Major new features in PI + V1.7 Regional Economic Models, Inc

advertisement

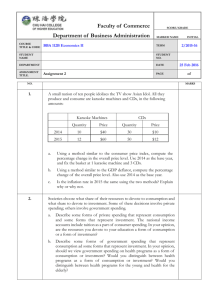

MAJOR NEW FEATURES IN PI+ V1.7 Regional Economic Models, Inc. Data Modifications and New Policy Variables Sherri Lawrence Senior Vice President Regional Economic Models, Inc. BEA Regional Price Parities Real Personal Income for States and Metropolitan Areas, 20082012 RPP’s measure geographic differences in the price levels of consumption goods and services relative to the national average. Develop procedure for normalizing REMI’s estimate of state PCE’s with RPP’s for 2008-2012. Apply 2008 adjustment back to 1990, apply state adjustments to each county within a state. BEA Regional Price Parities, continued Regional Price Parities REMI relative to BEA 1.15 1.1 1.05 1 0.95 0.9 0.85 0.8 2008 2009 2010 2011 2012 ALABAMA ALASKA ARIZONA ARKANSAS CALIFORNIA COLORADO CONNECTICUT DELAWARE DISTRICT OF COLUMBIA FLORIDA GEORGIA HAWAII IDAHO ILLINOIS INDIANA IOWA KANSAS KENTUCKY LOUISIANA MAINE MARYLAND MASSACHUSETTS MICHIGAN MINNESOTA MISSISSIPPI MISSOURI MONTANA NEBRASKA NEVADA NEW HAMPSHIRE NEW JERSEY NEW MEXICO NEW YORK NORTH CAROLINA NORTH DAKOTA OHIO OKLAHOMA OREGON PENNSYLVANIA RHODE ISLAND SOUTH CAROLINA SOUTH DAKOTA TENNESSEE TEXAS UTAH VERMONT VIRGINIA WASHINGTON WEST VIRGINIA WISCONSIN WYOMING Expanded Property Income Components • The model now incorporates historical State Property Income data from the BEA to expand Property Income into its components of Personal Dividend Income, Personal Interest Income, and Rental Income of Persons. The state shares are applied to applicable County Property Income in order to estimate the component shares at the county level. • Each component is now forecasted independently (with the same equation previously used but with a potentially different national trend). • Policy variables have been added for each component. Expanded Transfer Payment Components • The model now incorporates historical County Personal Current Transfer Receipts based on 21 detailed components. • Each component is now forecasted independently (with the same equation previously used but now based on four major types of transfer payment, and with a potentially different national trend). • Policy variables have been added for each component. Expanded Transfer Payments, continued Current transfer receipts of individuals from governments Retirement and disability insurance benefits Social Security benefits Other retirement and disability insurance benefits Medical benefits Medicare benefits Public assistance medical care benefits Military medical insurance benefits Income maintenance benefits Supplemental security income (SSI) benefits Earned Income Tax Credit (EITC) Supplemental Nutrition Assistance Program (SNAP) Other income maintenance benefits Unemployment insurance compensation State unemployment insurance compensation Other unemployment insurance compensation Veterans benefits Education and training assistance Other transfer receipts of individuals from governments Current transfer receipts of nonprofit institutions Current transfer receipts of individuals from businesses Historical Data Modifications • County nonresidential investment and equipment investment is now estimated based on the county’s employment weighted by capital use share of the nation instead of the county’s construction industry employment share of the nation. Historical Data