information about alternatives, and complexity in the cost function or other environmental constraints are so great that they prevent the actor from calculating the best course of action, “only” being able to achieve a satisfactory decision. Bryan Jones argues that organisms trying to satisfice instead of optimize will show the following characteristics: 1. Limitation on the organism’s ability to plan long behavior sequences, a limitation imposed by the bounded cognitive ability of the organism as well as the complexity of the environment in which it operates. 2. The tendency to set aspiration levels for each of the multiple goals that the organism faces. 3. The tendency to operate on goals sequentially rather than simultaneously because of the ‘bottleneck of short-term memory’. 4. Satisficing rather than optimizing search behavior” (Jones 1999, p.301) 11 The introduction of rational choice theories within the political science was developed during the second half of the 20th century and includes different subfields: party competition, voter turnout, and the one we are considering here: voter’s choices (Bendor 2011, p.1). Rational choice theory was able to predict some events within the political frame, but some parts were not able to stand empirical tests very well, specifically voter turnout (Bendor 2011, p.18) and the choices of voters in an election. Rational choice theory assumes a voter that is fully rational, but tests demonstrate that this is far from true: Some of our cognitive constraints are obvious. For example, our attention is sharply limited: we can consciously think about only one topic at a time. Some are more subtle: e.g., we are sometimes sensitive to small differences in how problems are described (framing effects) (Bendor 2011, p.19) 1.3. The 2012 Republican Presidential Nomination (RPN) Until the first week of December of 2011, there had been already six changes for the front runner position in the RPN polls. The candidates observed were: Gingrich, Romney, Cain, Paul, Perry, Bachmann, Santorum, and Huntsman. On December first, the situation was the following: 26.6%Gingrich, 20.4%Romney, 14.0%Cain, 8.0%Paul, 7.2%Perry, 4.6%Bachmann, 2.6%Santorum, and 2.4%Huntsman. Considering the weeks from July 31st to December 1st, the changes had been the following: 7/31 8/20 9/12 9/28 10/5 10/19 11/9 11/17 12/1 Gingrich 4.6 5 4.4 8.2 9.2 8.3 12.2 21.6 26.6 Romney 21.5 20.2 19.8 22.8 21.6 25.3 23.3 22 20.4 Cain 6.3 5 4.2 8.2 15 24.6 25.5 18.6 14 Paul 8 8.8 9.2 7.8 7 8.1 8.3 7.8 8 Perry 11.9 18.4 31.8 27.2 18 12.6 10.2 8.2 7.2 Bachmann 12.9 9.6 6.4 6.4 4.2 4.7 3.3 5.4 4.6 Santorum 1.9 1.8 3 2.6 2.8 1.5 1.7 1.8 2.6 Huntsman 1.9 2.2 1.4 1.8 1.8 1.7 1 2.2 2.4 12 If we explain voting processes from the model of rationality of classical economics, we will find that voters would always arrive at the best decisions in a way that would never be incoherent with their values and preferences, being able to chose among all possible alternatives, always aware of what these alternatives are (H. A. Simon 1976a, p.xxvii). Accordingly, voters must have the list of all alternatives, the determination of all consequences that will follow (in the future) if the alternative is “elected” and, as Gustavo Barros explains: “the comparison of the alternatives, that should be evaluated by the sets of consequences following each one of them, according to the pre established ends (utility, profit or any other specified pay-off function)” (Barros 2010, p.457) Classical economics assumes that if I were to decide between candidates, I should first obtain all information possible, apply my calculative capabilities, and decide according to values, beliefs and a specific utility function. But what we find if we “get up from the sofa”5 is a very different scenario than the one described before. A model of bounded rational agents would explain the behavior of subjects in a more satisfactory manner. The data above mentioned shows the changes of preferences during a specific period of time. This is a normal scenario and very common in decision processes. Most of the time, the change of preferences is due to new information arriving about candidates (or alternatives) and its repercussion to the choices the voters make according to the values they have, rather than related to a change of values by the subjects themselves. The opinions of the voters are going to be shaped by the information they gathered from media, which is able to influence voter’s choices dramatically. But this was not seriously researched until the 80’s (Lenz 2009, p.821). The influence may come from debates, campaign advertising (Johnston et al. 1992, p.213) or news (Iyengar & A. F. Simon 2000), although as 5 Words used by Simon to criticize the lack of empirical realism of classical economists (H. A. Simon & Bartel 1986) 13 Marvin Kalb explains, the final goal of most media is not to report news, but to increase profit: he calls it “the new news” (Kalb 1998, p.3). So, in order to keep the voters interested: “What better enticement than sex, sleaze, and scandal?” (Iyengar & A. F. Simon 2000, p.154) In order to make up their minds, voters not only focus on these issues about the candidates, they will also look at other political or personal information about them. In general, agents cannot observe