Canty International Pricing Case

advertisement

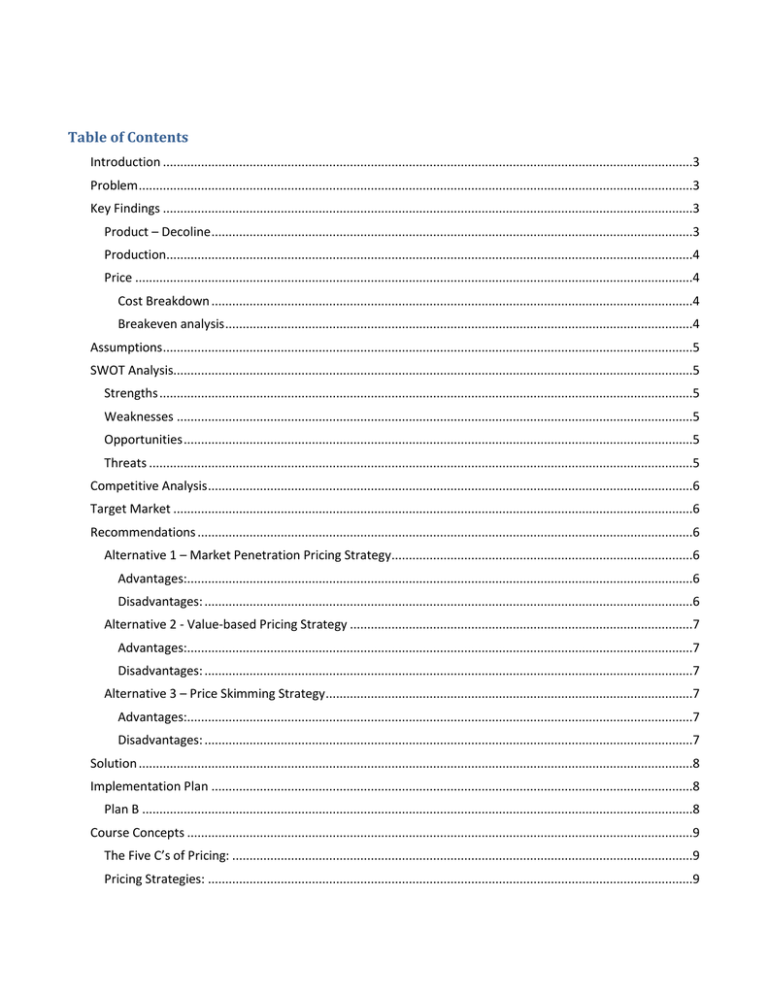

Table of Contents Introduction .........................................................................................................................................................3 Problem ................................................................................................................................................................3 Key Findings .........................................................................................................................................................3 Product – Decoline ...........................................................................................................................................3 Production........................................................................................................................................................4 Price .................................................................................................................................................................4 Cost Breakdown ...........................................................................................................................................4 Breakeven analysis .......................................................................................................................................4 Assumptions.........................................................................................................................................................5 SWOT Analysis......................................................................................................................................................5 Strengths ..........................................................................................................................................................5 Weaknesses .....................................................................................................................................................5 Opportunities ...................................................................................................................................................5 Threats .............................................................................................................................................................5 Competitive Analysis ............................................................................................................................................6 Target Market ......................................................................................................................................................6 Recommendations ...............................................................................................................................................6 Alternative 1 – Market Penetration Pricing Strategy.......................................................................................6 Advantages:..................................................................................................................................................6 Disadvantages: .............................................................................................................................................6 Alternative 2 - Value-based Pricing Strategy ...................................................................................................7 Advantages:..................................................................................................................................................7 Disadvantages: .............................................................................................................................................7 Alternative 3 – Price Skimming Strategy ..........................................................................................................7 Advantages:..................................................................................................................................................7 Disadvantages: .............................................................................................................................................7 Solution ................................................................................................................................................................8 Implementation Plan ...........................................................................................................................................8 Plan B ...............................................................................................................................................................8 Course Concepts ..................................................................................................................................................9 The Five C’s of Pricing: .....................................................................................................................................9 Pricing Strategies: ............................................................................................................................................9 The AAAs Product Pricing Strategies: ...............................................................................................................................9 Business to Business Pricing Tactics and Discounts .........................................................................................9 References ...........................................................................................................................................................9 Appendix A ........................................................................................................................................................ 