Site of Care Matters

advertisement

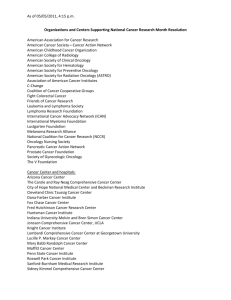

Site of Care Matters: The Value of Community Oncology The Payer Value Proposition Prepared for ION Solutions September 2012 Outline Current State of Oncology Management Community vs Hospital-based Oncology Care Changing Oncology Landscape AmerisourceBergen Consulting Services – Confidential 2 The Value of Community Oncology Patients managed in an office-based setting are less costly than those managed in hospital outpatient settings Care provided in a community office-based setting is more accessible and less costly for patients Patients in community settings utilize more generics and less brand therapies, which results in savings for payers Community practices are more willing to participate in pay-for-quality pathway programs, which will translate into improved outcomes and savings for payers AmerisourceBergen Consulting Services – Confidential 3 Current State of Oncology Management Consolidation in the cancer care landscape continues as larger hospital groups acquire, purchase, or merge with private, community-based practices Changing Business Structure of 1,254 Oncology Clinics/Practices From 2008–20121 241 Clinics Closed 442 Practices Struggling Financially 47 Practices Sending Patients Elsewhere 392 Hospital Agreement/Purchase 132 Merged/Acquired by Another Entity 1. Practice Impact Report. Community Oncology Alliance. April 4, 2012. http://www.communityoncology.org/pdfs/community-oncology-practice-impact-report.pdf Accessed August 23, 2012 AmerisourceBergen Consulting Services – Confidential 5 In 2011, nearly 1 in 4 practices (24%) indicated that they are currently changing their business structure or may only remain viable for another year or so How long to you expect this business structure will remain unchanged and viable? Current (N=106 practices)1 Future (N=106 practices) 3% 1% 24% 11% 10% 13% 54% 22% 86% Physician-owned practice For the foreseeable future Hospital-owned practice For at least 5 years Other For another year or so only Academic practice We are changing now 1. Barr TR, Towle EL. National Oncology Practice Benchmark, 2011 Report on 2010 Data. J Onc Pract. 2011;7(6S):67S-82S. AmerisourceBergen Consulting Services – Confidential 6 Payers’ Understanding of the Issue • Payers understand that oncology is unique and must be approached differently than other specialties • Payers often consider 2 opposing goals when managing oncology1 – Find ways to more aggressively control oncology spending – Craft management policies that are politically and clinically defensible • Payers focus their management attention on the most prevalent and high-cost cancer types to generate the largest return for their efforts in developing and implementing management programs – These cancer types are: Breast Lung Colon 1. McConnell K, Wu J, Dautel N. Payers Must Create Defensible Oncology Management Strategies. Oncology Business Review. 2010 AmerisourceBergen Consulting Services – Confidential 7 Payers prioritize costs before other relevant oncology issues, like site of care • Although the provider landscape in oncology is rapidly changing, payers prioritize other aspects of oncology care before the movement of community-based care to hospitalaffiliated practices • Priorities remain cost drivers such as the cost of hospitalizations or the cost of highpriced products 70% Payer Priorities in Payer Priorities in Oncology1 Oncology1 Movement of community-based care to hospitalaffiliated practices 60% 50% 40% Cost of Hospitalizations 30% 20% High-priced new products 10% 0% 1 - Not at all a priority 4 - Neutral 7 - Extremely high priority 1. High-priced new products 2. Cost of hospitalizations 3. Ability to compare and analyze pharmacy and medical benefit 4. Need to increase use of generics 5. Appropriate use of biomarkers 6. Pathway implementation 7. Appropriate use of hospice 8. Compliance and persistency with oncology drugs 9. Cost of emergency room visits 10. Movement of community-based care to hospital-affiliated practices 11. Role of 340B 1. Xcenda. Managed Care Network. PayerPulse June 2012. AmerisourceBergen Consulting Services – Confidential 8 