Global Trends

advertisement

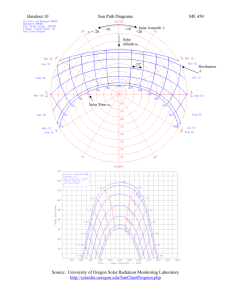

Policies, Dynamics & Trends That are Shaping Today’s Solar Industry CTF Solar Subgroup April 5, 2010 1 Government Policies - Dave Government Policies Update • US Programs • Copenhagen • Global trends PV Technology & Roadmap US Market Dynamics • Status & Trends • VCs & Funding Key Countries • Germany • Spain • China • India Career Options • Solar Subgroup landings Summary & coordinator Dave Fraser Dinah Cheng Paritosh Rajora Wen-Ben Chou Ranjeet Pancholy Dinah Cheng Ravinder Sachdeva Ranjeet Pancholy Mike Hsieh Ranjeet Pancholy Steve Campbell Keith Imai Keith Imai 2 Global Solar Power Map 5-7 hours of peak sunlight in California 3 US Government Incentives Federal • Income Tax Credit and Depreciation State Programs • Retrofit Construction • New Construction • Affordable Housing Local Incentives and Financing • San Francisco, Berkeley, Sonoma Source PG&E Webinar: PV Financial Analysis 4 California Incentives CSI – California Solar Initiative • Retrofit residential and non-residential • New construction non-residential • Incentives designed to decline over time NSHP - New Solar Homes Partnership • New residential homes only • Builders, developers, custom homeowners Source PG&E Webinar: PV Financial Analysis 5 California Incentives (cont.) MASH and SASH • Multifamily Affordable Solar Homes • Single Family Affordable Solar Homes • Designed to encourage adoption for low income housing residents Over $1B in these programs! Solar feed in tariff coming soon Source PG&E Webinar: PV Financial Analysis 6 Making Solar Affordable “Energy Conservation First” strategy Energy Audits Retrofit projects Smart Meters + home management systems Government + PG+E incentives for conservation with rebates and tax credits 7 2009 Copenhagen Mission Set new agreement to extend the Kyoto Protocol beyond 2012 GHG Emissions Control 1. Ambitious emission targets for developed countries 2. Appropriate mitigation actions of developing countries 3. Financial and technological support for both adaptation and mitigation 4. Effective institutional framework with governance structures to address the needs of developing countries 8 Pre-conference Announcements from the Top Four Emitters China • Cut CO2 emission intensity (CO2 per GDP) by 40%-45% from 2005 level US • Cut GHG emissions by ~17% below 2005 levels by 2020 • EPA rule that CO2 and other GHG as a toxic gas • Allows regulation of planet-warming gases without legislation in Congress Indonesia • Reduce annual carbon emission by 5% and preserving the Kampar peninsula Brazil • Reduce >36% of carbon emissions by 2020 9 2009 Copenhagen Accord Drafted by US, China, India, Brazil, & South Africa Judged a "meaningful agreement" by US Non-legally binding commitments Not passed unanimously • Opposed by many countries and NGO Recognized that climate change is one of the greatest challenges…actions needed to keep global temperature increases to below 2°C 10 Global Government Policies 64 countries have some type of policy to promote renewable power generation Feed-in tariffs are most widely used policy • 45 countries • Adopted first time: South Africa, Philippines, Ukraine, Poland, Kenya • Engaged in developing Feed-in-policies: UK, Japan, Israel, Egypt, Nigeria 11 Global Trends Common revisions to Feed-in laws • • • • • Extending feed-in periods Modifying tariff levels Establishing or removing annual caps Adding eligibility for micro-generation Modifying administrative procedures Solar heaters getting attention • New subsidies, tax incentives, loan programs 12 Grid Parity vs. Countries Parity • PV ≈ Fossil Fuels (cost per unit) • PV makes sense Countries in order of Grid Parity (Higher the rank - PV easier to justify ) Italy Israel Spain, Japan, Germany Worldwide fossil fuel subsidies per year: ~$190B Vs. Total renewable subsidies: $10B (incl. PV) California, France, UK, Greece Australia, USA China, India Less Parity • PV cost >> Fossil Fuels Canada • PV much more expensive • Harder to justify Russia Countries