and analyze all information about their future decision, rather “they attend selectively to a few issues that appear important at the moment” (Iyengar & A. F. Simon 2000, pp.156–7). Such importance can also be controlled by media or through the influence that other candidates have in media outlets. Voters can be “primed” by the rhetoric of the information they receive, and that includes how that information is presented, and when it is released. The rhetoric is used to persuade voters telling them how to vote (Johnston et al. 1992, p.240). In this paper, the issue of priming will not be considered as described before or as criticized by Lenz (2009). The focus rather, is in how the timing in the release of information affects our choices, challenging the view of voters as subjects who would consider information about candidates disconnected from when that information was acquired. Therefore, what is difficult to understand and problematic, according to the classical model of rationality, is the idea that if we eliminate time, and voters are to consider all the possibilities and all information available at a given moment, the changes of preferences would have been very different. Looking at the information that arrived to voters prior the changing in the polls, we see that the mere fact that this information is recent, automatically gives it more relevance than if it were older. We can find an example in the decline of Cain’s run for republican nominee, connected to the release of information about an extramarital affair he had during a few years of his life, the accusations of sexual harassment by two women, and the way he handled himself when this information was released. On December 3rd, Cain suspended his campaign. During that 14 same period of time, the candidate in front of all polls was Newt Gingrich, ahead by a margin of 6.2% above his closest follower, Mitt Romney. Gingrich’s marital life, according to the same values, was very similar, if not worse, than that of Cain. Now this is not to say that there might not be other hidden (unconscious) factors involved in the decision of voters to switch their preferences, but it’s necessary to highlight that voters changed their mind right after the release of such news. If you present two candidates (A and B) with similar biographies as those from Cain and Gingrich, challenging in the same way the values some voters may have, on paper, the majority of them would argue that the candidates are not that much different in respect to the values held. But one model is the one where we decide on paper and we are able to rationally choose and satisfy our expected utility, and another where we have to decide based on information that has been framed (Kahneman & Amos Tversky 1979; A. Tversky & Kahneman 1981) and given in a specific way and at a specific moment of our decision: “As framing experiments […] have repeatedly shown, if two decision makers use sufficiently different representations, their behavior will differ in some choice contexts even if they are using similar operations” (Bendor 2011, p.24). The goal of Tversky and Kahneman with “prospect theory” was to criticize the expected utility theory as a descriptive model of decisions under risk arguing that choices may shift depending on how the information is presented, violating, therefore, the axioms of expected utility theory (Kahneman & Amos Tversky 1979, p.263). In an experiment described by Kahneman (2011, pp.101–2), a group of students was asked to assess their happiness. Half of the students had to answer the following questions: How happy are you these days? How many dates did you have last month? The experimenters were trying to find a correlation between the answers, and they found none. The other part of students was asked the same questions but in reverse order. The results were different. The correlation between number 15 of dates and happiness was as high as correlations are within the psychological field. What happened? What came to mind in the second scenario was the number of dates and that affected the feelings about the second question. Dating was not in the mind of the students in the first scenario, but it was in the second establishing a relation with the answer to the second question. From this experiment it’s clear that depending on the order of the questions we may describe ourselves more or less happy. Something similar occurs with the order of how the information arrives to our knowledge, affecting our judgment about how relevant or important this information is. The rational model of classical economics cannot give an account of this type of contradiction and is not able incorporate them to its scientific structure. Understanding the above mentioned polls under the satisficing behavior frame of the bounded rationality theory provides a more accurate model than the complete rationality one, which falls short in describing the “apparent” irrational behavior of voters. Applying Jones’ third point to the data helps us to understand the impossibility of considering all informative aspects of a decision in a specific moment from an objective point of view. Recent information will always be more relevant than old information, even when the old one could be more important if time is eliminated from the decision environment. When we consider alternatives sequentially, time will affect our decisions as time affected how voters dealt with the information provided about Cain’s affair in relation to the information (which at that moment was not being considered) about the different affairs Gingrich has had. Choices depend not only on the set of alternatives presented to those deciding but, as Manzini and Mariotti support (2009), also on the frame in which these alternatives are presented. Such choice has to be formalized introducing the frame: c(S,f), where “c” is the choice, “S” the set of alternatives and “f” the frame. An example of frame could be the moment in time in which the alternatives in S are presented (Manzini & Mariotti 2009, p.391). 