There also appears to be a disconnect between payer and provider preferences for acquiring infused therapies; payers prefer SPP, while providers demonstrate a preference for buyand-bill Payers’ Preferred Infused Therapy Distribution Channel1 2% 3% Providers’ Primary Infused Therapy Acquisition Channel1 42% 53% • >70% of infused therapies for oncology are distributed via buy-and-bill1 • Average sales price (ASP) used as the primary method of reimbursement by payers Buy-and-bill Specialty vendor Patient acquisition Other 1. Snyder M, Goldberg L, Ryan T. Payer Management of Oncology Gets Serious. Pharmacy Times. http://www.pharmacytimes.com/publications/specialty-pt/2011/May2011/PayerManagement-of-Oncology-Gets-Serious. Accessed August 17, 2012. AmerisourceBergen Consulting Services – Confidential 9 The Challenge of Establishing the Site of Oncology Care Payer Value Proposition • There is somewhat of a disconnect between payers and oncology providers – Payers have other priorities in oncology that supersede site of care, despite the recent market changes • – Preferences for product acquisition vary and create an additional point of discussion and negotiation between the 2 groups • • Payers are seeking additional payment models that make oncology practices’ income independent of drug selection and reward physicians for improving outcomes and reducing costs As heard in a recent payer focus group, smaller regional payers may have different views, needs, and opinions than larger national payers1 – • Payers lack awareness of the value that community oncology practices bring to the market National payers may have more lucrative contracts with hospitals, particularly larger hospital systems, than with smaller community practices, and therefore, may see comparable costs in patients treated in the hospital outpatient department (HOPD) setting • The opposite being true for smaller payers • Mid-size plans are more undecided and potentially able to be persuaded either way Payers are also looking for a demonstration of quality as part of the value equation1 – ie: Value = Quality / Cost 1. Xcenda, data on file. Oncology Site of Care Virtual Payer Council. September 2012. AmerisourceBergen Consulting Services – Confidential 10 Community vs Hospital-based Oncology Care While HOPDs often profess to care for sicker patients to justify their higher costs, recent claims analyses show similarities in the demographics of office-managed vs HOPD-managed breast, lung, and colorectal cancer patients1 Patients by Gender in Select Tumor Types1 Patient Severity in Select Tumor Types1 10 80 60 Office 40 HOPD 20 Score/Number % of patients 100 5 Office HOPD 0 0 Male Female Gender • Slightly more females than males are treated in the HOPD compared to community practices Charlson comorbidity index # of unique # of unique diagnoses prescriptions • Patient illness severity is roughly the same in the community practice setting as the HOPD setting across these 3 tumor types • The mean age of patients in the community practice setting is slightly higher than in the HOPD setting (58.7 years vs 56.9 years, respectively) 1. Xcenda, data on file. Site of Care Claims Analysis Report. September 2012. AmerisourceBergen Consulting Services – Confidential 12 The Value of Community Oncology • Patients managed in an office-based setting are less costly than those managed in hospital outpatient settings Three separate analyses of managed care claims in commercial and Medicare populations demonstrate that patients managed in a community office setting cost less than patients managed in a hospital-based outpatient setting1-3 – The difference in cost varies for individual tumor types; however, the data suggest that this applies to breast, lung, and colorectal cancer3 • Evidence suggests that patients managed in a community office setting have lower hospitalization rates than patients managed in a hospital-based outpatient setting • The majority of common breast, colorectal, and lung cancer chemotherapy-specific costs are lower for patients managed in a community setting 1. Avalere Health Analysis Report of National Association of Managed Care Physicians member data. Total cost of cancer care by site of service: physician office vs outpatient hospital. March 2012. 