which heavily subsidize Fossil Fuel! 13 Global Incentives Top Financial Incentives Countries: (Feed-in-Tariffs, Tax Incentives, Loan Programs) Top Regulatory Incentives Countries: (Easing admin. procedures, easing eligibility, removing annual caps) Germany Greece France Italy California Greece Australia, UK, Spain, France California Germany, India Italy China USA USA 14 PV Technology & US Market - Srikanth Government Policies Update • US Programs • Copenhagen • Global trends PV Technology & Roadmap US Market Dynamics • Status & Trends • VCs & Funding Key Countries • Germany • Spain • China • India Career Options • Solar Subgroup landings Summary & coordinator Dave Fraser Dinah Cheng Paritosh Rajora Wen-Ben Chou Ranjeet Pancholy Dinah Cheng Ravinder Sachdeva Ranjeet Pancholy Mike Hsieh Ranjeet Pancholy Steve Campbell Keith Imai Keith Imai 15 PV Efficiency Roadmap 16 Technology Challenges Bulk Si Solar Cells Contact Resistance Shadowing Shallow Emitter Si usage <3g/W ARC improvements Low loss Packaging Recombination Control Lower Shadowing Loss Yield Improvement 2015 goal production cost $1/W Adapted from Management Report NREL/MP-520-41733 June 2007 Reliability Improvement MPP Tracking 17 Technology Challenges Thin Film Photovoltaics High rate deposition - 20-30 um/hr for 1um thickness Reduced light induced instability 2-3% efficiency loss Lower interconnect and TCO resistance Improved packaging reliability for 1%/ power loss per year Roll-Roll manufacturing Maximum Power Point Tracking 2015 goal production cost $0.4-0.7/W Adapted from http://www.solarthinfilms.com/active/en/home/photovoltaics/ 18 Technology Challenges Concentrator Photovoltaics - Terrestrial Junction Temperature Control!! Demonstrate 20 year life for “realworld” conditions 500X concentration to 3000X concentration Multi-junction cells/III-V for spectral efficiency MPPT and sun tracking 2015 goal installed cost $2/W http://www.emcore.com/solar_photovoltaics/terrestrial_concentrator_photovoltaic_a19 rrays Policy Requirements 2010 - 2020 Long term utility targets and supporting policies • Builds confidence for investment in manufacturing capacity and deployment of utility scale PV systems Implement incentive schemes and low cost financing • Catalyses consumer market creation • Incentives will be transitional and decrease over time Increase R&D funding to sustain technology roadmap • Reduces production and ramp-up costs • Supports longer term technology breakthroughs 20 US PV Status & Trends US and State incentives accelerated in 2009 • Installed capacity growth 64% • Cost Parity still not viable Manufacturing cost reductions - steep price declines • Acceleration of cost reduction plans “Holy Grail” cell prices of $1 /W may be reached in 2010 Module Prices Drop 38% in 2009 to $2.50 /W • Expected to Drop 20% in 2010 to $2 /W Good job opportunities for the next several years! 21 Source : Solid solar.com Web site US PV Energy Status US PV Grid Connected PV demand Grows Largest PV demand states • California • Arizona, New Jersey, New Mexico, New York, Nevada and Colorado Significant growth • 2009 - 544 MW • 2010 - 650 MW (est.) • 2012 - 1500-2000 MW (est.) World leader by 2012 California • Bigger than Spain or Germany 22 2012 PV Cell & Module Manufacturing Est. Market Share • Crystalline 35% • Thin Films 65% Thin Film Breakdown • CdTe 18% • Amorphous Si 24% • CIGS 22% Estimated annualized growth rate of 50% & 45% respectively from 2008 to 2012 23 Top 20 US PV Plants Top 20 US PV Projects Top 5 US plants • • • • • Nellis AFB, AZ El Dorado, NV Alamosa, CO Springville, AZ Rancho Seco, CA Name Location State 14 Ground NV 2007 12.6 Ground NV 2008 Alamosa 8.2 Ground CO 2007 Springerville Generating Station 4.6 Ground AZ 2001-2004 Rancho Seco Power Plant 3.9 Ground CA 1984-2000 Prescott Airport 3.5 Ground AZ 2001-2005 Hall's Warehouse Corp. Solar Project 3.2 Roof NJ 2009 Ground PA 2008 Nellis AFB 14 MW 13 MW 8 MW 5 MW 4 MW El Dorado PV Plant Exelon-Epuron Solar Energy Center MW 3 Date Atlantic City Conv. & Visitors Auth. 2.4 Roof