Modifications, continued • County residential investment is now based on the county’s disposable income share of the nation instead of the county’s construction industry employment share of the nation. Historical Data Modifications, continued • County output by industry is now estimated based on the county’s earnings share of the nation instead of the county’s compensation share of the nation when the earnings share is greater than the compensation share. Historical Data Modifications, continued • County residence-adjusted employment is calculated based on estimated commuter data when not inconsistent with the flow of residence adjusted income reported by the BEA. New Productivity Policy Variables Alternative labor productivity and labor access policy variables will have an immediate effect on market shares, instead of a lagged effect. • An increase in the current Labor Productivity policy variable leads to an immediate short-term loss of jobs because the factor that converts from output to employment (labor productivity) is changed by 100% of the user-supplied policy variable value, but the cost of production response is lagged, resulting in only 20% of the improved labor productivity benefiting market shares in the first year, 40% in the second year, etc. Productivity Policy Variables, continued • The assumption is that it takes time for markets to respond to changes in business conditions, such as the cost of production. This response is appropriate for some scenarios, such as labor productivity changes due to new technology implementation, or production equipment, but may not be appropriate for others. • Overall the short-term results are very different, but the longerterm impacts are essentially the same. Labor Productivity Policy Variables Chart 1: 1% Increase in Labor Productivity, All Industries, All Regions – RLABPV (current default) Chart 2: 1% Increase in Labor Productivity, All Industries, All Regions – RLABPV_Immediate (alternative) Labor Access Policy Variables Chart 3: 1% Increase in Labor Access Index, All Industries, All Regions – FLPRMPV (current default) Chart 4: 1% Increase in Labor Access Index, All Industries, All Regions – FLPRMPV_Immediate (alternative) Occupational Training Policy Variables Chart 5: +100 Jobs Occupational Training, All Occupations, All Regions – OTRPV (current default) Chart 6: +100 Jobs Occupational Training, All Occupations, All Regions – OTRPV_Immediate (alternative) Data Unsuppression and Automatic Parallelization Hoksung Yau, PhD Senior Analyst Regional Economic Models, Inc. DATA UNSUPPRESSION Overview BEA Historical Data PI+ input All US states and counties at 2digit industry level Data Suppressed on Purpose Compensation Employment Personal Income Goals and Method Constraints Industrial consistency Regional consistency Smoothness Across Years Compensation/Employment/Personal Compensation Income Rate/Earnings Rate Unsuppression Process Estimate suppressed numbers Run models to adjust these numbers, so that the constraints are satisfied while keeping all concepts’ trend lines as smooth as possible. Major Changes Since V1.7 Improved unsuppression model More accurate initial estimation Better parameters More concise structure Implemented efficient algorithms for fast computing Parallelized the most time-consuming computation Automated unsuppression process Data Quality Improvement PI+ v1.6 PI+ v1.7 Efficiency Enhancement The short processing