CHAPTER 8

advertisement

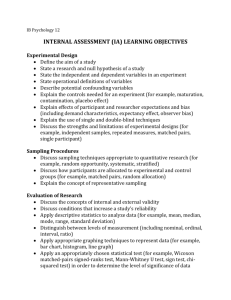

AUDITING CHAPTER 9 Audit Sampling By David N. Ricchiute TOPICS Use of sampling in audit engagements Role of sampling, nonsampling risk Risk of assessing control risk too high, too low Risks of incorrect rejection, acceptance Distinction between statistical, nonstatistical sampling Audit sampling for tests of controls and substantive tests of details 2 Attribute estimation, sequential sampling Probability-proportional-to-size (PPS) GBW 8th ed., Ch. 9 SAMPLING: Definitions Sampling: examining less than 100% of items in a population Population: all items within a class of transactions Sampling plan: procedures to test a sample Attributes sampling: tests rate of deviation from a prescribed control procedure Variables sampling: tests whether recorded account balances are fairly stated 3 GBW 8th ed., Ch. 9 AUDIT RISK Risk that auditor may unknowingly fail to modify opinion on materially misstated financial statements 2 parts Risk that errors will occur: uncontrollable Inherent risk & control risk Risk that material errors will not be detected: controllable Detection risk 4 GBW 8th ed., Ch. 9 UNCERTAINTIES Sampling risk Risk that sample may contain disproportionately more/less error than exists in population Nonsampling risk 5 Aspects of audit risk not attributable to sampling such as human error GBW 8th ed., Ch. 9 CONTROL RISK ASSESSMENT: Too High Inefficient Assessing control risk at maximum when it should be lower Concluding control not effective when it is 6 GBW 8th ed., Ch. 9 CONTROL RISK ASSESSMENT: Too Low Ineffective Lowering control risk when should be set at maximum Concluding control is effective when it isn’t 7 GBW 8th ed., Ch. 9 STATISTICAL SAMPLING Apply the laws of probability to Design efficient sample Measure sufficiency of sample Evaluate sample results Measures sampling risk quantitatively 8 GBW 8th ed., Ch. 9 NONSTATISTICAL SAMPLING Relies exclusively on judgment to Determine sample size Evaluate sample results Cannot measure sampling risk quantitatively 9 GBW 8th ed., Ch. 9 (NON)STATISTICAL SAMPLING CHOICE Choice based on relative costs & benefits Independent of audit procedures 10 GBW 8th ed., Ch. 9 ATTRIBUTES & DEVIATIONS Attribute A characteristic of control Deviation 11 Absence of the attribute GBW 8th ed., Ch. 9 ATTRIBUTE ESTIMATION SAMPLING Used to test controls that leave an audit trail 1 Determine objectives, attributes, deviation conditions 2 Define population 3 Define sample size 4 Perform sampling plan 5 Evaluate sample results 12 GBW 8th ed., Ch. 9 ATTRIBUTE ESTIMATION SAMPLING: Objectives Whether controls for class of transactions sufficiently effective to lower control risk below maximum 13 Trail of observable & documented evidence Does not rely primarily on segregation of duties GBW 8th ed., Ch. 9 ATTRIBUTE ESTIMATION SAMPLING: Sample Size Sample size components Acceptable risk of assessing control risk too low Inverse relationship with sample size Tolerable rate of deviation Maximum population rate of deviation from control Expected population deviation rate Estimated from prior year or pilot sample 14 GBW 8th ed., Ch. 9 SAMPLE SELECTION METHODS A Random-number sampling B Systematic sampling C Block sampling D Haphazard sampling E Stratified 15 GBW 8th ed., Ch. 9 SAMPLE SELECTION METHODS: Random Number Uses computer-generated numbers to select sampling units Match number to prenumbered documents Appropriate for both statistical & nonstatistical sampling 16 GBW 8th ed., Ch. 9 SAMPLE SELECTION METHODS: Systematic Sampling Selecting every nth item from population of sequentially ordered items Useful when identification numbers lacking Appropriate for both statistical & nonstatistical sampling 17 GBW 8th ed., Ch. 9 SAMPLE SELECTION METHODS: Block Sampling A group of items arranged contiguously within a larger grouping Inefficient & not generalizable Should not be used for statistical or nonstatistical sampling without care in