Inventory Models

advertisement

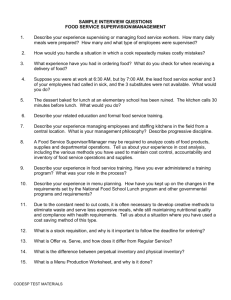

Inventory Models Inventory models Help to decide How much to order When to order Basic EOQ model POQ model Basic EOQ model Assumptions Known and constant demand Known and constant lead time Instantaneous receipt of material No quantity discounts Only order (setup) cost and holding cost No stockouts Basic EOQ model Receive an order Use the inventory at a constant rate Reorder same amount Instantaneously receive the order On-hand inventory (units) Economic Order Quantity Time On-hand inventory (units) Economic Order Quantity Time Economic Order Quantity On-hand inventory (units) Receive order Q Time Economic Order Quantity On-hand inventory (units) Receive order Q 1 cycle Time Economic Order Quantity On-hand inventory (units) Receive order Q 1 cycle Time Economic Order Quantity On-hand inventory (units) Receive order Inventory depletion (demand rate) Q 1 cycle Time Economic Order Quantity On-hand inventory (units) Receive order Inventory depletion (demand rate) Q 1 cycle Time Economic Order Quantity On-hand inventory (units) Receive order Inventory depletion (demand rate) Q Average cycle inventory Q — 2 1 cycle Time Total Cost = Holding Cost + Order Cost Annual cost (dollars) Total Cost = Holding Cost + Order Cost Lot Size (Q) Annual cost (dollars) Total Cost = Holding Cost + Order Cost Holding cost (HC) Lot Size (Q) Why Holding Costs Increase More units must be stored if more are ordered Purchase Order Description Qty. Microwave 1 Order quantity Purchase Order Description Qty. Microwave 1000 Order quantity Annual cost (dollars) Total Cost = Holding Cost + Order Cost Holding cost (HC) Ordering cost (OC) Lot Size (Q) Why Order Costs Decrease If we order more when we place an order, then we order fewer times over the year. Example: You expect to order 10 microwave ovens over a year for a retail Order cost $10 Purchase Order Description Qty. Microwave 1 store like Sears. It cost $10 to place an order. If you order 1 microwave, how many orders will you place over the year? what is the ordering cost? What is the ordering cost per microwave? If you order 10 microwaves, how many orders will you place over the year? What is the ordering cost? What is the ordering cost per microwave? Order Cost $10 Purchase Order Description Qty. Microwave 10 Total Cost = Holding Cost + Order Cost Annual cost (dollars) Total cost = HC + OC Holding cost (HC) Ordering cost (OC) Lot Size (Q) Gift Shop A museum of natural history is having problems managing their inventories. Low inventory turnover is squeezing profit margins and causing cash-flow problems. A Class A item, a birdfeeder is also a topselling item. Sales: 18 units/week Purchase cost: $60 Order cost: $45 Annual holding cost: 25% of purchase cost 52-week year Management has been ordering in lots of 390 units. What is the annual cost of the current policy? Q – order quantity TC – Total cost Annual Monthly ?? Q Time Holding Cost AnnualHold ingCost ( AveInventory )( HoldingCos t / unit / year ) Q AnnualHold ingCost H 2 Holding cost Annual cost (dollars) 3000 — 2000 — Holding cost = Q (H) 2 1000 — 0— | 50 | 100 | 150 | 200 | 250 Lot Size (Q) | 300 | 350 | 400 Ordering cost AnnualDemand AnnualOrde rCost (OrderCost ) OrderQuant ity D AnnualOrde rCost S Q Holding & Ordering Cost Annual cost (dollars) 3000 — 2000 — Holding cost = Q (H) 2 1000 — Ordering cost = 0— | 50 | 100 | 150 | 200 | 250 Lot Size (Q) | 300 | 350 | 400 D (S) Q Total Cost Annual cost (dollars) 3000 — Total cost = Q D (H) + (S) 2 Q 2000 — Holding cost = Q (H) 2 1000 — Ordering cost = 0— | 50 | 100 | 150 | 200 | 250 Lot Size (Q) | 300 | 350 | 400 D (S) Q Total cost: TotalCost TotalOrder Cost TotalHoldi ngCost D Q TC S H Q 2 What is the annual cost of the current policy? D – Total demand Q – Order quantity S – Setup/order cost H – Holding cost D Q TC S H Q 2 What is the annual cost of the current policy? D – Total demand 936/year Q – Order quantity 390/order