16

35

Extending the Analysis of Aggregate

Supply

McGraw-Hill/Irwin

Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

From Short Run to Long Run

• Short run

• Wages and other input prices don’t

•

LO1

change.

• Upsloping aggregate supply

Long run

• Wages and other input prices fully

flexible

• Vertical aggregate supply.

35-2

From Short Run to Long Run

• Production above potential output:

• Price level increases.

• Nominal wages eventually rise to

maintain real wages (purchasing power).

• Other input prices rise

• Short run aggregate supply shifts left

because costs are higher.

• Return to potential output at a higher

price level.

LO1

35-3

Extended AD-AS Model

Increased Demand -- Short

Long Run

Price Level

LRAS

b

P2

P1

AS1

a

AD2

AD1

Qf Q2

Real Domestic Output

LO2

35-4

Perfectly Competitive Firm in Long-run Equilibrium

Price ($)

MC

Pe

D = P = MR

Qe

Q2

QUANTITY

Extended AD-AS Model

Increased Demand -- Short

Long Run

Price Level

LRAS AS2 AS

1

P3

c

b

P2

P1

a

AD2

AD1

Qf Q2

Real Domestic Output

LO2

35-6

Extended AD-AS Model

Long Run

Run

Decreased Demand - Short

Price Level

LRAS AS1

a

P1

P2

AS2

b

AD1

AD2

Q1 Qf

Real Domestic Output

LO2

35-9

Perfectly Competitive Firm in Long-run Equilibrium

Price ($)

MC

Pe

D = P = MR

Q2

Qe

QUANTITY

Extended AD-AS Model

Long Run

Run

Decreased Demand - Short

Price Level

LRAS AS1

a

P1

P2

P3

AS2

b

c

AD1

AD2

Q1 Qf

Real Domestic Output

LO2

35-11

From Short Run to Long Run

So what is it about full employment that

keeps bringing everything back here?

Price Level

ASLR

AS1

a

P1

AD1

Qf

Real Domestic Output

LO1

35-12

From Short Run to Long Run

It’s the level of employment at which there is neither

upward nor downward pressure on wages and input

prices.

Price Level

ASLR

AS1

a

P1

AD1

Qf

Real Domestic Output

LO1

35-13

Extended AD-AS Model

Demand-Pull Inflation

Price Level

ASLR

P3

AS1

c

b

P2

P1

AS2

a

AD2

AD1

Qf Q2

Real Domestic Output

LO2

35-14

Extended AD-AS Model

Cost-Push Inflation

Price Level

ASLR

AS1

c

P3

P2

AS2

b

a

P1

AD2

AD1

Q2 Q f

Real Domestic Output

LO2

35-15

Extended AD-AS Model

Recession

Price Level

ASLR

P3

AS2

a

P1

P2

AS1

b

c

AD1

AD2

Q1 Qf

Real Domestic Output

LO2

35-16

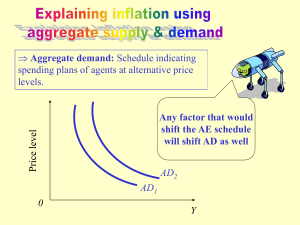

Inflation and Unemployment

• Low inflation and unemployment

• Fed’s two major goals

• Compatible or conflicting?

• Short-run tradeoff between inflation

•

•

LO3

and unemployment

Supply shocks cause both rates to

rise

No long-run tradeoff

35-20

The Phillips Curve

• Demonstrates short-run tradeoff between

inflation and unemployment

Concept

Empirical Data

7

6

5

4

3

2

1

0

0

1

2

3

4

5

6

Unemployment Rate (Percent)

LO3

7

Annual Rate of Inflation (Percent)

Annual Rate of Inflation (Percent)

Data for the 1960s

7

69

6

5

68

4

66

67

3

65

2

1

64

63

62

61

0

0

1

2

3

4

5

6

7

Unemployment Rate (Percent)

35-22

The Phillips Curve

Annual rate of inflation (percent)

14

13

12

11

10

9

8

7

6

5

4

3

2

1

Unemployment rate (percent)

LO4

35-23

The Long-Run Phillips Curve

PCLR

Annual Rate of Inflation (Percent)

15

PC3

12

b3

PC2

9

a3

b2

PC1

6

c3

a1

c2

b1

3

0

a2

3

4

5

6

Unemployment Rate (Percent)

LO4

35-24

The Phillips Curve

• No long-run tradeoff between inflation

and unemployment

• Short-run Phillips curve

• Role of expected inflation

• Long-run vertical Phillips curve

• Disinflation

LO4

35-26