16 Tversky (1972) proposes a theory of “elimination by aspects” in which an individual chooses among alternatives without comparing all aspects at once but by considering one aspect at a time, eliminating alternatives along the way (Conlisk 1996, p.676). As Simon anticipated: “It appears, then, that in actual behavior, as distinguished from objectively rational behavior, decision is initiated by stimuli which channel attention in definite directions, and that the response to the stimuli is partly reasoned, but in part large habitual” (1997a, p.102). Going back to the polls, Perry’s ups and downs could easily be explained by this model. Once new information arrives, in this case, his gaffes6 at the September 12th debate in Tampa (FL), together with a couple more unlucky appearances during that week in September, forced his decline in the polls and change voters’ choice: First, humans are cognitively constrained in many ways, e.g., there are limits on shortterm memory and on attention. Second, these mental properties significantly affect decision making. Third, the impact of these information-processing constraints increases with the difficulty of the choice problem that a person faces (Bendor 2011, p.28). Agents, when they have to decide among different alternatives, have to evaluate different pieces of information, some of it must be rescued from memory. The problem of evaluating alternatives in such way is that time is not neutral to our decision processes and affects them producing inconsistencies. This is a specific case of a more general description of dynamic inconsistent behavior. 2. Adding Dynamic Inconsistency7 to the model 6 The one about Merck’s contributions: “Rep. Michele Bachmann pointed out that Perry's former chief of staff, Mike Toomey, was a lobbyist for Merck, the drugmaker set to make the HPV vaccine and profit from the mandate. Perry's response must rank among the all-time most ill-advised debate lines. ‘The company was Merck, and it was a $5,000 contribution that I had received from them,’ Perry said. ‘I raise about $30 million. And if you're saying that I can be bought for $5,000, I'm offended.’” (Ward 2011) This may allow us to believe that he does not sell himself cheap. 7 Also: “time inconsistency”. 17 The concept of dynamic inconsistency was introduced by Strotz (1955) and it can be defined as the discrepancy of preferences during a period of time, where “the individual's future behavior will be inconsistent with his optimal plan” (Strotz 1955, p.165). That inconsistency is the result of not being able to optimize backwards (Fischer 1980, p.94). Because many real-life decisions involve multiple stages of choices and uncertain events, subjects sometimes try to decide from a present moment any possible choices in the future; these may include different procedures to mitigate health problems or preferences for candidates in the future considering the arrival of new information. A dynamically inconsistent behavior may occur when a participant’s planned choice differed from his/her final choice. According to Barkan and Busemeyer, “when we are given full information, actual experience should not change our planned preferences, and the utilities we use to evaluate the decision problem should stay constant […] this change inevitably affects the perceived values associated with the next stage of the decision problem, making the original plan less desirable” (1999, p.553). Time and the order of how information is received affect our decisions, and to be time consistent we will have to act in the future in a way that would maximize present values of utility, and these actions must remain optimal in the periods when actions are to be taken. But this is not the normal scenario of human decision; neither is it the one we see in the polls above mentioned: “Time consistency requires that the future be discounted at a fixed rate, independent of when the costs and benefits of the actions actually occur. People tend not be time consistent. Rather, they appear to have higher discount rates over payoffs in the near future than in the distant future [...] people often favor short-term gains that entail long-term losses” (Gintis 2000, p.313). When alternatives are not presented in a preference ordering and appear simultaneously having to be evaluated by an agent, our constraints play an important role in our decisions. When agents must also factor previous knowledge about the alternatives, the amount of information to 18 take into consideration makes the choice extremely difficult. If we have