Break-Even Analysis - California State University, Northridge

advertisement

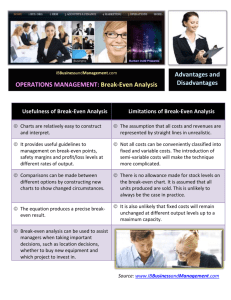

Capacity Planning Break-Even Point Ardavan Asef-Vaziri Systems and Operations Management College of Business and Economics California State University, Northridge Capacity Planning: Break-Even Analysis Operation costs are divided into 2 main groups: Fixed costs – Costs of Human and Capital Resources wages, depreciation, rent, property tax, property insurance. the total fixed cost is fixed throughout the year. No matter if we produce one unit or one million units. It does not depend on the production level. fixed cost per unit of production is variable. Variable costs – Costs of Inputs raw material, packaging material, supplies, production water and power. The total variable costs depend on the volume of production. The higher the production level, the higher the total variable costs. variable cost per unit of production is fixed. Break-Even Analysis Ardavan Asef-Vaziri March, 2015 2 Five Elements of the Process View Information structure Inputs (natural or processed resources, parts and components, energy, data, customers, cash, etc.) Variable Break-Even Analysis Process Management Network of Activities and Buffers Outputs Goods Services Flow Unit Human & Capital Resources Ardavan Asef-Vaziri March, 2015 Fixed 3 Total Fixed Cost and Fixed Cost per Unit of Product Total fixed cost (F) Fixed cost per unit of product Production volume (Q) Production volume (Q) Break-Even Analysis (F/Q) Ardavan Asef-Vaziri March, 2015 4 Variable Cost per Unit and Total Variable Costs Variable costs Per unit of product (V) Total Variable costs (VQ) Production volume (Q) Production volume (Q) Break-Even Analysis Ardavan Asef-Vaziri March, 2015 5 Total Costs in $ (TC) Total Costs TC = F+VQ 0 Break-Even Analysis Total Fixed cost (F) Volume of Production and Sales in units (Q) Ardavan Asef-Vaziri March, 2015 6 Total Revenue It is assumed that the price of the product is fixed, and we sell whatever we produce. Total sales revenue depends on the production level. The higher the production, the higher the total sales revenue. Price per unit (P) Production (and sales) (Q) Break-Even Analysis Total revenue (TR) Production (and sales ) (Q) Ardavan Asef-Vaziri March, 2015 7 Total Costs or Revenue in $ (TC) Break-Even Computations TC=TR F+VQ=PQ QBEP = F/ (P-V) Break-Even Point Volume of Production and Sales in units (Q) Break-Even Analysis Ardavan Asef-Vaziri March, 2015 8 Example 1 $1000,000 total yearly fixed costs. $200 per unit variable costs $400 per unit sale price TR = TC 400Q= 1000,000+200Q (400-200)Q= 1000,000 Q= 5000 QBEP=5000 If our market research indicates that the present demand is > 5,000, then this manufacturing system is economically feasible. Break-Even Analysis Ardavan Asef-Vaziri March, 2015 9 BEA for Multiple Alternatives Break-even analysis for multiple alternatives: Such an analysis is implemented to compare cases such as A Simple technology An Intermediate technology An Advanced technology General purpose machines Multi-purpose machines Special purpose machines Low F high V In between High F Low V In general, when we move from a simple technology to an advanced technology; F V Break-Even Analysis Ardavan Asef-Vaziri March, 2015 10 BEA for Multiple Alternatives Flow-Shop Batch