Chapter 6

advertisement

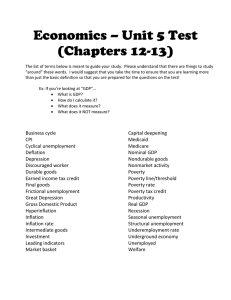

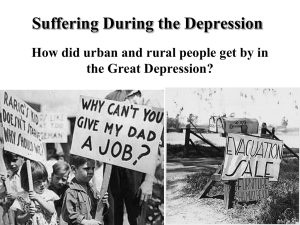

Chapter 3 Labor Force Participation Are people poor because they don’t work? • 81.3% of male headed households participate in the labor force • More than 50% of females headed households participate in the labor force • What does it mean to be in the labor force?? – Employed or actively seeking work – May not be collecting a wage Sub-employed • Discouraged worker – Stop looking because frustrated – No longer counted as unemployed – Can be contagious • Underemployed – Accept any job – Usually in secondary labor market • Unemployed – Not working but attached to labor force Why are people subemployed?? • Conservatives – Poor are unwilling to take any job – Have unrealistic job expectations • Liberals – Poor lack the opportunity or education to get jobs that will assure a decent standard of living Official Definition of Unemployed • A person 16 years or older is unemployed if he/she – Is not currently working – Has actively looked for work during the previous four weeks – Is currently available for work Types of Unemployment • Frictional – Arises from normal operations of the labor market – Labor markets are dynamic and information is not perfect – In between jobs • Seasonal – Can’t work due to seasonal patterns • Structural – Imbalance between skills have and those demanded by labor market – Lack of proper training – Monetary and Non-monetary costs • Cyclical – Demand deficient unemployment – Associated with the business cycle – Aggregate Demand: total amount of goods and services demanded by all people – Aggregate Supply: Total amount of good and services supplied by all people Price AS AD’ 2 5 AD GDP (in trillions) Unemployment because need 3 trillion less units of the good Natural Rate of Unemployment • Frictional + Seasonal + Structural + Cyclical • Estimated at 5% • Can this figure ever be zero? – No…why?? – Cyclical is the only type of unemployment that could even in theory be zero Costs of Unemployment • Economic – Inefficient because not using all our resources – Okun’s Law • For every 1% increase in unemployment there is a 2.5% decrease in GDP – If we are inefficient where are we on the PPC?? • Inside the curve • Social – Loss of self respect, erosion of stable family, more crime, homelessness, discrimination Roger and me Pick out as many costs of unemployment as you can…the person with the most will get extra credit!!! Relative Importance of Income Sources • Differ for poor and non-poor – Average incomes differ by $27,396 – Part of this gap is closed by in-kind transfers – Gap can be closed by labor market earnings – Poor either not work enough or are paid too little Poor: Average Income = $7,642 19% Earnings Cash Welfare 56% 25% Other Sources Non-Poor: Average Income = $35,038 16% 2% Earnings Cash Welfare Other Sources 82% Nonparticipants • If you don’t work you run the risk of poverty…but not a simple relationship – ½ of nonparticipants are children under age 16 – 20 million are retired – 8 million are over 16 but full time students – 10 million are institutionalized, sick or disabled – 23 million are women who consider themselves homemakers – 6 million are others who just don’t work Remember duration is important ½ of those who experience unemployment stay unemployed for greater than 5 weeks Review • Poor families receive most of their income from work – Labor force participation is key • Many are sub-employed – Discouraged worker, underemployed, unemployed Is reducing poverty a societal goal? • Public Policy affects Aggregate Demand – If increase AD more jobs – No need for more products = surplus – Expensive for the firm – Must layoff workers to compensate • Is there an opportunity cost of unemployment??? – Yes….inflation Phillips Curve • Statistical Relationship between unemployment and inflation – Not a series of equilibrium points • Shows the Short Run tradeoff between unemployment and inflation • Can relate to Aggregate Supply Curve Aggregate Supply Price AS Quantity What are the relationships?? • Between Prices and Inflation? – Positive – Inflation is the rate of change of prices • Between Quantity produced and Unemployment? – Negative – Produce more??? You need more people (unemployment decreases) Phillips Curve Inflation Expected Rate of Inflation Natural Rate Unemployment Of Unemployment More Phillips Curve… • Negative relationship between inflation and unemployment • What would happen on the Phillips Curve if Aggregate Demand would increase? – Move up the curve – Because unemployment