10 1. Amortization Calculations (Straight-Line Amortization Method) ............................................................. 10 Building Table ............................................................................................................................................ 10 Cutting Machine ........................................................................................................................................ 10 2. Break Even Calculations ............................................................................................................................ 10 Break Even at 500m² ................................................................................................................................. 10 Break Even at 2000m² ............................................................................................................................... 10 3. Competitor Costs ...................................................................................................................................... 10 Appendix B ........................................................................................................................................................ 11 Total Costs..................................................................................................................................................... 11 Based on 500m² ........................................................................................................................................ 11 Based on 2000m² ...................................................................................................................................... 11 Margin Calculations ...................................................................................................................................... 11 4. Market Penetration Calculations .......................................................................................................... 11 5. Value-Based Calculations ...................................................................................................................... 11 6. Price Skimming Calculations ................................................................................................................. 11 2|Page The AAAs Introduction In March 2009, Bob Sweeny at Canty International, a manufacturer of wall systems and coverings, receives a request for proposal from a purchasing agent at Bryant Inns. Bryant Inns is a successful multinational firm in the hospitality industry that operates 150 inns and hotels across Canada. The proposal from Bryant Inns states that they would like to replace their existing vinyl/paper based wall coverings for a longer lasting, more durable material. The material would have to meet safety standards and provide a level of soundproofing. Also, once the material was installed it would have to fit with the décor of the hotel, be stain-resistant and be priced competitively. After considering the proposal, the product development group at Canty International, known as the Design Lab, developed Decoline. Problem What pricing strategy can Canty International propose to Bryant Inns that will secure their business while keeping in mind costs and profits? Will Canty be able to increase their current estimated sales capacity of 500m²/month up to or near their production capacity of 2000m²/month? Key Findings Product – Decoline B2B product for use by commercial and industrial clients Innovative new fabric material on a sturdy bamboo core Extensive testing shows that Decoline is: Highly abrasion-proof Fire resistant Soil-proof and easy to clean Soundproof Useful for ten years Can be made is a variety of different colours, textures and designs Fits with the current track system commonly used in commercial buildings Supply of raw materials (techno-fibre and backing) ban be secured from another division of Canty Due to specialized nature of the product, Decoline cannot be mass-produced, it needs to be custom made to customer specifications Based on reactions from potential customers, Decoline has potential sales of 500 m2 per month 3|Page The AAAs Production Procedure of producing Decoline is as follows: 1. Cut bamboo to desired length 2. Apply cement to top area of bamboo 3. Allow cement to dry 4. Apply techno-fabric on bamboo backing by hand 5. Trim edges and clean top area 50 m² of Decoline require approximately 3 hours and 20 minutes to produce Maximum capacity based on a 173-hour work month is 2598m² Experience proves that the actual production capacity is 2000m², 77% of the maximum capacity Price The product is already manufactured on a regular basis at another division of Canty International Raw materials can be acquired at cost from other divisions Manufacturing division must replace any materials not meeting quality expectations Negligible incoming transportation costs Three tables and a cutting machine must be purchased, both having a life of approximately ten years. Tables are $1550 each and the cutting machine will be $480.00 Cost Breakdown Monthly Fixed Operational Costs Supervision Inspection Miscellaneous Indirect Labour Floor Space Materials Amortization, tables* Amortization, cutting machine* Selling and Administration Total Monthly Operational Costs $1,080.00 165.00 84.00 327.00 30.00 38.75 4.00 4300.00 $6,028.75 Variable Costs (per m2) Techno Fibre Bamboo backing Cement Direct Labour Total Variable Costs $7.28 3.30 0.80 1.31 $12.69 *based on a 10 year amortization with $0 residual1 Breakeven analysis2 Monthly Production 500m² 1000m² 2000m² Break even Selling Price Total Monthly Costs $24.75 / m² $12,373.75 $18.72 / m² $18,718.75 $15.70 / m² $31,408.75 *based on fixed and