Sole Proprietorships

advertisement

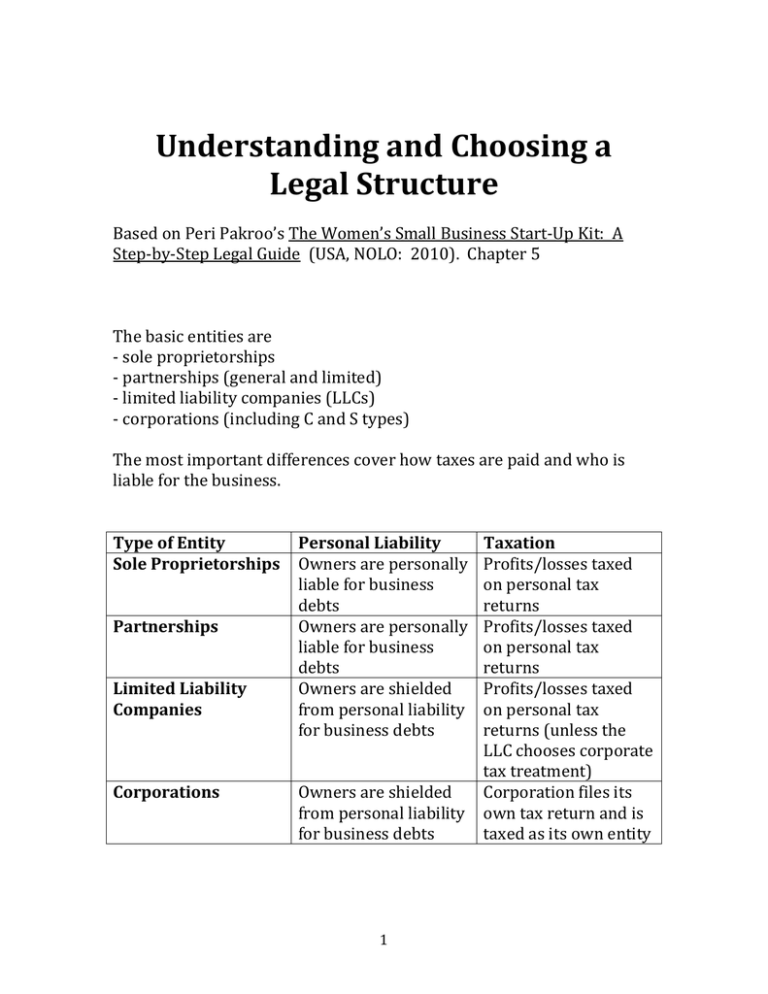

Understanding and Choosing a Legal Structure Based on Peri Pakroo’s The Women’s Small Business Start-Up Kit: A Step-by-Step Legal Guide (USA, NOLO: 2010). Chapter 5 The basic entities are - sole proprietorships - partnerships (general and limited) - limited liability companies (LLCs) - corporations (including C and S types) The most important differences cover how taxes are paid and who is liable for the business. Type of Entity Sole Proprietorships Partnerships Limited Liability Companies Corporations Personal Liability Owners are personally liable for business debts Owners are personally liable for business debts Owners are shielded from personal liability for business debts Owners are shielded from personal liability for business debts 1 Taxation Profits/losses taxed on personal tax returns Profits/losses taxed on personal tax returns Profits/losses taxed on personal tax returns (unless the LLC chooses corporate tax treatment) Corporation files its own tax return and is taxed as its own entity Sole Proprietorships – any one-person business that has not filed papers to become a corporation or an LLC. About 3/4ths of all businesses operate as sole proprietorships. Being a sole proprietor does not mean you are the only person who works at the business. It means that you are the only person who owns the business. Just because you are a sole proprietor, you are still subject to local registration requirements and rules. Pass-Through Taxation – The sole proprietorship is not legally separate from the person who owns it. With respect to taxation, a sole proprietor simply reports all business income or losses on her individual income tax return. This is called “pass-through” taxation, because business profits pass through the business to be taxed on the business owner’s tax return. When filing, report income from the business just like wages from a job and include Schedule C along with Form 1040. This form of taxation will help if business losses offset any taxable income you have earned from other sources. Make sure you have a separate business bank account and keep accurate records of all income and expenses. Self-employment taxes and payroll taxes are essentially the same tax: Social Security and Medicare taxes, totaling 15.3% of income/wages up to $106,800 (for tax year 2009), and 2.9% on income/wages above that. Doing business with your spouse – Two unmarried people working at a business that’s not an LLC or a corporation would be considered one of 2 things: (1) partners in a partnership, or (2) one would be a sole proprietor and the other an employee. 2 If the two are considered to be business partners, they will need to file a partnership tax return and each person would have to pay selfemployment taxes on their share of business income. If one person is considered to be a sole proprietor, then she would owe selfemployment taxes on her business income, and payroll taxes would apply to the employee’s wages. The IRS typically allows a spouse to work without pay without being classified as an owner or an employee of the other spouse’s business. The IRS loosely terms this as a “husband-wife sole proprietorship.” The upside of this arrangement is that you do not have to pay payroll taxes for your spouse. The down side is that your spouse will not get Social Security or Medicare account credit. If the spouses want to be co-owners of the business, the IRS now allows husband and wife co-owners to file as “co-sole proprietors,” with each spouse filing his own Schedule C reporting of his and her share of profits and losses. Here, both spouses will receive Social Security and Medicare credits. If you use your spouse as a volunteer, the IRS might find your business to be a partnership and charge your spouse with back self-employment taxes. The sole-proprietor can be held personally liable for businessrelated obligations. “This means that if your business doesn’t pay a supplier, defaults on a debt, loses a lawsuit, or otherwise finds itself in financial hot water, you, personally, can be forced to pay up.” (p. 158) Insurance is an important tool for the sole proprietor. Insurance will help with a slip-and-fall lawsuit, for example. But it might not help your business if you fail to make a profit and fall into debt. Take a step back and ask yourself: What are the risks in my business? 