Service Costing - Bannerman High School

advertisement

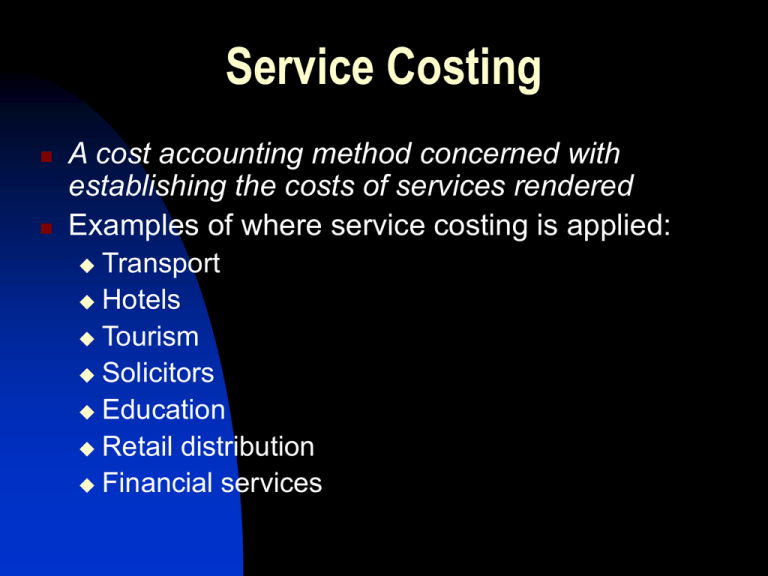

Service Costing A cost accounting method concerned with establishing the costs of services rendered Examples of where service costing is applied: Transport Hotels Tourism Solicitors Education Retail distribution Financial services Service Costing Service costing is also applied within a manufacturing setting For example: a manufacturer might wish to calculate the costs of the following services: Transport Catering Computing and IT Accounting Human resources The Differences Between Product Costing and Service Costing There may be very few, if any, materials to worry about Overheads will comprise the most significant portion of any costs of which, labour costs may well comprise as much as 70% Service Costing: profit or cost centre? Many organisations simply want to determine the costs of operating its services from a management control and management information point of view However, there are many organisations now that operate services for their own organisations as well as sub-contracting them out to other organisations. Sub-contracting Examples There are companies that operate their own payroll section for themselves; and offer this service to other organisations as well Other organisations sell CPU time on their computers at times when they do not use it themselves: for example, in overnight batch work. Service Cost Units What are the cost units for a service? Transport - Passenger miles, tonne miles, total miles driven Hotels - Education – canteen services, office housekeeping, meals, room service services, janitorial staff