Job-Shop Q1 Break-Even Analysis Q2 Ardavan Asef-Vaziri March, 2015 11 Example 2 Management should decide whether to make a part at house or outsource it. Outsource at $10 per unit. To make it at house; two processes: Advanced and Intermediate (1) At house with intermediate process Fixed Cost: $10,000/year Variable Cost: $8 per unit (2) At house with advanced process. Fixed Cost: $34,000/year Variable Cost: $5 per unit Prepare a table to summarize your recommendations. Demand Recommendation R≤? ? ?≤R≤? ? ?≤R ? Break-Even Analysis Ardavan Asef-Vaziri March, 2015 12 Example 2. BEA for Multiple Alternatives Manufacture II Manufacture I Outsource Q1 Break-Even Analysis Q2 Ardavan Asef-Vaziri March, 2015 13 Example 2. Outsource vs. Manufacturing I 100000 90000 80000 70000 60000 10000+8Q=10Q 2Q=10000 50000 40000 30000 20000 10000 1000 Break-Even Analysis 2000 3000 4000 5000 6000 Q=5000 7000 8000 Ardavan Asef-Vaziri 9000 10000 March, 2015 14 Example 2. Manufacturing I vs. Manufacturing II 100000 90000 80000 70000 60000 10000+8Q=34000+5Q 3Q=24000 50000 40000 30000 20000 10000 1000 Break-Even Analysis 2000 3000 4000 5000 6000 7000 8000 9000 Q=8000 Ardavan Asef-Vaziri 10000 March, 2015 15 Example 2. Executive Summary We summarize our recommendations as Demand Recommendation R ≤ 5000 Buy 5000 ≤ R ≤ 8000 Manufacture Alternative I 8000 ≤ R Manufacture Alternative II On the boundary points, in practice, we need more information Break-Even Analysis Ardavan Asef-Vaziri March, 2015 16 Example 3. BEA for Multiple Alternatives Three alternatives 1) Job-Shop Total Fixed Cost Variable cost F = $10,000, V = $10 per unit 2) Group-Shop Total Fixed Cost Variable cost F = $60,000, V = $5 per unit 3) Flow-Shop Total Fixed Cost F = $150,000, Variable cost V = $2 per unit Tell me what to do: In terms of the range of demand and the preferred choice… Break-Even Analysis Ardavan Asef-Vaziri March, 2015 17 Example 3. BEA for Multiple Alternatives Q1 Break-Even Analysis Q2 Ardavan Asef-Vaziri March, 2015 18 Example 3. BEA, Job-Shop vs. Batch Processing Group-Shop Job-Shop Q1 Break-Even Analysis Ardavan Asef-Vaziri March, 2015 19 Example 3. BEA, Job-Shop vs. Batch Processing F1=10000 F2=60000 V1=10 V2=5 Break-even of 1 and 2 F1+ V1 Q = F2+ V2 Q 10000+10Q = 60000 + 5Q Q = 60000 10000 10000 10 5 Break-Even Analysis Ardavan Asef-Vaziri March, 2015 20 Example 3. Batch Processing vs. Flow Shop Flow-Shop Group-Shop Q2 Break-Even Analysis Ardavan Asef-Vaziri March, 2015 21 Example 3. Batch Processing vs. Flow Shop F2=60000 F3=150000 V2=5 V3=2 Break-even of 2 and 3 F2+ V2 Q = F3+ V3 Q 60000 + 5Q = 150000+2Q Q = 150000 60000 30000 52 Break-Even Analysis Ardavan Asef-Vaziri March, 2015 22 Recommendations to Management and Marketing Demand Recommended Alternative D ≤ 10000 Job-Shop 10000 ≤ D ≤ 30000 Group-Shop 30000 ≤ D Flow-Shop We also need to know Price and Revenue! Suppose sales price is $8 per unit. Revise the table Break-Even Analysis Ardavan Asef-Vaziri March, 2015 23 Recommendations to Management and Marketing Alternative 1 has a variable cost of $10>$8 will never use it Alternative 2 has a variable cost of $5<$8 Alternative 3 has a variable cost of $2<$8 As we saw before, Alternatives 2 and 3 break even at 30,000 If demand is greater than 30,000, we use alternative 3. Now we can compute the break-even point of Alternative 