time enables us to achieve the best solution by testing as many different unsuppression strategies as possible. PI+ AUTOMATIC PARALLELIZATION Automatic Parallelization Key parts of the 64-bit version of the model have been converted into multi-threaded code in order to utilize multiple processors (cores/threads) simultaneously in a shared-memory multiprocessor computer. The maximum number of threads will be detected automatically upon model use. The larger the model in terms of sectors and regions, the larger the savings in run time. Automatic Parallelization, continued Single CPU vs Parallelization Model Sector Region Single CPU (sec) Parallelized (sec) GAP Uwin12.23 23 29 34 30 12% Fwin12.23 23 67 127 83 35% SCwin12.70 70 4 17 11 35% Wwin12.70 70 23 220 79 64% Mwin12.70 70 83 1,934 564 71% NEBwin12.70 70 93 2,200 608 72% AFwin12.160 160 4 65 40 38% Wwin12.160 160 23 538 162 70% NGCwin12.160 160 65 4,099 1,110 73% Overall Average Processors: Intel® Core™i7-2600 CPU @ 3.4GHz (4 cores, 8 threads) 52% FORECAST ASSUMPTIONS Jerry Hayes Senior Analyst / Project Management Regional Economic Models, Inc. Forecast Assumptions Users may create and store own assumption sets. Macroeconomic Update, Employment Update, Population Update National demographic assumptions Users can easily switch forecasts assumptions and generate new forecast. Assumptions are available across workbooks. Forecast Assumptions NATIONAL DEMOGRAPHIC FORECAST Jerry Hayes Senior Analyst / Project Management Regional Economic Models, Inc. National Demographic Forecast The national demographic forecast may now be adjusted. Changes to national demographic variables will flow through to the regional model. However, changes to the national demographic forecast will not lead to endogenous changes in the economic forecast. National Demographic Adjustments Users can create new demographic assumptions and reuse them with other forecasts. New demographic policy variables can be used for simulations. National Demographic Adjustments Birth Rates Survival Rates International Migration Participation Rates National Demographic Assumptions Users may select from predefined “assumption” datasets, or create their own, and generate a new national control forecast. Alternative migration assumptions are included : Low Middle High National Demographic Assumptions Double Precision, Year Selection Dialog and Internationalization Gabor Lukacs Senior Software Engineer Regional Economic Models, Inc. Legacies of Development Environment and 64-bit Upgrade Memory space (Model outside of crowded 32 bit area) Larger models (All MSA-s ~ 380 regions) Speedier calculations (Parallelization) Double Precision (Results for smaller changes) Internationalization (Alternative language display) Double Precision The REMI model now works with Double Precision which use approximately 16 significant digits when performing calculations (instead of 8 significant digits it used before). There is also currently a very slight difference in the baseline forecast generated with our 32-bit version of the application vs. the 64-bit version. This difference is reduced by using double precision calculations. Double Precision, continued Previously, when a small change was introduced in a relatively large region, the impact results may have been “noisy” (wavering up and down year to year without apparent reason). Year Selection Dialog Preferences can be stored and a default can