here are all of the notes - Lawton Community Schools

advertisement

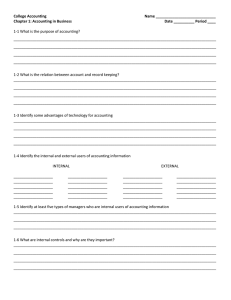

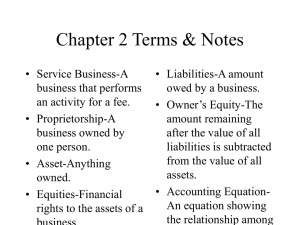

Chapter 1 The Accounting Equation General Info • Accounting is the language of business! • Understanding accounting helps managers & owners make better business decisions. • Failure to understand accounting info. can result in poor business decisions. • Inaccurate accounting records often contribute to business failure and bankruptcy. ENRON! 1-2 2 LESSON 1-1 What does an accountant do? •Plans, records, analyzes, and interprets financial records •Handles a broad range of responsibilities •These are skills successful businesses cannot do without. •If you are good, the sky’s the limit. Is Accounting Boring? • Will it lead you to a career in the spotlight? • Brad Pitt staring in an action thriller about a jet setting accountant??? • Who develops and approves the budget for his films to go into production? • Who advises Mr. Pitt how to invest his salary? 1-2 4 1-1 New Vocabulary • Service Business – A business that performs an activity for a fee • Examples: • Dr. Moser • Marcy Allen-Klaus, Attorney • Sole Proprietorship—Proprietor means “owner”. – A business owned by one person. • • • • Examples: Tresses Dr. Haines Mike’s Landscaping 1-2 5 Proprietorships • Advantages – Easy to set up – All profits go to the owner – Owner has total control – Few regulations to follow • Disadvantages Consider: Do the advantages outweigh the disadvantages? – Limited expertise – Hard to raise money – Owner has all the risks – Hard to attract talented1-2employees 6 THE ACCOUNTING EQUATION page 8 1-2 7 Key Terms • Asset– Anything of value that is owned. They can be used to acquire other assets or be used to operate a business. For your note card: • • • • • Cash Accounts Receivable Supplies Insurance Petty Cash Key Terms • Equities– Financial rights to the assets of a business. • Liability- (DEBT) – An amount owed by a business (at a later date). • Accounts Payable (on note card) Yes, More Terms Owner’s Equity(the value of ownership) • The amount remaining after the value of all liabilities is subtracted from the value of all assets. • Assets-Liabilities = Owner’s Equity Financial Claims • Property = Creditor’s Financial Claim + Owner’s Financial Claim – Truck – $20,000 • Assets = = 15,000 + 5,000 Liabilities + Owner’s Equity 1-2 11 The Accounting Equation • Shows the relationship among assets, liabilities and owner’s equity. • Assets = Liabilities + Owner’s Equity – Left side amounts = Right side amounts • It must be in balance to be correct • Remember: An equation must always have equal amounts on each side of the equal signs 1-2 12 The Accounting Equation • Assets = Liabilities + Owner’s Equity Left side amounts = Right side amounts 150 = 60 + ? 475 333 = 275 + ? 90 200 = ? 111 + 222 1-2 13 Audit Your Understanding • Give examples of service businesses – Dry Cleaners – Doctor’s Office – Auto Repair • What is a proprietorship? – A business owned by one person • State the accounting equation – Assets = Liabilities + Owner’s Equity 1-2 14 Work Together 1-1 • On the O: drive – We will do this together ON YOUR OWN – Just like it says, you will be doing this by yourself 1-2 15 LESSON 1-2 How Business Activities Change the Accounting Equation Quick Review • What is the Accounting Equation? • What is a Proprietorship? 1-2 – Notecard Time!!! • Note card #1 –Assets • Cash • Petty Cash • Accounts Receivable • Supplies • Prepaid Insurance #1 1-2 – Notecard Time!!! • Note card #2 –Liabilities • Accounts Payable #2 1-2 – Notecard Time!!! • Note card # 3 –Owner’s Equity • Capital • Drawing #3 Accounting Concepts • Business Entity: This concept is applied when a business’s financial information is recorded and reported separately from the owner’s personal financial information. – Example: house, personal car, personal belongings • Unit of measurement: Business transactions are stated in numbers that have common values; that is, using a common unit of measurement. – Example: Canadian dollar • Realization of Revenue: Revenue is recorded at the time goods or services are sold.—even if it is a charge sale 1-2 21 New Vocabulary • Transaction: A business activity that changes assets, liabilities, or owner’s equity. Example: paid cash for supplies • Account: A record summarizing all the information pertaining to a single item in the accounting equation. Example: Cash • Account Title: The name given to an account. • Account Balance: The amount in an account. • Capital: The account used to summarize the owner’s equity in a business. Example: Travis Smith, Capital 1-2 22 RECEIVING CASH page 10 Transaction 1 August 1. Received cash from owner as an investment, $5,000.00. +5,000 +5,000 inv. 1-2 23 PAYING CASH page 11 Transaction 2 August 3. Paid cash for supplies, $275.00. -275 +275 -1200 +1200 Transaction 3 August 4. Paid cash for insurance, $1,200.00. 1-2 24 TRANSACTIONS ON ACCOUNT page 12 Transaction 4 August 7. Bought supplies on account from Supply Depot, $500.00. +500 -300 +500 -300 Transaction 5 August 11. Paid cash on account to Supply Depot, $300.00. 1-2 25 Audit Your Understanding What must be done if a transaction increases the left side of the accounting equation? • The right side must also be increased How can a transaction affect only one side of the accounting equation? • If one account is increased, another account on the same side of the equation must be decreased by the same amount. To what does the phrase “on account” refer? • Buying items and paying for them at a later date. 1-2 26 LESSON 1-3 How Transactions Change Owner’s Equity in an Accounting Equation New Vocabulary • Revenue: An increase in owner’s equity resulting from the operation of a business. • Sales on Account: A sale for which cash will be received at a later date. (A.K.A. charge sale) • Expense: A decrease in owner’s equity resulting from the operation of a business. • Withdrawals: Assets taken out of the business for the owner’s personal use. (decreases Owner’s1-2Equity) 28 REVENUE TRANSACTIONS page 14 Transaction 6 August 12. Received cash from sales, $295.00. +295 +295 rev. +350 +350 rev. Transaction 7 August 12. Sold services on account to Oakdale School, $350.00. 1-2 29 EXPENSE TRANSACTIONS page 15 Transaction 8 August 12. Paid cash for rent, $300.00. -300 -40 Transaction 9 August 12. Paid cash for telephone bill, $40.00. 1-2 -300 (exp.) -40 (exp.) 30 OTHER CASH TRANSACTIONS page 16 Transaction 10 August 12. Received cash on account from Oakdale School, $200.00. +200 -200 -125 -125 withdrawal Transaction 11 August 12. Paid cash to owner for personal use, $125.00. 1-2 31 Audit Your Understanding How is owner’s equity affected when cash is received from sales? • increased How is owner’s equity affected when services are sold on account? • increased How is owner’s equity affected when cash is paid for expenses? • decreased 1-2 32 Work Together • Download it from my site 1-2 33