3 (i.e. – using hazardous materials; manufacturing or selling edible goods; driving as a part of your job; building or repairing structures or vehicles; caring for children or animals; providing or allowing access to alcohol; conducting or allowing activities that may result in injury, such as personal training or skateboarding; and repairing or working on items of value, such as cars or antiques) Partnerships – a business owned by two or more people designed to make a profit. When two or more people engage in business activity and they have not filed papers with the state to become a corporation or an LLC (or other less common business form), by default the business is considered a partnership. General partnership – 1) The partners are personally liable for all business debts, including court judgments. In addition, each individual partner can be sued for the full amount of any business debt. 2) Any individual partner can bind the whole business to a contract or business deal. Each partner has “agency authority.” Limited partnership – A limited partnership requires at least one general partner and at least one limited partner. The general partner plays the same role of controlling day-to-day operations and is personally liable for business debts. The limited partner contributes financially to the partnership but has minimal control over business decisions or operations, and normally cannot bind the partnership to business deals. In return for giving up management power, a limited partner gets the benefit of protection from personal liability. But the limited partner MUST stay out of management activity, otherwise the limited partner can be liable to third parties who reasonably believed, based on the limited partner’s conduct, that the limited partner was a general partner. Limited Liability Partnership – all the owners have limited personal liability. New York States has LLPs; however, they are only available to professionals like lawyers and accountants. 4 Pass-Through Taxation A partnership is also a “pass-through entity” and income passes through the business to each partner who pays taxes on his share of profit on his individual income tax returns with Schedule E. The partnership, itself though, must also file what the IRS calls an “informational return”, Form 1065 (U.S. Return of Partnership Income), to let the government know how much the business earned or lost that year. No tax is paid along with this return. Personal Liability for Business Debts General partners are personally liable for business-related obligations. In a general partnership, the business actions of any one partner bind the other partners, who can be held personally liable for those actions. “Marie and Ivy are general partners in a profitable plant nursery specializing in native and drought-tolerant plants for sustainable landscapes. They’ve been in business for five years and have earned healthy profits, allowing them each to buy a collection of garden sculptures and Ivy’s roomful of vintage musical instruments. One day Marie finds a website offering fertile marijuana seeds that she knows would be a hit with their customers. She orders two cases of the seeds, without telling Ivy. But when the shipment arrives, so do agents of the federal drug enforcement agency, who confiscate the seeds which, as it turns out, violate U.S. drug laws. Soon thereafter, criminal charges are filed against Marie and Ivy. Though the partners are ultimately cleared, their attorney fees come to $50,000 and they lose several key accounts, putting the business into serious debt.” As a general partner, is Ivy liable for any of these debts even though she had nothing to do with the ill-fated marijuana seed purchase? 5 Partnership Agreements – you can structure your relationship with your partners in practically any manner you want. However, it is not legally necessary for a partnership to have a written agreement; the act of two or more people doing business together creates a partnership. In the absence of a partnership agreement, your state’s version of the Uniform Partnership Act (UPA) or Revised Uniform Partnership Act (RUPA) is the standard. WHAT A PARTNERSHIP AGREEMENT CANNOT DO 1) free the partners from personal liability for business debts 2) restrict an partner’s right to inspect the business books and records 3) affect the rights of 3rd parties in relation to the partnership – i.e. – if a partner signs a contract with a 3rd party even if the partner cannot do so 4) eliminate or weaken the duty of trust (the fiduciary duty) each partner owes to the other partners Partnership agreements usually include: - name of the partnership and partnership business - date of partnership creation - purpose of the partnership - contributions (cash, property, and work) of each partner to the partnership - each partner’s share of profits and losses - provisions for taking profits out of the company (often called partners’ draws) - each partner’s management power and duties, such as what departments they will manage and specific responsibilities such as hiring or budgeting - how the partnership will handle departure of a partner, including buyout terms - provisions for adding or expelling a partner - dispute resolution procedures. 