controlling sampling risk 18 GBW 8th ed., Ch. 9 SAMPLE SELECTION METHODS: Haphazard Sampling Sampling units selected without special reason or conscious bias Inappropriate for statistical sampling Useful for nonstatistical sampling 19 GBW 8th ed., Ch. 9 SAMPLE SELECTION METHODS: Stratified Sampling Subdivide population into homogeneous strata Select separate sample for each strata by one of prior methods 20 GBW 8th ed., Ch. 9 OTHER TECHNIQUES: Sequential Sampling Stop-or-go 21 Performed in stages Auditor decides to stop or continue sampling after each stage GBW 8th ed., Ch. 9 OTHER TECHNIQUES: Nonstatistical Sampling Used when costs outweigh benefits of statistical sampling Auditor judgment guided by 22 Experience Prior knowledge Current information GBW 8th ed., Ch. 9 SUBSTANTIVE SAMPLING RISK: 2 Sources Risk of incorrect rejection Risk that audit sample suggests account balance is materially misstated when it is fairly stated Risk of incorrect acceptance 23 Risk that sample suggests account balance is fairly stated when it is materially misstated GBW 8th ed., Ch. 9 VARIABLES SAMPLING PLAN Determine objectives of test Define population Choose sampling technique Determine sample size Determine method of sample selection Perform sampling plan Evaluate sample results 24 GBW 8th ed., Ch. 9 OBJECTIVES OF TEST To estimate account balance that is not recorded To test reasonableness of recorded account balance 25 GBW 8th ed., Ch. 9 DEFINING POPULATION Audit population All items constituting an account balance or class of transactions defined by auditor’s characteristic of interest Sampling unit 26 Any individual elements of a population GBW 8th ed., Ch. 9 AUDIT SAMPLING Sampling used only for those accounts where it is appropriate When large number transactions within one account Techniques 27 Probability proportional to size (PPS) Nonstatistical sampling Classical variables sampling (appendix) GBW 8th ed., Ch. 9 SAMPLING DECISIONS Choice between statistical & nonstatistical sampling based on 28 Costs Effectiveness Need for quantitative estimate of sampling risk GBW 8th ed., Ch. 9 PROBABILITY-PROPORTIONALTO-SIZE (PPS) Derived from attributes sampling theory Appropriate when 1 or a few errors expected Characteristics Automatically stratifies an audit population Appropriate for testing for overstatement Useful for testing assets & revenues 29 GBW 8th ed., Ch. 9 PPS An Example Define population for accounts receivable All customer debit balances testing overstatement or All customer balances, including 0 & negative Requires special consideration Dollar is sample unit 30 GBW 8th ed., Ch. 9 PPS SAMPLE SIZE ELEMENTS Determine Reliability factor for overstatement errors based on Expected number overstatement errors Risk of incorrect acceptance 31 Tolerable (acceptable) error Anticipated error & expansion factor GBW 8th ed., Ch. 9 PPS SAMPLE SIZE MODEL n= RF x B TE – (AE x EF) where RF – reliability factor (from table) B – book value (from client) TE – tolerable error (auditor judgment) AE – anticipated error (auditor judgment) EF – expansion factor (from table) 32 GBW 8th ed., Ch. 9 PPS SAMPLE SELECTION Used for statistical sampling methods 33 Random number Systematic sampling GBW 8th ed., Ch. 9 EVALUATING RESULTS: PPS Decision Rule If the upper error limit is less than or equal to the tolerable error, the account is fairly presented 34 GBW 8th ed., Ch. 9 NONSTATISTICAL SAMPLING Used when No apparent need to quantify sampling risk Cost of statistical sampling exceeds benefits Cost to select sampling units exceeds benefits 35 GBW 8th ed., Ch. 9 SAMPLE SIZE IN NONSTATISTICAL SAMPLING Requires Degree audit assurance Substantial, moderate, little 36 Assurance factor Estimated tolerable error GBW 8th ed., Ch. 9 EVALUATING SAMPLE RESULTS When likely error is estimated, auditor has 4 choices 37 Accept client’s book value Propose audit adjustment Perform additional substantives tests Request client to revalue entire population GBW 8th ed., Ch. 9