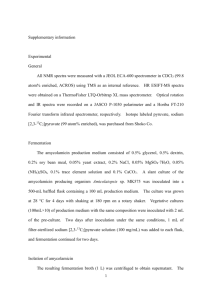

Presnetation on Maintenance of Bank Reconciliation Statement

Presentation on

Preparation of Bank

Reconciliation Statement by Chief Consultant, TSG and Finance Controller,

SSA Assam

Preparation of Bank Reconciliation Statement

• State Implementation Society is required to deposit the grants received from Government of India and

State Governments and any other receipts into a joint signatory Savings Bank Account in any nationalised or scheduled bank.

• Society needs to prepare a Cash Book on daily basis recording the receipts and payments. There should be columns for cash and bank on both the sides of the cash book.

• Society is required to prepare a Bank Reconciliation

Statement every month in respect of each Savings

Bank Account.

• Bank Reconciliation Statement is the process of comparing and matching figures from the accounting records against those shown on a Bank statement or Bank pass Book. The result is that any transactions in the accounting records not found on the bank statement or Bank pass Book are said to be outstanding.

• Advantages of preparing Bank Reconciliation Statement are :

A bank reconciliation statement offers checks and balances for our accounting and bank’s accounting.

The errors that might have been committed either in the Cash book or in the Bank Account by Bank are revealed .

The reconciliation statement will also indicate any undue delay in the clearance of cheques.

If any acts of embezzlement is committed by any staff of an organization or the bank it can be detected immediately.

• Chapter IV para 84 of the Manual on FM&P,

GOI provides details on preparation of BRS.

Para 84.1 : Monthly Bank Reconciliation should be carried out on a regular basis at SPO , DPO & BRC level.

Para 84.2 : Bank Pass Book should be updated regularly at all level .

Para 84.3 : In case Bank Pass Book not issued , monthly Bank Statement should be obtained from

Bank regularly.

Mechanism followed by SSA, Assam

Preparation of BRS :

Instructions are given to prepare bank wise BRS at the end of every month up to BRC level.

Regular updating of Bank Pass Book / Collection of Bank

Statement by 2 nd day of the next month.

After preparation of BRS if any stale cheque are located :

Intimate concern bank immediately to stop payment .

Then related expenditure will be reverted back in the

Cash

Book against same activity head,

If any bank error detected during preparation of BRS, matter is taken up with the bank to sort out the differences.

Any discrepancy will be rectified and difference explained in the bank reconciliation statement in the manner explained below :

Balance as per Cash Book -----------------

Add : (i) Cheque issued but not cashed / presented -----------------

( Detailed particulars of the cheques should be shown as an analysis)

(ii) Credit entries made in the bank but not shown in the cash book ------------------

(iii) Interest credited by bank but not entered in the Cash Book ------------------

Total -----------------

Less (i) Amount deposited into bank but not credited in bank account ------------------

(ii) Bank charges debited in the bank account but not entered in the cash book ------------------

Total ----------------

Balance as per Bank Statement/Pass Book ------------------

Reporting :

SPO

DPO

BRC

Bank wise BRS prepared on monthly basis.

BRS position is intimated to MHRD on quarterly basis.

BRS to be prepared on monthly basis & submit a copy to

SPO by 7th of every month along with all financial statement

BRS to be prepared on monthly basis & submit a copy to

DPO by 5 th of every month along with all financial statement

Name of the office

SPO

DPO

BRC

Status of BRS up to 30.06.2010

SSA, Assam

Total

Nos.

BRS position Remarks

1 June

23 22 – Till

June

Kamrup

DPO upto

May ‘10

145 June

An instance……

Civil fund amounting to Rs.11.00 lakhs was transferred to

SMCs bank A/c’s under Dibrugarh District from SPOs bank A/c in the month of Jan . Instead of crediting the same into the SMC bank A/c’s , the district bank branch has credited the amount to DPO bank A/c. The Cashier of the DPO also missed out the same amount while writing Cash Book, as it was directly transferred from

SPO. The matter was traced only at the end of March while preparing BRS for the last quarter. Thus the corrective measures could be taken only at the end of

March .

results …………….

Such type of critical situation arises if we donot prepare BRS on regular basis.

Fund was lying ideal for 3 months.