2. Can you analyze the situation before solving the problem? If the break-even point for alternative 2 is X and is greater than 30,000, then we never use Alternative 2 since beyond a demand of 30,000, Alternative 3 is always preferred to Alternative 2. D<X Do nothing D> X Alternative 3 Lets see where is the BEP of alternative 2 F+VQ = PQ 60,000+5Q=8Q Q= 20,000. Break-Even Analysis Ardavan Asef-Vaziri March, 2015 24 Recommendations to Management and Marketing D < 20,000 20,000 < D < 30,000 30,000 < D Do nothing Alternative 2 Alternative 3 If sales price was $6.5 instead of $8, then F+VQ = PQ 60,000+5Q=6.5Q Q= 40,000. But for Q> 30,000 you never use Alternative 2, but Alternative 3 Where Alternative 3 breaks even? 150000+2Q = 6.5Q 150000 = 4.5 Q Q = 33333 D ≤ 33333 Do nothing D ≥ 30,000 Alternative 3 Break-Even Analysis Ardavan Asef-Vaziri March, 2015 25 Example 4. BEP for the Three Global Locations You’re considering a new manufacturing plant in the sites at the suburb of one of the three candidate locations of: Bristol (England), Taranto (Italy), or Essen (Germany). Total Fixed costs (costs of human and capital resources) per year and variable costs (costs of inputs) per case of product is given below Bristol (England) Essen (Germany): Taranto (Italy): Break-Even Analysis F = $300000, V = $18 F = $600000, V = $12 F = $900000, V = $9 Ardavan Asef-Vaziri March, 2015 26 Example 3. BEA for Multiple Alternatives Taranto Essen Bristol Q1 Break-Even Analysis Q2 Ardavan Asef-Vaziri March, 2015 27 Example 3. BEA for Multiple Alternatives Taranto Essen Bristol Q1 Break-Even Analysis Q2 Ardavan Asef-Vaziri March, 2015 28 Example 4. BEP for the Three Global Locations 1. At what level of demand a site at Bristol suburb is preferred? Bristol Total Costs = 300000+18Q Essen Total Costs = 600000+12Q 300000+18Q = 600000+12Q 6Q = 300,000 Q = 50,000 2. At what level of demand is a site at Essen suburb preferred? Essen Total Costs = 600000+12Q Taranto Total Costs = 900000+9Q 600000+12Q = 900000+9Q 3Q = 300,000 Q = 100,0000 Essen is preferred for 100,000≥ Q ≥ 50,000 Break-Even Analysis Ardavan Asef-Vaziri March, 2015 29 Example 3. BEA for Multiple Alternatives Taranto Essen Bristol 50000 Break-Even Analysis 100000 Ardavan Asef-Vaziri March, 2015 30 Example 4. BEP for the Three Global Locations 3. At what level of demand a site at Taranto suburb is preferred? More than 100,000 4. Suppose sales price is equal to the average of the variable costs at Bristol and Essen. At what level of demand is a site at Bristol suburb preferred? Never 6. Given the same assumption as (4). At what level of demand a site at Essen suburb is preferred? P = (18+12)/2 = 15 Total Essen cost = 600,000 + 12Q PQ = F + VQ 15Q = 600,000 + 12Q 3Q = 600,000 Q = 200,000 Never. Why??? Break-Even Analysis Ardavan Asef-Vaziri March, 2015 31 Example 5. BEP for the Three Global Locations Why At Q = 100,000 Taranto dominates Essen 5. Given the same assumption as (4). At what level of demand is a site at Taranto suburb preferred? P = (18+12)/2 = 15 Taranto Total cost = 900,000 + 9Q PQ = F + VQ 15Q = 900,000 + 9Q 6Q = 900,000 Q = 150,000 P =15 D ≤ 150000 No Where D ≥ 150,000 Taranto Break-Even Analysis Ardavan Asef-Vaziri March, 2015 32 Example 5. BEP for the Three Global Locations 7. Suppose sales price is $20. At what level of demand a site