2015-09-25 TEI Carolinas CbC Compliance

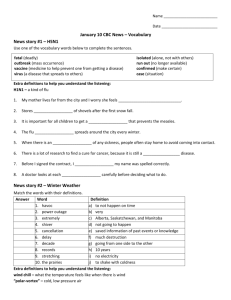

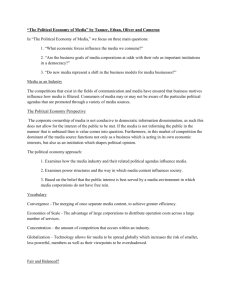

advertisement

Country-by-Country Reporting Compliance Tax Executives Institute: Carolinas Chapter September 25, 2015 | Raleigh, NC Presenter: Mary Bennett (Washington, DC) Baker & McKenzie LLP is a member firm of Baker & McKenzie International, a Swiss Verein with member law firms around the world. In accordance with the common terminology used in professional service organizations, reference to a "partner" means a person who is a partner, or equivalent, in such a law firm. Similarly, reference to an "office" means an office of any such law firm. © 2015 Baker & McKenzie LLP Your presenter Mary Bennett Washington, DC mary.bennett@bakermckenzie.com (202) 452-7045 © 2015 Baker & McKenzie LLP 2 Agenda Today’s topics ‒ Introduction to BEPS Action 13 ‒ Preparation of the CbC report ‒ Implementation of CbC requirements by governments ‒ Related developments to monitor © 2015 Baker & McKenzie LLP 4 Introduction to BEPS Action 13 Action 13: CbC Reporting -- Background ‒ Pressure has been building for years to require greater transparency of MNEs’ tax payments on a CbC basis ‒ Started as effort to hold (developing country) governments accountable for revenues from extractive industries (e.g. EITI, PWYP, Dodd-Frank) NGOs began to advocate public disclosure as a means to combat corporate tax avoidance Some NGOs have candidly advocated public CbC reporting as a step needed to move away from the arm’s length principle and toward global formulary apportionment Increased information reporting to tax authorities is highest priority BEPS response for OECD and many countries © 2015 Baker & McKenzie LLP 6 Action 13: Status of guidance ‒ September 2014 Action 13 Report – laid out framework of required documentation, left open issues of implementation ‒ February 2015 Guidance – addressed issues of who must file, when, with whom, and how information could be used ‒ June 2015 Implementation Package – contained model CbC legislation and model competent authority agreements ‒ October 2015 Final Report – expected to consolidate prior guidance © 2015 Baker & McKenzie LLP 7 Action 13: CbC Reporting -- Background ‒ September 2014 Action 13 Report established three goals for transfer pricing documentation: providing tax administrators with data necessary to perform risk assessments; ensuring that taxpayers meet requirements and appropriately report income in transfer pricing transactions; and permitting tax administrations with the required information to audit transfer pricing practices ‒ The main innovation of the Guidance is to focus not on documentation of related party transactions, but on "risk assessment." © 2015 Baker & McKenzie LLP 8 Action 13: CbC Reporting — TPD framework ‒ The Guidance proposed a three-tiered structure consisting of: a master file containing standardized information relevant for all MNC group members a local file referring specifically to material transactions of the local taxpayer; and a country-by-country report containing certain information relating to the global allocation of the MNC's income and taxes paid together with certain indicators of the location of economic activity within the MNC group © 2015 Baker & McKenzie LLP 9 Action 13: TPD — Master File ‒ Master File MNC group's organizational chart Description of the MNC's business(es) (including profit drivers, major product supply chain, intercompany service agreements, main geographic markets, brief functional analysis for entities, recent restructurings/M&A) MNC's intangibles, e.g., list of intangibles important for transfer pricing with legal owner(s) and a general description of group's transfer pricing policies for R&D and intangibles MNC's intercompany financial activities, e.g., related and unrelated financing MNC's financial and tax positions: APAs and tax rulings relating to allocation of income © 2015 Baker & McKenzie LLP 10 Action 13: TPD — Local File ‒ Local File Local entity information, including management structure and local organization chart Detailed description of specific intercompany transactions between local country and entities in other countries, and copies of all material intercompany agreements executed by that entity Includes relevant financial information regarding transactions, comparability analysis, and selection and application of the transfer pricing method © 2015 Baker & McKenzie LLP 11 Action 13: CbC Reporting -- Contents ‒ CbC Report Aggregate CbC data about entities (and PEs) in every country to go to every tax administration (not public) Proposed CbC template includes: Revenues (broken down by unrelated party, related party, and total) Profit (loss) before income tax Income tax paid (on cash basis) Income tax accrued – current year Stated capital and accumulated earnings Number of employees Tangible assets other than cash and cash equivalents Option to use “bottom-up” or “top-down” approach © 2015 Baker & McKenzie LLP 12 Action 13: CbC Reporting -- Implementation ‒ ‒ Implementation issues left open in September 2014: With which government(s) should CbC report be filed What confidentiality restrictions will apply For what year will first report be required When will report be due What groups must file report What restrictions will there be on countries’ use of report How will consistency of requirements be achieved and maintained February 2015 Implementation Guidance addresses some issues © 2015 Baker & McKenzie LLP 13 Action 13: CbC Reporting — Feb. 2015 Guidance ‒ Who files, where, and when: Recommendation for master file and local file to be filed locally in each country Agreement parent company country should provide CbC report through automatic EOI to eligible countries First CbC reports recommended to be filed for years beginning in 2016 (some countries may need more time); participating countries agree no reporting for earlier years to be required Taxpayers to have 12 months after year-end to file Only groups with > €750M consolidated group revenue in prior year to be required to file © 2015 Baker & McKenzie LLP 14 Action 13: CbC Reporting — Feb. 2015 Guidance ‒ Participating countries agree to conditions underpinning obtaining and using CbC reports: Confidentiality Consistency Appropriate use ‒ Mechanisms will be developed to monitor countries’ compliance with their commitments, in addition to 2020 review of implementation ‒ Agreement to develop implementation package: Parent country legislation / sub country “secondary mechanisms” Implementing agreements for AEOI © 2015 Baker & McKenzie LLP 15 CbC reporting and confidentiality This will not please the NGOs but the CbCR information will go to tax administrations only. This is extremely sensitive Information. Pascal SaintAmans OECD This exclusion will not help rebuild citizens’ trust in global businesses’ wealth creating mission for societies. Pierre Habbard Trade Union Advisory Committee © 2015 Baker & McKenzie LLP June 2015 Implementation Package (1/2) ‒ Model CbC legislation – overview Designed as model legislation which could be used by countries to require ultimate parent entity of an MNE group to file CbC report in its country of residence Includes backup “secondary” mechanism for requiring filing by local subsidiary in certain circumstances Expected that jurisdictions could adapt the model legislation to their domestic legal systems © 2015 Baker & McKenzie LLP 17 June 2015 Implementation Package (2/2) ‒ Model Competent Authority Agreements (MCAAs) Designed to implement AEOI of CbC reports under EOI provisions of tax treaty, TIEA, or Multilateral Convention on Mutual Administrative Assistance in Tax Matters Addresses timing and scope of AEOI, conditions regarding confidentiality, data safeguards, and appropriate use Includes detailed questionnaire on confidentiality and data safeguards © 2015 Baker & McKenzie LLP 18 Preparation of the CbC report Preparing to comply ‒ Conducting dry runs ‒ Understanding accounting system / software and capabilities ‒ Identifying interpretive issues in OECD guidance ‒ Achieving collaboration across corporate departments, including tax, treasury, IT, and Finance, and best practices regarding the same ‒ Analyzing benefits and pitfalls of a “top down” versus “bottom up” approach ‒ Developing a strategy regarding narrative © 2015 Baker & McKenzie LLP 20 © 2015 Baker & McKenzie LLP 21 © 2015 Baker & McKenzie LLP 22 © 2015 Baker & McKenzie LLP 23 Some data items (1/7) ‒ Countries included: All tax jurisdictions in which the MNE group has an entity resident for tax purposes Apparently includes disregarded entities if considered tax resident in a jurisdiction Separate line for all entities not resident in any country Dual resident entities – use treaty tie-breaker or POEM test Partnerships? Not resident anywhere? Proportionately resident in partners’ jurisdictions? Treated like dual residents? © 2015 Baker & McKenzie LLP 24 Some data items (2/7) ‒ Entities included: “Constituent Entities” -- any separate business unit of the MNE group (company, corporation, trust, partnership etc.) that is included in the consolidated group for financial reporting purposes No materiality threshold