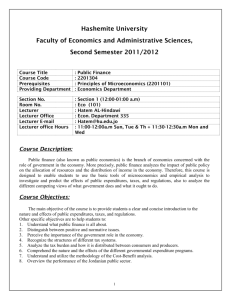

Finance

advertisement

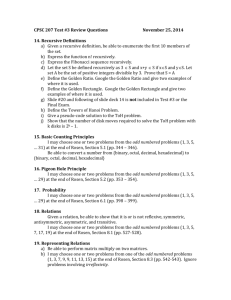

Finance PROF. EUGENIO PELUSO; PROF. MASSIMO BORDIGNON COURSE AIMS The course aims to give the student the tools needed for understanding the problems of the public sector, from the standpoint of economic theory. The course presents theoretical reasoning for the existence of the public sector, and analyzes the trend of Italy's public sector spending and the sources of its financing; the rules for budget decisions are also explained. After the study of fiscal federalism and its application in Italy, the course looks at the theoretical principles for creating a good taxation system and analyzes the actual tax burden. The characteristics and properties of Italy's tax system are also discussed. COURSE CONTENT 1. Reasons for public intervention (5 hours - Peluso) (Welfare economics: Pareto efficiency, I and II theorems of welfare; market failures). Rosen: Chapter(s) 4; Giarda: Part I. 2. Public goods and externalities (5 hours - Peluso) (free riding, Lindahl equilibrium, benefit principle, corrections of externalities: private solutions and public solutions). Rosen: Chapter(s) 5 and 6; Giarda Part I. 3. Social welfare, inequality and equity (5 hours - Peluso). Rosen: Chapter(s) 8. 4. Education and opportunities (5 hours - Peluso), extra readings. 5. Pensions (5 hours - Peluso). Rosen: Chapter(s) 10; Giarda Part VI. 6. Income, capital and redistribution (5 hours - Peluso), extra readings. 7. Introduction to Italian public finance and budget rules (5 hours - Bordignon). Giarda: part II, pages 64-105; Rosen: Chapter(s) 2. 8. Classification of taxes; objectives and constraints of a taxation system (3 hours - Bordignon). Giarda: Part III, pages 3-8; Rosen: Chapter(s) 13. 9. Clear-cut loss from taxation and applications to the market for labour, goods and savings, Ramsey rule, Barone theorem; implications for the definition of income (7 hours - Bordignon). Giarda: part III, pages10-38; Rosen: Chapter(s) 14 10. Prevalence: perfect competition and monopoly (5 hours - Bordignon). Rosen: Chapter(s)12; Giarda: part III, pages 78-88. 11. Personal income tax and the progressive nature of taxation (5 hours Bordignon). Rosen: Chapter(s) 15; Giarda: part III, pages 58-65. 12. Institutional aspects of Italy's taxation system (5 hours - Bordignon). BG, Rosen, Chapter(s)16-18. READING LIST Textbooks P. GIARDA,“Appunti per il corso di Scienza delle finanze” (notes). H.S. ROSEN-T. GAYER, Scienza delle Finanze, MacGraw-Hill, 2010. P. BOSI-M.C. GUERRA, I tributi nell’economia Italiana, Il Mulino, 2012. TEACHING METHOD Lectures, with some presentations by experts. ASSESSMENT METHOD Written test running for 2.5 hours covering the entire course. The student will need to answer five open-ended questions about various course topics, with 2-3 of the questions being mandatory and the others selected from a range of questions. All questions will be weighted equally. Economic students taking the course for eight credits: all parts. Students taking the course for five credits: the Peluso or Bordignon part, with only three questions. Law students taking the course for 6, 7 or 8 credits: the analytical parts of the programme may be omitted and substituted by study of Title V of the Constitution or study of the court system. The decision about offering a mid-term exam will be taken by mid-October. NOTES Further information can be found on the lecturer's webpage at http://docenti.unicatt.it/web/searchByName.do?language=ENG, or on the Faculty notice board.