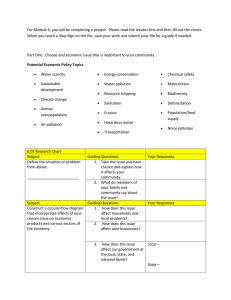

Module The Study of Economics

advertisement

Module Micro: 39 Econ: 75 Externalities and Public Policy KRUGMAN'S MICROECONOMICS for AP* Margaret Ray and David Anderson What you will learn in this Module: • How external benefits and costs cause inefficiency in markets. • Why some government policies to deal with externalities, such as emissions taxes, tradable emissions permits, and Pigouvian subsidies, are efficient, although others, including environmental standards, are not. Arthur Cecil Pigou Policies Toward Pollution • Environmental Standards (emissions testing; sewage treatment) • Emissions Taxes • Tradable Emissions Permits Production, Consumption, and Externalities • Private versus social benefits • Private versus social costs Externalities A Pigouvian tax is a tax levied on a market activity that generates negative externalities (or a subsidy for a positive externality. The tax or subsidy is intended to correct the market outcome. In the presence of negative externalities, the social cost of a market activity is not covered by the private cost of the activity. In the presence of positive externalities, the social benefit of a market activity is not covered by the private benefit of the activity. Positive Externalities When the production and consumption of a good provides benefits to third parties, that good is said to provide positive externalities to society. Price, MSB S Popt Pmkt Pcons Subsidy MPB Qmkt Qopt MSB Qty home improvements Positive Externalities • We can see that the market under-produces goods that generate positive externalities. In other words, we don’t get enough of a good thing. • This is inefficient and produces deadweight loss just like price controls and monopoly. This represents benefits that would be enjoyed by society if the socially optimal, not the market, output was produced. • The area of the deadweight triangle is above the supply curve, with base of (Qopt - Qmkt), and height of (Pmsb – Pmkt), Price, MSB S Popt Pmkt Pcons Subsidy MPB Qmkt Qopt MSB Qty home improvements Positive Externalities Price, MSB • How could policy eliminate the deadweight loss? • We could provide a subsidy (called a Pigouvian subsidy) on each unit of home improvement goods demanded S Popt Pmkt Pcons Subsidy MPB Qmkt Qopt MSB Qty home improvements Negative Externalities Price, MSC When the production and consumption of a good creates costs to third parties, that Popt good is said to create Pmkt negative externalities Pfirm to society. MSC MPC Tax D Qopt Qmkt Qty electricity Negative Externalities • We can see that the market over-produces goods that Price, MSC generate negative externalities. In other words, we get too much of a bad thing. • This is inefficient and produces deadweight loss just like price controls and monopoly. This represents additional costs that would not be incurred by society if the socially optimal, not the market, output was produced. MSC MPC Popt Pmkt Tax Pfirm D Qopt Qmkt Qty electricity Negative Externalities - Examples • Smokers ignore the unintended but harmful impact of toxic ‘passive smoking’ on non-smokers • Acid rain from power stations in the UK can damage the forests of Norway • Air pollution from road use and traffic congestion • The social costs of drug and alcohol abuse • External costs of scraping the seabed for supplies of gravel Negative Externalities - Examples • External costs of traveling by taxi • The environment damage caused by the intensive use of fertilizers in agriculture • The external costs of cleaning up from litter and the dropping of chewing gum • The external costs of the miles that food travels from producer to the final consumer Network Externalities A network externality exists when the value to an individual of a good or service depends on how many other people use the same good or service. • When more people use Facebook or Twitter, it becomes more valuable to you. Figure 75.1 In Pursuit of the Efficient Quantity of Pollution Ray and Anderson: Krugman’s Economics for AP, First Edition Copyright © 2011 by Worth Publishers Figure 75.2 Environmental Standards versus Emissions Taxes Ray and Anderson: Krugman’s Economics for AP, First Edition Copyright © 2011 by Worth Publishers Figure 75.3 Positive Externalities and Consumption Ray and Anderson: Krugman’s Economics for AP, First Edition Copyright © 2011 by Worth Publishers Figure 75.4 Negative Externalities and Production Ray and Anderson: Krugman’s Economics for AP, First Edition Copyright © 2011 by Worth Publishers