would decrease • What would happen on the Phillips Curve if Aggregate Demand would decrease? – Move down the curve – Because unemployment would increase Long Run Phillips Curve • Represents equilibrium • Vertical at the natural rate of unemployment Inflation Natural Rate Unemployment In-class exercise 9 The Phillips Curve Phillips Curve worked until the early 1970s • Due to Stagflation – High rates of unemployment and inflation from supply shocks AS’ Price AS P2 P1 AD Q2 Q1 Quantity Summary • Price increased – Inflation did what?? • Increased • Quantity decreased – Unemployment did what?? • Increased • Phillips Curve says they should move in the opposite direction!! So… • Phillips Curve still used by economists but less faith is put in it • Politicians disagree about it also… – Conservatives • Slope is steep – Liberals • Slope is flat • Important in decision whether or not to fight inflation Inflation Inflation Unemployment Conservatives (Republicans) Fight Inflation Big decrease in inflation with only Small increases in unemployment Unemployment Liberals (Democrats) Don’t Fight Inflation Small decrease in inflation but Big increases in unemployment Chapter 4 The Working Poor Is it possible to eliminate poverty by providing everyone a job? • Statistics say no!! • Most of the poor population work – Don’t work enough – Work part time or part year • New problem – Low wages Where do wages come from? • Interaction of the Supply and Demand for Labor • Where does demand for labor come from? – Firms • What are the important variables? – Wages and number of workers • What relationship do these variables have? – Negative What happens when wages increase? • Higher costs for the firm – – – – – – What happens to prices? increase What happens to output? decrease What happens to the number of workers needed? decreases • Change from using labor to capital What factors affect the demand for labor? • Demand for the product – Increase??? • More output needed so more workers needed • Price of inputs – Increase??? • Costs increases so less output produced and less workers needed • Available technology??? – Increase??? • More capital used so less workers needed What determines the Supply of Labor? • Workers • What is the slope? – Positive or Zero depending on whether it is the market or firm • Market Labor Supply – Positive Slope – If wages of secretaries increase (ceteris paribus) more people want to be secretaries • Firm Labor Supply – Horizontal – If all firms were offering similar wages and everyone had enough workers…. • How many workers will want to work at a lower wage? – NONE • What if firms want to offer a higher wage? How many workers will they get? – Infinitely many…but the firm already had enough » Higher wages will only increase the costs to the firm • Everyone offers the same wage…which is??? – MARKET EQUILIBRIUM WAGE Wage Wage Ls Ls Market Ld Ld # workers # workers Firm What about between occupations?? • A decrease in the Ls of one occupation could increase the Ls in another occupation • Remember – A decrease in Ls is a shift to the left – An increase in Ls is a shift to the right In-class exercise 10 What happens as workers change occupations? Equilibrium Wages Can Change Overtime!! Ls’ Wage Wage Ls W2 W1 Ls Ls’ W1 W2 Ld N2 N1 Sales # workers Ld N1 N2 # workers Computer Since Ld is downward sloping, if wage gets too high will the firm stop hiring workers? NO…workers add to output and revenue Marginal Product of Labor (MPL) • Additional output that can be produced by a firm when they hire one additional worker • What is the goal of the firm?? – Maximize profits – Profits = Revenue – Costs So… • Employ up to the point where the additional revenue (Marginal Revenue) just equals the additional cost (Marginal Cost) of that worker • If MR > MC what should the firm do – Hire another worker • If MC > MR what should the firm do – Don’t hire Does does MPL look like either of these? MP MP Number of Workers Number of Workers MP MR=MC MR>MC Hire Stop Hiring Don’t Hire MR<MC Number of Workers Marginal Revenue Product of Labor (MRPL) • Value of the additional output produced • MRPL = MPL * P What about the cost side? • What is the MC or additional cost per worker? – Wage • Want to hire until revenue made by the last worker = cost of the last worker – Hire until MR = MC • What is the MR?? – MPL * P • Hire until MPL * P = wage In-class exercise 11 Hire or Not??? Why is the wage rate too low?? MPL * P = wage • MPL is too low – MPL poor < MPL non-poor – Too little education – Not enough skills or experience • Price too low – Farmers during a good harvest because everyone is probably having a good harvest Where does income come from? • • • • Wages Capital/assets Government transfers If first two do not equal some “required minimum” then the third entered Summary: The poor have lower wages because… • Low Marginal Revenue Product of Labor – Low levels of training/education – Low price of the output – Work in markets with restricted demand – Work in markets with high labor supply – Work in non-unionized markets • Discrimination What can we do?? • Increase productivity – Subsidize education – Job placement • Guaranteed minimum income • Government intervention in the labor market • But…give people something for free and it decreases the incentive to get it on your own. Chapter 11 Welfare Programs Movie: Ending Welfare as We Know It Homework: Detail the changes that the Clinton Administration tried and the impacts of these changes on the families depicted Chapter 11 Welfare Programs What is the history of helping the poor? • Great Depression brought high unemployment – Enacted income security programs as part of the New Deal • Late 1950s and Early 1960s Kennedy set fighting poverty as a major goal – Highlighted by the Civil Rights March in August 1963 • 1964 Johnson declared poverty as part of his Great Society plan – Goal: reducing poverty, eliminate discrimination, and begin training programs • Late 1960s – Early 1970s Nixon supported a cash and food stamp program for the poor • Republicans pushed harder for the cash transfers Income transfer payments • Money income transferred from the government to the poor • Two types: – Social insurance programs • Benefits given on a basis of previous service or contribution (social security or unemployment) – Means-tested program • Benefits given on the basis of need Basic Idea • Give money to the poor and it will eliminate poverty • Monetary transfers are referred to as welfare or public assistance • In 1987 48 billion dollars would have been necessary to put everyone in poverty above the poverty standard Problems • Exclusive reliance – People will never escape poverty if the government gives freely – Lead to perpetual poverty • No work incentive Cash Assistance Programs • Supplementary Security Insurance – For the elderly, blind or disabled • Temporary Aid To Needy Families (TNAF) – Provide families whose father is absent or disabled – 1961 Congress permitted but didn’t require aid to be extended to two parent families – 1968 Supreme eliminated the no man in the house requirement – Was called Aid to Families with Dependent Children (AFDC) • Changed July 1, 1997 • General Assistance – Given by each state – Assistance for the needy How much does each give?? Program Number of recipients Average monthly payment SSI 5.3 million 364 TANF 14.1 million 137 GA 1.2 million 150 Is this amount adequate??? • A mother with two children receives about $10,200 in benefits. • This is about ½ of the poverty standard • Is this fair? – SSI gives more than 2.6 times more than TANF • Other Problems – With TANF most male headed households don’t qualify – Deserving vs. non-deserving Family Disincentive Issue • Targeting female heads of households may create more female headed families – Females may leave home to create a separate household – May increase likelihood of separation or divorce – May increase likelihood of having more children • New programs designed to help reduce this problem – Fathers may leave to increase eligibility Work Disincentive Issue • Until 1967 there was no incentive to work – Every $1 earned in the labor market, welfare benefits decreased by $1 • Marginal Tax Rate was 100% • What is the Marginal Tax Rate? – Tax on the last (additional) dollar earned • Program was changed in 1967 to try to fix the problem. – Marginal tax rate decreased to 67% Before 1967 • A mother with 3 children could receive $400 per month ($4800 a year) and was able to find a part time job paying $5 per hour for 10 hours a week for 48 weeks. How much would her benefits decrease if she took the job? • How much does she earn at her job? – 5*10*48 = 2400 • Original benefits – amount earned from job = new benefit amount – 4800 – 2400 = 2400 • How much is she actual earning per hour from her job? – $0.00 per hour Changes in 1967 • Marginal Tax Rate was decreased to 67% • Disregarded the first $1080 of income earned in the labor market – $720 per year for work release expenses – $360 per year for other general expenses Did it make a difference? • Basic structure: 1.) original benefits (income 1080) * .67 new benefits 2.) New