PE is a Constituent Entity if it has a separate income statement for regulatory purposes, financial reporting, internal management or tax purposes (most of its data is reported separately by reference to jurisdiction where it is located) © 2015 Baker & McKenzie LLP 25 Some data items (3/7) ‒ Source of data: Can be “top down” or “bottom up” “Top down” refers to data from the group’s consolidation reporting packages “Bottom up” refers to separate entity financial statements, regulatory financial statements, or internal management accounts Group should consistently use same sources year to year, should describe sources used and explain any change in source of data © 2015 Baker & McKenzie LLP 26 Some data items (4/7) ‒ Reportable period can be either: Information for the fiscal year of the relevant Constituent Entities ending with or within the fiscal year of the parent Reporting MNE, or Information for all the relevant Constituent Entities reported for the fiscal year of the Reporting MNE ‒ Approach should be consistently applied © 2015 Baker & McKenzie LLP 27 Some data items (5/7) ‒ Aggregation (versus consolidation) of items of the Constituent Entities resident in each jurisdiction ‒ Revenues – exclude amounts from Constituent Entities treated as dividends by payor’s jurisdiction ‒ Cash tax paid – includes taxes paid by Constituent Entities to their residence jurisdiction and other jurisdictions (e.g., withholding taxes imposed on payment they received) E.g. Mexican withholding tax on payment to US company reported as tax paid by US entity © 2015 Baker & McKenzie LLP 28 Some data items (6/7) ‒ Current year income tax accrued – should exclude deferred tax and provisions for uncertain tax liabilities ‒ PE’s stated capital and accumulated earnings – should be reported as part of the PE’s legal entity numbers ‒ Number of employees Refers to FTE employees Can do snapshot or average, but must be consistent across entities and years Can include independent contractors participating in ordinary activities of business Rounding permissible if not distortive © 2015 Baker & McKenzie LLP 29 Some data items (7/7) ‒ Tangible assets other than cash and cash equivalents Report net book value of assets fo Constituent Entities resident in the jurisdiction (without regard to where assets are located, unless attributable to a PE) © 2015 Baker & McKenzie LLP 30 Action 13: CbC Reporting -- Responses ‒ ‒ ‒ ‒ ‒ Analyze ability to collect and process data (sources of data points, responsibilities, systems requirements) Eliminate unneeded entities Identify potential “hot” data points (especially high profit, zero tax jurisdictions) and consider whether to restructure Consider potential explanatory supplement Monitor implementation by governments © 2015 Baker & McKenzie LLP 31 Implementation by governments CbC reports – confidentiality ‒ Participating countries agree jurisdictions should have in place and enforce legal protections of confidentiality as a condition for obtaining and using the CbC report Protection should be at least equivalent to that for info obtained under EOI provisions of treaties / TIEAs / MCMAATM, which say: Information obtained through EOI to be treated as secret to same extent as info obtained under domestic laws (relevant only where country obtains CbC report through EOI) Information shall be disclosed “only to persons or authorities (including courts and administrative bodies) concerned with the assessment or collection of, the enforcement or prosecution in respect of, the determination of appeals in relation to” the jurisdiction’s taxes or the oversight of the above (MTC Article 26) Information disclosed shall be used only for such purposes © 2015 Baker & McKenzie LLP 33 CbC reports -- consistency ‒ Participating countries agree jurisdictions should meet certain consistency requirements as a condition for obtaining and using the CbC report They agree to use “best efforts” to adopt a legal requirement that locally-parented MNEs file CbC report They agree to use the standard template in the TPG – no additions or omissions © 2015 Baker & McKenzie LLP 34 CbC reports – appropriate use (1/2) ‒ ‒ Participating countries agree jurisdictions should meet an “appropriate use” requirement as a condition for obtaining and using the CbC report – so info may be used for: High-level transfer pricing risk assessment Evaluating other BEPS-related risks Economic and statistical analysis Making further inquiries on audit Info may not be used: As a substitute for a detailed TP analysis of individual transactions and prices based on a full functional analysis and