Unit 4: finance

advertisement

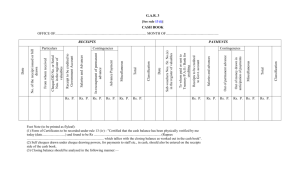

UNIT 4: FINANCE Chapter 12 Income Management WHAT IS MONEY? Without money, businesses could not operate, and consumers could not buy they goods and ser vices they need and desire. Forms of Legal Tender Legal tender – must be accepted as payment for goods and ser vices. There are two main forms of legal tender and they are coins and bills. Coins are m inted, or manufactured, at the Royal Canadian Mint headquar ters in Ottawa or at the Mint’s Winnipeg branch. The Bank of Canada issues paper money, also known as bank notes. The Bank issued its fir st notes in separate French and English ver sions in 1935. In 1937, it released a redesigned, bilingual series. The Bank of Canada does not run its own facilities to print bank notes. It uses two privately owned, high -security printing companies. Counter feiting is the production of fake money. Features on our bills are always under review, to ensure they can not be replicated falsely. Please see figure 1 2.1 on page 366 MONEY’S CHANGING PURCHASING POWER Money’s true value is its purchasing power. The paper used to print our currency is virtually worthless, as are the metals used to make coins. Although money serves as a standard of value, its purchasing power changes as prices for goods and services change. In general, prices tend to rise (inflation), so the dollar buys less from one year to the next. Purchasing power is measured by the Consumer Price Index (CPI), which is calculated monthly by Statistics Canada. It measures 600 products typically bought by Canadian households. These products include food, shelter, transportation, clothing, and recreation. WHAT IS INCOME? Income is money that an individual or business receives from various sources, such as wages, sales, interest, or dividends. For some people, most of the money they earn is used to pay for necessities such as food, rent, and clothing. Types of Per sonal Income Most people earn money through employment, in forms such as salar y, wages, commission, piecework and profit sharing. Gross income – is the total amount of income received by a per son. Disposable income – is the total amount of income received af ter taxes, CPP, and EI is deducted. It is also known as take-home-pay. Discretionar y income – is the income lef t af ter necessities have been paid for. It is used to purchase luxur y items and other items wanted not needed. MANAGING MONEY FOR PERSONAL USE Money management – refers to the daily financial activities connected to using your limited income to satisfy all your needs and wants. Why do we buy? Income and Price – The amount of money consumers have to spend has a big influence on what they buy. Price is the most important consideration for consumers. Today, consumers expect good value for the money they spend. Most will not pay more than what they believe an item is worth. Status – many people brag about how much they paid for a product. This desire to flaunt purchases to impress others is called conspicuous consumption. MANAGING MONEY FOR PERSONAL USE Current trends – Peer pressure – clothing, gadgets, technology…expensive to keep up with peers. Customs and habits – family, religion, and customs af fect consumer choices. Habits play a part in what you buy regularly. Promotion – business advertising and promotion influence consumer spending. Lifestyle advertising shows attractive, healthy, successful, and appealing people using a product or service. SPENDING MONEY Comparison shopping – areas that are considered when comparison shopping are: - price and quality - features - services such as warranties - planning and comparing by visiting stores locations, internet searches, consumer reports, newspapers, flyers, etc. When to buy – a decision based on income availability, choice of products, time of year, etc. Examples of when to buy are: - clearance sales - promotional sales - second-hand shopping - avoiding impulse buying BUDGETING A budget is a plan for wise spending and saving based on income and expenses. Personal budgeting is a matter of determining what and how much you can spend in a given period. This can be accomplished through: - setting personal goals - preparing a personal budget: with fixed and variable expenses. See sample budget on page 383 Figure 12.7 MANAGING MONEY FOR BUSINESS USE Types of business income: - revenue – the amount of money collected by the business - gross income – the total amount of money received by the business minus the cost of goods sold. - net income – is the gross income minus the business’s expenses. Budgeting for a business: - start-up budget – needed to plan for the opening of a business. - operating budget – done on a monthly, yearly, or project basis, clearly sets out the on -going revenues and