at Essen suburb is preferred? Essen Total cost = 600,000 + 12Q 20Q = 600,000+12Q Q = 75000 From 75000 to ?? At what level of demand a site at Essen is preferred? At 100,000 Essen and Taranto Break Even – After that Taranto denominates From 75,000 to 100,000 P= 20 75,000 ≤ D ≤ 100000 D ≥ 100,000 Break-Even Analysis Essen Taranto Ardavan Asef-Vaziri March, 2015 33 Financial Throughput and Fixed Operating Costs We define financial throughput as the rate at which the enterprise generates money. By selling one unit of product we generate P dollars, at the same time we incur V dollars pure variable cost. Pure variable cost is the cost directly related to the production of one additional unit - such as raw material. It does not include sunk costs such as salary, rent, and depreciation. Since we produce and sell Q units per unit of time. The financial throughput is Q(P-V). Fixed Operating Expenses (F) include all costs not directly related to production of one additional unit. That includes costs such as human and capital resources. Throughput Profit Multiplier = % Changes in Profit divided by % Changes in Throughput 1% change in the throughput leads to TPM% change in the profit Break-Even Analysis Ardavan Asef-Vaziri March, 2015 34 Financial Throughput and Fixed Operating Costs Suppose fixed cost F = $180,000 per month. Sales price per unit P = 22, and variable cost per unit V = 2. In July, the process throughput was 10,000 units. A process improvement increased throughput in August by 2% to 10,200 units without any increase in the fixed cost. Compute throughput profit multiplier. July: Financial Throughput = 10000(22-2) = 200000 Fixed cost F = 180,000 Profit = 200000-180000 = $20,000 In August throughput increased by 2% to 10200 August: Financial Throughput of the additional 200 units = 200(22-2) = 4,000 We have already covered our fixed costs, the $4000 directly goes to profit. Break-Even Analysis Ardavan Asef-Vaziri March, 2015 35 Throughput Profit Multiplier (TPM) % Change in Throughput = 2% % change in profit = 4000/20000 = 20% Throughput Profit Multiplier (TPM) = 20%/2% = 10 1% throughput improvement 10% profit improvement Break-Even Analysis Ardavan Asef-Vaziri March, 2015 36 A Viable Vision – Eliyahu Goldratt A Viable Vision (Goldratt): What if we decide to have todays total revenue as tomorrows total profit. In our example, Financial Throughput in July was Q1(P-V) = 10,000(22-2). In order to have your profit equal this amount we need to produce Q2 units such that: Q2(P-V) – F = Q1(P) Q2(20) -180,000 = 10,000(22) Q2(20) = 40,000 Q2 = 20,000 In order to have your todays total revenue as tomorrows total profit. We only need to double our throughput. Our sales, our current revenue becomes our tomorrows profit. Break-Even Analysis Ardavan Asef-Vaziri March, 2015 37 Example 5 A manager has the option of purchasing 1, 2 or 3 machines. The capacity of each machine is 300 units. Fixed costs are as follows: Number of Machines 1 2 3 Fixed cost $9,600 $15,000 $20,000 Total Capacity 1-300 301-600 601-900 Variable cost is $10 per unit, and the sales price of product is $40 per unit. Tell management what to do! Break-Even Analysis Ardavan Asef-Vaziri March, 2015 38 Example 5. BEP Recommendations Prepare an executive summary similar the following: R<= ? ?