a full comparability analysis To propose TP adjustments based on global formulary apportionment © 2015 Baker & McKenzie LLP 35 CbC reports – appropriate use (2/2) ‒ Participating countries further agree: If CbC info is used by local tax administration to make a formulary apportionment-based adjustment, that country’s competent authority will “promptly cede” the adjustment in any relevant MAP proceeding Where CbC info was provided through tax treaty EOI, MAP will be available Where CbC info was provided through other EOI, the competent authority EOI agreement will incorporate “a mechanism for competent authority procedures to discuss with the aim of resolving cases of undesirable economic outcomes, including if such cases arise for individual businesses” © 2015 Baker & McKenzie LLP 36 CbC reports – EOI framework ‒ Participating countries agreed on following framework: Jurisdictions should require timely CbC reports from locallyparented MNEs Jurisdictions should provide those reports through automatic EOI to countries that meet the confidentiality, consistency, and appropriate use conditions A “secondary mechanism” (requiring local filing in sub country or moving central filing obligation to a lower tier country) would be acceptable where eligible sub countries do not receive report from parent country because: No CbC report required in parent country No CA agreement timely in place to provide for AEOI Parent country has failed to comply with AEOI agreement © 2015 Baker & McKenzie LLP 37 Model CbC Legislation Model CbC legislation -- contents ‒ Article 1: Definitions ‒ Article 2: Filing obligation ‒ Article 3: Notification ‒ Article 4: Country-by-Country report ‒ Article 5: Time for filing ‒ Article 6: Use and confidentiality of CbC report information ‒ Article 7: Penalties ‒ Article 8: Effective date © 2015 Baker & McKenzie LLP 39 Model CbC legislation – Article 1 (Definitions) ‒ ‒ Definitions of terms such as “MNE Group”, “Constituent Entity” (including PEs) based on September 2014 Report Some definitions reflect February 2015 guidance, e.g.: “Excluded MNE Group” – having consolidated group revenue on Consolidated Financial Statements of less than 750 million Euro Query: Can an MNE Group be “Excluded MNE Group” if has no Consolidated Financial Statements? “Reporting Entity”: Generally, the Ultimate Parent Entity Group may appoint “Surrogate Parent Entity” where for certain reasons CbC information would not be available from jurisdiction of Ultimate Parent Entity © 2015 Baker & McKenzie LLP 40 Model CbC legislation – Article 1 (Definitions) (cont’d) ‒ “International Agreement” – legal instrument authorizing automatic EOI – can be: Multilateral Convention for Mutual Administrative Assistance in Tax Matters, (MCMAA) tax treaty, or TIEA ‒ “Qualifying Competent Authority Agreement” (QCAA) – CA agreement pursuant to International Agreement, requiring AEOI of CbC reports © 2015 Baker & McKenzie LLP 41 Model CbC legislation – Article 1 (Definitions) (cont’d) ‒ “Systemic Failure” – refers to situation where a country is not providing CbC reports through AEOI – specifically: The term “Systemic Failure” with respect to a jurisdiction means that a jurisdiction has a QCAA in effect with [Country], but has suspended AEOI (for reasons other than those that are in accordance with the terms of that Agreement) or otherwise persistently failed to automatically provide to [Country] CbC reports in its possession of MNE Groups that have Constituent Entities in [Country]. Query: what if a jurisdiction hasn’t concluded an International Agreement with [Country] due to concerns about [Country]’s confidentiality / data safeguard standards? © 2015 Baker & McKenzie LLP 42 Model CbC legislation – Article 2 (Filing Obligation) ‒ ‒ Paragraph 1: imposes CbC filing obligation on Ultimate Parent Entity resident in [Country] Paragraph 2: secondary mechanism, imposes CbC filing obligation on subsidiary resident in [Country] if: Ultimate Parent not required to file in its country, Ultimate Parent’s country has an International Agreement with [Country] but no QCAA in effect by filing deadline There has been a “Systemic Failure” by Ultimate Parent’s country which has been notified to local sub by [Country Tax Administration] © 2015 Baker & McKenzie LLP 43 Model CbC legislation – Article 2 (Filing Obligation) (cont’d) ‒ Note that existence of International Agreement authorizing AEOI won’t guarantee that CbC reports will be exchanged – e.g.: “[T]he IRS is not required to exchange information with another country, even if an information exchange agreement is in effect, if there are