Market insufficiencies and the government's microeconomic role

advertisement

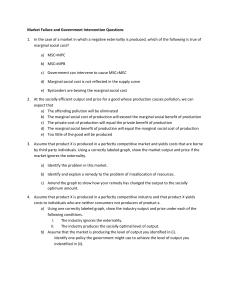

Institute of Economic Theories - University of Miskolc Microeconomics MARKET FAILURES Mónika Kis-Orloczki Assistant lecturer 1 Market failure The ‘invisible hand’ of the marketplace and competition lead profit-seeking producers to offer consumers an efficient variety of goods and services, which are produced at least cost, and in efficient quantities. Efficiency is the market’s great success, and is the reason market economies have been able to improve living standards over time. However, there are also instances of market failure, in which markets do not bring about economic efficiency. market failure Occurs when resources are misallocated or allocated inefficiently. Examples: – Monopoly – Externalities, – Public goods 2 Externality • externality arise when the production or consumption of private goods leads to cost or benefits to third parties, meaning people or businesses who are not party to the transaction. – negative externality - an externality that harms someone. – positive externality – an externality that benefits other. 3 Cost marginal social cost (MSC) The total cost to society of producing an additional unit of a good or service. MSC is equal to the sum of the marginal costs of producing the product and the correctly measured damage costs involved in the process of production (marginal social cost = marginal private cost + marginal external cost). Sample activities with external costs: – Allowing your cell phone to ring in class – Driving a vehicle that emits exhaust gas – Using river water to remove industrial waste – Burning coal to generate electricity 4 Benefit Marginal social benefit is equal to the private marginal benefit a good provides plus any external benefits it creates. In other words, MSB gives the total marginal benefit of the good to society as a whole. (Marginal social benefit = Marginal private benefit + Marginal external benefit) Sample activities with external benefits – Looking your best – Getting immunized against disease 5 MSC P S=MC lB P* Pmkt lC lA D=MU Qefficient Qmarket Q A=Free Market Equilibrium C=Efficient equilibrium which occurs when all costs of production are included. • Without intervention, the free market will produce too much at too low a price (the market does not allocate resources efficiently) • To correct this, the government must tax the good, and use the money to correct the problem or pay those hurt by the negative externality 6 A = free market equilibrium; free maket. produces less than the efficient equilibrium. If all benefits are added in, should be at C (efficient equilibrium). Need a subsidy to correct (internalize) the externality. P S=MC lB lC P* Pmkt lA MSB D=MU Qmarket Qefficient Q 7 Internalizing externalities Policies to control pollution or preserve common property resources require a government. Five approaches have been taken to solving the problem of externalities: 1. 2. 3. 4. government-imposed taxes and subsidies, private bargaining and negotiation, legal rules and procedures, sale or auctioning of rights to impose externalities, and 5. direct government regulation. Taxes, subsidies, legal rules, and public auction are all methods of indirect regulation designed to induce firms and households to weigh the social costs 8 of their actions against their benefits. Industrial CO2 Emissions, 2004 9 The government • might control pollution directly by restricting the amount of pollution that firms may produce • emissions standard • by taxing them for pollution they create. A governmental limit on the amount of air or water pollution • emissions fee – tax on air pollution • effluent charge - tax on discharges into the air • internalize the externality - to bear the cost of the harm that one inflicts on others (or to capture the benefit that one provides to others) 10 Reducing Externalities - Kyoto protocol Oftentimes market failures go beyond the confines of any single country. In these situations, the best solutions often involve international cooperation. It is important to recognize that many countries’ governments have been responsible for the world’s pollution. Kyoto protocol Reached in Kyoto, Japan, in 1997 – required most industrialized nations to reduce CO2emissions by an average of 5.2% below 1990 levels by 2008–2012. To achieve this goal, the United States, Europe, and Japan need to curb their CO2 emissions by 31%, 22%, and 35%, respectively, from the levels that would have been attained in the absence of a reduction policy. – The Bush administration rejected this agreement. – The EU and its Member States ratified the Protocol in May 2002. Of the two conditions, the "55 parties" clause was reached on 23 May 2002 when Iceland ratified the Protocol. The ratification by Russia on 18 November 2004 satisfied the "55%" clause and 11 brought the treaty into force 16 February 2005. Public (social) goods • A private good is a good or service that can be consumed by only one person at a time and only by those people who have bought it or own it. A private good is both rival and excludable. • A public good is a good or service that can be consumed simultaneously by everyone and no one can be excluded from enjoying its benefits. It is both nonrival and nonexcludable. In an unregulated market economy with no government, public goods would at best be produced in insufficient quantity and at worst not produced at all. 12 The characteristics of public goods • nonrival in consumption A characteristic of public goods: One person’s enjoyment of the benefits of a public good does not interfere with another’s consumption of it. • nonexcludable A characteristic of most public goods: Once a good is produced, no one can be excluded from enjoying its benefits. 13 The characteristics of public goods Excludable Non-excludable Rival Private good (pencil, coke) Merit goods Common property (fish in the sea, space on a public beach) Nonrival Club goods (concert, tennis club, cable television) Pure public goods (national defence, clean air mixed goods Goods that have characteristics that are part public and part private. –Common property –Club goods merit goods are those goods and services that the government feels that people left to themselves will under-consume and which therefore ought to be subsidised or provided free at the point of use. Consumption of merit goods is thought to generate positive externality effects where the social benefit from consumption exceeds the private benefit. (health services 14 vaccination, education) Common property resources are nonexcludable, so consumers cannot prevented from using them and are rival, so one person’s use reduces another person’s ability to benefit from the good. These two characteristics lead to an important economic implication: Consumers will have an incentive to overuse the good. Because it’s rival, if a consumer doesn’t use the good, they will lose the opportunity to use it. Club goods a subtype of public goods that are excludable but non-rival, at least until reaching a point where congestion occurs. 15 • free-rider problem Because people can enjoy the benefits of public goods whether they pay for them or not, they are usually unwilling to pay for them. A free rider is a person who enjoys the benefits of a good or service without paying for it. Because of the free-rider problem, the market would provide too small quantity of a public good. To produce the efficient quantity, government action is required. Methods reducing free riding: – – – – social pressure, mergers, compulsion, privatization. • drop-in-the-bucket problem The good or service is usually so costly that its provision generally does not depend on whether or not any single person pays. 16 Optimal level of provision for public goods Government has no choice but to produce pure public goods itself. For impure public goods, it is possible for government to use regulation, or price incentives to guide the marketplace towards efficiency. Government policy alternatives are of three general sorts: – Government can price the good. – Government can produce the good. – Government can regulate the good. Governments can impose taxes and licensing fees to require those who benefit from public goods to pay for them. 17 Optimal provision of public goods • The price mechanism forces people to reveal what they want, and it forces firms to produce only what people are willing to pay for, but it works this way only because exclusion is possible. • For private goods, market demand is the horizontal sum of individual demand curves—we add the different quantities that households consume (as measured on the horizontal axis). • For public goods, market demand is the vertical sum of individual demand curves—we add the different amounts that households are willing to pay to obtain each level of output (as measured on the vertical 18 axis). At the optimal level, society’s total willingness to pay per unit is equal to the marginal cost of producing the good. 19