to face to alternatives and we have only one piece of information about them, the choice is fairly simple (Car1 Vs Car2, taking into consideration their prices). If we start adding more pieces of information, the complexity increases. Car1 Vs Car2, considering price, fuel economy, appearance, safety, etc. Now, imagine that the information is not presented in a simultaneous manner, that is, we have to access our memory to obtain that information. A questionnaire was answered by 121 college students in 2012 where they rated the difficulty of deciding in different scenarios. The difficulty was measured by a scale going from 1 to 10, being 1 the easiest and 10 the most difficult. Students were asked to rate the difficulty in deciding about a car they had to buy by taking into consideration different aspects and information about them. In the questionnaire, 5 scenarios were presented; each had different aspects to consider from different cars before deciding what to buy. Scenario 5 included also some information students had to collect from memory. The students considered that the difficulty of a decision increases (1-10) with the amount of information, choices and, above all, if that information is scattered around time. Loewenstein (1988) linked inter-temporal decision making to prospect theory: “when people choose between immediate and delayed consumption, the reference point used to evaluate alternatives can significantly influence choice” (1988, p.200). He saw the inconsistency of decisions within time as a special case of Tversky and Kahneman’s theory. Taking this linkage one step further, I posit that whenever we deal with information collected in different moments in time, and time influences our decision (it could be the order in which the information was collected in the past or the possibility of future gains), it’s a particular case of framing. The order in which information is received can change the value we give to that information in the same way that a specific form of presenting a problem can alter the way we may decide. 19 With the arrival of new relevant information, preferences shift, sometimes regardless of the importance of it. New information is taken into consideration by the subjects in a deeper and more dramatic way than the information previously known. As Bryan Jones argues: “They tend to react to new information with neglect or overestimation” (2001, p.25). The fact that the information is new will affect the way it is considered and it will alter its relevance, opposing the view of the standard model, which understands a rational actor who is time consistent “We say that a strategy is time-consistent if at no information set reached as the decision problem unfolds does reassessing the strategy for the remainder of the decision problem lead to a change in the plan of action” (Rubinstein 1998, p.72). What we see from subjects is a behavior that does not follow such consistency, that is, when new information arrives, our preferences may change: “time inconsistency is obtained as a consequence of changes in preferences (tastes) during the execution of the optimal plan” (1998, p.75). A complete rational agent would eliminate the time factor, comparing two different candidates by focusing, as many voters do to select their choices, by trying to avoid those who may differ from their values. But what polls show is that our preferences are inconsistent with our own values and may shift with respect to how recently we obtain the negative information about the candidates. The complexity of the choice problem and our short memory bounds our rational capability to make decisions as prescribed by the classical model. The behavior of the voters, as shown in the polls, belongs to dynamic inconsistent agents with bounded rationality. But we’re still missing an important piece to complete the choice model I’m defending here: Axiological Rationality. Once this is explained and combined with what was previously written, we will have a more satisfactory model to understand such behavior. 20 3. Axiological rationality Both bounded and complete (ideal) rationality are based on an instrumental view of rationality, one under the idealistic assumptions described by the Rational Choice Theory and the other one under the position that rationality falls short of them. I argue that this view is empty if it’s not complemented with a view of rationality that may also consider non instrumental factors like those in axiological, also called “expressive” rationality. Hargreaves Heap (1989) distinguished three different types of rationality: instrumental, procedural and expressive. While instrumental focuses on means and ends, procedural is about the means chosen and expressive has nothing to do with any means, just with finding ends. While instrumental looks for the consequences of actions, expressive rationality focuses on the “past”, that is, the first one is prospective and the second one retrospective (Engelen 2006, p.427). As Richard Coughlin argues, the introduction of “the socioeconomic frame of meaning introduces elements of procedural as well as expressive rationality in the negotiated economy” (Coughlin 1991, p.161). Following this notion and the ideas found in Echeverría and Álvarez (2008), I consider that “we are instrumentally