concerns about confidentiality, safeguarding of data exchanged, the use of the information, or other factors that would make the exchange of information inappropriate.” (Rev. Proc. 2014-64) “David Varley, acting director of the IRS Transfer Pricing Operations group, said U.S. may block automatic exchange of country-by-country data to countries that don't provide reciprocal information.” (BNA Daily Tax Report, April 24, 2015) © 2015 Baker & McKenzie LLP 44 Model CbC legislation – Article 2 (Filing Obligation) (cont’d) Per Rev. Proc. 2014-64, countries with which US has International Agreement authorizing EOI are these (85+): ‒ Antigua & Barbuda, Aruba, Australia, Austria, Azerbaijan, Bangladesh, Barbados, Belgium, Bermuda, Brazil, British Virgin Islands, Bulgaria, Canada, Cayman Islands, China, Colombia, Costa Rica, Croatia, Curacao, Cyprus, Czech Republic, Denmark, Dominica, Dominican Republic, Egypt, Estonia, Finland, France, Germany, Gibraltar, Greece, Grenada, Guernsey, Guyana, Honduras, Hong Kong, Hungary, Iceland, India, Indonesia, Ireland, Isle of Man, Israel, Italy, Jamaica, Japan, Jersey, Kazakhstan, Korea (South), Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Marshall Islands, Mauritius, Mexico, Monaco, Morocco, Netherlands, Netherlands island territories: Bonaire, Saba, and St. Eustatius, New Zealand, Norway, Pakistan, Panama, Peru, Philippines, Poland, Portugal, Romania, Russian Federation, Slovak Republic, Slovenia, South Africa, Spain, Sri Lanka, St. Maarten (Dutch part), Sweden, Switzerland, Thailand, Trinidad and Tobago, Tunisia, Turkey, Ukraine, United Kingdom, Venezuela Countries with which US has determined AEOI of bank info is appropriate are these (18): ‒ Australia, Canada, Denmark, Finland, France, Germany, Guernsey, Ireland, Isle of Man, Italy, Jersey, Malta, Mauritius, Mexico, Netherlands, Norway, Spain, United Kingdom © 2015 Baker & McKenzie LLP 45 Model CbC legislation – Article 2 (Filing Obligation) (cont’d) ‒ Tax Notes Today, February 25, 2015: David Varley, acting director of transfer pricing operations in the IRS Large Business and International Division, said the IRS's recent experience with large AEOI projects under FATCA and the CRS "lends some insights into exactly how much work it will be for tax administrators both in the United States and the rest of world." Varley noted that confidentiality risks are higher when large volumes of information are exchanged. To eliminate some of the risks, the IRS has committed to meeting with every country that it exchanges information with under FATCA, Varley said. "That's about a day and a half of going over the [International Data Safeguards & Infrastructure] workbook," he said. There are two teams in the field making country visits, and each team can do approximately four to five visits per month, he said. "When you start looking at review of the domestic law and procedures for safeguarding and infrastructure in the context of CbC, I think it raises interesting issues that are unique to it," Varley said. ‒ Doug O’Donnell, June 12, 2015: Country reviews are “very enlightening, time-consuming, difficult” © 2015 Baker & McKenzie LLP 46 Model CbC legislation – Article 2 (Filing Obligation) (cont’d) ‒ Local sub can be required to file where there’s “systemic failure” by Ultimate Parent’s country Can include having a QCAA but not living up to its terms What about not having an International Agreement at all? Does that come within “or otherwise persistently failed to automatically provide to [Country] CbC reports in its possession”? ‒ Where there is more than one local sub, MNE group can designate one to file the CbC report on behalf of the group © 2015 Baker & McKenzie LLP 47 Model CbC legislation – Article 2 (Filing Obligation) (cont’d) ‒ Paragraph 3: notwithstanding paragraph 2, local sub won’t be required to file if group has appointed a Surrogate Parent Entity and: Surrogate Parent’s country requires CbC filings, Surrogate Parent’s country has a QCAA in effect covering CbC reports Surrogate Parent’s country hasn’t notified [Country tax administration] of a Systemic Failure Surrogate Parent’s country has been notified by entity that it’s acting as Surrogate Parent, and Surrogate Parent has notified [Country tax administration] of its status © 2015 Baker & McKenzie LLP 48 Model CbC legislation – Article 3 (Notification) ‒ A local Constituent Entity shall notify [Country Tax Administration] by last day of Reporting Fiscal Year if it is Ultimate Parent Entity or Surrogate Parent Entity ‒ A local Constituent Entity which is not the Ultimate Parent or Surrogate Parent shall