2. Fitch K, Pyenson B. Site of service cost differences for Medicare patients receiving chemotherapy. Milliman Client Report. 2011. 3. Xcenda, data on file. Site of Care Claims Analysis. September 2012. AmerisourceBergen Consulting Services – Confidential 13 Analysis of 4 large commercial health plans reveals that patients who are managed in an office setting are 24% less costly than hospitalmanaged patients for common cancer types1 Office-managed episodes Types of cancer Prostate HOPD-managed episodes # of episodes Average episode cost # of episodes Average episode cost % difference in average episode cost 3,503 $21,299 394 $25,504 19.7% Average Cost of Chemotherapy for Most Common Cancer Types 24% Difference $40,000 $35,000 Genitourinary system 3,152 Breast 2,252 $30,072 860 $33,391 11.0% $25,000 Lung 3,036 $32,913 1,239 $32,382 -1.6% $20,000 Colon 973 $45,997 233 $46,220 0.5% $15,000 Digestive system 688 $30,018 266 $30,044 0.1% $10,000 Leukemia 581 $39,008 350 $43,508 11.5% Hodgkin’s/ lymphoma 2,131 $39,080 902 $42,537 8.8% $8,960 655 $19,592 118.7% $35,000 $30,000 $28,200 $5,000 $0 Office-managed chemotherapy HOPD-managed chemotherapy 1. Avalere Health Analysis Report of National Association of Managed Care Physicians member data. Total cost of cancer care by site of service: physician office vs outpatient hospital. March 2012. AmerisourceBergen Consulting Services – Confidential 14 There was a 114% difference in the average cost of episodes for office-managed patients ($26,800) vs HOPD-managed patients ($57,400) over 9 months1 Office-managed episodes HOPD-managed episodes Length of episode in months # of episodes Average episode cost # of episodes Average episode cost % difference in average episode costs 1 4,601 $7,350 1,784 $9,903 34.7% 3 2,502 $19,238 1,091 $24,592 27.8% 5 1,601 $26,979 481 $40,677 50.8% 7 1,091 $26,395 268 $40,879 54.9% 9 734 $26,794 127 $57,384 114.2% 11 302 $47,468 69 $63,366 33.5% 1. Avalere Health Analysis Report of National Association of Managed Care Physicians member data. Total cost of cancer care by site of service: physician office vs outpatient hospital. March 2012. AmerisourceBergen Consulting Services – Confidential 15 In a Medicare population, office-managed patients cost $6,500 less per year than hospital-managed patients Annual cost per patient $6,500 Difference $56,000 $54,000 $54,000 $52,000 $50,000 $48,000 $47,500 $46,000 $44,000 Office-managed chemotherapy HOPD-managed chemotherapy 1. Fitch K, Pyenson B. Site of service cost differences for Medicare patients receiving chemotherapy. Milliman Client Report. 2011. AmerisourceBergen Consulting Services – Confidential 16 Hospital-managed patients with breast, colorectal, and lung cancer were more costly than communitymanaged patients1 Mean Chemotherapy Costs – All Regimens $25,000 Community Hospital $19,136 $20,000 $15,000 $13,577 $12,318 $11,599 $10,272 $10,000 $8,344 $5,000 $0 Breast Colorectal Lung 1. Xcenda, data on file. Site of Care Claims Analysis. September 2012. AmerisourceBergen Consulting Services – Confidential 17 Breast cancer patients managed in a hospital-based setting are more costly in all treatment categories1 Breast Cancer Treatment Costs Community Hospital $25,000 $20,236 $20,000 $18,493 $15,545 $15,000 $14,474 $13,149 $12,860 $10,593 $10,000 $9,403 $7,668 $5,000 $4,831 $3,899 $3,052 $2,504 $2,348 $0 Non-targeted chemotherapy combinations Bone metastasis agent Targeted chemotherapy Single-agent hormone Single-agent chemotherapy Single-agent Chemotherapy targeted + bone metastasis agent 1. Xcenda, data on file. Site of Care Claims Analysis. September 2012. AmerisourceBergen Consulting Services – Confidential 18 Colorectal cancer patients managed in a hospitalbased setting are more costly in all treatment categories except bone metastasis agents1 Colorectal Cancer Treatment Costs Community Hospital $80,000 $73,920 $70,000 $60,000 $50,000 $40,000 $32,010 $30,000 $20,000 $16,214 $15,902 $10,345 $15,033 $11,644 $10,000 $14,517 $5,471$5,552 $1,870 $330 $0 Non-targeted chemotherapy combinations Bone metastasis agent Targeted