rational agents, but we also exhibit axiological rationality” (Echeverría & Álvarez 2008, p.173) both as complementary foundations of our behavior. Actions become expressive in the sense that they mean something to us (Hargreaves Heap 2009, p.134). Since it’s necessary that we move from a monistic view of rationality like the one supported by Rational Choice Theory (RCT), embedded in this words will be found a rejection of such monism, arguing for the complementary model above mentioned, complementarity similar to the one we find in Engelen’s words: “Instrumental and expressive motivations, as I have analysed them, are two opposing ends of a single scale” (Engelen 2006, p.435) To this end the model of 21 axiological rationality is analyzed and the criticism of RCT in the same manner Raymond Boudon has previously done (1998; 2001; 2003; 2009). Separating ourselves from the instrumental notion of rationality allows us to conceive a broader view in which we can include values to act in a specific way. These actions depend on beliefs, and the reasons an actor has to behave in that specific way are seen by that actor as rational. Not all rational choices must deal with a utility function and a cost-benefit analysis. In some cases, actions are related to cost-benefit (instrumental) but in other cases they are not or they just have, like most of the times, both components: “On the whole, to get a satisfactory theory of rationality, one has to accept the idea that rationality is not exclusively instrumental” (Boudon 2003, p.17). The term rationality should be applied to those actors who have strong reasons to act and believe the way they do (Boudon 1998, pp.825–26). Actions cannot only be directed to maximize our utility function from an individualistic position: they are also meaningful and express our values. Sometimes, as with the case of the ultimatum game8, they even contradict the requirements of RCT or are merely independent. We may say, therefore, that actors are neither rational nor irrational idiots9 (Boudon 2006, p.39). In the same way, voters will try to express their reasons for choosing a specific candidate according to a set of values they hold as meaningful, despite the instrumental repercussion of the choice itself. In some cases voters may vote against their own interest to do so according to their values and beliefs. Sometimes they will do it because they have good reasons to do so or due to 8 “In the Ultimatum Game, two players are given the opportunity to split a sum of money. One player is deemed the proposer and the other, the responder. The proposer makes an offer as to how this money should be split between the two. The second player (the responder) can either accept or reject this offer. If it is accepted, the money is split as proposed, but if the responder rejects the offer, then neither player receives anything. In either event, the game is over.” (Sanfey et al. 2003, p.1755) 9 Idiots (or fools) as it was used by Sen (1977) 22 party affiliation: “expressive voters have already acquired a certain party identification (3), which they express by supporting their favourite party (2), even before having decided whether to go out and vote (1)” (Engelen 2006, p.432). According to Echeverría and Álvarez (2008), there are four different approaches to the inclusion of values into decision theory. The first one, a type of axiological monism, declares that there is a single value to which the rest submit. For example, a businessman whose only value is profit would belong to a model 1 (M1) of axiological rationality. M2 also includes some satellite values (ethical aspects of a business enterprise). M3 considers the parallel existence of values related in a partial mixture (a businessman with political aspirations). M4, the one we defend in this article, explains that there is an equivalency of preferences in values: “Requires plural agents with the capacity to integrate different individual agents, each of which takes on and promotes the different types of values that we have described” (Echeverría & Álvarez 2008, p.186). Agents have a multiplicity of parallel values that cannot be subordinated into others but they can be different in relationship to their importance at a given moment. Subjects are to be considered within the social frame in which they evaluate and decide. Taking into consideration that frame allows us to understand behaviors that otherwise would be incomprehensible. Social expectations, moral standards, norms, etc are variables that play an important part in our decisions. Expressive rationality connects to these social elements, and it’s irrelevant if these come from education, indoctrination or rational deliberation (Engelen 2006, p.431), what matters is that the agent has enough reason to act in a specific way, expressing certain values and beliefs. A model of rationality must incorporate an axiological or expressive part in order to comprehend all aspects of our decisions, including also a realistic description rejecting any type of global or ideal model on behalf of a bounded one. A clear example of how axiological rationality shapes our decisions is found in different games, like the “ultimatum game” (Sanfey et 23 al. 2003, p.1755). This type of experiment challenged the classical view that subjects