variable costs shown above 1 2 See Appendix A for amortization calculations See Appendix A for break even formula and calculations 4|Page The AAAs Assumptions That Canty International will not exhaust it’s supply of raw materials That the residual value on the Building Tables and Cutting Machine is $0 That Canty International will be able to accommodate any increases in demand up to 2000m² SWOT Analysis Strengths Manufacturing facilities already in place Design Lab can create products custom made to customer specifications Manufacturing division can supply needed materials Solid interdepartmental supply line No profits in interdivisional transfers of finished goods Manufacturing division has to replace rejected goods Minimal transportation costs Raw materials produced next to design building Short lead time on materials, maximum 2 weeks Weaknesses Heavy reliance on manual labour No automated systems in place to increase production Skilled labour is very expensive to operate and maintain No economies of scale Current market conditions prevent Canty from creating 'off-the-shelf' items Manufacturing limitations also limit variety of products Canty can produce Opportunities New product could be high in demand Canty can create products that are vastly superior to the current product Multiple customers may be interested in Canty's new product lines Create new production line Semi-automated or fully-automated assembly line production to replace current production methods Threats Cheaper alternatives Canty's current production methods may be too expensive to maintain a competitive advantage with other inferior products Long-term sustainability Canty is unsure of the long-term effectiveness of their newly developed product No current existing market beyond single and specific customer request 5|Page The AAAs Competitive Analysis The only competing product is one with a two year life span and a total cost (including installation) of $16.30m². This product has a two year life span, which means it has a cost of $8.15m²/year.3 Target Market The current target market is Bryant Inns. Currently, the Decoline product has been made specifically for this customer. However, Canty International should look at selling this product to any number of commercial operations with high-traffic buildings. These can include places like schools, restaurants, hospitals, and office buildings. Currently, Canty has some strategies in place to target new customers including search engine placement and ads in a Canadian trade magazine. Recommendations All pricing strategies assume that Canty is selling an average of 500m² per month as per their preliminary market research. Alternative 1 – Market Penetration Pricing Strategy Canty International will set the initial price for Decoline low for the introduction of Decoline with the objective of building sales, market share, and profits quickly As sales build, Canty’s production costs will decrease and they will be able to further cut prices We recommend a margin of 26%4, setting the price for Decoline at $33.45/ m² The price per year at this margin will be about $3.35/year Advantages: Great potential to build sales, market share and profits Discourages competitors from entering the market because the price is tough to compete with Unit cost drops as volume sold increases (experience curve effect) Disadvantages: 3 4 Canty International must have the capacity to satisfy any sharp rise in demand Low prices can be a signal to customers of a low quality product Consumers may be willing to pay more than what the product is priced for, causing Canty International to "miss out" on potential profits See Appendix A for competitor cost calculations See Appendix B for Penetration Pricing calculations 6|Page The AAAs Alternative 2 - Value-based Pricing Strategy Focus on the overall value of the product as perceived by the potential consumer. Compare old product to Decoline 10 year lifespan on Decoline compared to a 2 year life on competing product Decoline is durable, low-maintenance, and stain-proof We have worked out a price that allows the same Cost of Ownership for the customer per year as the current product The margin is set at 67%5, making the price $75.00 / m² The price per year will be around $7.50/year Advantages: Position Decoline as a quality product, supported by lab testing results that conclude Decoline as highly abrasion-resistant, soil-proof, heat resistant, sound filter and 10 years service life. Target potential customers who are interested in long-term usage, as defined in the Target Market analysis Large profit margins means Canty can "play" with pricing via trade and/or volume discount options Disadvantages: High price limits customer base to large client operations such as hotel chains or other large businesses Lack of consumer research which may cause some issues during implementation stage Customers may not find Decoline product valuable enough to justify higher up-front costs vs. competing product Alternative 3 – Price Skimming Strategy Set's a high, profit oriented price for Decoline After the high-price market segment is saturated, we would reduce the price to capture the lower-price market Initial margin would be set at 85%6, which would price Decoline at $165.00 / m² Yearly cost would be $16.50/year Advantages: There are no comparable products offered by other producers, therefore clients have no external reference prices Would ensure that demand does not exceed the maximum production capabilities of 2000m² Canty can differentiate its product from competitors by highlighting its relative advantage of customers not having to disrupt business operations every two years to replace the wall coverings Disadvantages: 5 6 If prices are set too high, clients might opt out for the competing product with its lower