<R<=? R>? ? ? ? Now it is up to the Marketing Department to provide an Executive Summary regarding the demand. Break-Even Analysis Ardavan Asef-Vaziri March, 2015 39 BEP: One Machine The beak-even point for 1 machine is 320 But one machine can not produce more than 300 Demand <= 300 No Production Otherwise Consider two machines 40000 35000 30000 25000 20000 15000 9600 + 10Q = 40Q 9600= 30Q 10000 5000 320 100 200 Break-Even Analysis 300 400 500 600 700 800 900 Ardavan Asef-Vaziri 1000 March, 2015 40 BEP: Two Machine The beak-even point for 2 machine is 500 Demand <= 500 No Production Otherwise Two machines and consider 3 machines 40000 35000 30000 25000 20000 15000 15000 + 10Q = 40Q 15000= 30Q 10000 5000 500 100 200 Break-Even Analysis 300 400 500 600 700 800 900 Ardavan Asef-Vaziri 1000 March, 2015 41 BEP: Three Machine The beak-even point for 3 machine is 667 Demand <= 667 Produce up to 600 using 2 machine Otherwise 3 machines 40000 35000 30000 25000 20000 15000 20000 + 10Q = 40Q 20000= 30Q 10000 5000 667 100 200 Break-Even Analysis 300 400 500 600 700 800 900 Ardavan Asef-Vaziri 1000 March, 2015 42 BEP for the Three Alternatives and Recommendations Prepare an executive summary similar the following: R<= 500 Do nothing 500 <R<=667 Buy two machines and produce 500< Q<= 600 Q>667 Buy three machines and produce 667<R<=900 Now it is up to the Marketing Department to provide an Executive Summary regarding the demand. Please Think again!. We have made a mistake. Break-Even Analysis Ardavan Asef-Vaziri March, 2015 43 BEP: Two Machine- Revisited TC = 15000 + 10(600) TC = 21000 TR = 40(600) = 24000 Profit = 24000-21000 = 3000 40000 35000 30000 25000 } 20000 You do not switch to 3 machines unless you make 3000 profit 15000 10000 5000 600 100 200 Break-Even Analysis 300 400 500 600 700 800 900 Ardavan Asef-Vaziri 1000 March, 2015 44 From Wrong to Right Recommendations Q<= 500 Do-Nothing 500<Q<=667 Buy two machines and produce 500<Q<= 600 Q>667 Buy three machines and produce 667<Q<=900 At Q = 667 you make 0 profit with 3 machines 20000 + 10Q = 40Q 20000= 30Q Q = 667 Break-Even Analysis 20000 + 10Q +3000= 40Q 23000= 30Q Q = 767 Ardavan Asef-Vaziri March, 2015 45 Executive Summary Q<= 500 Do-Nothing 500<Q<=767 Buy two machines and produce 500<Q<= 600 Q>767 Buy three machines and produce 767<Q<=900 Now it is to Marketing Department to provide executive summary regarding the demand Break-Even Analysis Ardavan Asef-Vaziri March, 2015 46 Example 5- At Your Own Will You are the production manager and are given the option to purchase either 1, 2 or 3 machines. Each machine has a capacity of 500 units. Fixed costs are as follows: Number of Machines 1 2 3 Fixed cost $19,200 $30,000 $40,000 Total Capacity 1- 500 501-1000 1001-1500 Variable cost is $35 per unit, and the sales price of product is $69 per unit. Determine the best option! Break-Even Analysis Ardavan Asef-Vaziri March, 2015 47 BEP for the Three Alternatives and Recommendations Prepare an executive summary similar the following: R<= ? ?