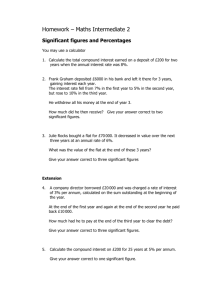

Exam 1 Extra Credit

advertisement

Exam 1 Extra Credit If you complete this assignment with at least a 70%, I will move 5% of the weight from exam 1 to your highest exam. 1 Your stock costs $100 today, pays $5 in dividends at the end of the period, and then sells for $98. What is your rate of return? 2 Over 20 years, would you prefer 10% per annum, with interest compounding, or 15% per annum but without interest compounding? (That is, you receive the interest, but it is put into an account that earns no interest, which is what we call simple interest.) 3 A project has cash flows of $15,000, $10,000, and $5,000 in 1, 2, and 3 years, respectively. If the prevailing interest rate is 15%, would you buy the project if it costs $25,000? 4 A project has the following cash flows in periods 1 through 4: $200, $200, $200, $200. If the prevailing interest rate is 3%, would you accept this project if you were offered an upfront payment of $10 to do so? 5 What is the PV of a perpetuity paying $30 each month, beginning next month, if the annual interest rate is a constant effective 12.68% per year? 6 The prevailing discount rate is 15% per annum. Firm F’s cash flows start with $500 and grow at 20% per annum for 3 years. Firm S’s cash flows also start with $500 in year 1 but shrink at 20% per annum for 3 years. What are the prices of these two firms? Which one is the better “buy”? 7 If you could pay for your mortgage forever, how much would you have to pay per month for a $1,000,000 mortgage, at a 6.5% annual interest rate? Work out the answer (a) if the 6.5% is an APR and (b) if the 6.5% is an effective annual rate of return. 8 Your firm just finished the year, in which it had cash earnings of $400 (thousand). You forecast your firm to have a quick growth phase from year 0 to year 5, in which it grows at a rate of 40% per annum. Your firm’s growth then slows down to 20% per annum, from year 5 to year 10. Finally, beginning in year 11, you expect the firm to settle into its long-term growth rate of 2% per annum. You also expect your cost of capital to be 15% over the first 5 years, then 10% over the next 5 years, and 8% thereafter. What do you think your firm is worth today? 9 What maximum price would you pay for a standard 8% level-coupon bond (with semiannual payments and face value of $1,000) that has 10 years to maturity if the prevailing discount rate is an effective 10% per annum? 10 You can sell your building for $200,000. Alternatively, you can lease out your building. After expenses you make $1,300 per month from the lessee. At the end of the 20-year lease, you expect the building to be worthless, but the land to have a residual value of $150,000. Your cost of capital is 0.5% per month. Should you sell or lease your building? 11 You can choose between the following rent payments: a. A lump sum cash payment of $100,000; b. 10 annual payments of $12,000 each, the first occurring immediately; c. 120 monthly payments of $1,200 each, the first occurring immediately. Which rental payment scheme would you choose, as a tenant, and landlord? The interest rate is 5% per year? 12 Assume you are a real estate broker with an exclusive contract—the condo association rules state that everyone selling their condominiums must go through you or a broker designated by you. A typical condo costs $500,000 today and sells again every 5 years. This will last for 50 years, and then all bets are off. Your commission will be 3%. Condos appreciate in value at a rate of 2% per year. The interest rate is 10% per annum. What is the value of this exclusivity rule? In other words, at what price should you be willing to sell the privilege of exclusive condo representation to another broker? Assume all condo have already sold this year.