6 Limited Liability Companies (LLCs) The LLC offers the simplicity and tax benefits of pass-through taxation (as with sole proprietorships and partnerships) without the exposure to personal liability. LLCs are less complex and costly to start and operate than corporations. Limited Personal Liability Owners of an LLC are not personally liable for the LLC’s debts. Creditors can take all of the LLC’s assets, but they generally can’t get at the personal assets of the LLC’s owners. Like a general partner, any member of a member-managed LLC can legally bind the entire LLC to a contract or business transaction. In a manager-managed LLC, any manager can bind the LLC to a business contract or deal. Protection from personal liability is not absolute and there are several situations where an LLC owner can still be personally liable for debts: 1) Personal Guarantees – If you give a personal guarantee on a loan to the LLC, then you are personally liable for repaying that loan. Banks and other lenders often require this personal guarantee. 2) Taxes – The IRS or the state tax agency may go after the personal assets of LLC owners for overdue federal and state business tax debts, particularly overdue payroll taxes. 3) Negligent or intentional acts – An LLC owner who intentionally or even carelessly hurts someone will usually face personal liability. (i.e. – an LLC owner who drunkenly crashes with a client as a passenger) 4) Breach of fiduciary duty – LLC owners have a legal duty to act in the best interest of their company and its members. This is a fiduciary duty or a duty of care. The business judgment rule protects LLC owners when they act with reasonably good faith. Thus, there is only a breach of duty due some type of fraud, gross negligence, or other illegal behavior. 7 5) Blurring the boundaries between the LLC and its owners. An LLC owner can be found liable when the LLC looks like an extension of the owner’s personal affairs. Avoid this by opening a separate LLC checking account, getting a federal identification number, keeping separate accounting books for your LLC, and funding your LLC adequately enough to be able to meet foreseeable expenses. Because of all these considerations, insurance is still an important option to explore. LLCs v. S Corporations – Before LLCs, people used S Corporations as ways to conveniently limit liability. An S Corporation is like an LLC except for the fact that business profits pass through to the owner, rather than being taxed to the corporation at corporate tax rates. Why not S Corporations? LLCs are not bound by the many regulations that govern S corporations. Ownership restrictions – An S corporation may not have more than 75 shareholders, all of whom must be U.S. citizens or residents. (So you really don’t have the option of making any large public offers.) Any person can be a member of an LLC. Allocation of profits and losses – Shareholders of an S corporation must allocate profits according to the percentage of stock each owner has. Subject to a few IRS rules, LLC owners can allocate membership freely. Corporate meeting and record-keeping rules – Corporate rules are more stringent than how LLC owners just have to make sure that their management team is in agreement on major decisions about business. Tax treatment of losses – An S Corporation’s business debt cannot be passed along to its shareholders unless they have personally cosigned and guaranteed the debt. LLC owners can normally real the tax benefits of any business debt, cosigned or not. 8 LLC Taxation – An LLC is also a “pass-through entity.” On the individual income tax return, this is Form 1040 with Schedule E, Supplemental Income and Loss. A multi-owned LLC, like a partnership, does have to file Form 1065, “an informational return”. By filing a form with the IRS (Form 8832, Entity Classification Election), you can choose to have your LLC taxed like a corporation rather than a pass-through entity. “For example, if the owners of an LLC become successful enough to keep some profits in the business at the end of the year (or regularly need to keep significant profits in the business for upcoming expenses), paying tax at corporate tax rates can save them money. That’s because federal income tax rates for corporations start at a lower rate than the rates for individuals.” (p. 174) Forming an LLC To form an LLC, you must file Articles of Organization with