<R<=? R>? Break-Even Analysis ? ? ? Ardavan Asef-Vaziri March, 2015 48 Variable Cost Per Unit is Not Fixed – Diminishing Marginal Return Variable costs Per unit of product (V) Total Variable costs (VQ) Output Production volume (Q) Production volume (Q) Input Variable costs Per unit of product (V) Output Input Break-Even Analysis Production volume (Q) Ardavan Asef-Vaziri March, 2015 49 Average Total Costs Economy of Scale- Dis-economy of Scale ATC-1 ATC-5 ATC-2 ATC-3 ATC-4 Long-Run ATC Output Break-Even Analysis LO4 Ardavan Asef-Vaziri March, 2015 50 7-50 Total Production Note on the Basic MEP Model 30 TP 20 10 0 Marginal and Average Production 1 Break-Even Analysis LO2 20 2 3 Increasing Marginal Returns 4 5 6 7 8 9 Negative Marginal Returns Diminishing Marginal Returns 10 AP 1 2 3 4 5 6 7 8 9 MP Ardavan Asef-Vaziri March, 2015 51 7-51 A Viable Vision – Eliyahu Goldrat Economies of scale Labor specialization Managerial specialization Efficient capital ------------Diseconomies of scale Control and coordination problems Communication problems Worker alienation Shirking Dinosaur Effect Break-Even Analysis Ardavan Asef-Vaziri March, 2015 52 Stop Here Break-Even Analysis Ardavan Asef-Vaziri March, 2015 53 Back to Example1 - Simulation $1000,000 average total yearly fixed costs ($800,000-$1,200,000). $200 average per unit variable costs ($180-$220). $400 average per unit sale price ($350-$450) Sales 4000-6000 . Break-Even Analysis Ardavan Asef-Vaziri March, 2015 54 180 350 220 450 Variable Cost Sales Price 185 448 207 405 215 426 183 400 188 427 205 434 208 439 188 422 209 387 182 442 220 423 213 369 215 382 194 447 180 438 188 374 180 352 220 410 206 435 208 350 4000 6000 Sales Total Cost Total Revenue 4457 1780941 1996736 4071 1818543 1648755 4812 2008625 2049912 4183 1668455 1673200 5200 1783752 2220400 5386 2048308 2337524 4594 1817549 2016766 5541 1941992 2338302 4155 1706063 1607985 4327 1747484 1912534 4229 1883842 1788867 4401 1890272 1623969 5611 2069902 2143402 5233 1973607 2339151 4093 1542329 1792734 4134 1647911 1546116 4051 1605308 1425952 5779 2170288 2369390 5017 1899201 2182395 5034 1959326 1761900 Break-Even Analysis Profit 215795 -169788 41287 4745 436648 289216 199217 396310 -98078 165050 -94975 -266303 73500 365544 250405 -101795 -179356 199102 283194 -197426 Max 772024 Min -467941 Range 1239965 4194304 K 22 1 -467941 -439759 -467941 to -439758.5 2 -439759 -411576 -439758.5 to -411576 3 -411576 -383394 -411576 to -383393.5 4 -383394 -355211 -383393.5 to -355211 5 -355211 -327029 -355211 to -327028.5 6 -327029 -298846 -327028.5 to -298846 7 -298846 -270664 -298846 to -270663.5 8 -270664 -242481 -270663.5 to -242481 9 -242481 -214299 -242481 to -214298.5 10 -214299 -186116 -214298.5 to -186116 11 -186116 -157934 -186116 to -157933.5 12 -157934 -129751 -157933.5 to -129751 13 -129751 -101569 -129751 to -101568.5 14 -101569 -73386 -101568.5 to -73386 15 -73386 -45203.5 -73386 to -45203.5 16 -45203.5 -17021 -45203.5 to -17021 17 -17021 11161.5 -17021 to 11161.5 18 11161.5 39344 11161.5 to 39344 19 39344 67526.5 39344 to 67526.5 Ardavan Asef-Vaziri 2 2 4 20 36 58 102 137 205 227 266 316 344 429 444 484 491 512 515 0.0002 0.0002 0.0004 0.002 0.0036 0.0058 0.0102 0.0137 0.0205 0.0227 0.0266 0.0316 0.0344 0.0429 0.0444 0.0484 0.0491 0.0512 0.0515 March, 2015 TRUE Width 56365 CumulativeLoss 28182.5 0.0002 0.0002 0.3363 0.0004 0.0002 Probability of Loss is: 0 0.0008 0.0004 0.0028 0.002 0.0064 0.0036 0.0122 0.0058 0.0224 0.0102 0.0361 0.0137 0.0566 0.0205 0.0793 0.0227 0.1059 0.0266 0.1375 0.0316 0.1719 0.0344 0.2148 0.0429 0.2592 0.0444 0.3076 0.0484 0.3567 0.4079 0.4594 55 Break-Even Analysis Ardavan Asef-Vaziri March, 2015 56