D Q TC S H Q 2 936 390 TC 45 15 390 2 S – Setup/order cost $45/order TC 108 2925 H – Holding cost TC 3033 = 0.25*60 = $15/unit/year Total Cost for Q = 390 Current cost Annual cost (dollars) 3000 — Total cost = Q D (H) + (S) 2 Q 2000 — Holding cost = Q (H) 2 1000 — Ordering cost = 0— | 50 | 100 | 150 | 200 | 250 Lot Size (Q) | 300 | 350 D (S) Q | 400 Current Q Can the gift shop do better? Current cost Annual cost (dollars) 3000 — Total cost = Q D (H) + (S) 2 Q 2000 — Holding cost = Q (H) 2 1000 — Ordering cost = 0— | 50 | 100 | 150 | 200 | 250 Lot Size (Q) | 300 | 350 D (S) Q | 400 Current Q Economic Order Quantity – Q* Annual cost (dollars) 3000 — 2000 — 1000 — Setup cost = Holding Cost 0— | 50 | 100 Q* | 150 | 200 | 250 Lot Size (Q) | 300 | 350 | 400 Economic Order Quantity (EOQ) – Q* 2 DS Q* H 2(936)( 45) Q* 15 74.94 75units / order Total Cost of Economic Order Quantity (EOQ) – Q* D Q* TC S H Q* 2 936 75 TC 45 15 75 2 TC 1124.10 When Q = 390 TC 3033 When to order? Reorder point (ROP) Lead time – amount of time from order placement to receipt of goods Lead time demand – the demand the occurs during the lead time On-hand inventory Reorder point Order received OH On-hand inventory Reorder point Order received OH TBO Time between orders On-hand inventory Reorder point Order received OH L TBO Lead time On-hand inventory Reorder point Order received OH R Order placed L TBO Gift shop reorder point Demand: 18 birdfeeders/week Lead time: 2 weeks Lead time demand: 36 birdfeeders ROP: 36 birdfeeders Gift shop order policy Place order when the on-hand inventory is 36 birdfeeders. Order 75 birdfeeders Order received in 2 weeks Place next order when the on-hand inventory is 36 birdfeeders On-hand inventory Gift shop order policy Order received 75 OH 36 Order placed 2 wks Distribution Game What is the EOQ for the central warehouse in the distribution game? Order cost: Holding S= cost: H = Demand: D= $200 $14.70/unit/year 2190 Distribution Game 2 DS Q* H 2(2190)( 200) Q* 14.7 Q* 244.1 244units Production Order Quantity On-hand inventory Production Order Quantity Time On-hand inventory Production Order Quantity Q Production quantity Time On-hand inventory Production Order Quantity Production quantity Q Demand during production interval p–d Time On-hand inventory Production Order Quantity Production quantity Q Demand during production interval p–d Time On-hand inventory Production Order Quantity Production quantity Q Demand during production interval p–d Time Production and demand Demand only TBO On-hand inventory Production Order Quantity Production quantity Q Demand during production interval p–d Time Production and demand Demand only TBO On-hand inventory Production Order Quantity (POQ Model) Production quantity Q Demand during production interval Maximum inventory p–d Time Production and demand Demand only POQ model Assumptions Known and constant demand Known and constant lead time Partial receipt of material No quantity discounts Only order (setup) cost and holding cost No stockouts POQ model Producing and shipping product simultaneously until production quantity is reached. Ship the inventory at a constant rate (no production) Reorder same amount Begin production and shipping product simultaneously POQ Model D – annual demand S – Setup cost Q * p 2 DS H (1 d / p) H – Holding cost d – daily demand rate p – daily production rate Chemical Plant A plant manager of a chemical plant must determine the lot size for a particular chemical that has a steady demand of 30 barrels/day. The production rate is 190 barrels/day, annual demand is 10,500 barrels, setup cost is $200, annual holding cost is $0.21/barrel, and the plant operates 350 days/year. Determine the production order quantity. Chemical Plant Demand: d = 30 barrels/day D = 10,500 barrels/year Setup cost: $200/setup Holding cost: $0.21/barrel/year Production: 190 barrels/day Chemical Plant Q * p 2 DS H (1 d / p) 2(10500)( 200) Q 0.21(1 30 / 190) * p Q 4873.4 4873barrels * p