NJ 2008 Toyota North America Parts Center 2.3 Roof CA 2008 Applied Materials Corporation 2.1 Roof CA 2008 Prologis Solar System 2.4 Roof CA 2008 9 California plants in top 20 Denver International Airport 2 Ground CO 2008 Fresno Yosemite Int. Airport 2 Ground CA 2008 TESCO Riverside 2 Roof CA 2008 Fort Carson 2 Ground CO 2007 South San Joaquin Irrigation Dist. 1.9 Ground CA 2008 Bolthouse Farms 1.9 Ground CA 2008 Continuum Lakewood Dev. Co. 1.8 Roof CO Google Headquarters 1.6 Roof CA 242008 2007 US Solar System Cost Competitiveness Small Systems $/W Silicon $/Kg Wafers $/W C- Si Modules $/W Ref: iSuppli Report 2009 C –Si Cells $/W 25 The VC’s Most active NEA CMEA Khosla Ventures Kleiner Perkins NGEN Partners DFJ Foundation Capital Quercus Trust Others Google Ventures, Foundation Capital Northgate Capital Argonaut Private Equity Exxon Sequoia Capital Foundation Capital Fjord Capital Mesirow Capital 2009 Funding trends • Middle stage rounds saw difficulty for less-than-profitable companies • Increase in early stage (>110 deals) series A & seed rounds 26 2009 VC Funding $4.9B in green technologies • Down from $7.6B • 356 deals Solar power is leading at $1.4B in 84 deals • Followed by biofuels at $976M in 44 rounds Greentech Media Inc. 27 2009 VC Funding Top Deals Silver Spring Network - $100M Solyndra - $198M Tesla Motors - $83M Suniva $75M C round Serious Materials - $60M Greentech Media Inc. 28 Key Countries & Careers Paritosh Government Policies Update • US Programs • Copenhagen • Global trends PV Technology & Roadmap US Market Dynamics • Status & Trends • VCs & Funding Key Countries • Germany • Spain • China • India Career Options • Solar Subgroup landings Summary & coordinator Dave Fraser Dinah Cheng Paritosh Rajora Wen-Ben Chou Ranjeet Pancholy Dinah Cheng Ravinder Sachdeva Ranjeet Pancholy Mike Hsieh Ranjeet Pancholy Steve Campbell Keith Imai Keith Imai 29 German Government to Lower Subsidies Subsidies for mature technology likely to decrease by mid 2010 Coalition suggests drastic cut by 30% in Feed-in-tariffs Four different models for subsidy reduction • • • • BSW (German Solar Business Association) suggests 3-5% Solar World: Systems >1500MW, 1% reduction every 200mW Sunpower suggested 1% reduction every 300MW 15% drop in feed-in tariffs synchronized to production cost at double of PV production Farmer’s Association pushing for elimination of undeveloped area subsidies to operators of installations • First Solar uses undeveloped areas for their systems • Will push for rooftops - issue becomes cadmium on roof-tops? 30 Recycling First Solar’s CdTe Cells Farm fire in 2008 required panels to be disposed as hazardous waste Will not subsidize plant unless panels are recycled Recycling program in place to recycle toxic Cd Recycling cost is part of production costs Collection Shredder Hammer mill Film removal: Acids dissolve CdTe Separate Solid and liquid Separate glass and laminates Glass rinsing Precipitation 31 Spain Started initial boom in solar technology with subsidies China accelerated supply chain manufacturing Spain capped incentives & Feed-in tariffs in 2009/2010 • Significant drop in investments • Worldwide oversupply Germany following Spain in capping incentives Ref: Metro Solar Spain 32 China: Industry Landscape GDP growing ~10%/year Critical pollution problems 8 IPO’s since 2005 100+ solar fabs built ~49% of worldwide polysilicon volume in 2009 ~30% worldwide solar cell volume Vertical integration of solar industry • Value chain covers polysilicon, wafers, solar cells, and solar PV modules • Infrastructure includes solar production equipment and materials Polysilicon production investments slowing down • Worldwide oversupply in 2009 33 Government Support to Industry $3.2/W subsidy for Building Integrated PV Golden Sun Demonstration Projects - 600MW capacity Approved 10MW solar farm project in western China targeting $0.16/KWh Power companies started active acquisition of land for utility scale solar farms in 2009 34 China: New Energy Stimulus Plan Establish 15% renewable