Social Enterprise - Procopio Fundraising

advertisement

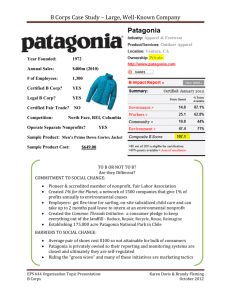

+ Achieving Social Impact: Profit with Purpose Eric Davis Managing Partner Elliott & Davis, PC www.elliott-davis.com Anne Marie Toccket Principal Procopio Fundraising annemarie@procopiofundraising.com + Agenda Definition of terms Examples of social enterprises Benefits and Risks for nonprofits and entrepreneurs Legal considerations and types of entities Break Demystifying B Corporations and B Corp Certified businesses Case study Discussion and Questions + Working Definitions Social Enterprise* – a venture undertaken by an NPO or social business that uses market-based approaches to achieve a dimension of its mission Social Entrepreneurship – a venture undertaken by an individual that creates a replicable, scalable market-based solution to an intractable social problem B Corporation – an emerging legal form of entity available to incorporate social enterprises, often confused with B Corp Certification. Available in 28 states, including PA and DE. B Corp Certification- a third-party recognition of the social practices, norms and values of a for-profit company – NOT a legal entity Social Impact – the desired result of social enterprises, social entrepreneurs, B Corporations, some private enterprises, NPOs, and other non- and for-profit ventures Impact Investing: the injection of capital into a social enterprise or other venture, intended to catalyze increased social impact + Examples Social Enterprises: Social Entrepreneurs and Their Ventures: Equal Exchange Waldorf Schools Ted Talks (owned by nonprofit) EECM Workforce, Inc. Awamaki Grameen Bank (Muhammad Yunus) Manchester Bidwell Corporation (Bill Strickland) Tom’s Shoes (Blake Mycoskie) Seventh Generation (Jeffrey Hollender) B Corp Certified Companies: Patagonia Ben & Jerry's Thread International Big Idea Bookstore + Financial Sustainability/Generate Revenue Why Should a Nonprofit Form a For Profit Social Enterprise? Limit Unrelated Business Income Separate Position Risk/Liability of Organization in Community + Why Should an Entrepreneur Consider Forming a Social Enterprise? Marketing Differentiation Attract mission-driven team members Ability to formalize values and social impact metrics Opportunity to scale Opportunity to take idea to attract new types of investors and capital + New York Times case study Part 1 Rapidly scaling nonprofit social enterprise quandary: How to generate more revenue with the fewest restrictions, allowing team to focus on achieving mission? Remain a nonprofit Abandon nonprofit; form a for-profit Consider a hybrid model Following slides illustrate deeper inquiry into possibilities, risks and benefits of all three approaches Choice revealed later in this session + Nonprofit What Form of Corporate Entity is Best For Your Social Enterprise? LLC (organized under B Corp principles) Benefit Corporation Corporations, Limited Partnerships, etc. + Social Enterprises vs. Nonprofits & For Profits NonProfit Versus For-Profit. Benefit Corporations, LLCs, Flexible Purpose Corporations and LC3s, are a blend of the two. Twenty-eight states, including Delaware, have benefit corporation statutes. B Corporations became a form of entity in PA in 2012 and in Delaware in 2014. Social Enterprises have been organized as nonprofits, LLCs and Corporations for years. -Long before the advent of Benefit Corporations. + Financial Sustainability/Revenue Generation for Nonprofits Reduces Reliance on Foundation Support and Charitable Giving Introduces or increases Financial Sustainability to the Organization Nonprofit Should Earmark Funds Derived From Social Enterprise for Particular Programs if Seeking Foundation or Major Donor Support to Start Social Enterprise Note that many for-profit businesses fail and this is a risk for any social enterprise. + Unrelated Business Income Generally speaking, nonprofits must pay tax on income generated that is not directly related to charitable purposes. Business activity might distract organization from true reason for existence and requires resource allocation that might reduce resources for nonprofit Business activity may skew financials of nonprofit organization and it is good to keep it off its books. Examples… Unrelated Business Income draws attention/ire of IRS and local taxing authorities + Separate Risk/Liability Legal Rule of Thumb is that, if the Character and Nature of Risk is Different, then a Separate Corporate Entity should be Considered. Many Nonprofits have valuable facilities, endowments and other assets that need to be protected. Business activities may give rise to new types of Employment related liabilities. + Organization in Community Competing Against Local Businesses Property Taxes Unfair Trade Practices (Using donated equipment, volunteers, etc. to compete) Local businesses and their employees could be your donors, volunteers, people you serve Best way to avoid inadvertently hurting existing businesses in the community is to engage in activities that those businesses aren’t interested in. For example, hiring those hardest to train, using space that would be unused, selling products or services in great need, but that are no profitable to sell, etc. + Why Choose a Benefit Corporation as a Form of Entity? A New Class of Corporate Entity to Increase Transparency and Accountability. Formation Needs: General Public Benefit “material positive impact on society and the environment, taken as a whole, assessed against a third party standard, from the