are selfish, or in Gintis terms: self regarding (2009, p.50) According to the classical economical model, what subjects would do is to offer the minimum amount and to accept it, but what we see is that we have a biological embedded sense of fairness (D. Lee 2008, p.405) that does not allow us to behave as described by this model: “when actually played by subjects in an experimental setting, the H. economicus outcome is almost never attained or even approximated […] For instance, in the ultimatum game, individuals frequently choose zero payoffs when positive payoffs are available. Critics claim that subjects have not learned how to play the game and are confused by the unreality of the experimental conditions, so their behavior does not reflect real life” (Gintis 2000, pp.316–19). Subjects, therefore, instead of showing self interest and a rational approach to decision making by choosing to keep the money, they sacrifice the quantity offered to defend the value of fairness (Gintis et al. 2005, p.12). But, as with the example of voting, if we eliminate the frame of the decision in a scenario where the amount to split is $10.00 and we offer a person the possibility of choosing between $1.00 and $0.00, the subjects would always choose the first one (they will show their instrumental side, that’s why they complement). But if this decision is framed within the ultimatum game, subjects are willing to sacrifice benefit due to the unfairness produced by the low offer, taking joy in punishing the person who is being unfair. 4. Conclusion: Bounded Axiological Rationality (BAR) Both bounded and axiological models of rationality will create a theoretical frame capable of explaining the choices subjects make from a more realistic perspective than the one postulated by the classical branch of economics: “These are two different notions of rationality but we act with both of them in a single communicative situation” (Echeverría & Álvarez 2008, p.175). 24 In the line of Amartya Sen (1977; 1993; 1997; Sen et al. 1986), I argue that values not only guide our behavior but also act as filters that restrict information, dramatically affecting our perception of the environment and the choices we make. They guide our behavior, sometimes sacrificing the instrumental notion of rationality: “People do not always simply act because the action satisfies some preference or other, they sometimes act because the act reflects well upon them and they derive a sense of self-worth from knowing this. Or to put this round the other way, people experience feelings like guilt, shame and embarrassment through reflecting on the worth of their actions and the anticipation of such feelings can affect people's choice of actions” (Hargreaves Heap 2004, p.48). Those actions can be seen as norm-guided according to the specific values. Hargreaves-Heap refer to them as part of our expressive rationality (2004, p.52), admitting that behavior can also be based on commitment rather than instrumental optimization. This is challenging for economical and decision theory since, as Sen said, “commitment […] involves choosing an action that yields a lower expected welfare than an alternative available action” (1977, p.328). To better support a more realistic description of our rational choices, we should move from a model based on pure instrumental satisfaction of goals and maximization of profit to one which recognizes our boundaries and the role of values in our decisions. As Boudon argues: “only being congruent with values could be qualified as rational” (Boudon 2001, p.94). This complementary model of rationality which, following the work of Echeverría and Álvarez (2008), we can call bounded axiological rationality, gives us a more plausible theory to understand the volatility of voters’ decisions as they are shown in the polls previously mentioned. Our values, the frame in which decisions happen, the information gathered and how such information is framed, and our bounded rational skills that must operate within a complex environment, can make our choices dynamically inconsistent and make us rational fools, using the terminology of Sen. But only fools 25 if we defend a metaphysical and ideal definition of rationality based on some Olympian skills that realistically we do not have. The form of rationality described by this model is the only one that empirically exists, that is, rationality per se is bounded and axiological. From this frame we can interpret the change in decision that may be seen through the polls previously mentioned. An agent’s decision, depending on the circumstances, can be altered by the order of how information about alternatives is presented. To this we must add the multiple values running in a parallel process (as the M4 describes). Since she has to prioritize, attending and satisfying a specific one, depending on the information received, the values will shift. The question is the following: do they shift due to a dynamic inconsistent process of our bounded rationality or is it that we have many values to attend to. This multiplicity of values can forced us to consider their relevance differently according to specific circumstances. The answer is not simple and involves the idea of abandoning the independence of both perspectives. The cause of voter opinion