Benefits Income Total income 3.) Total income original benefits change in income from working 4.) Addition to income / Hours worked Actual Dollar Earned per hour In-class exercise Did it make a difference? A mother with 3 children could receive $400 per month ($4800 a year) and was able to find a part time job paying $5 per hour for 10 hours a week for 48 weeks. How much would her benefits decrease if she took the job? Solution • Earnings: 2400 • New benefits: 4800 – (2400-1080)*.67 = 3915.60 • Total Earnings: 2400 + 3915.60 = 6315.60 • Additional Income: 6315.60 – 4800 = 1515.60 • Dollar Per hour earned: 1515.60/480 = $3.15 Does this really give the incentive to work?? • Earn $3.15 per hour of $5 per hour job • Include in child care, transportation, and other necessities and you now earn under $2 per hour • But…income increased from $4800 to $6315.60 – 30% increase in income In-class exercise 11 Is there an incentive to work?? Now Graphically Total Income D A B W E Basic support level C Hours of work What were those points? • A: individual doesn’t work at all • B: hit income equal to 1080 benefits will begin to decrease • C: decrease in benefits due rising income • D: income increasing at a slower rate due to Marginal Tax Rate of 67% • E: income before 1967 when Marginal Tax Rate was 100% • W: increase in income as more hours are worked Conflicting Welfare Goals • Maybe we should decrease the Marginal Tax Rate to 33% or even zero. – What happens to the dollar per hour earned as we decrease the Marginal Tax Rate? • Increases • Redo in-class exercise 11 with a Marginal Tax Rate of 33% – Why don’t we do this?? • What will pay for the program? Welfare has three distinct goals • Provide income • Provide work incentives • Achieve cost minimization Breakeven income income floor breakeven income disregarde d income Tax Rate • Point at which the individual loses all cash benefits • From exercise 11 what would be the breakeven income level? – (7500/.67)+1080 = 12,274.03 • If the marginal tax rate would decrease what would happen to the breakeven income? – increase Where did this come from? • What are the new benefits at the breakeven income level? – Zero • Old benefits – (income-1080)*.67 = 0 • Solve for income – (old benefits/.67) = income - 1080 – (old benefits/.67) + 1080 = income Now adding in the in-kind programs • Food Stamps – Coupons which people use to purchase food – Average benefit in 1999 was $272 per month for a family of four – $9.07 per day for the family to eat three meals – $3.02 per meal for the family – $0.76 per meal per family member – Small amount per meal but increases the standard of living for the family • Medicaid – Medical insurance program for the poor – Annual benefit averages about $2,000 per family of four • Housing Assistance – Averages $2,000 per family per year – Subsidizes rent (based on income) • If a family of four were eligible for all three… – Gain $7,264 in addition to any cash transfers that they were eligible for But… • Not all in-kind benefits increase a family’s standard of living • Not everyone is eligible for all three in-kind programs • Now…adding these to our graph Total Income D* B* A* A E* D B E C W Basic support level Hours of work What were those points? • A*: start at higher level to reflect in-kind and cash transfers • B*: Cash benefits, food stamps, and housing assistance beings to decrease after disregarded income is earned • D*: lose all food stamps and housing assistance • E*: lose all benefits (cash and in-kind) When do we lose benefits? • Medicaid – Must earn < 133% of the poverty line – How much can you earn if the poverty line is $12,000? • $15,960 • Cash transfers – Marginal Tax Rate is 67% • In-kind transfers – Marginal tax rate is 33% New work incentive problem • Between B* and D* – Marginal tax rate of cash transfers?? • 67% – Marginal tax rate of in-kind transfers?? • 33% – If gain both, what is the marginal tax rate?? • 100% – No incentive to work again What has been tried? • Negative income tax – Guaranteed income – Simple program because give on basis of need – Monetary and non-monetary costs (time) Impacts • Family structure – No incentive to split up family, but incentive to form household early to become eligible for aid – + and – impacts • Work incentives – Labor force participation decreased – 5% by males, and 22% by females – Negative impact • When do you file?? Guaranteed Jobs (Carter administration) • Everyone willing and able to work will be found a job • Positive impacts – Decreases need for welfare, provides a work incentive, and promotes