Lesson 3

advertisement

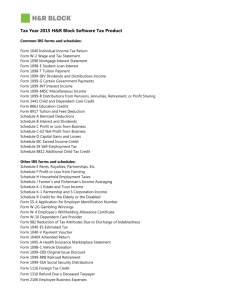

Lesson 3 Income Objectives • Determine what is taxable and nontaxable income • Determine where to report income on Forms 1040, 1040A, and 1040EZ • Identify who can file Schedule C-EZ • Identify who must file Schedule SE Intake/Interview Process – Form 13614 - Income Taxable Income • • • • • • Wages, salaries, commissions, tips Interest, dividends, pensions, capital gains Alimony, business income, hobby income Rents, royalties, estate or trust income Unemployment benefits, jury duty pay Other items of income unless they are designated as nontaxable Nontaxable Items • • • • • • • Child Support Federal income tax refunds Gifts and inheritances Municipal bond interest Public assistance Veteran’s disability benefits Other items listed in the text Earned Income • Wages and Salaries • Tip Income • Scholarships and Fellowships Interest • Interest Income • Taxable Interest Income • Coverdell ESA • Tax-Exempt Interest Dividend Income • Reporting Dividends and Capital Gain Distributions Other Income • State and Local Tax Refunds • Alimony • Income From Business Who Can File Schedule C-EZ? • • • • • • • Business expenses do not exceed $5,000 Use the cash method of accounting Did not maintain an inventory Did not have a net loss Had no employees Does not claim depreciation Does not deduct expenses for use of home Completing Schedule C-EZ and Schedule SE • Be sure to include the Principal Business Code on the Schedule C-EZ • You do not have to provide details on the type of expenses included • Complete Schedule SE if the net profit is $400 or more. • Remember to deduct, as an adjustment to income, ½ of the amount calculated on the SE Other Income • Capital Gains and Losses • Sale of Business Property • Pension and Annuity Income • Rents, Royalties, Partnerships, Estates, and Trusts • Farm Income • Unemployment Compensation Quality Review (QR) Income • Use the Form 8158, Quality Review Checklist or the Publication 730, Important Tax Records Envelope or your site’s equivalent form to review all returns prepared. – All income indicated on the intake sheet and supporting documents is included on the return. Lesson Summary Review of types of income Military Objectives • Determine gross income of Armed Forces members • Amend return for medical separation pay • Determine combat pay exclusion • Identify qualifying items of military pay received from combat zone. Military Income • Includible and Excludable Military Income • Medical Separation Pay • Combat Zone Exclusion • Combat Zones Military/Special Issues Objectives • Determine whether the taxpayer qualifies for the foreign earned income exclusion. • Calculate the foreign earned income exclusion. Military/Special Issues Foreign Earned Income Exclusion • Must show home is in foreign country • Meet bona fide residence or physical presence test • Tax Home Military/Special Issues Foreign Earned Income Exclusion • Period of Stay • Physical Presence Test Military/Special Issues Foreign Earned Income Exclusion • Military Members working second jobs • Spouses Military/Special Issues Foreign Earned Income Exclusion • Must have Earned Income • Can exclude up to $82,400 • Voluntary • Use Form 2555 or 2555 EZ Military Summary Review Military Income issues International Issues • Worldwide Income • Self-employment Tax • Rental Income & Expenses International Issues Objectives – Worldwide Income • Define worldwide income and compute the U.S. dollar value of a foreign currency. • Determine when to use average annual exchange figures International Issues Objectives – Self-Employment Tax • Determine who is a self-employed individual • Compute the self-employment tax for a U.S. citizen or resident • Compute the deduction for self-employment tax International Issues Objectives – Rental Income and Expenses • Determine how to report rental income • Determine how to report rental expenses • Determine how to report rental income when property is used for personal purposes either part of the year or during the entire year International Issues Objectives – Rental Income and Expenses (cont.) • Determine how to compute deductible depreciation expense • Identify the application of at-risk and passive activity rules International Summary Review International Income issues