your secretary of state or other LLC filing office. You should also execute an operating agreement, which governs the internal working of your LLC. It might be more expensive to form an LLC because of state filing fees. LLCs that have owners who do not actively participate in the business may have to register their membership interests as securities, or more likely, qualify for an exemption to the registration requirements. See the Securities and Exchange Commission’s website – www.sec.gov 9 Corporations A corporation is simply a specific legal structure that imposes certain legal and tax rules on its owners (shareholders). A corporation is a separate legal entity from its owners. Shareholders are normally protected from personal liability for business debts and the corporation itself – not just the shareholders – is subject to income tax. Limited Personal Liability Limited Personal Liability also allows owners to protect themselves from legal and financial responsibility in case their business flounders or loses an expensive lawsuit and can’t pay its debts. Creditors can take all of the corporation’s assets but they generally cannot get at the personal assets of the shareholders. However, when corporate owners ignore corporate formalities and treat the corporation like an unincorporated business, a court may ignore the existence of the corporation (“pierce the corporate veil”) and rule that the owners are personally liable for business debts and liabilities. Corporate Taxation Corporate Taxation is a bit more complicated and demands the help of an accountant and an attorney. After deductions for employee compensation, fringe benefits, and all other reasonable and necessary business expenses have been subtracted from its earnings, a corporation pays tax on whatever profit remains. TAX ADVANTAGE OF A CORPORATION – If a corporation pays for benefits such as health and disability insurance for its employees and owners/employees, the cost can usually be deducted from the corporate income, reducing a possible tax bill. As a general rule, owners of sole 10 proprietorships, partnerships, and LLCs can deduct the cost of providing these benefits for employees, but not for themselves. The fact that fringe benefits for owners are deductible for corporations may make incorporating a wise choice. But the business must have enough capital to underwrite these expenses. Since initial rates of corporate taxation are comparatively low, corporations that keep some profits in the business from one year to another rather than paying out all profits as salaries and bonuses can take advantage of 15% to 25% tax brackets. Marginal Tax Rates for Corporations Taxable Income 0 to $50,000 $50,001 to $75,000 $75,001 to $100,000 $100,001 to $335,000 $335,001 to $10,000,000 $10,000,001 to $15,000,000 $15,000,001 to $18,333,333 Over $18,333,333 Tax Rate 15% 25% 34% 39% 34% 35% 38% 35% Professional corporations are subject to a flat tax of 35% on all corporate income. The double taxation problem – Unlike salaries and bonuses, dividends paid to shareholders cannot be deducted as business expenses from corporate earnings. These dividends are taxed as a part of corporate profits and then double taxed as a part of the shareholder’s individual tax rate. Double taxation can be avoided by not paying dividends. This is easy if all shareholders are employees, but probably more difficult if some shareholders are passive investors waiting for a return on their investments. 11 Forming and Running a Corporation Forming a corporation takes major time and expense. To incorporate, you must file articles of incorporation with the secretary of state along with paying hefty filing fees and minimum annual taxes. If a corporation sells public shares, the corporation has to comply with lots of complex federal and state securities laws. To limit your personal liability, the corporation must adopt bylaws, issue stock to shareholders, maintain records of various meetings of directors and shareholders, and keep records and transactions of the business separate from those of the owners. As a Whole The LLC is more popular than ever because it offers protection from personal liability along with the simplicity of pass-through taxation. If risks are so low as to be nonexistent, or if you don’t have any personal assets worth protecting, you might want to wait on forming an LLC or corporation until your circumstances change. An LLC or a corporation? Incorporation normally makes sense only if a business needs to take advantage of the corporate stock structure to attract key employees and investment capital. The ability to issue employee stock options is a key to retaining key employees. 12