2015 Year End Detailed Procedures

advertisement

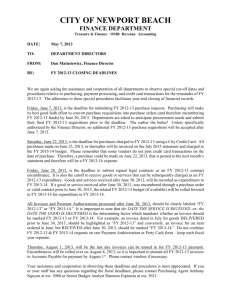

2014/15 FINANCIAL YEAR END PROCEDURES The financial year end falls on Friday 31 July 2015. For a period from 1 August, both 2014/15 (period 12) and 2015/16 (period 1) will be open for processing (except for the external purchase ledger which closes on 31st July 2015). The aim of the following procedures is to ensure that, during July and August, transactions are included in the appropriate financial year. For further information please refer to the FAQs on the finance services webpage. The procedures outlined below cover the following financial transactions: 1. External purchases (including foreign payments and creditors) 2. Sales (including debtors) 3. Income 4. Staff business expenses 5. Non-staff and student expense claims 6. Payroll claims 7. Petty cash expenditure 8. Internal trading 9. Equipment 10. Other key dates Other year end documentation included separately: Link to CD forms 1. CD1/2015 CD1/2015/A CREDITORS (EXTERNAL) - for outstanding payments to be made by the University for goods or services received on or before 31 July 2015, where there is no purchase order, or there is a foreign payment due. CD1/2015/B PREPAYMENTS (EXTERNAL) - for purchase invoices processed in advance in 2014/15 relating to goods or services to be received in 2015/16. CD1/2015/C NON-STAFF AND STUDENT EXPENSES – for non-staff and student business expenses that relate to 2014/15 i.e. where expense is incurred on or before 31 July 2015 but has not been passed to Accounts Payable by 18th July for inclusion in 2014/15. (All staff business expenses should be picked up through the automatic accrual of the expenses system, if not, include them here). 2. CD2/2015 CD2/2015/A DEBTORS (EXTERNAL) - for outstanding monies due to the University where goods or services have been supplied on or before 31 July 2015, but not yet invoiced. CD2/2015/B INCOME (EXTERNAL) IN ADVANCE - for income invoiced in advance in 2014/15 for goods or services to be supplied by the University in 2015/16 A code checker has been incorporated into the CD forms so that no forms with inactive or closed codes will be accepted by corporate accounting, these will be returned to the sender and not processed. Codes need to be active before the CD form is submitted. 3. Detailed procedures in relation to RESEARCH ACCOUNTING TRANSACTIONS to ensure maximisation of research data will be issued at the start of July 2015. Please ensure that all staff in your College/Service etc. who deal with financial matters are given copies of these procedures and documentation. Staff should note that the deadlines for direct input of purchase and sales invoices to APTOS will be enforced by the closure of period 12 at the end of the working day of the relevant deadline. If there are any queries arising or further explanation required, please do not hesitate to contact Izzy Clayton (i.clayton@exeter.ac.uk; Ext. 3076) or Tanya Hitchen (t.m.hitchen@ex.ac.uk; Ext 5009) or refer to the FAQs. Page 1 of 8 2015 Detailed Year end procedures 1a. PURCHASE INVOICES (external) CONTACT Invoices received up to and including 31st July 2015 for goods/services received in 2014/15 and matched by 31st July 2015 Invoices received after 31st July 2015 for goods/services received by the University prior to 1st August 2015 Process as normal in 2014/15 Period 12 Invoices received after 31st July 2015 for goods/services received on or after 1st August 2015 Gill Pearn Ext 2777 Process invoices as normal in 2015/16 Period 1 these will be included in the review of auto accruals to be issued August 4th Please see details of the process for Auto accruals of external purchases on the finance services webpage Process invoices as normal in 2015/16 Period 1 Deadline: 31st July Deadline for return: 5pm 10th August 1b. FOREIGN PAYMENT REQUESTS CONTACT For goods/services received in 2014/15 ; up to 17th July submit foreign payment request forms in the usual way After 17th July 2015 for goods/services received by the University prior to 1st August 2015; Submit to Accounts Payable for processing in 2014/15 Deadline: 17th July Complete form CD1/2015/A, for exchange rates see http://www.xe.com/ucc/ and return to financialreporting@ex.ac.uk (£500 is the suggested materiality level). This is particularly important for research and other externally funded projects that complete on or before 31st July 2015 Deadline: 5pm 10th August For goods/services received on or after 1st August 2015. Gill Pearn Ext 2777 AND Submit foreign payment request form in normal way to Accounts Payable for processing in 2015/16 Process foreign payment request forms as normal in 2015/16 Period 1 clearly mark 2015/16 Notes The key date is the date goods and services are received, not the date of the invoice, nor the date the invoice is received; you cannot choose in which year’s budget to apply costs, you must account for the costs in the year to which they apply. Where a part delivery has been made, do not process the invoice for part- payment. Include the part amount due on the creditor schedule (CD1/2015) and process the whole invoice in 2015/16. Page 2 of 8 2015 Detailed Year end procedures 1c. CREDITORS (where the University owes money) CONTACT Izzy Clayton Ext 3076 Goods/services supplied to the University prior to 1st August 2015 for which there is no purchase order. Complete form CD1/2015/A – estimate if necessary – and send to financialreporting@ex.ac.uk (£500 is the suggested