Cost Terminology and Concepts

advertisement

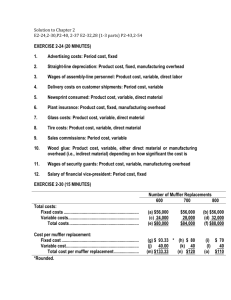

Cost Terminology and Concepts Basic Cost Terminology • Cost – resource sacrificed to achieve a specific objective • Actual cost – a cost that has occurred • Budgeted cost – a predicted cost • Cost object – anything of interest for which a cost is desired Manufacturing Costs Direct Labor Direct Material The Product Manufacturing Overhead Further Classification of Labor Costs Idle Time Treated as manufacturing overhead cost Overtime Premium of Factory Workers Treated as manufacturing overhead cost Labor Fringe Benefits Treated as manufacturing overhead or direct labor Classifications of Costs in Manufacturing Companies Manufacturing costs are often combined as follows: Direct Material Direct Labor Prime Cost Manufacturing Overhead Conversion Cost Nonmanufacturing Costs Marketing and Selling Cost Administrative Cost R&D Costs necessary to get the order and deliver the product. All executive, organizational, and clerical costs. Manufacturing Cost Flows Costs Material Purchases Direct Labor Balance Sheet Inventories Raw Material Work in Process Manufacturing Overhead Finished Goods Selling and Administrative Income Statement Expenses Period Expenses Cost of Goods Sold Selling and Administrative Product Costs Versus Period Costs Product costs include direct materials, direct labor, and manufacturing overhead. Cost of Good Sold Inventory Period costs are not included in product costs. They are expensed on the income statement. Expense Sale Balance Sheet Income Statement Income Statement Balance Sheet Merchandiser Current assets – – – – Cash Receivables Prepaid expenses Merchandise inventory Manufacturer Current Assets Cash Receivables Prepaid Expenses Inventories Raw Materials Work in Process Finished Goods The Income Statement Cost of goods sold for manufacturers differs only slightly from cost of goods sold for merchandisers. Merchandising Company Cost of goods sold: Beg. merchandise inventory $ 14,200 + Purchases 234,150 Goods available for sale $ 248,350 - Ending merchandise inventory (12,100) = Cost of goods sold $ 236,250 Manufacturing Company Cost of goods sold: Beg. finished goods inv. $ 200 + Cost of goods manufactured 415,000 Goods available for sale $ 415,200 - Ending finished goods inventory (190) = Cost of goods sold $ 415,010 Schedule of Cost of Goods Manufactured Comet Computer Corporation Schedule of Cost of Goods Manufactured Raw material used $ 134,980 50,000 230,000 Direct labor Total manufacturing overhead Total manufacturing costs Add: Work-in-process inventory, January 1 $ 414,980 120 Subtotal Deduct: Work-in-process inventory, December 31 $ 415,100 100 Cost of goods manufactured $ 415,000 Computation of Cost of Raw Material Used Schedule of Cost of Goods Manufactured Raw-material inventory, January 1 Add: Purchases of raw materials $ Raw material available for use Deduct: Raw material inventory, December 31 Raw material used Comet Computer Corporation 6,000 134,000 140,000 5,020 $ 134,980 Schedule of Cost of Goods Manufactured Raw material used $ 134,980 50,000 230,000 Direct labor Total manufacturing overhead Total manufacturing costs Add: Work-in-process inventory, January 1 $ 414,980 120 Subtotal Deduct: Work-in-process inventory, December 31 $ 415,100 100 Cost of goods manufactured $ 415,000 Schedule of Cost of Goods Manufactured Computation of Total Manufacturing Overhead Indirect material $ 10,000 Indirect labor 40,000 Depreciation on factory 90,000 Depreciation on equipment 70,000 Utilities 15,000 Comet Computer Corporation Insuranceof Cost of Goods Manufactured 5,000 Schedule Total manufacturing overhead $ 230,000 Raw material used $ 134,980 50,000 230,000 Direct labor Total manufacturing overhead Total manufacturing costs Add: Work-in-process inventory, January 1 $ 414,980 120 Subtotal Deduct: Work-in-process inventory, December 31 $ 415,100 100 Cost of goods manufactured $ 415,000 Income Statement for a Manufacturer Comet Computer Corporation Income Statement For the Year Ended December 31, 20X2 Sales revenue Less: Cost of goods sold $ 700,000 415,010 Gross margin Selling and administrative expenses $ 284,990 174,490 Income before taxes Income tax expense $ 110,500 30,000 Net income $ 80,500 Income Statement for a Manufacturer Comet Computer Corporation Schedule of Cost of Goods Sold For the Year Ended December 31, 20X2 Finished-goods inventory, Jan. 1 Add: Cost of goods manufactured $ Cost of goods available for sale Comet Computer Corporation Deduct Finished-goods inventory, Dec. 31 200 415,000 415,200 190 Income Statement $ 415,010 For the Year Ended December 31, 20X2 Cost of goods sold Sales revenue Less: Cost of goods sold $ 700,000 415,010 Gross margin Selling and administrative expenses $ 284,990 174,490 Income before taxes Income tax expense $ 110,500 30,000 Net income $ 80,500 Cost Behavior • Variable costs – changes in total in proportion to changes in the related level of activity or volume • Fixed costs – remain unchanged in total regardless of changes in the related level of activity or volume Cost Classifications Activities that cause costs to be incurred are called cost drivers. Variable Costs $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 Unit Variable Cost Graph Cost per Unit Total Costs Total Variable Cost Graph $20 $15 $10 $5 0 10 20 30 Units Produced (000) 0 10 20 30 Units Produced (000) Units Produced 5,000 10,000 15,000 20,000 25,000 30,000 Total Cost Cost per Unit $ 50,000 $10 100,000 10 150,000 10 200,000 10 250,000 10 300,000 10 Fixed Costs $150,000 $125,000 $100,000 $75,000 $50,000 $25,000 Unit Fixed Cost Graph Cost per Unit Total Costs Total Fixed Cost Graph $1.50 $1.25 $1.00 $.75 $.50 $.25 0 100 200 300 Units Produced (000) 0 100 200 300 Units Produced (000) Units Produced Total Cost Cost per Unit 50,000 $75,000 $1.500 100,000 75,000 .750 150,000 75,000 .500 200,000 75,000 .375 250,000 75,000 .300 300,000 75,000 .250 Types of Fixed Costs Committed Discretionary Long-term, cannot be significantly reduced in the short term. May be altered in the short-term by current managerial decisions Examples Examples Depreciation on Equipment and Real Estate Taxes Advertising and Research and Development A Cost Caveat • Unit costs should be used cautiously • Unit costs change with a different level of volume (activity) – Unit costs that include fixed costs should always reference the given level of activity – Unit Costs are also called Average Costs Cost Behavior Patterns Example Bicycles by the Sea incurs variable costs of $52 for each of its bicycles. Bicycles by the Sea also incurs $94,500 in fixed costs per year Use Unit Costs Cautiously What is the unit cost when Bicycles assembles 1,000 bicycles in a year? Use Unit Costs Cautiously Assume that Bicycles management uses a unit cost of $146.50 Management is budgeting costs for different levels of production. What is their budgeted cost for an estimated production of 600 bicycles? 600 × $146.50 = $87,900? Use Unit Costs Cautiously What is their budgeted cost for an estimated production of 3,500 bicycles? 3,500 × $146.50 = $512,750? Summary of Variable and Fixed Cost Behavior Cost In Total Per Unit Variable Total variable cost changes as activity level changes. Variable cost per unit remains the same over wide ranges of activity. Total fixed cost remains the same even when the activity level changes. Fixed cost per unit goes down as activity level goes up. Fixed Assigning Costs to Cost Objects Direct costs Indirect costs • Costs that cannot be • Costs that can be easily and conveniently easily and conveniently traced to a unit of traced to a unit of product or other cost product or other cost object. object. • Examples: direct material and direct labor • Example: manufacturing overhead Determining Product Costs Manufacturing overhead (OH) Applied to product using a predetermined rate Direct materials Product Direct labor BMW: Assigning Costs to a Cost Object Direct or Indirect? Consider a supervisor’s salary in the canning department of Campbell Soup Company. If the cost object is the department, the supervisor’s salary is a direct cost. If the cost object is a can of soup (the “product” of the company), the supervisor’s salary is an indirect cost. Differential Cost and Revenue Costs and revenues that differ among alternatives. Example: You have a job paying $1,500 per month in your hometown. You have a job offer in a neighboring city that pays $2,000 per month. The commuting cost to the city is $300 per month. Differential revenue is: $2,000 – $1,500 = $500 Differential cost is: $300 Controllable and Uncontrollable Costs A cost that can be significantly influenced by a manager is a controllable cost. Cost item Manager Classificaton Cost of food used Restaurant in a restaurant manager Controllable Cost of national advertising by a restaurant chain Uncontrollable Restaurant manager Opportunity Cost The potential benefit that is given up when one alternative is selected over another. – Example: If you were not attending college, you could be earning $20,000 per year. Your opportunity cost of attending college for one year is $20,000. Sunk Costs All costs incurred in the past that cannot be changed by any decision made now or in the future. Sunk costs should not be considered in decisions. – Example: You bought an automobile that cost $12,000 two years ago. The $12,000 cost is sunk because whether you drive it, park it, trade it, or sell it, you cannot change the $12,000 cost. Marginal Costs and Average Costs The extra cost incurred to produce one additional unit. The total cost to produce a quantity divided by the quantity produced. Marginal and average costs are largely a function of cost behavior -- variable and fixed costs. Additional Cost Terminology • Variable Costs – costs that change in total in relation to some chosen activity or output • Fixed Costs – costs that do not change in total in relation to some chosen activity or output • Mixed Costs – costs that have both fixed and variable components; also called semivariable costs Mixed Costs A mixed cost has both fixed and variable components. Consider the example of renting a car. Total Cost Y Variable Cost per Mile X Activity (Miles Driven) Fixed Charge Mixed Costs The total mixed cost line can be expressed as an equation: Y = a + bX Where: Total Cost Y Y = the total mixed cost a = the total fixed cost (the vertical intercept of the line) b = the variable cost per unit of activity (the slope of the line) X = the level of activity Variable Cost per Mile X Activity (Miles Driven) Fixed Charge Mixed Costs Example If your fixed daily rental charge is $40, your variable cost is $0.20 per mile, and your activity level is 100 miles, what is the amount of your rental cost? Y = a + bX Y = $40 + ($0.20 × 100) Y = $60