Value chain and GVC

advertisement

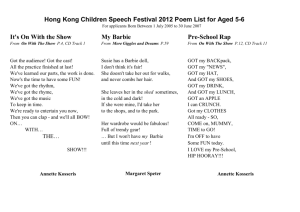

Dr Gautam Dutta Mekong Institute OUTLINE PRESENTATION Introduction Objective Process Outcome Q&A Value Chain The term value chain refers to the full range of activities that are required to bring products from conception through different phases of to delivery to the final customers and disposal after use. A value chain exist when all the actors operate in a way that generates maximization of value across the chain. Common questions that value chain should reply analysis Who are the actors that participate in businesses across value chains? Are there actors that coordinate activities in the overall value chain? What are the contractual arrangements under which actors buy and sell products? How do actors exchange information and learn about solutions to improve products and business performance? What technical, business and financial services are available to support actors in the chain? How much value do actors add to the product in the different steps in the chain, what are their costs and how is this value distributed? What are the power relations in the chain and to what extent do they determine how economic gains and risks are distributed among chain actors? What kinds of barriers exist for firms to enter the value chain? What is the level of competitiveness of firms in the value chain? What bottlenecks exist and what opportunities are available for development (upgrading) of the value chain? Which policies and institutions constrain/support chain actors and facilitate value chain development? Global value chain and cluster linkage Pakistan Twain India Bangladesh pur Raw cotton Spinning Dying Knitting Thailand Selling Finishing with Japanese zipper EU Barbie is sold in 140 countries at a rate of two dolls every second. Barbie's story begins on the outskirts of Los Angeles where Mattel's team of experts on commodity and material prices determine the optimum locations to buy the plastic resins, the cloth, the paper and other materials. Barbie has never been made in the United States. The first doll was produced in Japan in 1959, More than 40% of the dolls are sold overseas, primarily in Europe and Japan. Taiwan's imported oil--about 32%--comes from Saudi Arabia. Other major sources include Oman (10%), Kuwait (10%), Iran (8%) and the United Arab Emirates (7%). Most of the moulds themselves, the most expensive item in toy making, come from the U.S. (for Barbie), Japan or Hong Kong. Pricing Virtually all the materials used in making Barbie are shipped through Hong Kong and trucked to the Guangdong factories In most cases, the only things that China supplies are the factory space, labor and electricity. Pricing: US Retail price: $9.99 Leaving Hong Kong harbor: $2 which includes :35 cents for labor,65 cents for materials. 80 cents for transportation and overhead, 20 cents profit for the companies that manage the manufacturing process. Shipping, ground transportation, marketing, wholesale, retail, : $5.99 Approx Mattel profit:$2 Barbie's Sourcing El Segundo: Mattel Inc. U.S.: Cardboard packaging, paint pigments, moulds China: Factory space, labor, electricity Saudi Arabia: Oil Hong Kong: Management, shipping Taiwan: Refines oil into ethylene for plastic pellets for Barbie's body. Japan: Nylon hair Nike’s Value Chain In footwear, Nike has been able to develop long-term relations with several large Korean and Taiwanese firms. With some of these firms, Nike designers create and then relay via satellite new footwear designs and styles for upcoming seasons to suppliers, who in turn, develop the prototypes. • Once these prototypes are approved, these lead suppliers fax the product specifications to their various plants throughout Southeast Asia, where production can take place almost immediately. •In apparel, given short product cycles and volatile trends, the situation is completely different. Nike works with numerous suppliers, most of whom are also working for other (often competitor) companies. NIKE’S Sourcing ke Assembly Product Design Lining Label, elastic, studs, toggle and string BY X Shell Filler Zipper Performing production slicing to identify the best location/ country to undertake each stage of process, adding value along the way & integrating the entire supply chain Cluster linkage with GVC /IPN Orchestrate & discover value along the supply chain The Evolution of SCM Consumer Needs Product Design Product Development Raw Material Sourcing Consumer Li & Fung’s Supply Chain Wholesaler Factory Sourcing Local Forwarding Consolidation Customs Clearance Forwarder Consolidation Shipping Consolidation Manufacturing Control Li & Fung Group Li & Fung Group Li & Fung Trading Export Sourcing • USD14 billion in 2008 • Soft & Hard goods • 40 countries, 70 offices (HKSE#494) IDS Group Integrated-Distribution Services • USD1.7 billion in 2008 • Asian Distribution • Global Logistics (HKSE#2387) Li & Fung Retailing Retailing • USD900 million in 2008 • Toys ‘R Us, Trinity, BLS • Circle K (HK GEM) (Privately held)