materiality level.) This is particularly important for research and other externally funded projects that complete on or before 31st July 2015 Deadline for return: 5pm 10th August Goods/services supplied to the University prior to 1st August 2015 for which there is a purchase order. Review the automated accrual circulated to Colleges and Services issued Aug 6th to ensure that it has been correctly included. Please see details of the process for Auto accruals of external purchases on the finance services webpage Deadline for return: 5pm 10th August 2a. SALES INVOICES (external) CONTACT Supplies of goods/services made up to and including 31st July 2015 Issue sales invoice as soon as possible after date of supply, dated when raised or 31st July 2015, whichever is earlier Phil Jones Ext 5029 OR (if invoices are normally issued on your behalf by Accounts Receivable) submit request to Accounts Receivable clearly marked 2014/15 Deadline: 7th August (period 12 closes) Deadline: to be received by 7th August Notes Where a college or service manually raises an invoice outside of APTOS, either in GBP or a foreign currency, for the supply of goods/services up to and including 31st July 2014 and the money has not been received by this date, then a copy of this invoice should be sent to Accounts Receivable by the deadline of 7th August 2015. Supplies of goods/services already invoiced in 2014/15 for which a credit note is required Submit request to Accounts Receivable clearly marked 2014/15 Deadline: 7th August Payments (relating to sales invoices) received up to and including 31st July 2015 Send immediately to Accounts Receivable for processing Deadline: to be received by 12 noon 31st July Goods/services supplied after 31st July 2015 Issue sales invoice as normal in 2015/16 dated August 2015 Page 3 of 8 2015 Detailed Year end procedures 2b. DEBTORS (people who owe the University money) CONTACT Izzy Clayton Ext 3076 Goods/services supplied by University prior to 1st August 2014 for which the invoice has not been issued by 7th August 2015 Complete form CD2/2015/A return to financialreporting@ex.ac.uk (£500 is the suggested materiality level) Nil Returns are also required 3. ACCOUNTING FOR INCOME RECEIVED CONTACT Areas sending cash via the Cashier’s Office for transit to the bank by professional carrier for income up to and including 31st July 2015. Cash/cheques/cards received up to and including 31st July 2015 and processed by Cashier’s Office. Ensure the cash and paperwork are sent or taken promptly to the Cashier’s Office Deadline: 3rd August Ensure receipts relating to 2014/15 are kept separate from receipts relating to 1st August 2015 onwards Send or take immediately to the Cashier’s office, together with paperwork Deadline: 3rd August Deadline: to be received by 5pm 10th August Liz Shillingford Ext 3098 Notes On no account must cash from the old year be mixed with cash from the new year. Please note that special cash collections can be arranged if necessary – contact Estate Patrol Ext. 3999 Cash received by Finance Services after the deadline of 1st August will be processed in 2015/16, irrespective of the date on the paperwork. Page 4 of 8 2015 Detailed Year end procedures 4. STAFF BUSINESS EXPENSE CLAIMS AND PURCHASING CARDS CONTACT Please see details of the process for Staff expense claims and purchasing cards on the finance services webpage These will be converted to an electronic accrual to be posted by finance services systems support. The electronic accrual will be circulated to finance staff in Colleges and Services at 10am on the 6th August to: Confirm that all items should be accrued; Confirm/add coding A response should be submitted by the deadline Complete form CD1/2015/C and return to financialreporting@ex.ac.uk. This is particularly important for research and other externally funded projects that complete on or before 31 July 2015. (£500 is suggested materiality level) AND Submit expense claims on the expenses system in the usual way Scrutinise a report of all claims submit in the financial year; for narrative for activity dates in 2015/16. Extract these as prepayments and enter on CD1/2015/B Submit expense claims on the expenses system in the usual way Expense claims dated prior to 1st August 2015 on the expenses system and submitted by the 5th August. Expense claim for costs that relate to 2014/15, which have not been entered in Expenses on Line by the 5th August Expense claims for costs that relate to 2015/16. Expense claims for costs incurred after 31st July 2015. Gill Pearn Ext 2777 Deadline: 5pm 10th August Deadline: to be received by 5pm 10th August Deadline: to be received by 5pm 10th August 5. NON-STAFF AND STUDENT EXPENSE CLAIMS CONTACT Non-staff/student expense claims for costs incurred in 2014/15. Non-staff/student expense claims RECEIVED in Accounts Payable by 17th July 2015 will be processed in July. Deadline: to be received by 17th July Non-staff/student expense claims for costs incurred in 2014/15, received by 17th July, that relate to 2015/16 activity. Complete form CD1/2015/B and return to financialreporting@ex.ac.uk. Non-staff/student expense claims that relate to 2014/15, which will be received by Accounts Payable after 17th July deadline. Complete form CD1/2015/C and return to financialreporting@ex.ac.uk. This is particularly important for research and other externally funded projects that complete on or before 31st July 2015. (£500 is suggested materiality level). AND Submit expense claims to Accounts