associated costs Canty runs the risks of seeing new producers entering the market with equivalent or superior products at cheaper prices Canty may see a lack of demand for its product due to a prohibitive price point See Appendix B for Value-Based Pricing calculations See Appendix B for Price Skimming pricing calculations 7|Page The AAAs Solution We suggest that Canty International adopts a value-based pricing strategy (alternative 2) We believe it is the best price representative of Decoline’s value and superiority to the current product This price can provide a profitable price while maintaining an equitable price structure with competing product Implementation Plan We will answer Bryant Inn’s request for proposal with a price of $75.00 / m² (plus installation fees) We will advertise Decoline to other businesses as outlined in the target market analysis We plan to offer a volume discount of up to a maximum of 40% for customers who purchase over 500m² in a single order. This is based on our breakeven point analysis while still allowing us to make a profit We can offer further trade discount terms of 2/30, n60. Based on the high costs of Decoline we want to allow our customers a reasonable amount of time to pay while giving incentive to pay early Success of the pricing strategy will be measured in profits, sales, and an increase in demand of up to 2000m², the current maximum production capabilities of Canty International Plan B Market penetration pricing strategy (Alternative 1) Low price point, especially the yearly cost, will entice customers to buy our product and will build marketshare Will build profits quickly, enabling Canty to recover if they incur a loss from the first solution 8|Page The AAAs Course Concepts The Five C’s of Pricing: Company objectives - We analyzed the four company objectives which are profit orientation, sales orientation, competitor orientation and customer orientation to determine our solution. Customers - We used this concept to understand our consumer’s reaction to different prices. To analyze consumer’s perception, we looked at the price elasticity of demand to determine how consumers react to actual changes in price. Costs - To determine costs, we used variable costs, fixed costs and the sum which would be the total cost. We also calculated the breakeven point to determine which price revenues would equal costs. Competition - Competition was determined by how competitors react to certain pricing strategies. In this case study, it would be two types of products with different life span. Channel members - The raw materials are provided in-house at another division of the company. We sell the finished product directly to the customer. Pricing Strategies: Cost base methods - This method determines the final price by analyzing the costs and not recognizing the role of consumers. Competitor based methods - We looked at this method to determine how the firm wants the consumers to perceive the product compared to its competitors. Value based methods - Value based pricing method is the solution that we chose because it focuses on the overall value of the product offered from the consumer’s point of view. Cost of ownership method- A method we looked at which is used to set prices that figures out the total cost of owning the product over the life of the product. Product Pricing Strategies: We analyzed price skimming, market penetration, and value based pricing methods to assess different pricing options. Business to Business Pricing Tactics and Discounts Quantity Discounts - We can utilize this price tactic by offering a discounted price based on the volume purchased. Trade Discounts - We offer standard payment discount terms to customers that pay within a set amount of time. References Grewal, D., Levy, M., Persaud, A., & Lichti, S. (2009). Marketing Canadian Edition. McGraw-Hill Irwin. Case Study Handout 9|Page The AAAs Appendix A 1. Amortization Calculations (Straight-Line Amortization Method) 𝐴𝑚𝑜𝑟𝑡𝑖𝑧𝑎𝑡𝑖𝑜𝑛 = 𝐶𝑜𝑠𝑡 − 𝑅𝑒𝑠𝑖𝑑𝑢𝑎𝑙 𝑉𝑎𝑙𝑢𝑒 𝑈𝑠𝑒𝑓𝑢𝑙 𝐿𝑖𝑓𝑒 Building Table Cutting Machine (3 × $1550) − 0 10 𝑦𝑒𝑎𝑟𝑠 = $465/year = $38.75/month 𝐴𝑚𝑜𝑟𝑡𝑖𝑧𝑎𝑡𝑖𝑜𝑛 𝑅𝑎𝑡𝑒 = $480 − 0 10 𝑦𝑒𝑎𝑟𝑠 = $48/year = $4/month 𝐴𝑚𝑜𝑟𝑡𝑖𝑧𝑎𝑡𝑖𝑜𝑛 𝑅𝑎𝑡𝑒 = 2. Break Even Calculations 𝐵𝑟𝑒𝑎𝑘 𝐸𝑣𝑒𝑛 𝑝𝑜𝑖𝑛𝑡 = 𝑃𝑟𝑖𝑐𝑒 = Break Even at 500m² 𝑃𝑟𝑖𝑐𝑒 = $6028.75 + $12.69 500𝑚² = $24.75m² 𝐹𝑖𝑥𝑒𝑑 𝐶𝑜𝑠𝑡𝑠 𝑃𝑟𝑖𝑐𝑒 − 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝐶𝑜𝑠𝑡𝑠 𝐹𝑖𝑥𝑒𝑑 𝐶𝑜𝑠𝑡𝑠 + 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝐶𝑜𝑠𝑡𝑠 𝐵𝑟𝑒𝑎𝑘 𝐸𝑣𝑒𝑛 𝑝𝑜𝑖𝑛𝑡 Break Even at 2000m² 𝑃𝑟𝑖𝑐𝑒 = $6028.75 + $12.69 2000𝑚² = $15.70m² 3. Competitor Costs Current product price: $11.50m² + $4.80 installation fee = $16.30m² per 2 years = $8.15m² per year 10 | P a g e The AAAs Appendix B Total Costs 𝐶𝑜𝑠𝑡 = 𝐹𝑖𝑥𝑒𝑑 𝐶𝑜𝑠𝑡 + 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝐶𝑜𝑠𝑡(𝑢𝑛𝑖𝑡𝑠) Based on 500m² Based on 2000m² 𝐶𝑜𝑠𝑡 = $6028.75 + $12.69(500) = $12.373.75 𝐶𝑜𝑠𝑡 = $6028.75 + $12.69(2000) =$31408.75 Margin Calculations 𝑀𝑎𝑟𝑔𝑖𝑛 = 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 − 𝐶𝑜𝑠𝑡 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 4. Market Penetration Calculations 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 − $24.75 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 0.26𝑆 = 𝑆 − 24.75 −0.74𝑆 = −24.75 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 = $33.45 0.26 = 5. Value-Based Calculations 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 − $24.75 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 0.67𝑆 = 𝑆 − 24.75 −0.33𝑆 = −24.75 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 = $75.00 0.67 = 6. Price Skimming Calculations 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 − $24.75 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 0.85𝑆 = 𝑆 − 24.75 −0.15𝑆 = −24.75 𝑆𝑒𝑙𝑙𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 = $165.00 0.75 = 11 | P a g e