family stability • Negative impacts – Very expensive – Who is able to work? – People move in and out of poverty…who do you help first? Workfare (Regan administration) • Force the poor to work to keep their benefits • Point…give back to the community that is providing for you – Community service • What about non-participants?? – Didn’t really make a difference Edfare • Force the poor to do “something” that will help them move off of welfare – Teach people hot to search for a job – States control • Too much difference between states – California • Start with a 3 week job search • If no job…enroll in training program • If still no job…perform community service Family Support Act of 1988 • 20% of states nonexempt TANF recipients must be in edfare programs by 1995 • States required to put workfare programs in place – One parent must provide 16 hours of community service a month • Recipients can continue receiving Medicaid and subsidized housing for one year after leaving the poverty roles What are the objectives of an income transfer program? • Adequacy – People who can and can’t work have access to adequate income levels • Target Efficiency – Target those who are most in need • Administrative Efficiency – Achieve goals at minimum cost • Horizontal Equity – People in similar circumstances should be treated equally – Problem: State run programs • Vertical Equity – Give before judge – Those with greater needs should receive more • Work Incentives – Should be in the interest of those to work to do so • Family Stability Incentive – Should promote initial family structure • Independence – Progress should be to move people off the program • Coherency – Should be understandable and able to be controlled Anti Poverty Effects • Goal: alleviate economic distress by those with no or low incomes • How find?? – Compare pre- and post-transfer poverty rates – Estimate degree to which transfers decreased the poverty gap • Findings: people remain poor after transfers BUT poverty gap is decreased • Programs are effective!! Chapter 5 Age and Health Does not working = poverty? • NO!!! – ½ of those who are poor are retired or disabled • 3.5 million people over 65 are considered poor • 11% of the poor are not expected to work • What are they called? – Nonparticipants Elderly are less likely to be poor than the non-elderly Poverty Rate Elderly 12.5% Age 18-64 13% Under age 18 18.7% 70% of the poor elderly are women • Why?? – Men of that generation worked – Men’s life expectancy is shorter • Women – 80.1 • Men – 74.8 – Women gain benefits from their husband’s job but they are cut Poverty rate for elderly has been decreasing • ½ of the rate in 1970 • Still considered a serious problem – Less able to get a full time job – Why? • • • • Firm’s don’t want to train Less productive Less flexible frame of mind Won’t be able to work 40 hour weeks Thus…working is really not an option Year Total Male Female 2004 2000 1995 77.6 76.3 75.7 74.8 73.5 72.4 80.1 79.1 79.0 1990 1985 1980 1975 75.4 74.7 73.7 72.6 71.8 71.1 70.0 68.8 78.8 78.2 77.4 76.6 1970 1960 1950 70.8 69.7 68.2 67.1 66.6 65.6 74.7 73.1 71.1 1940 62.9 60.8 65.2 What are the leading causes of death? Total Deaths from All Causes WA State Death Certificates, 2000 Heart Disease 25.8 Can cer 24.3 Stroke 8.4 COPD 6.0 Un in t. In ju ry 4.7 Alzh eimer' s 4.1 Diab etes 3.0 Flu & Pn eu mon ia 2.3 Su icid e 1.7 L iver Disease 1.1 18.5 All Oth er 0 10 20 Percent of All Deaths 30 Total Deaths from All Causes Age and Gender WA State Death Certificates, 1998-2000 85+ 75-84 65-74 55-64 45-54 35-44 25-34 15-24 5-14 1-4 <1 0 5000 10000 15000 Rate per 100,000 Female Male 20000 Sources of Income • 10% of the elderly participate in the labor force • 90% are voluntarily removed from the labor market – Some of the “voluntarily” is forced early retirement – If lose job it is harder to find a new job Are there alternatives to working? • Savings • What would you guess the median net worth of an individual 60-65 would be?? – 120,000 • What composes most of this?? – Ownership of homes Remember… • This is a group of Nonparticipants • Important to look at why??? – Makes the relationship of not working = poverty not as direct Chapter 6 Family Size and Structure “The Feminization of Poverty” Female headed households have been increasing over the last 20 years • Why? – Increase in the number of single mothers • Out of wedlock births • Adoptions – Increase in the number of divorces • Divorce rate in the U.S. is 52% Changing Family Structure • Two parent families is not the norm anymore • Why? – Increase in