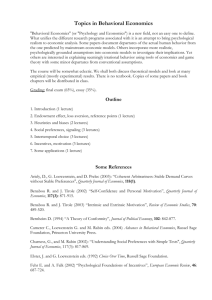

Intertemporal Choice

advertisement

Intertemporal Choice

(1)Traditional Approach

(2)Anomalies

(3)New Theories

(4)Applications

(5)Controversy

(6)Extensions

Dynamic Choice Theory

• Kreps (1988, 1979)

• X = menu, A dishes

• Changing Tastes and Sophisticated choice,

Preference for Flexibility (states of

preferences)

• Binary relation > on X x A is strategically

rational iff

(x,a)>=(x,a`) => (x,a) ~ (x, aUa`)

Exponential Discounting

• Adam Smith (1776)>>>Rae (1834)>>>von BohmBawerk(1889)>>>Fisher (1930)>>> Samuelson (1937)

• Exponential discount function:

•

•

•

•

u(cs, xs) is the felicity function

Monotonically falling, utility additive and independent across time

Constant Rate of Decline (

Recursive (

)

)

Anomaly 1 – Time Inconsistency

• Ainslie (1975)

• Also Thaler (1981)

• Discount rates declined sharply with the length of

time to be waited (ie. not constant)

• Immediacy effect (Prelec & Loewenstein 1991)

Anomaly 2 – Magnitude Effect

• “most robust of the ‘classic’

anomalies” (Read 2003)

• Implicit discount rates declined

sharply with the size of amount

(Thaler 1981)

• People give smaller proportional

tips the larger the restaurant bill.

(Chapman 1996)

• People sensitive also to absolute

differences.

• Mental accounting (forgone

interest vs forgone consumption)

Anomaly 3 – Direction Effect

• Delay vs Speed-up

(expedite)

• Loewenstein (1988)

• Reference point effect

• Delay premium is at

least twice the mean

speed-up cost

• Loss aversion?

(Kahneman &

Tversky)

Anomaly 4 – Sign Effect

• Gains vs. losses

• Thaler (1981),

Antonides &

Wunderink (2001)

• Discount rates for

gains is much greater

than for losses.

• “debt aversion”

Anomaly 5 – Sequence Effect

• People care about the “gestalt”, or overall

pattern of sequence

• Violates independence

• Loewenstein & Prelec (1993), Loewenstein &

Sicherman (1991)

• People prefer an increasing wage profile to a

declining or flat one

• French & Greek restaurant experiment

• Savoring and Dread

• {100, 100, 100} > {90, 100, 110} > {110, 100, 90}

(Barsky, Juster, Kimball & Shapiro 1997)

New Theories

• Interval Effect, u(x1)=u(x3`), u(x1)=u(x2), u(x2)=u(x3), x3>x3`shorter

interval more discounting (Read, 2001)

• Visceral Influences on Behavior, intense visceral factors cause

departure from perceived self-interest (Loewinstein 1996)

• Comsumer sovereignty, multiple selves with conflicting preferences

(Ainslie 1975, Elster 1979, Schelling 1984, Thaler & Shefrin 1981)

• Value function approaches, steeper for losses than gains, more

elastic for losses than gains, more elastic the larger the absolute

value. Sign, magnitude and direction effects by proportional changes.

(Loewenstein & Prelec 1992)

• Emotion-based theories. Temporal and physical proximity of options

leads to a disproportionate but transient increase in attractiveness of

options. Arousal not caused by delay but by aggravating stimulus.