energy by 2020 Reduce carbon emission 40-45% per GDP from 2005 level by 2020 Increase installed solar power capacity from 100MW in 2009 to 20GW by 2020 • ~62% compound annual growth rate (CAGR) Government to invest ~$450B in New Energy Industry • Nuclear, wind and solar Experts estimated government to ultimately invest $700B • Will attract ~$1.5T investments from public & private sectors 35 India Population: 1.3 billion in 2000 Area: 1/3 of USA Economic growth: 7-8% per year 300 sunny days per year 450 million people without electricity • Electrical energy consumption 660 kWh per capita • Use Kerosene / other fuels - 60,000 villages <10% of USA, <25% of world average Grid Power Supply Demand gap 10% with 150 GW (2008) Semi PV Group White Paper – The Solar PV Landscape in India April 2009 36 India Solar Mission 2020 Solar power target: 20 GW by 2020 • 1-1.5 GW by 2012 India Investment $20B for 30 year plan Rajasthan set 35,000 km2 area for solar 37 Solar System Uses: 2009 Street lighting systems: 54,795 Residential home lighting systems: 434,692 Lanterns: 697,419 Water heating systems: 140 km2 of collector area PV water pumps: 200-3K • Use < 1.8KW Panels – installed 7148 PV power plants: 2.1 MW Reference: Solar PV landscape in India - PV Group Market white paper, April 2009 38 US Solar Energy Careers Rapid projected growth makes career look good Transition possible because it’s new industry Get training (ex. www.solarliving.org) Understand cost/benefits of solar (especially Sales people) From: Charles Liu 39 (EverbrightSolar) Job Description Requirements Example Process Engineer •Educational requirement: Typically advanced degree in Chemical Engineering, Materials Science, or other related engineering disciplines •Experience with deposition techniques like CVD, and PVD Systems Engineer •Educational requirement: BS/MS in Electrical Engineering •Understanding of control theory and power systems Strong preference for C10 or C46 license, NABCEP installer certified (from Adecco job description) Also see: From: Green Jobs Guidebook, www.EDF.org/cagrreenjobs •http://www.greenforall.org/resources/green-jobs-guidebook 40 MEDIUM LOCATION: COMPAN BUSINES COMPANY Technology HQ c-Si Los Gatos, CA Santa Clara, CA Akeena Applied Materials AUSRA Solar thermal Borrego Solar BrightSource Energy DayStar Technologies CIGS Newark, CA First Solar CdTe AZ GreenVolts Lithium CPV batteries SF, CA NanoSolar Primestar Solar Paul Brown (Rec) Ronda knows CA CA MiaSole vac. CIGS atmos. CIGS REC Solar # Emp 120 Thom as Nguyen Mfg in OH Santa Clara, CA CA CO San Luis Obispo 250 Leo Volpe knows Carol a 60 Em ers on knows 250 Paul Brown knows Lin Recurrent Energy SF, CA Real Goods Solar Hopland, CA 250 Mtn View, CA 50 Sanyo c-Si Skyline Solar CPV SolFocus CPV SolarCity - Solaria CPV? Local Companies 120 Berkeley, CA Solar thermal medallurgical grade Si CaliSolar Other Recruiters , HR, other SPAIN; Mfg Mtn View, CA in AZ Berkeley, LA, Foster City, CA Sacto 420 Tracked by CTF Solar Subgroup Leo Volpe knows Patrick Donner Frem ont, CA SolarOne Leo Volpe knows Paul Brian Okam oto knows Joe Solexa SoloPower Solyndra CIGS Frem ont, CA 41 Solar Subgroup Landings Person Company Occupation Ellen Heian Eric Berkenkotter Margo Craca Roberto Valotta Sanjay Pejavar Sterling Goyer Tammy Lee ZT Plus Solyndra Applied Materials Silver Spring Net Deeya Eng. Solyndra Solyndra Scientist Process Eng. Process Eng. QA Eng. QA Eng. Process Eng. Process Eng. Sungevity Sun-Tech Power Apple Sales Sales Biz Dev Bruce Karney Roy Shaw Sofia Velastegui 42 Summary Solar industry has been & will continue to be driven by government policies Global grid parity severely constrained by fossil fuel subsidies USA solar VC funding of $1.4B, is largest green sector (30%) Industry growth will continue to create jobs 43 CTF Solar Subgroup New members always welcomed Meets every Friday: 1:30 – 3:30pm • At Right Management For questions, contact Co-leaders • Dinah Cheng – dwhcheng@gmail.com • John Foggiato - gfoggiato@aol.com • Keith Imai – imai.keith@gmail.com 44