swings can be found in the complementary connection between the bounded and the axiological model of rationality. Bibliography Alchian, A.A., 1950. Uncertainty, Evolution, and Economic Theory. Journal of Political Economy, 58(3), pp.211–221. Barkan, R. & Busemeyer, J.R., 1999. Changing plans: Dynamic inconsistency and the effect of experience on the reference point. Psychonomic Bulletin & Review, 6, pp.547–554. Barros, G., 2010. Herbert A. Simon and the concept of rationality: boundaries and procedures. Revista de Economia Política, 30, pp.455–472. Bendor, J.B., 2011. A behavioral theory of elections, Princeton, N.J: Princeton University Press. Bendor, J.B., 2010. Bounded rationality and politics, University of California Press. Binmore, K.G., 2008. Game theory: a very short introduction, Oxford University Press. Boudon, R., 2009. ¿Qué teoría de la evolución moral deben escoger los científicos sociales? Sociológica, Año 24(71), pp.157–183. 26 Boudon, R., 2006. Are we doomed to see the homo sociologicus as a rational or as an irrational idiot? In J. Elster, O. Gjelsvik, & A. Hylland, eds. Understanding choice, explaining behaviour: essays in honour of Ole-Jørgen Skog. Oslo Academic Press. Boudon, R., 2003. Beyond Rational Choice Theory. Annual Review of Sociology, 29, pp.1–21. Boudon, R., 1998. Limitations of Rational Choice Theory. The American Journal of Sociology, 104(3), pp.817– 828. Boudon, R., 2001. The Origin of Values: Sociology and Philosophy of Beliefs, New Brunswick, N.J: Transaction Publishers. Caplan, B.D., 2008. The myth of the rational voter: why democracies choose bad policies, Princeton University Press. Conlisk, J., 1996. Why Bounded Rationality? Journal of Economic Literature, 34(2), pp.669–700. Coughlin, R.M., 1991. Morality, Rationality, and Efficiency: New Perspectives on Socio-Economics, M.E. Sharpe. Cramer, C., 2002. Homo Economicus Goes to War: Methodological Individualism, Rational Choice and the Political Economy of War. World Development, 30(11), pp.1845–1864. Crowther-Heyck, H., 2005. Herbert A. Simon: The Bounds of Reason in Modern America, Baltimore: Johns Hopkins University Press. Dahl, R.A. & Lindblom, C.E., 1953. Politics, economics, and welfare, Transaction Publishers. Dosi, G., 2004. A very reasonable objective still beyond our reach: economics as an empirically disciplined social science. In Models of a Man: Essays in Memory of Herbert A. Simon. Boston, MA: MIT Press, pp. 211–226. Echeverría, J. & Álvarez, J.F., 2008. Bounded Rationality in Social Sciences. In E. Agazzi, ed. Epistemology and the Social. Rodopi, pp. 173–191. Engelen, B., 2006. Solving the Paradox The Expressive Rationality of the Decision to Vote. Rationality and Society, 18(4), pp.419–441. Etzioni, A., Piore, M.J. & Streeck, W., 2010. Behavioural economics / Bounded rationality / From bounded rationality to behavioural economics / Does “behavioural economics” offer an alternative to the neoclassical paradigm? Socio-Economic Review, 8(2), pp.377 –397. Fischer, S., 1980. Dynamic inconsistency, cooperation and the benevolent dissembling government. Journal of Economic Dynamics and Control, 2, pp.93–107. Friedman, M., 1953. Essays in positive economics, University of Chicago Press. Gigerenzer, G., 2008. Rationality for mortals: how people cope with uncertainty kindle ebook., Oxford University Press US. 27 Gigerenzer, G. & Selten, R. eds., 2001. Bounded Rationality: The Adaptive Toolbox, Cambridge, Mass: MIT Press. Gintis, H., 2000. Beyond Homo economicus: evidence from experimental economics. Ecological Economics, 35(3), pp.311–322. Gintis, H. et al., 2005. Moral Sentiments and Material Interests: The Foundations of Cooperation in Economic Life, MIT Press. Gintis, H., 2009. The bounds of reason: game theory and the unification of the behavioral sciences, Princeton University Press. Hargreaves heap, S., 1989. Rationality in Economics First ed., Blackwell Pub. Hargreaves Heap, S., 2004. Economic Rationality. In J. B. Davis, J. Runde, & A. Marciano, eds. The Elgar companion to economics and philosophy. Edward Elgar Publishing, pp. 40–60. Hargreaves Heap, S., 2009. Review of Bart Engelen’s “Rationality and institutions: on the normative implications of rational choice theory.” Erasmus Journal for Philosophy & Economics, 2(1), pp.132– 138. Hargreaves Heap, S. & Varoufakis, Y., 1995. Game theory: a critical introduction, Psychology Press. Iyengar, S. & Simon, A.F., 2000. New perspectives and evidence on political communication and campaign effects. Annual review of psychology, 51, pp.149–169. Johnston, R. et al., 1992. Letting the People Decide: The Dynamics of Canadian Elections, Stanford University Press. Jones, B.D., 1999. Bounded Rationality. ANNUAL REVIEW OF POLITICAL SCIENCE, pp.2–297. Jones, B.D., 2001. Politics and the Architecture of Choice: Bounded Rationality and Governance, Chicago: University of Chicago Press. Kahneman, D., 2011. Thinking, Fast and Slow, Macmillan. Kahneman, D. & Tversky, Amos, 1979. Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), pp.263–291. Kalb, M., 1998. The Rise of the New News: A Case Study of Two Root Causes of the Modern Scandal Coverage. Available at: http://www.hks.harvard.edu/presspol/publications/papers/discussion_papers/d34_kalb.pdf [Accessed August 16, 2012]. Keita, L.D., 1992. Science, rationality, and neoclassical economics, University of Delaware Press. Klamer, A., 1984. Levels of Discourse in New Classical Economics. History of Political Economy, 16(2), pp.263– 290. Krugman, P. & Wells, R., 2009. Economics, Macmillan. 