Similarity – Attribute-based

• Rubinstein (2003)

• Simiplifying choice

• (x,0) > (y,1) but (x,10) < (y,11) [10 & 11

similar]

• 3-stage procedure (x, t1) vs (y, t2)

– Looks for dominance (eg. x>y & t1<t2 )

– Looks for similarities (eg. between x & y)

– If not decisive, different criterion

Hyperbolic Discounting

•

•

Loewenstein & Prelec (1992)

Discount rates are greater in the

short run than in the long run

•

Instantaneous discount rate:

•

As t goes to infinity, discount rate

goes to 0

Empirical Support both in animals

and humans (Ainslie 1975,

Benzion et al. 1989)

•

Quasi-Hyperbolic Discounting

• Phelps & Pollack (1968)

• Laibson (1997). The Goose with Golden Eggs. Every morning, 1 golden

egg. Greedy, killed the goose and opened it up to find nothing.

• Analytical Tractability

• Most of the discounting takes place between the current period and the

immediate future

• People cares

more about ut+1 vs ut at t0<t but

more if

asked on day t

• There is little additional discounting between future periods

• We typically assume that beta = ½ and delta = 1

Self-Control and Temptation

• Gul & Pesendorfer (2001, 2002)

• 2 competing “utilities” (Long-term utility, u &

temptation, v). No dynamic inconsistency!!

• ct = actual consumption, mt = maximum possible

consumpion, u+v concave, v convex (+4 axioms)

• Choosing between

• Wait if:

Procrastination/Naïve vs

Sophistication

•

•

•

•

•

•

•

O'Donoghue & Rabin (1999, 1999, 2001)

Cost of doing the project at are {1, 3/2, 5/2}

at dates 0, 1 and 2. Hyperbolic discounting.

With commitment technology, project will

be done in period 1

Naifs will choose under the false

assumption that the later selfs will dowhat

the earlier selfs want

Sophisticates make decisions based on

correct beliefs about choices of later selfs

The Naif equilibrium is to do it in period 2,

while the Sophisticate equilibrium is to do it

on period 0 (since he has an effective

choice between 0 &2)

Also, partial naivette believes:

Stationary Procrastination

• (Rabin) 120 minutes of “fixing” effort reduces 10 minutes each day

after.

• The Naif will never do the task

• The sophisticate will do it on day 1 or day 2

Cumulative Procrastination

• (Rabin) Task: Read 30 pages in 30 days

• Decision on Day 1:

• 15½ minutes on day 1, 0.5 pages read

• Decision on Day 2:

• 16 minutes on day 2, plans to read 64 every day afterwards

• So, day 3 – 17 min, day 10 – 22 min, day 24 – 72 min, day 30 –

23¾ hours!!!

• So total of 51 hours spent on task

Application 1 – Life-cycle savings

and consumption

• Angeletos, Laibson, Repetto, Tobacman &

Weinberg

•

Application 2 – Steady State

• Gul & Pesendorfer (2002)

• Changing consumption from

• Taking FOC of

• For

• We get

• In steady state

&

,

Application 3 – Depp or Crap?

• (Rabin)

• Week 1 – crap movie, 3 utils. Week 2 – good movie, 5 utils. Week 3 – great

movie, 8 utils. Week 4 – Johnny Depp movie, 13 utils.

• You must skip one movie to write your research paper for BEE

• What would a sophisticate do?

– Because 8+½0 > 0+½13, the sophisticate won’t skip Week 3.

– Because 0+½(8+13) > 5+½(8+0), the sophisticate will skip Week 2 (if didn’t for

Week 1).

– Because 3+½(0+8+13) > 0+½(5+8+13), the sophisticate won’t skip Week 1.

– Hence sophisticate will miss the 2nd movie.

• What would a naif do?

–

–

–

–

Because 8+½0 > 0+½13, the naif won’t skip Week 3.

Because 5+½(0+13) > 0+½(8+13), the naif won’t skip Week 2.

Because 3+½(0+8+13) > 0+½(5+8+13), the sophisticate won’t skip Week 1.

Hence the naif will miss the Johnny Depp movie : (

Application 4 – Health Clubs

•

•

•

•

•

DellaVigna & Malmendier (2002)

Future benefits, b, “lose weight, get fit, stay healthy, and develop new social

contracts.”