notify [Country Tax Administration] which group entity is © 2015 Baker & McKenzie LLP 49 Model CbC legislation – Article 4 (CbC report) ‒ Paragraph 1: lists contents required, same as CbC template ‒ Paragraph 2: CbC report shall be filed in form identical to and using definitions and instructions in standard template contained in: [Annex III of Ch. V of TPG, as amended from time to time] [Annex III of [final BEPS Action 13 Report]], or [Appendix to this law] ‒ Query: presumably Appendix must conform to Annex III? © 2015 Baker & McKenzie LLP 50 Model CbC legislation – Article 5 (Time for filing) ‒ ‒ No later than 12 months after the last day of the Reporting Fiscal Year September 2014 Report: ‒ “With regard to the country-by-country report, it is recognised that in some instances final statutory financial statements and other financial information that may be relevant for the country-by-country data described in Annex III may not be finalised until after the due date for tax returns in some countries for a given fiscal year. Under the given circumstances, the date for completion of the country-by-country report described in Annex III to Chapter V of these Guidelines may be extended to one year following the last day of the fiscal year of the ultimate parent of the MNE group.” “U.S. officials are considering whether to require U.S. companies that must file a country-by-country template to do so along with their tax returns, according to Brian Jenn, an attorney-adviser in the Treasury Department Office of Tax Policy.” (BNA Daily Tax Report, June 15, 2015) © 2015 Baker & McKenzie LLP 51 Model CbC legislation – Article 6 (Use and confidentiality of the CbC report info) ‒ May be used “for purposes of assessing high-level transfer pricing risks and other base erosion and profit shifting related risks in [Country], including assessing the risk of non-compliance by members of the MNE Group with applicable transfer pricing rules, and where appropriate for economic and statistical analysis” ‒ TP adjustments not to be based on it ‒ Confidentiality to be preserved “at least to the same extent that would apply if such information were provided to it under the provisions of the [MCMAA]” © 2015 Baker & McKenzie LLP 52 Model CbC legislation – Article 7 (Penalties) ‒ “This model legislation does not include provisions regarding penalties to be imposed in the event a Reporting Entity fails to comply with the reporting requirements for the country-by-country report. It is assumed that jurisdictions would wish to extend their existing transfer pricing documentation penalty regime to the requirements to file the country-by-country report.” © 2015 Baker & McKenzie LLP 53 Model CbC legislation – Article 8 (Effective Date) ‒ “This [title of the law] is effective for Reporting Fiscal Years of MNE Groups beginning on or after [1 January 2016].” © 2015 Baker & McKenzie LLP 54 Model competent authority agreements Multilateral Competent Authority Agreement (MCAA) -- jurisdictions eligible to sign ‒ Those that “are Parties of, or territories covered by, the MCMAA or the MCMAA as amended by the Protocol (the “Convention”) or have signed or expressed their intention to sign the Convention” ‒ N.B. MCMAA was developed jointly by the OECD and the Council of Europe in 1988; it was amended by Protocol in 2010 to align it to the international standard on exchange of information on request and to open it to all countries More than 60 countries have signed, but the amended Convention is not yet in force in Andorra, Brazil, Cameroon, Chile, China, El Salvador, Gabon, Germany, Guatemala, Liechtenstein, Monaco, Morocco, Philippines, San Marino, Saudi Arabia, Seychelles, Singapore, Switzerland, Turkey, and the United States MCAA signatories acknowledge MCMAA must be in effect for them before AEOI on CbC can take place © 2015 Baker & McKenzie LLP 56 Pre-conditions to exchange ‒ Preamble states participating Jurisdictions “will have, or are expected to have in place by the time the first exchange of CbC Reports takes place”: i. appropriate safeguards to ensure that the information received pursuant to this Agreement remains confidential and is used for the purposes of assessing high-level transfer pricing risks and other base erosion and profit shifting related risks, as well as for economic and statistical analysis, where appropriate, ii. […/…] © 2015 Baker & McKenzie LLP 57 Pre-conditions to exchange (cont’d) ii. the infrastructure for an effective exchange relationship (including established processes for ensuring timely, accurate, and confidential information exchanges, effective and