be set with a new dialog, to allow for personalization. Other Preferences Further areas we plan to personalize the interface: • • • • Grouping regions, industries or commodities, Managing unit selection, precision, printer preferences, Storing color scheme and ribbon theme selections, Making these transportable between models. Future “Internationalization” Option The model application has been modified to more easily allow for international compatibility (alternative language display for the user interface and data inputs and outputs). Localization (translating the user interface and resources into different languages) will not be done by REMI, but could be provided to REMI for inclusion in an Internationalized version of the application. Sample Spreader - English Sample Spreader - Hungarian REMI Research Equation Re-estimation Wei Kang, PhD Regional Economist Regional Economic Models, Inc. State and Local Government Spending Equation State and Local Government Spending State and local government demand equation (original) 𝐺𝐷𝑃𝑘 𝑡 𝑆𝐺𝑡𝑘 = 𝑘 𝑅𝑆𝐺 ∗ 𝐺𝐷𝑃𝑢 𝑡 𝐺𝐷𝑃𝑘 𝑡 𝐿𝐺𝑡𝑘 = 𝑘 𝑅𝐿𝐺 ∗ 𝐺𝐷𝑃𝑢 𝑡 𝛽 𝑁𝑘 𝑡 ∗ 𝑆𝐺𝑡𝑢 𝑁𝑡𝑢 ∗ 𝑁𝑡𝑘 ∗ 𝐿𝐺𝑡𝑢 𝑁𝑡𝑢 ∗ 𝑁𝑡𝑘 𝑁𝑢 𝑡 𝛶 𝑁𝑘 𝑡 𝑁𝑢 𝑡 Where SG/LG = State/local government expenditures in chained 2005$ R = calibration factor for state/local government expenditures GDP = gross domestic product in chained 2005$ N = population β = GDP elasticity of state government expenditures 𝛶 = GDP elasticity of local government expenditures k = state t = time u = U.S. State and Local Government Spending State and local government demand equation (new) 𝑆𝐺𝑡𝑘 𝐿𝐺𝑡𝑘 = 𝑘 𝑅𝑆𝐺 = 𝑘 𝑅𝐿𝐺 ∗ 𝑘 𝛽 𝐺𝐷𝑃_𝑝𝑐_𝐴𝑡 ∗ 𝑘 𝛶 𝐺𝐷𝑃_𝑝𝑐_𝐴𝑡 ∗ 𝑆𝐺𝑡𝑢 𝑁𝑡𝑢 ∗ 𝑁𝑡𝑘 ∗ 𝐿𝐺𝑡𝑢 𝑁𝑡𝑢 ∗ 𝑁𝑡𝑘 where 𝐺𝐷𝑃_𝑝𝑐_𝐴𝑘𝑡 𝐺𝐷𝑃_𝑝𝑐𝑡𝑘 , 1 − 𝜆 ∙ 𝐺𝐷𝑃_𝑝𝑐𝑡𝑘 + 𝜆 ∙ 𝐺𝐷𝑃_𝑝𝑐_𝐴𝑘𝑡−1 , = 𝐺𝐷𝑃𝑘 𝑡 𝐺𝐷𝑃_𝑝𝑐𝑡𝑘 = 𝐺𝐷𝑃𝑢 𝑡 𝑁𝑘 𝑡 𝑁𝑢 𝑡 𝜆 = the speed of adjustment of the moving average. 𝑖𝑓 𝑡 = 0; 𝑜𝑡ℎ𝑒𝑟𝑤𝑖𝑠𝑒. State and Local Government Spending Data: Panel data 1997-2011 GDP: BEA State and local government spending: Government expenditure from Census Bureau Population: BEA Methodology: Fixed effects model State and Local Government Spending GDP elasticity of government spending (GRP) New Estimates Original Model Parameters State government spending (β) 0.377 0.904 Local government spending (Υ) 0.498 0.798 State fixed effects calibration factor New Estimates State government spending Local government spending Original Model Parameters Highest Lowest Highest Lowest State Alaska Nevada Alaska Texas Calibration factor 2.448 0.732 1.760 0.690 State D.C. Hawaii New York Hawaii Calibration factor 2.275 0.418 1.442 0.394 State and Local Government Spending PI+ simulation results: The state government spending responds less then the local government spending to a given change in GDP per capita. The use of the moving average term of GDP leads to a slower response in government spending due to changes in GDP per capita. Housing Price Equation Housing Price Equation 𝑃𝐻𝑡 = 𝜀1 𝑅𝑌𝐷𝑡 𝑁𝑡 𝑅𝑌𝐷𝑡𝑢 𝑁𝑡𝑢 − 1 + 𝜀2 −1 𝑅𝑌𝐷𝑡−1 𝑁𝑡−1 𝑢 𝑢 𝑅𝑌𝐷𝑡−1 𝑁𝑡−1 where PH = relative housing price; RYD = real disposable income; N = population; u represents the U.S.; t represents the time period; 𝜀1 = income elasticity of housing price; 𝜀2 = population elasticity of housing price. + 1 × 𝑃𝐻𝑡−1 Housing Price Equation Data: State-level annual panel data 1990-2013 Housing price index: Federal Housing Finance Agency HPI quarterly data (All-transaction indexes) Income (BEA) and population (BEA) data: PI+ V1.6 Methodology: Pooled regression