chemotherapy Single-agent chemotherapy Single-agent targeted Chemotherapy + bone metastasis agent 1. Xcenda, data on file. Site of Care Claims Analysis. September 2012. AmerisourceBergen Consulting Services – Confidential 19 Lung cancer patients managed in a hospital-based setting are more costly in most treatment categories1 Lung Cancer Treatment Costs Community Hospital $35,000 $30,665 $30,000 $25,000 $20,000 $14,891 $15,000 $10,000 $15,050 $13,632 $14,693 $13,391 $9,580 $13,505 $12,644 $9,565 $6,051 $4,131 $5,000 $0 Non-targeted chemotherapy combinations Bone metastasis agent Targeted chemotherapy Single-agent chemotherapy Targeted + chemo + bone metastasis Chemotherapy + bone metastasis agent 1. Xcenda, data on file. Site of Care Claims Analysis. September 2012. AmerisourceBergen Consulting Services – Confidential 20 In the same analysis, office-managed patients also had fewer hospitalizations during chemotherapy • An analysis of 3 years of commercial health plan data reveals that oncology patients treated in an HOPD have higher hospitalization rates Office-managed HOPD-managed 11 out of every 100 patients had at least 1 hospitalization during the chemotherapy episode 14 out of every 100 patients had at least 1 hospitalization during the chemotherapy episode 1. Avalere Health Analysis Report of National Association of Managed Care Physicians member data. Total cost of cancer care by site of service: physician office vs outpatient hospital. March 2012. AmerisourceBergen Consulting Services – Confidential 21 The majority of common breast, colorectal, and lung cancer chemotherapy-specific costs are lower for patients managed in a community setting1 Breast Cancer Mean Chemotherapy-specific Costs $20,000 $10,000 $13,754 $2,267 $1,291 $4,460 $6,615 $909 $1,033 $5,482 $10,518 $7,828 $0 CTX + DOXO CTX + DTX ZA CTX + DOXO + DTX CPL + DTX + trastuzumab Key: CPL – carboplatin, CTX – cyclophosphamide, DOXO – doxorubicin, DTX – docetaxel, ZA – zoledronic acid Colorectal Cancer Mean Chemotherapy-specific Costs $60,000 $41,482 $40,000 $20,000 $6,922 $5,544 $0 5-FU + LV + OX $824 $13,204 $4,169 5-FU $792 BEV + 5-FU+ LV + OX $534 $5,474 5-FU + LV $5,133 OX Key: CPL – 5-FU – fluorouracil, BEV- bevacizumab, LV – leucovorin, OX - oxaliplatin Lung Cancer Mean Chemotherapy-specific Costs $14,002 $15,000 $8,781 $10,000 $5,000 $1,618 $2,901 $8,869 $8,725 $4,165 $3,111 $1,637 $1,377 $0 PL + PTX/ETO PL + DTX BEV+ PL + PTX/ETO PL + GC PL + VNR/TPT Key: BEV- bevacizumab, DTX – docetaxel, ETO – etoposide, GC – gemcitabine, PL – platinum, PTX – paclitaxel, TPT – topotecan, VNR - vinorelbine 1. Xcenda, data on file. Site of Care Claims Analysis. September 2012. AmerisourceBergen Consulting Services – Confidential 22 HOPD costs are 40% to 54% higher than community practices for patients receiving non-targeted chemotherapy in breast, lung and colorectal cancers. This is primarily driven by physician costs being 89% to 1242% higher in HOPD vs community1 Breast Cancer Nontargeted Chemotherapy Combinations Colorectal Cancer Nontargeted Chemotherapy Combinations Lung Cancer Nontargeted Chemotherapy Combinations $18,000 $18,000 $18,000 $16,000 $16,000 $14,000 $13,149 $12,000 $15,902 $12,000 $12,000 $9,403 $8,000 $8,000 $8,000 $6,000 $6,000 $6,000 $4,000 $4,000 $4,000 $2,000 $2,000 $2,000 $0 Community Hospital $9,580 $10,000 $10,000 $0 $13,632 $14,000 $14,000 $10,345 $10,000 $16,000 $0 Community Hospital Community Hospital 1. Xcenda, data on file. Site of Care Claims Analysis. September 2012. AmerisourceBergen Consulting Services – Confidential 23 HOPD costs are 30% to 97% higher than community practices for patients receiving targeted chemotherapy in breast and colorectal cancers; however, lung cancer costs are comparable1 Breast Cancer Targeted Chemotherapy Colorectal Cancer Targeted Chemotherapy $35,000 $25,000 Lung Cancer Targeted Chemotherapy $20,000 $32,010 $20,236 $30,000 $20,000 $14,891 $15,050 Community Hospital $15,000 $25,000 $15,545 $15,000 $20,000 $16,214 $10,000 $15,000 $10,000 $10,000 $5,000 $5,000 $5,000 $0 $0 Community Hospital $0 Community Hospital 1. Xcenda, data on file. Site of Care Claims Analysis. September 2012. AmerisourceBergen