reliable communications, and capabilities to promptly resolve questions and concerns about exchanges or requests for exchanges and to administer the provisions of Section 4 of this Agreement [re collaboration on enforcement and compliance) and iii. the necessary legislation to require Reporting Entities to file the CbC Report. © 2015 Baker & McKenzie LLP 58 Aim to avoid double taxation? ‒ Preamble states participating “Jurisdictions are committed to discuss with the aim of resolving cases of undesirable economic outcomes, including for individual businesses, in accordance with paragraph 2 of Article 24 of the Convention, as well as paragraph 1 of Section 6 of this Agreement” Appears to be aimed at addressing situations where a country might make a formulary apportionment-based assessment, creating double taxation, in circumstances where MAP is not available © 2015 Baker & McKenzie LLP 59 MCAA Sections ‒ Section 1: Definitions ‒ Section 2: Exchange of Information with respect to MNE Groups ‒ Section 3: Time and Manner of Exchange of Info ‒ Section 4: Collaboration on Compliance and Enforcement ‒ Section 5: Confidentiality, Data Safeguards and Appropriate Use ‒ Section 6: Consultations © 2015 Baker & McKenzie LLP 60 MCAA Sections (cont’d) ‒ Section 7: Amendments ‒ Section 8: Term of Agreement ‒ Section 9: Coordinating Body Secretariat ‒ Annex to the Agreement: Confidentiality and Data Safeguards Questionnaire © 2015 Baker & McKenzie LLP 61 MCAA Annex – Confidentiality and Data Safeguards Questionnaire ‒ Requires response to specific questions in following areas: 1. Legal Framework for confidentiality / use restrictions 1. Tax Conventions, TIEAs, and other Exchange Agreements 2. Domestic Legislation 2. Information Security Management 1. 2. 3. 4. Background Checks and Contracts Training and Awareness Departure Policies […/…] © 2015 Baker & McKenzie LLP 62 MCAA Annex – Confidentiality and Data Safeguards Questionnaire (cont’d) 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. Physical Security: Access to Premises Physical Security: Physical Document Storage Planning Configuration Management Access Control Identification and Authentication Audit and Accountability Maintenance System and Communications Protection […/…] © 2015 Baker & McKenzie LLP 63 MCAA Annex – Confidentiality and Data Safeguards Questionnaire (cont’d) 13. 14. 15. 16. 17. 18. 19. System and Information Integrity Security Assessments Contingency Planning Risk Assessment Systems and Services Acquisition Media Protection Protection of Treaty-Exchanged data (formerly Prevention of Data Commingling) 20. Information Disposal Policies 3. Monitoring and Enforcement © 2015 Baker & McKenzie LLP 64 MCAA Annex – Confidentiality and Data Safeguards Questionnaire (cont’d) 3. Monitoring and Enforcement 3. Penalties and Sanctions 4. Policing Unauthorized Access and Disclosure 5. Sanctions and Prior Experience © 2015 Baker & McKenzie LLP 65 Implementation by US? We are not convinced that Treasury has the authority to require CbC reporting by certain U.S. companies (including sharing the information with foreign governments). Senate Finance Chair Orrin Hatch (R-UT) and W&M Chair Paul Ryan (R-WI) August 27, 2015 A word of caution for Treasury -- if you move ahead on CbC, you’ll get a challenge from us. Rep. Kevin Brady (R-TX), W&M September 21, 2015 © 2015 Baker & McKenzie LLP 66 Implementation by US? The Hatch-Ryan letter shows we have a robust democracy. At Treasury, we think we have the authority, and we’re proceeding to implement it in a timely manner. Bob Stack, Deputy Assistant Secretary (International Tax Affairs), US Treasury September 2, 2015 © 2015 Baker & McKenzie LLP 67 Implementation abroad Country Date CbC Event Australia September 16, 2015 Release of draft law Germany June 2015 Tax reform proposal Mexico September 8, 2015 Tax reform proposal Netherlands September 15, 2015 Release of draft law Poland April 27, 2015 Draft regulation Spain July 11, 2015 Royal decree 634/2015 United Kingdom January 2015 Release of draft law Etc. © 2015 Baker & McKenzie LLP 68 Related developments to monitor Action 13: CbC Reporting — Related Developments ‒ ‒ © 2015 Baker & McKenzie LLP June 17, 2015: European Commission launches transparency consultation July 8, 2015: European Parliament approves public CbC reporting ‒ July 22, 2015: UK HMRC launches consultation on proposal for annual publication of tax strategy ‒ August 18, 2015: Australian Senate Economic References Committee Report recommends that the government consider publishing excerpts from the CbC reports Thank You! © 2015 Baker & McKenzie LLP 71