Divorce/Separation – Out of Wedlock Births – Death of a Spouse • On average White FHH due to divorce • On average Black FHH due to out of wedlock births Questions to address • Why has there been a rapid increase in FHH? – Not necessarily a conscious choice • Why do FHH have high poverty rates? Causes of Growth in FHH • Increased labor force participation by females – 1950 – 30% – 1990 – 57.7% – Working outside the home decreased the dependence on men’s wages – Women are less likely to stay in an unhappy marriage Gary Becker’s Theory of Marriage • Decision to marry is influenced by the expected gains of the union • Historically – Females worked at home – Males worked in the labor market – Why??? Comparative Advantage • When you can perform the act at a lower opportunity cost than the others involved • THE FOLLOWING SEVERAL SLIDES ARE NOT IN THE SLIDE PACKET….. It is a matter of trade • Do we trade things of equal value? – NO!! – Trade to gain more of what we value • Would you trade me a dollar for a dollar? • In order to make a trade you have to come out ahead • Trade should create wealth – Productivity Productivity?? • Trade doesn’t always produce something • Example – Jack has a basketball, and Jim has a baseball glove – Jack wants a glove, and Jim wants a basketball – Trade takes place – Wealth has been created – New arrangement makes each happier What happened here?? • Basketball and Baseball Glove are scarce resources • Each traded for a more valuable good • Each incurred a cost – Opportunity cost – Next best alternative foregone – What you gave up to do what you are doing • What is the opportunity cost of Jim’s trade? – Baseball glove • What is the opportunity cost of Jack’s trade? – basketball When will trade happen? • When the value of exchange is greater than ONE value of glove For Jack 1 value of ball value of ball For Jim 1 value of glove • So…trade when the benefits > costs Example Gus Harry Lawn 40 minutes 120 minutes Garden 80 minutes 120 minutes Gus and Harry’s garden and lawn look EXACTLY the same upon completion Harry offers to do ¾ of Gus’s garden if Gus mows Harry’s entire lawn Should Gus agree to the trade?? YES!!! • For Gus – – – – Mow his own lawn (40 minutes) Mow Gus’s lawn (40 minutes) Do ¼ of his garden (80*.25 = 20 minutes) Total (100 minutes) saved 20 minutes • For Harry – Own garden (120 minutes) – ¾ of Harry’s garden (120*.75 = 90 minutes) – Total (210 minutes) saved 30 minutes • Both get everything done and have more leisure time Law of comparative advantage The principle that, given the freedom to respond to market forces, people will tend to export goods for which they have comparative advantage and import goods for which they have comparative disadvantage, and that they will experience gains from trade by doing so. Producing and trading • Two people: Elizabeth and Brian • Each produce two goods: Bread and Apples • Elizabeth 10 loaves of bread and 10 apples • Brian 5 loaves of bread and 15 apples Elizabeth Apples 20 Elizabeth Bread 0 10 10 0 20 Brian Apples Brian Bread 0 15 30 10 5 0 Comparative Advantage • Should both produce apples and bread or should they specialize? • What does specialize mean? – Produce the good that you do best – Produce at a lower costs than other person(s) can – Called comparative advantage – Looks at opportunity cost • What was that? • What you have to give up • Give up less?? Have the comparative advantage What are the opportunity costs? • Elizabeth – If only produce bread how many apples does she give up? • 10 apples – If only produces apples how much bread does she give up? Elizabeth Apples Elizabeth Bread 20 0 10 10 0 20 • 10 loaves of bread • Opportunity Costs – 10 Bread = 10 Apples – 1 Bread = 1 Apple What are the opportunity costs? • Brian – If only produce bread how many apples does she give up? Brian Apples Brian Bread 0 10 15 5 30 0 • 15 apples – If only produces apples how much bread does she give up? • 5 loaves of bread • Opportunity Costs – 5 Bread = 15 Apples – 1 Bread = 3 Apples – 1/3 Bread = 1 Apple Should we specialize? • Elizabeth 1 Bread = 1 Apple • Brian 1 Bread = 3 Apples 1/3 Bread = 1 Apple • Who produces apples cheaper? • What does cheaper mean? • Lower opportunity cost (give up less) • Brian!!! Give up only 1/3 loaves of bread • Who produces bread cheaper? • Elizabeth!!! Give up only 1 apple Here is the deal • Elizabeth produces only bread (20 loaves) • Brian produces only apples (30 apples) • Trade 8 loaves of bread for 12 apples • Breakdown of end result – Elizabeth Bread? • 12 loaves (20 - 8 traded) – Elizabeth Apples? • 12 apples (0 + 12 traded) • Brian Bread – 8 loaves (0 + 8 traded) • Brian Apples – 18 apples (30 -12 traded) • Are they better off?? Are they better off?? No Specialization Gains from Specialization and Trade trade or Trade Elizabeth Bread Elizabeth Apples Brian Bread Brian Apples Are they better off?? Elizabeth Bread Elizabeth Apples Brian Bread Brian Apples No Specialization Gains from Specialization and Trade trade or Trade 10 10 5 15 Are they better off?? Elizabeth Bread Elizabeth Apples Brian Bread Brian Apples No Specialization Gains from Specialization and Trade trade or Trade 10 12 10 12 5 8 15 18 Are they better off?? Elizabeth Bread Elizabeth Apples Brian Bread Brian Apples No Specialization Gains from Specialization and Trade trade or Trade 10 12 +2 10 12 +2 5 8 +3 15 18 +3 Both are Better off!! Can you do it?? United States United Kingdom Clothing Food Clothing Food 40 0 60 0 20 20 30 10 0 40 0 20 1. Draw the production possibility curves for both countries. (Clothing on y-axis) 2. Which country has the comparative advantage in clothing? Food? 3. The United States and United Kingdom are negotiating a trade of food and clothing between the countries. If the terms of trade is 25 units of clothing for 15 units of food, should both counties agree? Homework 4 Comparative Advantage Homework • Two countries produce two products – digital cameras and vacuum cleaners. With the same factor resources evenly allocated by each country to the production of both goods. • Who has the comparative advantage in each? • If the trade is 420 vacuum cleaners for 840 digital cameras, do the countries UK UK US US Camera vacuum Camera vacuum s s s 0 1200 0 2200 600 600 2400 1000 800 0 3360 0 Back to Becker’s Theory of Marriage Men had a comparative advantage in the labor market • • Why?? – More human capital, skill, and experience – Higher wages – Opportunity cost of not working is higher • Women had a comparative advantage in home production • Why? – – – – Wages in the labor market would be lower Less experience, less human capital Less costly for them to stay out of the labor market Opportunity cost is lower • Because of comparative advantage marriages stayed together Why are marriages breaking up now? • Increase in labor force participation of females caused – Increases in human capital, skill level, and experience – What happened to the wage? • Increased – What happened to the opportunity cost of not working? • Increased – Women not receiving as much benefit from the union as in the past Female LFP also has increased divorces… • Working wife may lead the man to feel inadequate as a provider • Alters the power of the relationship • Conflict of home duty allocation Declining Wages and increased unemployment of men • Median earnings for a full time male worker has declines since 1973 • Why??? – Labor pool has increased Wage Ls Ls’ W1 W2 Ld 1 2 # workers Welfare Benefits • Some blame for contributing to marital instability and out-of-wedlock births • Transfer payment reduce the cost of bearing another child • Problem – People are poor because they have no money – Tensions due to money are #1 reason for divorce – Is it the benefits that you can gain or the fighting because you have no money that causes divorce? • Issue has not been resolved The Supply of Marriageable Men • William Darity Jr. and Samuel L. Myers wrote “Changes in the Black Family Structure” • FHH among African American Families is due to the unfavorable marriage market • Why? – Unemployed – Jailed – Drug addicts – killed • Females are left with only a few “good” men to choose from • Probability of marriage is low Changes in Social Norms & Attitudes • Out-of-wedlock birth stigma has disappeared • Past – Get pregnant…total embarrassment • Now – Get pregnant…join a support group – Single parent is now an acceptable alternative to duel parent households Why do FHH experience poverty more?? • Low earnings capacity – – – – Women earn less than men (wage gap is about 40%) Less OJT, HC, less experience Enter labor force later in life (less seniority) More part time workers • Inadequate or non-existent child support – 61.5% of families eligible for child support receive it – Most receive ½ of the awarded amount • Low welfare benefits – Poverty rates would be lower if transfers were bigger – Widows receive two times the amount of FHH – Deserving versus non-deserving Consequences of Poverty in FHH • Children can grow up with – Limited resources – Poor nutrition levels – Inadequate medical services – Low investments in human capital • Intergenerational transmission of poverty