Consulting Services – Confidential 24 The Value of Community Oncology • • Care provided in community officebased settings is more accessible and less costly for patients • • Patient out-of-pocket amounts are higher for patients managed in an HOPD setting Most common chemotherapy regimens for breast, colorectal, and lung cancers are associated with lower patient out-of-pocket payments in a community office setting When patients receive care in an HOPD setting, they are more likely to wait longer for their first chemotherapy treatment Patients in rural areas are more likely to visit community office practices, indicating that community care is more accessible to these populations AmerisourceBergen Consulting Services – Confidential 25 In a Medicare population, patient out-of-pocket amounts are 10% higher for patients receiving chemotherapy in hospital outpatient settings1 Cancer Type Office-managed Chemotherapy Hospital-managed Chemotherapy Breast $759 $814 Colon $938 $975 Lung $852 $847 Rectal $690 $800 All cancers $700 $773 84% of oncologists say that patients’ out-of-pocket spending influences treatment recommendations2 1. Fitch K, Pyenson B. Site of service cost differences for Medicare patients receiving chemotherapy. Milliman Client Report. 2011. 2. Neumann P, Palmer J, Nadler E, et al. Cancer therapy costs influence treatment: a national survey of oncologists. Health Affairs. 2010;29(1):196-202. AmerisourceBergen Consulting Services – Confidential 26 With respect to common breast, colorectal, and lung chemotherapy regimens, most patient out-of-pocket costs are higher for hospital outpatient-managed patients1 Mean Patient Out-of-Pocket Costs for Breast Cancer Chemotherapy Regimens $10,000 $5,376 $224 $116 $2,305 $561 $310 $344 $176 $725 $571 $0 CTX + DOXO CTX + DTX ZA CTA + DOXO + DTX CPL + DTX + trastuzumab Key: CPL – carboplatin, CTX – cyclophosphamide, DOXO – doxorubicin, DTX – docetaxel, ZA – zoledronic acid Mean Patient Out-of-Pocket Costs for Colorectal Cancer Chemotherapy Regimens $10,000 $829 $958 $159 $1,051 $0 $95 $120 $6 $1,642 $1,087 $0 5-FU + LV + oxaliplatin 5-FU BEV + 5-FU+ LV + OX 5-FU + LV OX Key: CPL – 5-FU – fluorouracil, BEV- bevacizumab, LV – leucovorin, OX - oxaliplatin Mean Patient Out-of-Pocket Costs for Lung Cancer Chemotherapy Regimens $8,342 $10,000 $5,347 $496 $288 $718 $2,466 $471 $1,781 $3,270 $441 $0 PL + PTX/ETO PL + DTX BEV + PL + PTX/ETO PL + GC PL + VNR/TPT Key: BEV- bevacizumab, DTX – docetaxel, ETO – etoposide, GC – gemcitabine, PL – platinum, PTX – paclitaxel, TPT – topotecan, VNR - vinorelbine 1. Xcenda, data on file. Site of Care Claims Analysis. September 2012. AmerisourceBergen Consulting Services – Confidential 27 Access to community clinics is vital for patients in rural areas and Medicare beneficiaries without supplemental insurance1 Medicare beneficiaries without supplemental insurance Location of first chemotherapy course, n (%) Patients in rural areas Hospital infusion center/clinic 42 (22.3) 14 (21.2) Hospital inpatient facility 21 (11.2) 6 (9.1) Infusion center affiliated with private oncology practice 60 (31.9) 21 (31.8) Private doctor’s clinic 56 (29.8) 22 (33.3) n=188 n=66 1. Shea AM, Curtis LH, Hammill BG, et al. Association between the Medicare Modernization Act of 2003 and patient wait times and travel distance for chemotherapy. JAMA. 2008;300(2):189-196. AmerisourceBergen Consulting Services – Confidential 28 Changing Oncology Market Landscape The Value of Community Oncology • Patients in community settings utilize more generics and less brand therapies, which result in savings for payers • • • Breast, colorectal, and lung patients managed in a community setting are prescribed generic chemotherapy more frequently The maturing oncology portfolio will bring savings through competition and higher generic utilization in a community setting Breast, colorectal, and lung patients managed in a hospital setting are prescribed brand treatments more frequently An active pipeline creates more opportunity for payers to adopt aggressive management policies for hospitalbased providers with high brand utilization AmerisourceBergen Consulting Services – Confidential 30 