Payable in normal way. Submit expense claims to Accounts Payable in normal way. Deadline for return: 5pm 10th August Deadline for return: 5pm 10th August Non-staff/student expense claims for costs incurred after 31st July 2015. Page 5 of 8 Tanya Hitchen Ext 5009 2015 Detailed Year end procedures 6. PAYROLL CLAIMS CONTACT Tom Gardner Ext 5579 E-claims: Claims paid via ‘Claims Payroll’ for work done in 2014/15 processed through the e-claims system. Any claims that are APPROVED in the eclaims system by the 7th August 2015 will be automatically accrued for in 2014/15. Deadline: to be approved by 7th August 5pm Therefore approvers should ensure that they APPROVE all claims in relation to 2014/15 by the 7th August 2015. Any claims made in the e-claims system in relation to August 2015 should NOT BE APPROVED before the 11th August, otherwise they will be accrued for in the 2014/15 accounts. August claims must be approved between the 11th-14th August in order to make the deadline for payment in August. Paper-claims: Claims paid via ‘Claims Payroll’ for work done in 2014/15. Includes PD82s Excludes PD71 forms and PD107 forms (these are processed as part of ‘Main payroll’). This also excludes PD85s as these are paid in the month to which they relate. Claims should now all be submitted via the e-claims system. However, any approved paper claims relating to work done in 2014/15 that are RECEIVED in Payroll by midday on the 10th August will be automatically accrued for in 2014/15. Make sure that these claims are well marked as 2014/15 work. Deadline: to be received by 10th August noon Any paper claims received in relation to 2015/16 will be returned with a request for submission on the e-claims system. The accrual for both e-claims and paper claims will be posted by corporate accounting on August 12th. Any PD71 and PD107 forms relating to 2014/15 work will need to be included on a CD1\2015\C form Page 6 of 8 2015 Detailed Year end procedures 7. PETTY CASH EXPENDITURE CONTACT Liz Shillingford Ext 3098 Petty cash expenditure up to and including 31st July 2015 Send petty cash book and claim for reimbursement to Cashier’s office Deadline 3rd August Notes Do not send in a claim for reimbursement which spans both years. It is acceptable to close off petty cash earlier than 31st July 2015 and include all subsequent expenditure in 2014/15 unless material to the college/service. 8a. INTERNAL TRADING SALES INVOICES (Z-accounts) CONTACT Trish Tester Ext 5038 Goods/services supplied internally on or before 31st July 2015 Issue sales invoice as soon as possible after date of supply but by 24th July 2015 Goods/services supplied internally on or before 31st July but not invoiced by 24th July 2015 Issue sales invoice in 2014/15 dated 1st August 2015 Deadline: 24th July (period 12 closes) (See note below) Notes The deadline to enter 2014/15 internal transactions has remained as late as possible in order that the majority of internal transactions can be processed in the normal way (i.e. what happens throughout the year). This should effectively eliminate the need for internal transactions to be accrued for and, for this reason, the CD3 forms will not be issued as a matter of course. 8b. INTERNAL TRADING PURCHASE INVOICES (Z-accounts) CONTACT All internal invoices dated up to and including 24th July 2015 Process for payment as soon as possible following receipt but before 7th August 2015. Any outstanding balances will be then be direct debited. Ensure supplying department and Trish Tester have been formally notified. Direct Debiting of any unresolved invoices will be performed by close of play on the 11th August. All outstanding disputed invoices will be reinstated in 2015/16 pending resolution. Disputed internal invoices (Please make every effort to resolve these prior to 31st July 2015) Trish Tester Ext 5038 Deadline: 7th August Deadline: 31st July Notes If there is a need to provide for an internal transaction and the value is material to the receiving AND supplying department, a CD3/2015 form can be requested from Corporate Accounting and the accrual(s) may be submitted by mutual agreement. Internal sales invoices dated on or after 1st August 2015 will not be able to be processed by the receiving college/service until Tuesday 13th August when the old year internal purchase ledger has been closed and the new year internal purchase ledger has been opened. Page 7 of 8 2015 Detailed Year end procedures 9. EQUIPMENT CONTACT Capital equipment schedules (items costing more than £25,000) Inventory schedules (items costing between £500 and £25,000) To be issued during July 2014 – confirmation of equipment purchases exceeding £25,000 To be issued during July 2015 – confirmation that inventory schedules are held by individual Colleges/Services. These may be inspected during the course of the external audit. 10. APTOS DATES CONTACT Commitments Commitments will be rolled forward in Aptos by Finance Services Systems Support. A reminder will be sent out to remind staff to review the commitments in July before this is performed. All Aptos Balances to be circulated to Colleges and Services by the 16th October to confirm which items to be rolled forward on separate codes. Revised procedure notes to be circulated to clarify process. Roll forward of Aptos Page 8 of 8 Ian Toogood Ext 2213 Deadline for return: 7th August Deadline for return: 7th August Martin Henson Ext 5443 Deadline for review: 31st July Deadline for return: 23rd October 2015 Detailed Year end procedures