28 Kurrild-Klitgaard, P., 2001. An Empirical Example of the Condorcet Paradox of Voting in a Large Electorate. Public Choice, 107(1-2), pp.135–145. Lee, D., 2008. Game theory and neural basis of social decision making. Nature neuroscience, 11(4), pp.404– 409. Lee, L., Amir, O. & Ariely, D., 2009. In Search of Homo Economicus: Cognitive Noise and the Role of Emotion in Preference Consistency. Journal of Consumer Research, 36(2), pp.173–187. Lenz, G.S., 2009. Learning and Opinion Change, Not Priming: Reconsidering the Priming Hypothesis. American Journal of Political Science, 53(4), pp.821–837. Loewenstein, G.F., 1988. Frames of Mind in Intertemporal Choice. Management Science, 34(2), pp.200–214. Lucas, R.E. & Sargent, T.J., 1978. After Keynesian Macroeconomics. In After the Phillips curve: persistence of high inflation and high unemployment: proceedings of a conference held at Edgartown, Massachusetts, June 1978. p. 49. Manzini, P. & Mariotti, M., 2009. Consumer choice and revealed bounded rationality. Economic Theory, 41(3), pp.379–392. Ng, I.C.L. & Tseng, L., 2008. Learning to be Sociable: The Evolution of Homo Economicus. American Journal of Economics and Sociology, 67(2), pp.265–286. Popper, K.R., 2002. The logic of scientific discovery, Psychology Press. Rankin, D.J., 2011. The social side of Homo economicus. Trends in Ecology & Evolution (Personal Edition), 26(1), pp.1–3. Rosanas, J.M., 2004. Bounded Rationality, Value Systems and Time-Inconsistency of Preferences as Rational Foundations for the Concept of Trust. IESE, (Working Paper, no 567.). Available at: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=622863 [Accessed March 8, 2012]. Rubinstein, A., 1998. Modeling Bounded Rationality, Cambridge, Mass: MIT Press. Sanfey, A.G. et al., 2003. The Neural Basis of Economic Decision-Making in the Ultimatum Game. Science, 300(5626), pp.1755 –1758. Selten, R., 2001. What is bounded rationality? In G. Gigerenzer & R. Selten, eds. Bounded Rationality: The Adaptive Toolbox. Cambridge, MA: MIT Press, pp. 13–36. Sen, A., 1997. Maximization and the Act of Choice. Econometrica, 65(4), pp.745–779. Sen, A., 1993. Positional Objectivity. Philosophy and Public Affairs, 22(2), pp.126–145. Sen, A., 1977. Rational Fools: A Critique of the Behavioral Foundations of Economic Theory. Philosophy and Public Affairs, 6(4), pp.317–344. Sen, A., Last, A.G.M. & Quirk, R., 1986. Prediction and Economic Theory [and Discussion]. Proceedings of the Royal Society of London. A. Mathematical and Physical Sciences, 407(1832), pp.3 –23. 29 Simon, H.A., 1955. A Behavioral Model of Rational Choice. The Quarterly Journal of Economics, 69(1), pp.99– 118. Simon, H.A., 1947. Administrative Behavior, New York: Macmillan Co. Simon, H.A., 1976a. Administrative Behavior: A Study of Decision-making Processes in Administrative Organization 3d ed., New York: Free Press. Simon, H.A., 1997a. Administrative Behavior: A Study of Decision-Making Processes in Administrative Organizations 4th ed., New York: Free Press. Simon, H.A. et al., 2008. Economics, bounded rationality and the cognitive revolution, Edward Elgar Publishing. Simon, H.A., 1976b. “From Substantive to Procedural Rationality” Method and Appraisal in Economics. In New York: Cambridge University Press, pp. 129–148. Simon, H.A., 1997b. Models of bounded rationality, MIT Press. Simon, H.A., 1982. Models of Bounded Rationality, Cambridge, Mass: MIT Press. Simon, H.A., 1987. Models of Man, Social and Rational: Mathematical Essays on Rational Human Behavior in a Social Setting, New York: Garland Pub. Simon, H.A., 1957. Models of man: social and rational; mathematical essays on rational human behavior in society setting, Wiley. Simon, H.A., 1991. Models of My Life, New York: Basic Books. Simon, H.A., 1979. Rational Decision Making in Business Organizations. The American Economic Review, 69(4), pp.493–513. Simon, H.A., 1983. Reason in Human Affairs, Stanford, Calif: Stanford University Press. Simon, H.A., 1972. “Theories of Bounded Rationality” in Decision and Organization. a Volume in Honor of Jacob Marschak Edited by C. B. Radner and R. Radner., Amsterdam: North-Holland Pub. Co. Simon, H.A. & Bartel, R.D., 1986. The Failure of Armchair Economics. Challenge, 29(5), pp.18–25. Smith, V.L., 2008. Rationality in economics: constructivist and ecological forms, Cambridge University Press. Strotz, R.H., 1955. Myopia and Inconsistency in Dynamic Utility Maximization. The Review of Economic Studies, 23(3), pp.165–180. Sugden, R., 1991. Rational Choice: A Survey of Contributions from Economics and Philosophy. The Economic Journal, 101(407), pp.751–785. Tversky, A., 1972. Elimination by aspects: A theory of choice. Psychological Review, 79(4), pp.281–299. Tversky, A. & Kahneman, D., 1981. The framing of decisions and the psychology of choice. Science, 211(4481), pp.453–458. 30 Ward, J., 2011. Rick Perry’s Sudden Fall Due To Unforced Errors. Huffington Post. Available at: http://www.huffingtonpost.com/2011/09/23/rick-perry-2012-sudden-fall-errors_n_978608.html [Accessed December 4, 2011]. 31