Breast, colorectal, and lung patients managed in a community setting are prescribed generic chemotherapy more frequently1 Proportion of Patients Prescribed Generic Chemotherapy Only 90% 77% 80% 70% 60% 72% 68% 67% Community 58% 57% 50% 40% Hospital 30% 20% 10% 0% Breast Colorectal Lung 1. Xcenda, data on file. Site of Care Claims Analysis. September 2012. AmerisourceBergen Consulting Services – Confidential 31 The maturing oncology portfolio will bring savings through competition and higher generic utilization in a community setting 120 2014 Remicade Leukine Rapamune 2016 Enbrel Evista Erbitux Xeloda Zevalin 2013 Elitek Neupogen 2012 Humira Zometa Eloxatin Xeloda Prialt Enbrel Taxotere Vidaza Temodar 110 Generic/Patent Expiration 100 90 80 2008 Femara Camptosar Fosamax 70 2007 Kytril Gemzar 60 2011 Etopophos Xeloda Aromasin Femara Anzemet Istodax Plavix Avonex Neumega 2006 Zofran 50 2005 Duragesic Transdermal Sandostatin Generic Introduced Dacogen Epogen Procrit Remicade 2015 Epogen Aranesp Rituxan Epogen Procrit Gleevec Aloxi Neulasta Peg-Intron Emend oral Alimta 2017 Neulasta Sandostatin Velcade Tysabri Iressa Velcade Xolair 2021 Sutent Soliris 2023 Thalomid 2020 Nexavar Tykerb Revlimid Vectibix Sprycel 2018 Tarceva Avastin Herceptin Clolar 2019 Revlimid Zytiga Exjade Boniva Orencia By 2020, there will be a robust portfolio of generic and biosimilar treatments Patent Expiration 40 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 AmerisourceBergen Consulting Services – Confidential 32 Breast, colorectal, and lung patients managed in a hospital setting are prescribed brand treatments more frequently1 Proportion of Patients Prescribed Any Branded Chemotherapy 50% 43% 45% 42% 40% 35% 32% Community 32% 28% 30% 23% 25% Hospital 20% 15% 10% 5% 0% Breast Colorectal Lung 1. Xcenda, data on file. Site of Care Claims Analysis. September 2012. AmerisourceBergen Consulting Services – Confidential 33 An active pipeline creates more opportunity for payers to adopt aggressive management policies for hospitalbased providers with high brand utilization • The presence of numerous treatment options gives payers the opportunity to adopt more aggressive management policies by leveraging competitive market dynamics Bladder cancer Brain cancer Breast cancer Cervical cancer Colorectal cancer Head/neck cancer Kidney cancer Leukemia Liver cancer Lung cancer Lymphoma Multiple myeloma Ovarian cancer Pancreatic cancer Prostate cancer Sarcoma Skin cancer Solid tumors Stomach cancer Cancer-related conditions Other cancers Unspecified cancers 14 52 91 Nearly 900 drugs in development for cancer 9 55 21 31 108 31 98 97 49 49 41 80 21 65 240 24 32 98 78 0 50 100 150 AmerisourceBergen Consulting Services – Confidential 200 250 34 The Value of Community Oncology Community practices are more willing to participate in payfor-quality pathway programs, which will translate into improved outcomes and savings for payers • • • Evidence demonstrates community oncology practices are more likely to participate in pathways or pay-forquality programs Pathway programs result in reduced costs of cancer care by reducing the rate of both drug and nondrug expenses High community practice participation rates in pathways programs creates an opportunity for payers to improve care and reduce costs AmerisourceBergen Consulting Services – Confidential 35 An opportunity exists for payers to leverage community oncology practices’ willingness to participate in pay-for-quality pathway programs • Evidence demonstrates community oncology practices are more likely to participate in pathways or pay-for-quality programs1 – In a study where 362 oncology practices were eligible for participation, the highest participation rate was observed in community oncology practices1 Participation in Pay-for-Quality Pathways by Practice Type (n=362 practices) 100% – In a related study, the pathway program resulted in reduced costs of cancer care by reducing the rate of both drug and nondrug expenses2 80% – Total savings, factoring out the increased fee schedule for participating practices, was estimated at $8,585,1482 60% • Furthermore, pilot pathways programs suggest that the saliency of pay-for-quality incentives in academic and hospital settings should be further studied1 88% 90% 70% 50% 49% 44% 40% 30% 20% 6% 10% 0% Overall Community participants Hospitalbased participants Academic participants 1. Fortner BV, Wong W, Olson T, et al. Year one evaluation of participation and compliance in regional pay for quality (P4Q) oncology program. Poster presented at: International Society for Pharmacoeconomics and Outcomes Research; Atlanta, GA: May 15–19, 2010. 