with panel data Overall demand response: New Estimates Original Model Parameters Income Elasticity 0.462 0.211 Population Elasticity 0.648 0.548 Housing Price Equation Estimating State/MSA price elasticity 𝐻𝑃𝑡 𝐵𝑃𝑡 −1=𝑏× 𝐻𝑃𝑡−1 𝑈𝑡 where HP = the Freddie Mac Home Price Index; BP = the number of building permits for single-family homes; U = the number of housing units (1 unit detached); t represents the time period; b is the parameter to be estimated. Methodology: time series OLS regressions Data: House price index: Freddie Mac house price index Building permits: Census Building Permits Survey Housing units: American Community Survey 1-year estimates Housing Price Equation Estimating State/MSA scaling factors 𝑏𝑖 − 𝑏 +𝑏 𝑠𝑑𝑏 𝑆𝑐𝑎𝑙𝑖𝑛𝑔 𝐹𝑎𝑐𝑡𝑜𝑟𝑖 = 𝑏 where 𝑏𝑖 = estimated state/MSA parameters; 𝑏 = the mean of 𝑏𝑖′ 𝑠; 𝑆𝑑𝑏 = the standard deviation of 𝑏𝑖′ 𝑠. Regional parameters: 𝑆𝑐𝑎𝑙𝑖𝑛𝑔 𝐹𝑎𝑐𝑡𝑜𝑟𝑖 × 𝜀1 and 𝑆𝑐𝑎𝑙𝑖𝑛𝑔 𝐹𝑎𝑐𝑡𝑜𝑟𝑖 × 𝜀2 Housing Price Equation State scaling factors Housing Price Equation County-level scaling factors Housing Price Equation PI+ simulation results The larger new coefficients lead to larger responses in relative housing price. The original housing price equation followed population changes more closing due to the relatively higher population elasticity coefficient. The new equation is more balanced between response to changes in population and income since the coefficients are now closer in magnitude. Consumption Equation Consumption Equation (2). Age Composition Effect (1). Calibration Effect 𝑘 𝐶𝑗,𝑡 = 𝑌𝐷𝑇𝑘 𝑁𝑇𝑘 𝑌𝐷𝑇𝑢 𝑁𝑇𝑢 × 7 𝑙 7 𝑙 𝑢 𝑅 %𝐷𝐺𝑙,𝑡 × 𝑃𝐶𝑙,𝑗 𝑢 𝑢 %𝐷𝐺𝑙,𝑡 × 𝑃𝐶𝑙,𝑗 (3). Regional Effect × 𝐶𝑗𝑅 𝐶𝑗𝑢 𝐴𝑔𝑒 𝐶𝑜𝑚𝑝 𝐸𝑓𝑓𝑒𝑐𝑡 (2 (4). Marginal Income Effect × 𝑅𝑌𝐷𝑡𝑘 𝑁𝑡𝑘 𝑅𝑌𝐷𝑡𝑢 𝑁𝑡𝑢 𝑅𝑌𝐷𝑇𝑘 𝑁𝑇𝑘 𝑅𝑌𝐷𝑇𝑢 𝑁𝑇𝑢 (5). RegionSpecific Marginal Price Effect 𝛽𝑗 × 𝑘 𝐶𝐼𝐹𝑃𝑗,𝑡 𝑃𝑡𝑘 𝑢 𝑃𝑗,𝑡 𝑃𝑡𝑢 𝑘 𝑃𝑗,𝑇 𝑃𝑇𝑘 𝑢 𝑃𝑗,𝑇 𝑃𝑇𝑢 (6). U.S. (7). Local Forecast Population Effect 𝛾𝑗 𝑢 𝐶𝑗,𝑡 × 𝑢 × 𝑁𝑡𝑘 𝑁𝑡 Consumption Equation Estimating income and price elasticities by commodity 𝐶𝑡 𝑅𝑌𝐷𝑡 𝑃𝑡 ∆ =𝛽∙∆ + 𝛾∙∆ + 𝜀𝑡 𝑁𝑡 𝑁𝑡 𝑃𝑡 where 𝐶𝑡 = consumption expenditure on the commodity for time period t; 𝑁𝑡 = population; 𝑅𝑌𝐷𝑡 = real disposable income for time period t; 𝑃𝑡 = price index of the commodity for time period t; 𝑃𝑡 = average price index of all commodities for time period t; 𝛽 and 𝛾 are the parameters (elasticities) to be estimated; 𝜀𝑡 is the error term. Consumption Equation Data: BEA National Income and Product Accounts 1990-2012 Disposable Personal Income Price Indexes for Personal Consumption Expenditures by Type of Product Personal Consumption Expenditure by Type of Product Methodology: OLS 𝛽 < 1, 𝑁𝑒𝑐𝑒𝑠𝑠𝑖𝑡𝑖𝑒𝑠 Classification: 𝛽 > 1, 𝐿𝑢𝑥𝑢𝑟𝑖𝑒𝑠 Consumption Equation Panel Data Approach: 𝐶𝑗,𝑡 𝑅𝑌𝐷𝑡 ∆ = 𝛽𝐿 ∙ ∆ + 𝛾𝐿 ∙ ∆ 𝑁𝑡 𝑁𝑡 𝐶𝑗,𝑡 𝑅𝑌𝐷𝑡 ∆ = 𝛽𝑁 ∙ ∆ + 𝛾𝑁 ∙ ∆ 𝑁𝑡 𝑁𝑡 𝑃𝑗,𝑡 + 𝜀𝑗,𝑡 𝑃𝑡 𝑃𝑗,𝑡 + 𝜀𝑗,𝑡 𝑃𝑡 L stands for luxuries and N stands for necessities. Normalization: 𝛽𝑁 × 𝑊𝑁 + 𝛽𝐿 × 𝑊𝐿 = 1 𝛾𝑁 × 𝑊𝑁 + 𝛾𝐿 × 𝑊𝐿 = 1 where 𝑊𝑁 = 𝑃𝐶𝐸 𝑜𝑛 𝑛𝑒𝑐𝑒𝑠𝑠𝑖𝑡𝑖𝑒𝑠 ; 𝑃𝐶𝐸 𝑊𝐿 = 𝑃𝐶𝐸 𝑜𝑛 𝑙𝑢𝑥𝑢𝑟𝑖𝑒𝑠 𝑃𝐶𝐸 Consumption Equation New Estimates Income Elasticity Price Elasticity Original Model Parameters Income Elasticity Price Elasticity Necessities 0.614 -0.657 0.49 -0.66 Luxuries 1.729 -1.649 2.24 -1.82 Consumption Equation PI+ simulation results The consumption responses are similar between the two versions, due to similar coefficients. For a given change in population or output, the price index changes more in the new V1.7 model, which has a stronger effect on the consumption responses. REMI RESEARCH