Current costs, e, “logistic cost….. (and psychic) cost of exercising.”

Additional benefits for additional visits for flat rate, x.

Sign-up fee, F, for flat rate membership.

•

Flat rate contract will be chosen if:

•

At time 0, He believe he will attend at time t iff c <

b -10. But will actually attend if

c<

b - 10. The result is that he will always attend less often than he believes.

Sophisticates may use flat rate as commitment device. (Also, cancellation)

•

Other Applications

• Other forms of procrastination, drug addiction,

self-deception, retirement timing, undersaving,

marketing. (Akerlof 1991, Barro 1999, Benabou

& Tirole 2000, Carrillo & Marriotti 2000, Diamond

& Koszegi 1998, Laibson 1997, O’Donoghue &

Rabin 1999, 1999, 2000, Wertenbroch 2003).

• Job-search, Trying new means of commuting,

etc. (Rabin)

• Behavioral Contract theory (DellaVigna &

Malmendier 2004)

Controversies

•

•

•

•

•

•

Rubinstein (2003, 2004), HD misses the core of psychological decision-making

process

Rejected by 3 experiments, eg.

Same $2. NOT willing to accept delay at t = 60 => NOT willing to accept delay

at t = 0 (hyperbolic discounting)

¼ of the subjects made a switch (Q5 & Q6)

Q5 In 60 days you are suppose to receive a new stereo system to replace

your current one. Upon receipt of the system, you will have to pay $960. Are

you willing to delay the transaction by 1 day for a discount of $2?

Q6 Tomorrow you are supposed to receive a new stereo system to replace

your current one. Upon receipt of the system, you will have to pay $1080. Are

you willing to pay the delay the delivery and the payment by 60 days for a

discount of $120

“(I)nfinite number of functional forms consistent with the psychological findings”.

Procedure based on similarity explains observations better and is more

intuitive

Controversies

• Outta Control! (Loewenstein 1996)

• Usefulness of multiple self approach limited by

imperfections in analogy between interpersonal

and intrapersonal conflict (inherent asymmetry,

can’t punish past, unidirectional self-control)

• Multiple self model metaphorical only, difficult to

draw connections between multiple self models

and research on brain neurochemistry or

physiology.

• Impulsive selfs never promote one another’s

behavior. Motivational impact of visceral factors.

Controversies

• Gintis (2000)

• “rational” nature of time consistency?

• “No plausible models within which time consistency has

optimal welfare-enhancing properties”

• Hurwicz, “piggy bank effect”

• Quick temper today => tomorrow’s cost, possible if time

inconsistent, might lead to enemy giving way.

Evolutionary fitness.

• Time consistency doesn’t imply additivity and constant

rate. Aging => P(death) increases, higher discount rate

for future.

Extensions

• Continuous-time hyperbolic models

• Instantaneous gratification (Laibson &

Harris, 2001)

• 1 shock only, Tt is a Poisson arrival time

• Asset Uncertainty

• Harris &Laibson (2001)

• Corrects for non-monotonic hyperbolic

consumption function induced by borrowing

constraints

• Disappears if noisy enough

Extensions (cont.)

•

•

•

•

•

•

•

•

Getting Sophisticated

Chan (on-going research)

Game among selfs

Physiology of Intertemporal Choice

Manuck, Flory, Muldon & Ferrell (2003)

Neurology

Long Term decision-making – prefrontal lobe

Homo Sapien brain structure is structured for

present-biased

Recommended reading

• Harris & Laibson (2001), “Hyperbolic

Discounting and Consumption” in the

Eighth World Congress of the Econometric

Society.

• It will supplement the forgone

technicalities in my presentation

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

References

Angeletos, George-Marios, David Laibson, Andrea Repetto, Jeremy Tobacman, and Stephen

Weinberg (2001). The Hyperbolic ConsumptionModel: Calibration, Simulation, and Empirical

Evaluation. Journal of Economic Perspectives, 15(3), Summer, 47-68.