2. Scott JA, Wong W, Olson T, et al. Year one evaluation of regional pay for quality (P4Q) oncology program. J Clin Oncology. 2010;28(Supl 15):6013. AmerisourceBergen Consulting Services – Confidential 36 Summary The Value of Community Oncology Patients managed in an office-based setting are less costly than those managed in hospital outpatient settings Care provided in a community office-based setting is more accessible and less costly for patients Patients in community settings utilize more generics and less brand therapies, which results in savings for payers Community practices are more willing to participate in pay-for-quality pathway programs, which will translate into improve outcomes and savings for payers • Three separate analyses of managed care claims in commercial and Medicare populations demonstrate that patients managed in a community office setting cost less than patients managed in a hospital-based outpatient setting • Patients managed in a community office setting have lower hospitalization rates than patients managed in a hospital-based outpatient setting • The majority of common breast, colorectal, and lung cancer chemotherapy-specific costs are lower for patients managed in a community setting • Patient out-of-pocket amounts are higher for patients managed in an HOPD setting • Most common chemotherapy regimens for breast, colorectal, and lung cancer are associated with lower patient out-ofpocket payments in a community office setting • When patients receive care in an HOPD setting, they are more likely to wait longer for their first chemotherapy treatment • Patients in rural areas and Medicare patients without supplemental insurance are more likely to visit community office practices, indicating that community care is more accessible to these populations • Breast, colorectal, and lung patients managed in a community setting are prescribed generic chemotherapy more frequently • The maturing oncology portfolio will bring savings through competition and higher generic utilization in a community setting • Breast, colorectal, and lung patients managed in a hospital setting are prescribed brand treatments more frequently • An active pipeline creates more opportunity for payers to adopt aggressive management policies for hospital-based providers with high brand utilization • Evidence demonstrates community oncology practices are more likely to participate in pathways or pay-for-quality programs • Pathway programs result in reduced costs of cancer care by reducing the rate of both drug and nondrug expenses • High community practice participation rates in pathways programs creates an opportunity for payers to improve care and reduce costs AmerisourceBergen Consulting Services – Confidential 38 Recommendations • Know your audience: – The value messages (as described on the previous slide) are likely to resonate best with small to mid-size payers • Educate on cost and quality outcomes in the community setting compared to the HOPD setting • Smaller payers are likely more in touch with the local providers already, and therefore likely need less convincing; mid-size payers are likely to need the most education and persuading • Understand the hospital contracts and other drivers for large plans before approaching with these messages and tailor them accordingly • Generate and publish outcomes data to complete the value equation: – While it has been demonstrated that community practices are more likely to follow and participate in pay-for-quality programs, the outcomes of those initiatives have not been widely analyzed and published – more data generation and publication on outcomes are needed AmerisourceBergen Consulting Services – Confidential 39 Thank you!