business and operations of a benefit corporation” Third Party Standard Developed by a party not related to entity it’s measuring. Transparent in methodology. Special Public Benefit Providing individuals/communities with beneficial products and services. Promoting economic opportunities for individuals or communities beyond job creation and making money. Articles of Incorporation Must state benefit corporation status and specific public benefit. (Similar to nonprofit) Bylaws Must include public benefit purpose, management duties and reporting of public benefit information Stock Certificates/Shareholders Agreements Should include specific language Management Promoting health or environmental preservation Promoting arts and sciences. Reporting of Public Benefit Information Issue annual reports including records of successes and failures for general and specific public benefit (within 120 days after fiscal year + must be publicly available) Directors must take benefit into account on all decisions. Annual assessment by third party Some states require a benefit director (a good idea in practice) Taxes Subject to corporate tax on net income Dividends are subjected to personal income tax No favored Tax Status (may change some day) + Why Choose an LLC Form of Entity?Guidlelines for Looking Ahead to B-Corp Certification Needs: General/Special Public Benefit “material positive impact on society and the environment, taken as a whole, assessed against a third party standard, from the business and operations of a benefit corporation” Third Party Standard Developed by a party not related to entity it’s measuring. Transparent in methodology. Reporting of Public Benefit Information Issue annual reports including records of successes and failures for general and specific public benefit (within 120 days after fiscal year + must be publicly available) Management Manager(s)/Management committee must take benefit in account on all decisions Annual Assessment by third party Certificates of Membership Interests Should Include Specific Language Taxes No favored tax status. (May change some day) Formation Certificate of Organization Must state specific public benefit (like nonprofit) Operating Agreement Including public benefit purpose, management duties and reporting of public benefit information. Certificates of Membership Should include specific language Raising Capital No difference. Debt & Equity Financing is OK Consider seeking Risk Capital from groups looking to fund social benefit aspects + What’s the difference between being a Benefit Corporation and Being B Corp Certified? Benefit Corporations and Certified B Corporations are often confused. Certified B Corporation is a certification conferred by the B Lab. Benefit Corporation is a legal status administered by a state. Benefit Corporations do NOT need to be certified. Certified B Corporations are using the third party (B Labs) to show that they meet a high standard of overall social and environmental performance. Often seeking marketing differentiation. + Social Enterprises in Pennsylvania Seek B-Corp Certification (www.bcorporation.net) Voluntary Certification, NOT Legal Structure Can Be Applied to Any Legal Structure Differentiates Good Companies from Companies with Good Marketing/PR Periodic Assessment/Must Publish Results Need to Score Better than 80/200 on B-Labs Assessment Require addition of language to Bylaws/Operating Agreement No difference in Tax Treatment + What Are Accounting Issues Associated with Social Enterprise? Regular Corporate Taxes Need to Be Concerned with Retained Earnings Best Strategy is for Social Enterprise to Pay for Things that Nonprofit Needs, reducing profits for for-profit Consumable Materials Non-depreciable Assets Staff Rental Only (serious) tax consequences occur if Social Enterprise becomes Super Successful and generates more money than it can use to support nonprofit + Integration Issues Associated With Separate For-Profit Entity Business Mindset is Often Not Aligned with Nonprofit Values What happens when Social Enterprise reduces (even temporarily) resources available to Nonprofit? Identity of Nonprofit could become associated with business activity (Girl Scout Cookies) Curious thing to note about example is that Girl Scouts Don’t Pay Tax on Cookie Sales Because Volunteers Conduct Activity and it is (somehow) related to charitable purpose. “Customers” may expect more than people receiving products/services/help for free. Implications? + Management of For-Profit Subsidiary “Bake In” Ethos of Nonprofit Into Subsidiary’s Organization Documents. Examples… Create Test Derived from Statement of Purpose for Analyzing Management Decisions. Examples… Develop Metrics for Measuring Success and Report Results Need for Strong Benefit Manager/Committee Mechanisms for Benefit Manager/Committee to Exercise Power if Benefit is Not Being Adequately Considered Transparency and Reporting + New York Times case study Part 2 Saul Garlick’s decision to go for-profit based on: Lower energy expended to meet widely variable expectations of donors Ability to spend revenue where most needed, not to meet overhead percentage conventions Had found a model that generates revenue; profit expected in 3 years Avoids conflict of interest (Saul as CEO and ED simultaneously) What do you think? In-class examples. + Thank You! Discussion and Questions Contact Us! Eric Davis Anne Marie Toccket eric@elliottdavis.com anita@awamaki.org www.elliott-davis.com www.pghstartup.c om www.awamaki.org www.procopiofundraising.com