expenses of the company. MANAGING MONEY FOR BUSINESS USE Setting business goals – goals may be to launch a new product, expand internationally, increase research and development, or close down a division. Preparing a business budget: -step 1: calculate the amount of income expected -step 2: calculate expenses -step 3: calculate the amount left over -step 4: review the budget Figure 12.10 on page 388 has an example of a business budget. UNIT 4: FINANCE Chapter 13 Banking THE NEED FOR FINANCIAL INSTITUTIONS When someone says, “I need to go to the bank to get some money,” that person may not mean a bank as you know it. They might be referring to another one of Canada’s financial institutions or to an automated banking machine (ABM) The main deposit-taking institutions in Canada are chartered banks, trust companies, caisses populaires, and credit unions. These institutions accept deposits, encourage saving, and keep our money safe. They provide loans to individual consumers and to businesses. CANADIAN BANKING Banks are businesses, just as retail stores and manufacturing companies or businesses. Banks sell ser vices and earn profits on thee ser vices. They earn most of their revenue by charging interest on money they loan to consumer s, businesses, and government. They also invest customer funds and receive interest from them. The Bank Act – The Canadian Constitution of 1 867 gave the federal government control over money and banking. The government created a common, unified banking system – all banks in Canada had to operate under similar rules. In 1 871 , the federal parliament passes Canada’s fir st bank act. The Bank Act outlines the rules and regulations that banks have to follow. All banks in Canada receive a char ter, that is why they are known as char tered banks. Only a char tered institution that operates under Bank Act can call itself a “bank”. Please see Table 13.1 and Table 13.2 on pages 398 and 399, for the three classes of Canadian banks. CANADIAN BANKING Branch Banking – Each Schedule I bank has a head office in one of Canada’s main cities. Each head office determines overall bank policy and is connected to thousands of bank branches across Canada. Canadian banks have also established branches in more than 40 foreign countries. Please see Table 13.3 on page 400, Branch Banking in Canada The Bank of Canada – is not a chartered bank – customers cannot open accounts in or borrow money from the Bank of Canada. It helps keep the Canadian economy as stable as possible. It controls the money supply (all the money in circulation), by raising or lowering the bank rate (also called prime lending), the minimum rate of interest that the Bank of Canada charges for loans it makes to chartered banks. OTHER FINANCIAL INSTITUTIONS Trust Companies – first established in Canada in the late 1800s to manage and invest the funds entrusted to them by consumers. Today, they also provide many banking services, such as loans and savings and chequing accounts. Caisses populairs and credit unions are organized and owned by groups of people who agree to pool and share their resources. They are a form of co -operative business ownership. Both belong to the World Council of Credit Unions. Insurance Companies are financial institutions that insure risks. Their usual focus is on life and health insurance, and property and car insurance. Insurance works by using the payments from many policyholders to pay out claims of a few. ABOUT ACCOUNTS All of Canada’s deposit -taking institutions accept and hold deposits. The institution holds this money in an account until the depositor needs it. The steps in opening an account are basically the same in all financial institutions. A savings account can be in your own name, giving you full control. A joint account can be opened in the name of two or more people, such as a married couple or a parent and child. ABOUT ACCOUNTS Opening and Accessing an Account Must provide personal information Must show IDs that have your signature and is possible, a photograph You must fill out a signature card to provide a sample of your signature. Receive a banking card to conduct your transactions. These can also be used as a debit card. ABOUT ACCOUNTS Sample of bank signature card ABOUT ACCOUNTS Account Statements and Passbooks The financial institution may give you an account statement or a passbook as a record of account transactions. ABOUT ACCOUNTS Making a Deposit you can deposit your money into your account at a financial institution or at an automated banking machine (ABM). Making a Withdrawl You can go to a financial institution, where a teller will input your request electronically, or you may make withdrawls at an ABM. Please see security tips for using ATMs on page 408 of the textbook. TRANSACTION ACCOUNTS Transaction accounts – accounts where clients place money to use for ever yday needs. Transaction register ( account st atement) – shows all transactions of a bank account from day to day. Straight t ransaction account – a simple way to pay per sonal and household bills. No interest is paid on the balances in this account. Combination account – allows you to save and pay bills . It is par t chequing and par t savings. They can collect a small amount of savings. Ser vice c harges – a fee on processing cheques and other transactions. Cancelled c heque – is a cheque that has been cashed and paid by the financial institution. Current accounts – are for businesses. To open a current account, a business must be registered with the provincial or federal government, and the account must be in the business’s name. Reconciliation – checking to make sure your bank statement balances with your transaction records. Outstanding c heques – cheques that are not yet cashed and deducted from your account balance. WRITING CHEQUES Cheque Essentials Date Stale dated cheques – cheques that have not been cashed for 6 months or more after the date shown on them. Postdating – a cheque that has been dated for a later date. Payee – is the name of the person or business to whom the cheque is written. Drawee – is your financial institution. Drawer – the person from whose account the money will be taken. Amount Account number WRITING CHEQUES Security Features: Some cheques have a section using a special ink that changes colour when it is rubbed Some have watermarks and fibres seen under florescent lights Stop payment – if a cheque is lost or stolen, or if you do not want it cashed for some reason, you have the right to stop payment on the cheque. Cheque clearing – is the processing of cheques and the settling of account balance among financial institutions. Magnetic Ink Character Recognition (MICR) – across the bottom of any preprinted cheque is a string of coded numbers, or an encoding line. The encoding is the cheque number, branch number, institution number and account number. WRITING CHEQUES Holds on cheques – holds are delays on payment of the cheque. The hold gives the bank time to clear the cheque and to make sure that you or the financial institution on which the cheque is written does not present a risk. If you earn interest on money in your account, it is paid even if funds are being held. Holds simply protect you and your financial institution against losses from NSF cheques or cheques written for illegal purposes. WRITING CHEQUES Sample cheque SHARED ABM NETWORKS Automated machines provide services more quickly, conveniently, and accurately than the old manual methods. The Electronic Funds Transfer System (EFTS) –is a computerized system of electronic deposits and withdrawals. Debit Cards and Direct Deposit Interac Direct Payment (IDP) became available across Canada in 1993. With direct payments, consumers can use their ABM cards as debit cards. OTHER BANKING ITEMS Telephone Banking Online Banking - also known as virtual banks Loans - a term loan involves borrowing money and paying it back at a specific Lines of Credit - is a form of instant access to credit that has been arranged between you and your financial institution. Credit cards Direct deposit – transfers funds from an outside source directly into a specific account that you designate. OTHER BANKING ITEMS Money order – is a form of payment similar to a cheque. Payment is guaranteed by the issuing institution. Night depository – a chute at the bank that allows customers to make deposits or drop of f important financial documents at any time. Overdraft protection – is when the institution lends the depositor the money so the payee can cash the cheque. Overdraft means that you write a cheque for more than what you have in your account. Preauthorized bill payments (or debit) – with written permission, a company can make regular and automatic withdrawals from your account. Safety deposit boxes – they are fireproof, metal boxes to store important documents and valuables. SHOPPING FOR A FINANCIAL INSTITUTION When you are ready to open an account, visit dif ferent financial institutions in your area to compare what each one has to of fer. The future of financial services – although more and more financial transactions are being done electronically, there will be times when you have to visit a branch of your financial institution, and where there will always be some people who prefer the direct contact with employees of the financial institution. Over the past years, there has been a lot of discussion about smart cards. They look like an ABM card or a credit card, but has a powerful microchip. It can store dif ferent applications, including e-cash, or electronic cash. Plus the microchip adds another level of security.