You are an officer – NOW WHAT??

advertisement

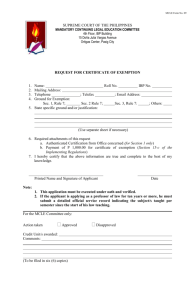

Booster Clubs PTA Class of 2009 You are an officer – NOW WHAT ?? Three Primary Responsibilities 1. Pay close attention to what’s going on and make decisions based on good information. Three Primary Responsibilities 2. Put the welfare of the organization above other interests when making decisions. Three Primary Responsibilities 3. Act in accordance with the mission and goals of the nonprofit organization. Steps to secure nonprofit status A purpose A name Officers Form of organization Governing documents Form of organization Nonprofit association Nonprofit corporation Seek competent legal advice to make this decision. Governing Documents Nonprofit association Nonprofit corporation Articles of incorporation Bylaws Seek competent legal advice. Steps to secure nonprofit status Federal Tax Identification Number IRS Application for exemption State Application for exemption Sales tax permit Federal Tax Id Number Form SS – 4 www.IRS.gov Can be filed Online Telephone Fax Mail IRS Application for exemption Form 1023 within 27 months Filing fee $300 if <$10,000 $750 if >$10,000 Publication 557 Seek competent tax advice IRS Application for exemption Public disclosure requirements Form 1023, and All supporting documents Any letter or document issued by the IRS with regard to the application IRS Application for exemption Already exempt and need a verification letter? (877) 829-5500 or write to Internal Revenue Service EO Customer Account Services P.O. Box 2508 Cincinnati, OH 45201 Texas Application for exemption PTA No application form Texas Application for exemption PTA Affiliated with state association? Yes – Send Letter from state association acknowledging affiliation Cover letter requesting exemption Texas Application for exemption PTA Affiliated with state association? NO – Send Cover letter requesting exemption Statement of operation as NPO Schedule of activities Texas Application for exemption Other PTOs No application form Send Cover letter requesting exemption Statement of operation as NPO Schedule of activities Texas Application for exemption Booster Clubs First - MUST have federal tax exemption Then - submit AP-204 with copy of federal determination letter Additional documentation listed on AP-204 Sales Tax Rules Texas Administrative Code Title 34: PUBLIC FINANCE Part 1: COMPTROLLER OF PUBLIC ACCOUNTS Chapter 3: TAX ADMINISTRATION Subchapter O: STATE SALES AND USE TAX Sales Tax Rules Rule § 3.322 Exempt from sales and use tax on purchases for the organization’s own use Sales Tax Rules Rule § 3.316 NOT exempt from collection and remittance of sales tax on items sold Exceptions: Rule §3.316 Meals and food products Annual banquets or suppers NOT professionally catered Amusement services Membership dues Publications Exceptions: Rule §3.316 Auctions, Rummage Sales and Other Fund Raisers: Exempts occasional sales by persons not in the business of selling, leasing or renting Exceptions: Rule §3.316 Auctions, Rummage Sales and Other Fund Raisers: Allows for two (2) ONE DAY sales during any 12 month period One day sale is literally 24 hours. A two day sale uses both of the allowed annual one day sales. Exceptions: Rule §3.316 Fund raiser in which items are sold over a period of several days or weeks Exempt if there is ONE collection date for turning money in. Qualifies as one of the two allowed annual one day sales. Exceptions: Rule §3.316 VERY IMPORTANT that there only be one collection date for turning the money in or the entire fund raiser becomes subject to sales tax! Sales Tax Rules Already exempt and need a verification letter? Exempt Organization Search: http://window.state.tx.us/taxinfo/exe mpt/xmptsearch.html Request for Verification online: http://www.window.state.tx.us/taxinfo /exempt/xmpt_ltr_req.html Sales Tax Rules Application for Resale Certificate AP-201 http://window.state.tx.us/taxinfo/ta xforms/ap-201.pdf Annual Federal Reporting Form 990-EZ or Form 990 Not required if annual GROSS RECIEPTS < $25,000 If filed, must be available for public inspection Form 990-EZ Annual Gross receipts <$100,000 AND Total assets <$250,000 Seek competent tax advice Form 990 Annual Gross receipts >$100,000 OR Total assets >$250,000 Seek competent tax advice Form 990-T Annual Gross income from unrelated trade or business >$1,000 Seek competent tax advice Loss of Exemption Public disclosure requirements Form 1023 Form 990-EZ, 990, 990-T Can charge for copies for 1st page .15 for each additional page $1 Loss of Exemption Political activity Excess benefit Private inurement Intermediate sanctions Loss of Exemption Prevention: Adequate books and records Policies and procedures Continuing accountant or lawyer Accounting Adequate books and records Board meeting minutes Check register Reconciled bank statements Income records Chart of Accounts 1 2 3 4 5 Assets – what you own Liabilities – what you owe Fund Balance – what’s left Income Expenses Policies and Procedures Internal controls Board meetings & minutes Reporting requirements Separation of duties Training of new officers Continuing accountant or lawyer Software When do I need it? Reporting 990 Recommendations QuickBooks