Economics Final Exam Review Terms / Vocabulary 1. Paradox of

advertisement

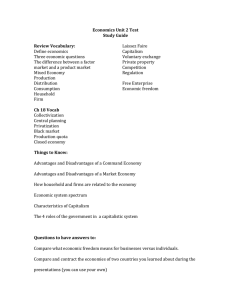

Economics Final Exam Review Terms / Vocabulary 1. Paradox of Value 2. Scarcity 3. Vertical Merger 4. Horizontal Merger 5.Compound Interest 6. Equilibrium Price 7. Factors of Production –describe and create illustration for each 8. Opportunity Cost 9. Gross Annual Income 10. Laissez Faire 11. Consumer Sovereignty 12. Determinants of Elasticity13. Elasticity 14. Deficit Spending 15. Fiscal Policy 16. Gross Domestic Product 17. 16th Amendment 18. Price Collusion 19. Limited Role of Government- 1 Review Questions: Financial Literacy 1. A) What are the steps involved in setting up a personal budget. 1. B) if you are on a budget, are you required to eliminate ALL entertainment expenses? 2. Essential expenses should not be more than _______% of gross monthly income. 3. Show how a person would calculate their monthly gross income if their gross annual income was $45000. 4. Which of the following would NOT be considered an important financial goal? Circle: Creating a retirement fund, building an emergency fund, saving for big ticket items like a car, new furniture, vacation, saving up for groceries 5. Explain why building an emergency fund is an important financial goal. 6. Which of the following would be considered a short-term goal for a typical high school senior? Circle: Money for college expenses / saving for retirement / saving for a down payment on an expensive home in River Oaks / Beginning to build an emergency fund 7. Why is it important to begin to save and invest at a young age? 8. What are the advantages of using the direct deposit system? 9. Why is it important to “pay yourself first”? 10. Explain how a person would determine how much money is in their checking account. Explain how a bank statement would be important in this process. 11. What happens if a person writes a check that exceeds the amount of money in their checking account? 12. Identify three important considerations involved in selecting a bank. 13. Explain why the FDIC was created. 14. What should a person do if they have MORE than $250,000 they want to have on deposit in an FDIC account? 2 15. Identify three advantages of investing in mutual funds. 16. Identify three disadvantages of investing in a mutual fund. 17. What are three consequences of having a low credit score and poor credit history? 18. What are the defining characteristics of a person best suited for buying a home instead of renting? 19. Rate the following savings and investing options according to the amount of interest each investment typically pays. Low or no interest to higher interest: money market account, certificate of deposit, regular savings account, regular checking account, hide in cookie jar Which of these investments would be considered the best low risk or no risk options? Fundamental Economic Concepts 20. Create a visual representation of the Circular Flow Model. 21. Describe what is happening in the Circular Flow Model. Be sure to explain how the Circular Flow Model illustrates economic interdependence. 3 22. Why is scarcity the “fundamental economic problem”? 23. Define and identify the advantages and disadvantages of each business structure. Definition: Sole Proprietorship advantages disadvantages Definition: Partnership advantages disadvantages Definition: Corporation advantages disadvantages 24. What are three things that would be included in the legal document known as “The Articles of Partnership”? 25. Identify each of the following important economic thinkers and explain their views regarding the role of government in the economy. Which would favor a laissez faire approach to economic issues? Adam Smith Karl Marx Frederich Hayek John Maynard Keynes Milton Friedman 4 26. What are the main characteristics of the free enterprise system? 27. What are the main characteristics of a command economy? 28.A) Provide one example of each economic system: Free Enterprise Command 28. B] What are other terms used to refer to a free enterprise system? 28.C) is the American economy a pure capitalist system or a modified private enterprise system? 29. Explain the purpose of each of the laws or agencies: Sherman Antitrust Act Clayton Act Pure Food and Drug Act Federal Trade Commission 30. Write a general statement that applies to all of the items listed in #29. 5 31. Which economic goal is being pursued by the minimum wage law? Economic Freedom or Economic Equity 32. Which economic and social goal is the trade-off when the government establishes a minimum wage law? Economic Freedom or Economic Equity 33. Describe the views of a person who favored laissez faire policies. 34. Create a graph that shows a surplus and a graph that shows a shortage. Surplus Shortage 35. Create a graph that shows the Law of Supply and a graph that shows the Law of Demand Law of Supply Law of Demand 36. Create a graph that shows equilibrium price. 6 37. Create the economic model called the Production Possibilities Frontier. Label the points that represent full potential and not full potential. Explain what is being illustrated with this model. 38. What factors would result in the frontier being pushed out and to the right? What would be the effect of the frontier being pushed out and to the right? 39. Create a model of the business cycle and label the parts. Which section of the business cycle would correspond with a reduction in the unemployment rate? Remember, if the unemployment rate decreases, more people are working. 40. What is the purpose of an antitrust law? 41. What are the three criteria of effective taxes? 42. What are the two principles of taxation? 7 43. The federal income tax is a ____________________________ type of tax. 44. The sales tax is a ____________________________ type of tax. 45. What is the purpose of a sin tax? 46. What does FICA stand for and what does it fund? 47. How will the baby boomers impact FICA programs? 48. What are the three main steps in creating the federal budget? 49. Provide 3 examples of federal spending that falls into the mandatory spending category. 50. Provide2 examples of spending that falls into the discretionary category. 51. Identify and describe the four types of unemployment. 8 52. Identify and describe the characteristics of the four market structures. Place them on a continuum from least competitive to most competitive. Continuum Below Most Competitive Least Competitive _________________________________________________________________________________ 9 10