Benabou and Pycia (2002) “Dynamic inconsistency and self-control: a planner-doer interpretation”

Economic Letters 77, 419-424.

Chapman G. B. “Temporal discounting and utility for health and money” Journal of Experimental

Psychology-Learning Memory and Cognition, 22(3) 771-791

DellaVigna, and Malmendier. Contract Design and Self-control: Theory and Evidence. May 2004,

Quarterly Journal of Economics 119, 2, 353-402.

DellaVign, and Malmendier. November 2003. Overestimating Self-Control: Evidence from the health

Club Industry. Stanford GSB Research Paper 1800

Gintis H. Game Theory Evolving. Princeton University Press.

F. Gul and W. Pesendorfer (2001), Temptation And Self-Control, Econometrica 69, 1403-35

Gul and Pesendorfer (2002), Self Control, Revealed Preference and Consumption Choice.

Kreps (1990) Notes on Choice Theory, Westview

Laibson (2004), Intertemporal Decision Making, Encyclopedia of Cognitive Science (forthcoming)

Laibson, David. Golden Eggs and Hyperbolic Discounting.?Quarterly Journal of Economics, 62, May

1997, 443?7.

Laibson, David, Andrea Repetto, and Jeremy Tobacman. Debt Puzzle.?NBER working paper 7879,

2000.

Loewenstein, G. (1988) Frames of Mind in Intertemporal Choice. Management Science, 34(2), 200214.

Loewenstein, George and Drazen Prelec. Preferences for Sequences of Outcomes.?In Choices,

Values and Frames, Ch. 32, pp. 565?77.

Loewenstein, George and Drazen Prelec. Anomalies in intertemporal: Evidence and an

interpretation.?Quarterly Journal of Economics, May 1992, 573?97.

Loewenstein, George and Drazen Prelec. (1993). Preferences over outcome sequences.

Psychological Review, 100(1), 91-108.

Mulligan, C. (1996) A Logical economist’s argument against hyperbolic discounting. Working Paper. U

of Chicago.

References 2

•

•

•

•

•

•

•

•

•

•

•

•

•

O’Donoghue, Ted and Matthew Rabin. Choice and Procrastination. Quarterly Journal of

Economics, February 2001, 121-160.

O’Donoghue, Ted and Matthew Rabin. Doing it now or doing it later.American Economic

Review, 89(1), 103?24, March 1999.

O’Donoghue, Ted and Matthew Rabin. Incentives for Procrastinators.Quarterly Journal of

Economics, 114(3), 769?16, August 1999.

Rabin M. “Psychology and Economics" Journal of Economic Literature, Vol. XXXVI, 11-46,

March 1998.

Read D. “Intertemporal Choice” London School of economics and Political Science Working

paper

Rubinstein, A. "Economics and Psychology"? The Case of Hyperbolic

Discounting, International Economic Review 44 (2003), 1207-1216.

Rubinstein, A.(2004) Presidential Address. Econometric Society

Schelling, Thomas C. "Self-Command: A New Discipline.?In Choice Over Time, Ch. 7, pp.

167?76.

Shefrin, Hersh M. and Thaler, Richard. "Mental Accounting, Saving, and Self-Control.In

Choice Over Time, Ch. 12, pp. 287?30.

Simonson, Itamar. The Effect of Purchase Quantity and Timing on Variety-Seeking.In Choices,

Values and Frames, Ch. 41, pp. 735?57.

Thaler, Richard. "Some Empirical Evidence on Dynamic Inconsistency.” In Quasi Rational

Economics, CH. 6, pp. 127?36.

Thaler, Richard. Intemporal Choice.In The Winner's Curse, Ch. 8,

Thaler, Richard. Savings, Fungibility, and Mental Accounts.In The Winner's Curse, Ch. 9